Avista Reaches Settlement in Idaho Electric and Natural Gas Rate Requests

June 16 2009 - 8:35PM

PR Newswire (US)

If approved, overall electric rates for residential customers could

increase by less than 2 percent with no net change in natural gas

rates SPOKANE, Wash., June 16 /PRNewswire-FirstCall/ -- Avista

(NYSE:AVA) and all other parties involved in the company's electric

and natural gas rate filing have reached a settlement agreement

that, if approved by the Idaho Public Utilities Commission (IPUC),

would result in a residential rate increase of less than two

percent for electric customers and no net rate increase for natural

gas customers. The new rates would take effect Aug. 1, 2009. (Logo:

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO) "The cost

of natural gas is a major driver in the price customers pay on

their bill," said Dennis Vermillion, president of Avista Utilities.

"Natural gas prices have decreased substantially since we filed for

rate adjustments this past January. Just as customers have seen a

decrease in the cost of natural gas that they use in their homes,

we've experienced a decrease in the cost of natural gas used to

generate electricity. We're pleased that the settlement reflects

these decreased costs for the benefit of our customers. "We also

believe the components of the settlement, when taken as a whole,

represent a fair resolution of the issues in the case, will provide

recovery of the company's costs, and will also provide an

opportunity to earn a fair return for shareholders," Vermillion

said. The settlement agreement sets Avista's rate of return on rate

base at 8.55 percent, with a common equity ratio of 50 percent and

a 10.5 percent return on equity. Lower natural gas prices related

to electric generation are one of the major reasons that the

electric rate increase in the agreement is lower than the company's

original request. Additional factors include the exclusion of the

costs associated with short-term power supply contracts that will

be recovered through the existing power cost adjustment (PCA)

mechanism. The agreement also provides 100 percent recovery of the

fixed costs associated with the Lancaster Project through the PCA

when Avista begins receiving power from the project in January

2010. Under the terms of the settlement agreement, electric

revenues could increase by an overall 5.7 percent, or $12.5

million. Offsetting the electric increase will be an overall 4.2

percent decrease in the current PCA surcharge. As a result of the

two adjustments, a residential customer using an average of 982

kilowatt hours per month would see a 1.9 percent, or $1.50,

increase per month for a revised monthly bill of $79.97. Included

in the rate proposal are relicensing costs for the company's

Spokane River hydropower projects. The parties have agreed that if

Avista receives approval from the Federal Energy Regulatory

Commission (FERC) for the relicensing of its Spokane River

hydropower projects before July 22, the relicensing costs will be

included in the electric rate increase. Avista's relicensing

application is currently on FERC's meeting agenda for June 18,

2009. If Avista does not receive a new FERC license before July 22,

under the terms of the settlement the relicensing costs would

continue to be deferred with a carrying charge. The resulting

increase in revenues would be 4.3 percent, or $9.4 million. With

the offsetting PCA decrease, a residential customer using an

average of 982 kilowatt hours per month would see a 0.6 percent, or

$0.48, increase per month for a revised monthly bill of $78.95. For

natural gas service, rates under the terms of the settlement

agreement would increase by 2.11 percent for $1.9 million in

additional revenue. Offsetting the natural gas rate increase for

residential customers will be an equivalent purchased gas

adjustment (PGA) decrease. As a result, a residential customer

using an average of 65 therms per month would see no change in

their $78.23 per month bill. "The offsetting PGA decrease in the

settlement agreement, the third natural gas decrease for our

residential customers since January, means natural gas rates will

have decreased by about 13 percent this year. If prices continue at

current levels, we still plan to request a significant PGA

reduction this fall," Vermillion said. To help customers most

impacted by rising energy prices, Avista will continue to support

legislation in Idaho during the next legislative session to

establish a new energy assistance program similar to the Low-Income

Rate Assistance Program (LIRAP) for Avista's Washington customers.

Avista will also continue to support low-income energy efficiency

programs. Avista Corp. is an energy company involved in the

production, transmission and distribution of energy as well as

other energy-related businesses. Avista Utilities is our operating

division that provides service to 355,000 electric and 315,000

natural gas customers in three Western states. Avista's primary,

non-regulated subsidiary is Advantage IQ. Avista stock is traded

under the ticker symbol "AVA." For more information about Avista,

please visit http://www.avistacorp.com/. Avista Corp. and the

Avista Corp. logo are trademarks of Avista Corporation. This news

release contains forward-looking statements regarding the company's

current expectations. Forward-looking statements are all statements

other than historical facts. Such statements speak only as of the

date of the news release and are subject to a variety of risks and

uncertainties, many of which are beyond the company's control,

which could cause actual results to differ materially from the

expectations. These risks and uncertainties include, in addition to

those discussed herein, all of the factors discussed in the

company's Annual Report on Form 10-K for the year ended Dec. 31,

2008, and the Quarterly Report on Form 10-Q for the quarter ended

March 31, 2009.

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO

http://photoarchive.ap.org/ DATASOURCE: Avista Corp. CONTACT:

Debbie Simock, +1-509-495-8031, , or Investors, Jason Lang,

+1-509-495-2930, , or Avista 24/7 Media Line, +1-509-495-4174 Web

Site: http://www.avistacorp.com/

Copyright

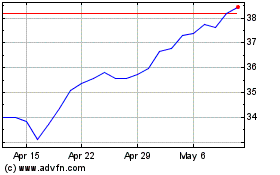

Avista (NYSE:AVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

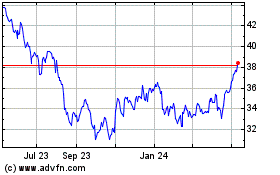

Avista (NYSE:AVA)

Historical Stock Chart

From Nov 2023 to Nov 2024