Bladex Reports Net Income of US$11.2 Million for the Third Quarter of 2006

November 13 2006 - 9:00AM

PR Newswire (US)

PANAMA CITY, Nov. 13 /PRNewswire-FirstCall/ -- Banco

Latinoamericano de Exportaciones, S.A. (NYSE:BLX) ("Bladex" or the

"Bank") announced today its results for the third quarter ended

September 30, 2006. Financial Highlights: * Net Income for the

third quarter totaled US$11.2 million, up 26% from the second

quarter, driven by increased Operating Income (1) and a higher

reversal of provisions for credit losses. Year-to-date, Net Income

was US$36.8 million, down 42% from the previous year, due to lower

credit provision reversals, as the Bank has collected 92% of its

restructured portfolio. * Operating Income for the third quarter

totaled US$8.7 million, up 19% from the previous quarter,

reflecting increases in net interest income and fee income, as well

as improving Treasury results. Year-to-date, Operating Income was

US$25.2 million, up 27% from the same period of last year. * Fee

income for the quarter grew by 35% on a sequential basis, to US$1.7

million, and 13% year-on-year. The table below depicts selected key

financial figures and ratios for the periods indicated (the Bank's

financial statements are prepared in accordance with U.S. GAAP, and

all figures are stated in U.S. dollars): Key Financial Figures US$

million, except percentages and per share amounts) 9M05 9M06 3Q05

2Q06 3Q06 Net Interest Income $32.8 $42.1 $11.7 $14.9 $15.6

Operating Income $19.9 $25.2 $7.2 $7.3 $8.7 Net Income $63.7 $36.8

$19.9 $8.9 $11.2 EPS (2) $1.65 $0.99 $0.52 $0.24 $0.31 Return on

Average Equity 13.6% 8.4% 13.0% 6.2% 7.9% Tier 1 Capital Ratio

38.2% 27.3% 38.2% 28.9% 27.3% Net Interest Margin 1.68% 1.76% 1.78%

1.87% 1.78% Book Value per common share $16.00 $15.55 $16.00 $15.29

$15.55 (1) Operating Income refers to net income excluding

reversals of provisions for credit losses and recovery of

impairment losses on securities. (2) Earnings per share

calculations are based on the average number of shares outstanding

during each period. Comments from the Chief Executive Officer Jaime

Rivera, Chief Executive Officer of Bladex, stated the following

regarding the quarter's results: "The figures for the third quarter

speak for themselves; it was an all- around solid performance. More

significantly, the results confirm and strengthen the positive

trend in our financial performance, as we execute the strategy that

we outlined two years ago. Our revenue is now diversified across an

expanding suite of products and clients, geared towards a growing

corporate segment and proprietary Treasury operations. The

expansion of our intermediation business is yielding particularly

promising results, as the commercial portfolio continues to grow an

average rate of close to 20% p.a. As we grow, we continue managing

risk based on a sound and flexible portfolio, 80% of which remains

trade financing in nature, while 77% matures within the next 12

months. During the fourth quarter, we expect to book our first

cross border leasing transactions, yet another niche where we enjoy

competitive advantages in terms of origination and risk management,

and which allows Bladex to support a growing need on the part of

our clients for specialized financing. In summary, our efforts

remain focused on sustaining the growth in Operating Income and on

gaining further efficiency, with the ultimate aim of improving ROE

levels." SAFE HARBOR STATEMENT This press release contains

forward-looking statements of expected future developments. The

Bank wishes to ensure that such statements are accompanied by

meaningful cautionary statements pursuant to the safe harbor

established by the Private Securities Litigation Reform Act of

1995. The forward-looking statements in this press release refer to

the growth of the credit portfolio, including the trade portfolio,

the increase in the number of the Bank's corporate clients, the

positive trend of lending spreads, the increase in activities

engaged in by the Bank that are derived from the Bank's client

base, anticipated operating income and return on equity in future

periods, including income derived from the treasury function, the

improvement in the financial and performance strength of the Bank

and the progress the Bank is making. These forward-looking

statements reflect the expectations of the Bank's management and

are based on currently available data; however, actual experience

with respect to these factors is subject to future events and

uncertainties, which could materially impact the Bank's

expectations. Among the factors that can cause actual performance

and results to differ materially are as follows: the anticipated

growth of the Bank's credit portfolio; the continuation of the

Bank's preferred creditor status; the impact of increasing interest

rates and of improving macroeconomic environment in the Region on

the Bank's financial condition; the execution of the Bank's

strategies and initiatives, including its revenue diversification

strategy; the adequacy of the Bank's allowance for credit losses;

the need for additional provisions for credit losses; the Bank's

ability to achieve future growth, to reduce its liquidity levels

and increase its leverage; the Bank's ability to maintain its

investment-grade credit ratings; the availability and mix of future

sources of funding for the Bank's lending operations; the

possibility of fraud; and the adequacy of the Bank's sources of

liquidity to replace large deposit withdrawals. About Bladex Bladex

is a supranational bank originally established by the Central Banks

of Latin American and Caribbean countries to support trade finance

in the Region. Based in Panama, its shareholders include central

banks and state- owned entities in 23 countries in the Region, as

well as Latin American and international commercial banks, along

with institutional and retail investors. Through September 30,

2006, Bladex had disbursed accumulated credits of over US$142

billion. Bladex is listed on the New York Stock Exchange. Further

investor information can be found at http://www.blx.com/. A LONGER

VERSION OF THIS PRESS RELEASE WITH DETAILED INFORMATION WILL BE

FILED WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION,

AND CAN BE OBTAINED FROM BLADEX AT: Bladex, Head Office, Calle 50 y

Aquilino de la Guardia, Panama City, Panama Attention: Mr. Carlos

Yap, Chief Financial Officer Tel. No. (507) 210-8563, e-mail: ,

-or- Investor Relations Firm i-advize Corporate Communications,

Inc. Mrs. Melanie Carpenter / Mr. Peter Majeski Tel: (212)

406-3690, e-mail: Conference Call Information There will be a

conference call to discuss the Bank's quarterly results on November

14, 2006, at 11:00 a.m., New York City time. For those interested

in participating, please dial (888) 335-5539 in the United States

or, if outside the United States, (973) 582-2857. Participants

should use conference ID# 8074729, and dial in five minutes before

the call is set to begin. There will also be a live audio webcast

of the conference at http://www.blx.com/ . DATASOURCE: Banco

Latinoamericano de Exportaciones, S.A. CONTACT: Carlos Yap, Chief

Financial Officer, Bladex, +011-507-210-8563, or ; or investors,

Melanie Carpenter or Peter Majeski, both of i-advize Corporate

Communications, Inc., +1-212-406-3690, or Web site:

http://www.blx.com/

Copyright

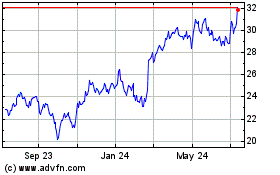

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Jun 2024 to Jul 2024

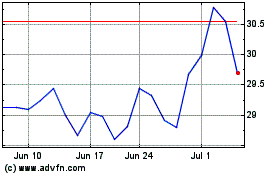

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Jul 2023 to Jul 2024