EQT Gets About 5 Bids From EUR2 Billion-EUR2.5 Billion For KabelBW - Sources

February 17 2011 - 1:57PM

Dow Jones News

Swedish private equity firm EQT has received about five bids in

the range of EUR2 billion to EUR2.5 billion on its auction of

German cable operator Kabel Baden-Wuerttemberg, three people close

to the process said Thursday, in a potential disappointment to EQT

on price.

The bidders include U.S. media conglomerate Liberty Global Inc.

(LBTYA), and private equity firms CVC Capital Partners, Cinven

Group, Providence Equity Partners and Hellman & Friedman, the

people said.

EQT will evaluate the bids over the next couple of weeks and

then decide if it should pursue with a sale or an initial public

offering, one person said. Providence Equity, owner of Germany

largest cable provider, Kabel Deutschland AG (KDG.XE), last year

opted for a EUR760 million IPO valuing KDG at just under EUR5

billion, despite having previously received higher private offers.

Providence later sold more shares in KDG and now holds about

44%.

People familiar with the matter said Providence Equity's bid

might be complicated by its KDG stake, and Liberty Media is also

expected to face anti-trust concerns because of its ownership of

Unitymedia, Germany's second-largest cable operator by subscribers.

KDG, KBW and Unitymedia had tried to merge in 2004 but were

thwarted by regulators.

EQT, the private equity arm of Sweden's Wallenberg family,

launched the sales process for Germany's third biggest cable

operator last year, lining up banks in preparation of either an

initial public offering or outright sale.

A person familiar with the matter earlier said the bidders would

have to put up at least nine times Kabel BW's earnings before

interest, taxes, depreciation and amortization, or EUR2.88 billion

given Kabel BW's 2010 Ebitda of EUR320 million, to be recognized by

the vendor. Another person said EQT was hoping for bids closer to

EUR3 billion.

EQT acquired the Heidelberg-based provider of cable TV, Internet

and telephone services from U.S. investment group Blackstone Group

LP (BLX) for around EUR1.3 billion in 2006 and has invested more

than EUR800 million in network expansion.

JPMorgan Chase & Co. (JPM) and Deutsche Bank AG (DB) are

serving as advisors to EQT in the process.

Kabel BW declined to comment on the process.

-By Anna Molin and Margot Patrick, Dow Jones Newswires; +46 8

545 131 03; anna.molin@dowjones.com

(Carol Dean in London and Philipp Grontzki in Frankfurt

contributed to this article.)

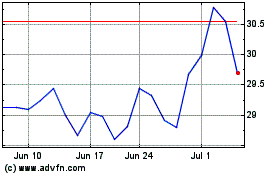

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Jul 2024 to Jul 2024

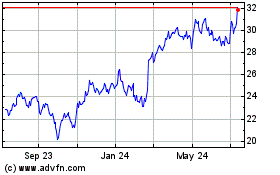

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Jul 2023 to Jul 2024