Bladex Reports Second Quarter Net Income of $26.3 Million Compared With $19.2 Million for the Prior Quarter

July 28 2008 - 8:41AM

PR Newswire (US)

ROE Was 16.7%, Compared to 12.6% in the First Quarter PANAMA CITY,

July 28 /PRNewswire-FirstCall/ -- Banco Latinoamericano de

Exportaciones, S.A. (NYSE:BLX) ("Bladex" or the "Bank") announced

today its results for the second quarter ended June 30, 2008.

Second Quarter Business Highlights -- Net income of $26.3 million,

an increase of 37% compared to the first quarter 2008, and 3% lower

than the second quarter 2007, principally due to lower trading

gains. -- Net operating revenue(1) of $36.4 million, an increase of

28% from the first quarter 2008, and unchanged from the second

quarter 2007, reflecting strong growth in the Bank's intermediation

business. -- Return on average equity ("ROE") of 16.7%, compared to

12.6% in the first quarter 2008, and 18.0% in the second quarter

2007. -- Commercial Division's net operating income(2) was $12.9

million, versus $14.7 million in the previous quarter. Net interest

income on lending spreads(3) increased 27% as a result of higher

lending spreads(4) (27 bps, or 22%), and a 4% growth on the average

commercial portfolio. -- Treasury Division's net operating income

was $3.0 million, an increase of $2.0 million compared to the first

quarter 2008, and a decrease of $1.1 million from the second

quarter 2007 due to lower gains on the sale of securities. -- Asset

Management Division's net operating income was $10.1 million, an

increase of $6.5 million from the first quarter 2008, and a

decrease of $1.9 million from the second quarter 2007, driven by

trading gains. -- As of June 30, 2008, the Bank had zero credit in

non-accrual or past due status. -- As of June 30, 2008,

liquidity(5) stood at $372 million, representing 7% of total

assets. During the quarter, deposits increased $379 million (28%)

to $1,736 million. -- The Bank's efficiency ratio(6) was 29%,

compared to 32% in the first quarter 2008, and 28% in the second

quarter 2007. Tier 1 capital ratio stood at 19%. Mr. Jaime Rivera,

Bladex's Chief Executive Officer, stated the following regarding

the quarter's results: "We are very pleased with the results for

the quarter which were solid across all business lines. This

performance demonstrates once more Bladex's ability to take

advantage of a Latin American market that continues to grow, and a

business franchise that continues to strengthen. In broad terms,

while we are mindful of both the stress placed on large segments of

the financial industry and the implications for the economy as a

whole, the current scenario has resulted in opportunities for the

Region, which Bladex is uniquely well positioned to realize.

Consistent with this favorable scenario, the Bank's intermediation

business continues to grow, with lending margins widening at an

accelerating rate and fee revenue building momentum. Bladex's Asset

Management Division posted another quarter of solid results, and

concerns regarding credit quality within Bladex's portfolio remain

a non-issue. On the liability side, the Bank's deposit base

increased at the faster pace that we have seen in years, and our

liquidity position remains strong. As satisfied as Bladex is with

the current results, we place great importance on the permanent

nature of our improving market share, which we believe will

continue to benefit the Bank through the next phase of the credit

cycle." CONSOLIDATED RESULTS OF OPERATIONS KEY FINANCIAL FIGURES

AND RATIOS (US$ million, except percentages and per share amounts)

2Q07 1Q08 2Q08 Net Interest Income $16.7 $21.1 $20.1 Net Operating

Income by Business Segment: Commercial Division $10.1 $14.7 $12.9

Treasury Division $4.1 $1.0 $3.0 Asset Management Division $12.0

$3.6 $10.1 Net Operating Income $26.1 $19.2 $25.9 Net Income $27.0

$19.2 $26.3 Net Income per Share(7) $0.74 $0.53 $0.72 Book Value

per common share (period end) $16.68 $16.73 $17.74 Return on

Average Equity ("ROE") 18.0% 12.6% 16.7% Operating Return on

Average Equity ("Operating ROE") 17.4% 12.6% 16.5% Return on

Average Assets ("ROA") 2.7% 1.6% 2.0% Net Interest Margin 1.70%

1.77% 1.56% Tier 1 Capital(8) $606 $608 $645 Total Capital(9) $642

$647 $688 Risk-Weighted Assets $2,862 $3,112 $3,392 Tier 1 Capital

Ratio(8) 21.2% 19.6% 19.0% Total Capital Ratio (9) 22.4% 20.8%

20.3% Stockholders' Equity to Total Assets 14.4% 12.0% 11.9% Liquid

Assets / Total Assets(5) 7.6% 9.7% 6.9% Liquid Assets / Total

Deposits 23.2% 36.3% 21.5% Non-Accruing Loans to Total Loans, net

0.0% 0.0% 0.0% Allowance for Loan Losses to Total Loan Portfolio

2.0% 1.9% 1.7% Allowance for Losses on Off-Balance Sheet Credit

Risk to Total Contingencies 2.6% 3.5% 4.0% Total Assets $4,205

$5,090 $5,407 Footnotes: (1) Net Operating Revenue refers to net

interest income plus non-interest operating income. (2) Net

Operating Income refers to net interest income plus non-interest

operating income, minus operating expenses. (3) Net interest income

on lending spreads refers to interest income on weighted average

net lending spreads of average loan portfolio, plus loan

commissions. (4) Lending spreads refer to loan portfolio weighted

average lending spread over weighted average Libor-based cost rate,

excluding loan commission. (5) Liquidity ratio refers to liquid

assets as a percentage of total assets. Liquid assets consist of

investment-grade 'A' securities, and cash and due from banks,

excluding cash balances in the Asset Management Division. (6)

Efficiency ratio refers to consolidated operating expenses as a

percentage of net operating revenues. Excluding the Asset

Management Division's net revenues and expenses, the efficiency

ratio is 38%, 34% and 35% for second quarter 2008, first quarter

2008 and second quarter 2007, respectively. (7) Net Income per

Share calculations are based on the average number of shares

outstanding during each period. (8) Tier 1 Capital refers to total

stockholders' equity. Tier 1 Capital ratio refers to Tier 1 Capital

as a percentage of risk weighted assets. Risk-weighted assets are

calculated based on US Federal Reserve Board and Basel I capital

adequacy guidelines. (9) Total Capital refers to total

stockholders' equity plus Tier 2 Capital based on US Federal

Reserve Board and Basel I capital adequacy guidelines. Total

Capital ratio refers to Total Capital as a percentage of risk

weighted assets. SAFE HARBOR STATEMENT This press release contains

forward-looking statements of expected future developments. The

Bank wishes to ensure that such statements are accompanied by

meaningful cautionary statements pursuant to the safe harbor

established by the Private Securities Litigation Reform Act of

1995. The forward-looking statements in this press release refer to

the growth of the credit portfolio, including the trade portfolio,

the increase in the number of the Bank's corporate clients, the

positive trend of lending spreads, the increase in activities

engaged in by the Bank that are derived from the Bank's client

base, anticipated operating income and return on equity in future

periods, including income derived from the Treasury Division and

Asset Management Division, the improvement in the financial and

performance strength of the Bank and the progress the Bank is

making. These forward-looking statements reflect the expectations

of the Bank's management and are based on currently available data;

however, actual experience with respect to these factors is subject

to future events and uncertainties, which could materially impact

the Bank's expectations. Among the factors that can cause actual

performance and results to differ materially are as follows: the

anticipated growth of the Bank's credit portfolio; the continuation

of the Bank's preferred creditor status; the impact of

increasing/decreasing interest rates and of improving macroeconomic

environment in the Region on the Bank's financial condition; the

execution of the Bank's strategies and initiatives, including its

revenue diversification strategy; the adequacy of the Bank's

allowance for credit losses; the need for additional provisions for

credit losses; the Bank's ability to achieve future growth, to

reduce its liquidity levels and increase its leverage; the Bank's

ability to maintain its investment-grade credit ratings; the

availability and mix of future sources of funding for the Bank's

lending operations; potential trading losses; the possibility of

fraud; and the adequacy of the Bank's sources of liquidity to

replace large deposit withdrawals. About Bladex Bladex is a

supranational bank originally established by the Central Banks of

Latin American and Caribbean countries to support trade finance in

the Region. Based in Panama, its shareholders include central banks

and state- owned entities in 23 countries in the Region, as well as

Latin American and international commercial banks, along with

institutional and retail investors. Through June 30, 2008, Bladex

had disbursed accumulated credits of over $156 billion. Conference

Call Information There will be a conference call to discuss the

Bank's quarterly results on Tuesday, July 29, 2008, at 11:00 a.m.,

New York City time (Eastern Time). For those interested in

participating, please dial (800) 311-9401 in the United States or,

if outside the United States, (334) 323-7224. Participants should

use conference ID# 8034, and dial in five minutes before the call

is set to begin. There will also be a live audio web cast of the

conference at http://www.bladex.com/. The conference call will

become available for review on Conference Replay one hour after its

conclusion, and will remain available through September 28, 2008.

Please dial (877) 919-4059 or (334) 323-7226, and follow the

instructions. The Conference ID# for the replayed call is 42697683.

For more information, please access http://www.bladex.com/ or

contact: Mr. Jaime Celorio Chief Financial Officer Bladex Calle 50

y Aquilino de la Guardia P.O. Box: 0819-08730 Panama City, Panama

Tel: (507) 210-8563 Fax: (507) 269-6333 E-mail address: Investor

Relations Firm: i-advize Corporate Communications, Inc. Mrs.

Melanie Carpenter / Mr. Peter Majeski 82 Wall Street, Suite 805 New

York, NY 10005 Tel: (212) 406-3690 E-mail address: DATASOURCE:

Banco Latinoamericano de Exportaciones, S.A. CONTACT: Mr. Jaime

Celorio, Chief Financial Officer, Bladex, +1-507-210-8563, Fax:

+1-507-269-6333, ; or Investor Relations Firm, Mrs. Melanie

Carpenter or Mr. Peter Majeski, i-advize Corporate Communications,

Inc., +1-212-406-3690, Web site: http://www.bladex.com/

Copyright

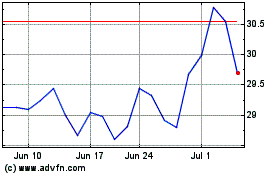

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Jul 2024 to Jul 2024

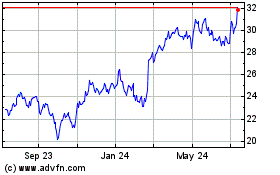

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Jul 2023 to Jul 2024