Washington Utility Commission Issues Decision in Avista's Electric and Natural Gas Rate Cases; Avista Reaffirms 2010 Earnings Gu

December 23 2009 - 8:34PM

PR Newswire (US)

Superior Court substantially upholds WUTC's 2008 Avista rate

decision SPOKANE, Wash., Dec. 23 /PRNewswire-FirstCall/ -- The

Washington Utilities and Transportation Commission (WUTC) has

issued its ruling on a rate request filed by Avista (NYSE:AVA) on

Jan. 23, 2009. The Commission approved a 2.8 percent increase in

annual electric rates, designed to increase revenue by $12.1

million per year, and an increase in natural gas rates of 0.3

percent, designed to increase revenue by $557,000. The Commission

also directed the company to file for deferred accounting treatment

of $12.2 million of annual costs associated with the Lancaster

generating project, including a carrying charge, with the

opportunity to recover the costs in the next rate case. The

Commission approved a 10.2 percent return on equity and a 46.5

percent common equity ratio. Rates will be effective Jan. 1, 2010.

Following the execution of an all-party partial settlement

agreement in September, Avista revised downward its electric rate

increase request from $69.8 million to $37.5 million, primarily due

to the decline in the wholesale prices of electricity and natural

gas. Avista also reduced its natural gas request from $4.9 million

to $2.8 million. The company's original request was based on a

proposed 11 percent return on equity and a 47.5 common equity

ratio. "We are disappointed with the outcome in this rate case. The

approved rates will not allow us to fully recover our costs for the

significant investments made in the generation and transmission

infrastructure to serve our customers' energy needs," said Scott

Morris, chairman, president and chief executive officer of Avista

Corp. "However, the commission's order does provide additional

guidance for procedures and documentation that we believe will

facilitate improved cost recovery for both operating expenses and

capital in the future. We anticipate filing general rate cases in

Washington as early as the end of the first quarter 2010. "While

the WUTC declined to allow recovery of costs in current rates

associated with the purchase of power from the Lancaster plant in

Rathdrum, Idaho, they directed the company to file for deferred

accounting treatment, with a carrying charge, for these costs and

the opportunity to recover them in the next rate case. We look

forward to adding the output from Lancaster to our diversified

resource mix. It is an outstanding resource for our customers, as

it is one of the most cost-effective and reliable gas-fired

generating resources in the Northwest. "With regard to recovery of

lost margin associated with Avista's energy efficiency programs, we

are pleased that the Commission approved continuation of the

company's natural gas decoupling mechanism with certain

modifications," said Morris. 2010 Earnings Guidance Reaffirmed

Avista reaffirms its 2010 guidance for consolidated earnings to be

in the range of $1.55 to $1.75 per diluted share. Although the WUTC

decision will not allow the company to make meaningful improvement

in reducing regulatory lag for 2010, Avista expects to manage its

capital investment and operating costs, while continuing to provide

safe, reliable service for its customers. WUTC 2008 Approval of

Settlement Stipulation Largely Upheld On Dec. 18, 2009, the

Thurston County (WA) Superior Court affirmed the previous decision

of the WUTC in Avista's 2008 general rate case and rejected the

arguments of the Office of Public Counsel, with the exception of

disallowing approximately $94,000 of miscellaneous expenses. On

Jan. 27, 2009, Public Counsel had filed a Petition for Judicial

Review (in Thurston County Superior Court) of the WUTC's December

2008 order approving Avista Corp.'s multi-party settlement, which

was designed to increase electric annual revenues by $32.5 million

and natural gas revenues by $4.8 million. Avista Corp. is an energy

company involved in the production, transmission and distribution

of energy as well as other energy-related businesses. Avista

Utilities is our operating division that provides electric service

to 353,000 homes and businesses and natural gas to 313,000 homes

and businesses in three Western states, serving more than 492,000

customers. Avista's primary, non-regulated subsidiary is Advantage

IQ. Avista stock is traded under the ticker symbol "AVA." For more

information about Avista, please visit http://www.avistacorp.com/.

Avista Corp. and the Avista Corp. logo are trademarks of Avista

Corporation. This news release contains forward-looking statements

regarding the company's current expectations. Forward-looking

statements are all statements other than historical facts. Such

statements speak only as of the date of the news release and are

subject to a variety of risks and uncertainties, many of which are

beyond the company's control, which could cause actual results to

differ materially from the expectations. These risks and

uncertainties include, in addition to those discussed herein, all

of the factors discussed in the company's Annual Report on Form

10-K for the year ended Dec. 31, 2008, and the Quarterly Report on

Form 10-Q for the quarter ended Sept. 30, 2009. DATASOURCE: Avista

Corp. CONTACT: Media, Jessie Wuerst, +1-509-495-8578, ; or

Investors, Jason Lang, +1-509-495-2930, ; or Avista 24/7 Media

Line, +1-509-495-4174, all of Avista Corp. Web Site:

http://www.avistacorp.com/

Copyright

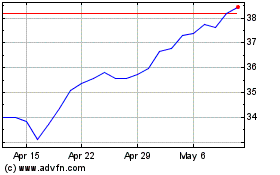

Avista (NYSE:AVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

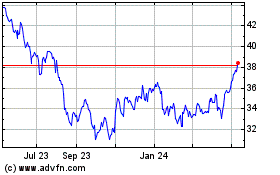

Avista (NYSE:AVA)

Historical Stock Chart

From Nov 2023 to Nov 2024