DTE Energy Beats - Analyst Blog

November 04 2011 - 9:40AM

Zacks

DTE Energy Company (DTE) clocked operating

earnings per share of $1.07 for the third quarter of 2011

surpassing the Zacks Consensus estimate of 98 cents. The company

also beat the prior-year quarterly earnings of 96 cents.

The Michigan-based energy company, showing resilience in its

business model, posted strong numbers despite the high unemployment

rate of 11.1% in Michigan in September 2011 versus the national

average of 9.1%. The variance in EPS year over year primarily

resulted from higher earnings at Energy Trading. This was partially

offset by lower earnings at Power & Industrial Projects and

Detroit Edison.

Operating Statistics

Total revenue of DTE Energy in the third quarter of 2011 was

$2.3 billion versus $2.1 billion in the year-ago period, reflecting

a growth of 5.9%. Reported quarter revenue also beat the Zacks

Consensus Estimate of $2.2 billion.

Operating earnings were $399 million compared with the year-ago

operating earnings of $386 million. Operating earnings increased

primarily due to solid results at Energy Trading, partially offset

by lower earnings at Power & Industrial Projects and Detroit

Edison. Overall DTE Energy reported net earnings of $183 million up

from $163 million in the third quarter of 2010.

Segment Update

Electric Utility: Segment earnings during the reported

quarter were $157 million or 92 cents per share, down from $165

million or 97 cents in the prior-year quarter.

Gas Utility: The loss from this segment during the

quarter under review was $11 million or 6 cents per share versus a

loss of $6 million or 4 cents.

Gas Storage and Pipelines: Segment profit increased by

$1 million to $13 million or 8 cents per share from $12 million or

7 cents in the year-ago quarter.

Unconventional Gas Production: Segment loss narrowed to

$2 million or 1 cent per share from a loss of $4 million or 2 cent

per share in the year-ago quarter.

Power and Industrial Projects: The segment posted a

profit of $12 million or 7 cents per share, down from $26 million

or 15 cents in the year-ago period.

Energy Trading: The segment posted a profit of $22

million or 13 cents per share, compared with a loss of $12 million

or 7 cent per share in the prior-year quarter.

Corporate and Other: Loss in the quarter was $8 million

or 6 cents per share, compared with a loss of $18 million or 10

cents per share in the prior-year quarter.

Outlook

DTE Energy is a Detroit-based diversified energy company

involved in the development and management of energy-related

businesses and services nationwide. Its operating units include

Detroit Edison, an electric utility serving 2.1 million customers

in Southeastern Michigan; MichCon, a natural gas utility serving

1.2 million customers in Michigan and other non-utility, energy

businesses focused on gas storage and pipelines; unconventional gas

production; power and industrial projects and energy trading.

Looking ahead, the company narrowed its 2011 earnings guidance

range to $3.50–$3.70 versus its earlier guidance of $3.40–3.70 per

share.

DTE Energy currently retains a Zacks #3 Rank (short-term Hold

rating). We provide a long-term Neutral rating on the stock. In the

near-term we would advise investors to focus on its Zacks #2 Rank

(short-term Buy rating) peers like The AES

Corporation (AES) and Avista Corporation

(AVA).

AES CORP (AES): Free Stock Analysis Report

AVISTA CORP (AVA): Free Stock Analysis Report

DTE ENERGY CO (DTE): Free Stock Analysis Report

Zacks Investment Research

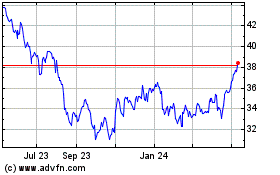

Avista (NYSE:AVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

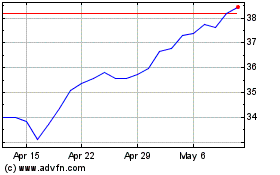

Avista (NYSE:AVA)

Historical Stock Chart

From Nov 2023 to Nov 2024