SPOKANE, Wash., Aug. 2 /PRNewswire-FirstCall/ -- Avista Corp.

(NYSE:AVA) today reported net income of $13.5 million, or $0.27 per

diluted share, for the second quarter of 2006, a decrease as

compared to net income of $18.6 million, or $0.38 per diluted

share, for the second quarter of 2005. For the six months ended

June 30, 2006, Avista Corp.'s net income was $45.0 million, or

$0.91 per diluted share, an increase as compared to net income of

$28.8 million, or $0.59 per diluted share, for the six months ended

June 30, 2005. (Logo:

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO ) "We are

on track for a good year in 2006 due to improved year-to-date

earnings from Avista Utilities and the continued trend of earnings

growth from Advantage IQ," said Avista Chairman and Chief Executive

Officer Gary G. Ely. "We are satisfied with Avista Energy's

operations, which are on track for the year as measured on an

economic basis. However, its reported results continue to differ

from economic results due to the required accounting for certain

contracts and assets under management," Ely added. Results for the

second quarter of 2006 and the six months ended June 30, 2006

(YTD), as compared to the respective periods of 2005: ($ in

thousands, except per- share data) Q2 2006 Q2 2005 YTD 2006 YTD

2005 Operating Revenues $287,394 $272,832 $786,596 $635,496 Income

from Operations $42,578 $49,219 $113,516 $87,402 Net Income $13,459

$18,604 $45,031 $28,793 Net Income (Loss) by Business Segment:

Avista Utilities $16,879 $18,407 $43,051 $37,393 Energy Marketing

& Resource Management $(4,610) $(250) $436 $(8,608) Advantage

IQ $1,558 $918 $2,985 $1,726 Other $(368) $(471) $(1,441) $(1,718)

Contribution to earnings per diluted share by Business Segment:

Avista Utilities $0.34 $0.38 $0.87 $0.76 Energy Marketing &

Resource Management $(0.09) $(0.01) $0.01 $(0.18) Advantage IQ

$0.03 $0.02 $0.06 $0.04 Other $(0.01) $(0.01) $(0.03) $(0.03) Total

earnings per diluted share $0.27 $0.38 $0.91 $0.59 Second Quarter

and Year-to-Date 2006 Highlights Avista Utilities: For the second

quarter of 2006 Avista Utilities' net income decreased as compared

to the same period in 2005. This decrease was primarily due to the

$3.2 million pre-tax gain on the sale of Avista's South Lake Tahoe,

California natural gas distribution properties during the second

quarter of 2005, as well as an increase in interest expense for the

second quarter of 2006. During the first half of 2005, the company

carried higher levels of short-term borrowings under its committed

line of credit at relatively low interest rates. During the fourth

quarter of 2005, the company essentially refinanced these

borrowings on a long-term basis at a fixed interest rate of 6.25

percent. A result of this prudent long-term financing decision was

an increase in interest expense for 2006 as compared to 2005. Gross

margin increased for the second quarter of 2006 as compared to the

second quarter of 2005 primarily due to lower power supply costs,

the effects of the Jan. 1, 2006, Washington general rate increase

and customer growth. The increase in gross margin was partially

offset by an increase in other operating expenses and taxes other

than income taxes. Net income for Avista Utilities increased for

the six months ended June 30, 2006, as compared to the six months

ended June 30, 2005, due to several factors. Most significantly,

electric resource costs were lower than the amount included in base

retail rates. These lower costs were primarily the result of

improved hydroelectric generation during the first half of the

year. Avista Utilities' benefit under the Energy Recovery Mechanism

(ERM) was $7.2 million for the first half of 2006 as compared to

$0.7 million for the first half of 2005. In June 2006, the

Washington Utilities and Transportation Commission (WUTC) approved

the modification of the ERM through a settlement agreement between

Avista and the other parties in the proceeding. The settlement

agreement provides for the continuation of the ERM with certain

agreed-upon modifications and was effective retroactive to Jan. 1,

2006. The settling parties have agreed to review the ERM after five

years. Under the modified ERM, Avista's annual deadband is reduced

from $9 million to $4 million. Annual power supply cost variances

between $4 million and $10 million will be shared equally between

Avista and its customers. As such, 50 percent of the annual power

supply cost variance in this range is deferred for future surcharge

or rebate to Avista's customers, and the remaining 50 percent is an

expense of, or benefit to, Avista. Once the annual power supply

cost variance from the amount included in base rates exceeds $10

million, 90 percent of the cost variance will be deferred for

future surcharge or rebate. The remaining 10 percent of the

variance beyond $10 million is an expense of, or benefit to, Avista

without affecting current or future customer rates. Also

contributing to the increase in net income for the first half of

2006 was the general rate increase implemented in Washington on

Jan. 1, 2006, and the sale of claims against Enron Corporation and

certain of its affiliates during the first quarter of 2006. During

the first half of 2006, Avista Utilities' power and natural gas

deferrals were reduced by $37.9 million. As of June 30, 2006,

deferred power costs were $80.0 million and deferred natural gas

costs were $29.7 million. Avista is forecasting hydroelectric

generation to be 104 percent of normal in 2006 assuming normal

precipitation for the remainder of the year. This forecast may be

revised based on precipitation, temperatures and other variables

during the year. Energy Marketing and Resource Management: This

business segment had a net loss for the second quarter of 2006 due

to the significant difference between the economic management and

the required accounting for certain contracts and physical assets

under the management of Avista Energy. The operations of Avista

Energy are managed on an economic basis, reflecting contracts and

assets under management at estimated market value, consistent with

industry practices, which is different from the required accounting

for certain contracts and physical assets under management. These

differences primarily relate to Avista Energy's management of

natural gas inventory and its control of natural gas-fired

generation through a power purchase agreement, as well as certain

other agreements. These differences had an estimated $7.9 million

(or $0.16 per diluted share) after-tax negative effect on results

for the second quarter of 2006 compared to an estimated $2.3

million (or $0.05 per diluted share) after-tax positive effect on

results for the second quarter of 2005. This business segment had

net income for the first half of 2006 as compared to a significant

net loss for the first half of 2005. The improved results were

primarily due to Avista Energy's asset management activities and

positive results from its natural gas end-user business and natural

gas trading. The estimated difference between the economic

management and the required accounting for certain contracts and

physical assets under management had an estimated $5.3 million (or

$0.11 per diluted share) after-tax negative effect on results for

the six months ended June 30, 2006, as compared to an estimated

$3.9 million (or $0.08 per diluted share) after-tax negative effect

on results for the six months ended June 30, 2005. Economic results

for this segment were consistent with the company's expectations

for the first half of 2006. A significant portion of the estimated

$5.3 million difference between the economic management and the

required accounting for certain contracts and physical assets under

management for the first half of 2006 is expected to reverse in the

first half of 2007 when the contracts are settled or realized. This

assumes stable commodity prices and no additional transactions by

Avista Energy. Until the contracts are settled or realized, this

difference could also increase or decrease due to changes in

forward market prices. Advantage IQ: To more effectively

communicate its identity in the marketplace and to enhance the

understanding of the services they provide, Avista Advantage has

changed its name to Advantage IQ. The earnings improvement at

Advantage IQ for the second quarter and first half of 2006 as

compared to the same periods in 2005 was primarily due to an

increase in operating revenues resulting from customer growth.

Advantage IQ's revenues increased by 25 percent for the six months

ended June 30, 2006, as compared to the six months ended June 30,

2005, while the dollar volume of bills processed increased by 19

percent for the same period. Advantage IQ has over 350 clients

representing approximately 192,000 billed sites in North America.

Other Business Segment: The net loss in the Other business segment

was less for the second quarter and first half of 2006 as compared

to the second quarter and first half of 2005, primarily due to the

improved performance of Advanced Manufacturing and Development

(doing business as METALfx). Liquidity and Capital Resources: Total

debt outstanding for Avista Corp. decreased approximately $64

million in the first half of 2006 primarily due to operating cash

flows in excess of utility capital expenditures, dividends and

other funding requirements. Avista Utilities plans to continue to

invest in its generation, transmission and distribution systems

with a focus on providing reliable service to its customers. The

utility capital budget is approximately $160 million for 2006, and

for the first half of the year these capital expenditures totaled

approximately $70 million. Potential Holding Company Formation: At

the 2006 Annual Meeting on May 11, Avista Corp. shareholders

approved a proposal to proceed with a statutory share exchange,

which would change the company's organization to a holding company

structure. The holding company is expected to ultimately become the

parent to Avista Utilities and Avista Capital, which is the parent

to the company's non-utility subsidiaries. Avista Corp. received

approval from the Federal Energy Regulatory Commission on April 18,

2006, (conditioned on approval by the state regulatory agencies)

and from the Idaho Public Utilities Commission on June 30, 2006.

Avista Corp. also has filed for approval from the utility

regulators in Washington, Oregon and Montana. The statutory share

exchange is subject to the receipt of the remaining state

regulatory approvals and the satisfaction of other conditions. The

company anticipates that the statutory share exchange and the

holding company structure implementation will not be completed

earlier than the fourth quarter of 2006. Earnings Guidance and

Outlook For 2006, Avista Corp. is confirming its guidance for

consolidated earnings to be in the range of $1.30 to $1.45 per

diluted share. The company expects Avista Utilities to contribute

in the range of $1.00 to $1.15 per diluted share for 2006. The

outlook for the utility assumes, among other variables, near normal

weather, temperatures and hydroelectric generation for the

remainder of the year. The 2006 outlook for the Energy Marketing

and Resource Management segment is a contribution range of $0.20 to

$0.30 per diluted share, excluding any positive or negative effects

related to the required accounting for certain contracts and

physical assets under management. Avista Corp. expects Advantage IQ

to contribute in a range of $0.10 to $0.12 per diluted share and

the Other business segment to lose $0.05 per diluted share. Avista

Corp. is an energy company involved in the production, transmission

and distribution of energy as well as other energy-related

businesses. Avista Utilities is a company operating division that

provides service to 339,000 electric and 298,000 natural gas

customers in three Western states. Avista's non-regulated

subsidiaries include Advantage IQ and Avista Energy. Avista Corp.'s

stock is traded under the ticker symbol "AVA." For more information

about Avista, please visit http://www.avistacorp.com/ . NOTE:

Avista Corp. and the Avista Corp. logo are trademarks of Avista

Corporation. NOTE: Avista Corp. will host a conference call on

August 2, 2006, at 10:30 a.m. EDT to discuss this report with

financial analysts. Investors, news media and other interested

parties may listen to the simultaneous webcast of this conference

call. To register for the webcast, please go to

http://www.avistacorp.com/ . A replay of the conference call will

be available until August 9, 2006. Call 888-286-8010, passcode

44199070 to listen to the replay. The webcast will be archived at

http://www.avistacorp.com/ for one year. The attached condensed

consolidated statements of income, condensed consolidated balance

sheets, and financial and operating highlights are integral parts

of this earnings release. This news release contains

forward-looking statements, including statements regarding the

company's current expectations for future financial performance and

cash flows, capital expenditures, the company's current plans or

objectives for future operations, future hydroelectric generation

projections and other factors, which may affect the company in the

future. Such statements are subject to a variety of risks,

uncertainties and other factors, most of which are beyond the

company's control and many of which could have significant impact

on the company's operations, results of operations, financial

condition or cash flows and could cause actual results to differ

materially from the those anticipated in such statements. The

following are among the important factors that could cause actual

results to differ materially from the forward-looking statements:

weather conditions, including the effect of precipitation and

temperatures on the availability of hydroelectric resources and the

effect of temperatures on customer demand; changes in wholesale

energy prices that can affect, among other things, cash

requirements to purchase electricity natural gas for retail

customers and natural gas fuel for electric generation, as well as

the market value of derivative assets and liabilities and

unrealized gains and losses; volatility and illiquidity in

wholesale energy markets, including the availability and prices of

purchased energy and demand for energy sales; the effect of state

and federal regulatory decisions affecting the ability of the

Company to recover its costs and/or earn a reasonable return,

including, but not limited to, the disallowance of previously

deferred costs; the outcome of pending regulatory and legal

proceedings arising out of the "western energy crisis" of 2001 and

2002, and including possible retroactive price caps and resulting

refunds; the outcome of legal proceedings and other contingencies

concerning the Company or affecting directly or indirectly its

operations; the potential effects of any legislation or

administrative rulemaking passed into law; the potential impact of

changes to electric transmission ownership, operation and

governance, such as the formation of one or more regional

transmission organizations or similar entities; wholesale and

retail competition including, but not limited to, electric retail

wheeling and transmission costs; the ability to relicense and

maintain licenses for hydroelectric generating facilities at

cost-effective levels with reasonable terms and conditions;

unplanned outages at any Company-owned generating facilities or the

inability of generating facilities to operate as intended;

unanticipated delays or changes in construction costs, as well as

the ability to obtain required operating permits with respect to

present or prospective facilities; natural disasters that can

disrupt energy delivery as well as the availability and costs of

materials and supplies and support services; blackouts or large

disruptions of transmission systems, which can have an impact on

the Company's ability to deliver energy to its customers; the

potential for future terrorist attacks or other malicious acts,

particularly with respect to utility plant assets; changes in the

long-term climate of the Pacific Northwest, which can affect, among

other things, customer demand patterns and the volume and timing of

streamflows to hydroelectric resources; changes in future economic

conditions in the Company's service territory and the United States

in general, including inflation or deflation and monetary policy;

changes in industrial, commercial and residential growth and

demographic patterns in the Company's service territory; the loss

of significant customers and/or suppliers; failure to deliver on

the part of any parties from which the Company purchases and/or

sells capacity or energy; changes in the creditworthiness of

customers and energy trading counterparties; the Company's ability

to obtain financing through the issuance of debt and/or equity

securities, which can be affected by various factors including the

Company's credit ratings, interest rate fluctuations and other

capital market conditions; the effect of any potential change in

the Company's credit ratings; changes in actuarial assumptions, the

interest rate environment and the actual return on plan assets with

respect to the Company's pension plan, which can affect future

funding obligations, costs and pension plan liabilities; increasing

health care costs and the resulting effect on health insurance

premiums paid for employees and on the obligation to provide

postretirement health care benefits; increasing costs of insurance,

changes in coverage terms and the ability to obtain insurance;

employee issues, including changes in collective bargaining unit

agreements, strikes, work stoppages or the loss of key executives,

as well as the ability to recruit and retain employees; changes in

rapidly advancing technologies, possibly making some of the current

technology quickly obsolete; changes in tax rates and/or policies;

changes in, and compliance with, environmental and endangered

species laws, regulations, decisions and policies, including

present and potential environmental remediation costs; and changes

in the strategic business plans of the Company and/or any of its

subsidiaries, which may be affected by any or all of the foregoing,

including the entry into new businesses and/or the exit from

existing businesses. For a further discussion of these factors and

other important factors, please refer to the company's Annual

Report on Form 10-K for the year ended Dec. 31, 2005 and Quarterly

Report on Form 10-Q for the quarter ended March 31, 2006. The

forward-looking statements contained in this news release speak

only as of the date hereof. The company undertakes no obligation to

update any forward-looking statement or statements to reflect

events or circumstances that occur after the date on which such

statement is made or to reflect the occurrence of unanticipated

events. New factors emerge from time to time, and it is not

possible for management to predict all of such factors, nor can it

assess the impact of each such factor on the company's business or

the extent to which any such factor, or combination of factors, may

cause actual results to differ materially from those contained in

any forward-looking statement. AVISTA CORPORATION CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (Dollars in Thousands

except Per Share Amounts) Six Months Ended Second Quarter June 30,

2006 2005 2006 2005 Operating revenues $287,394 $272,832 $786,596

$635,496 Operating expenses: Resource costs 140,282 130,975 462,014

353,132 Other operating expenses 64,787 58,683 126,825 118,013

Depreciation and amortization 21,424 21,388 43,852 44,094 Utility

taxes other than income taxes 18,323 15,776 40,389 36,064 Total

operating expenses 244,816 226,822 673,080 551,303 Gain on sale of

utility properties -- 3,209 -- 3,209 Income from operations 42,578

49,219 113,516 87,402 Other income (expense): Interest expense, net

of capitalized interest (23,329) (22,533) (46,653) (45,519) Other

income - net 2,078 1,840 4,553 3,662 Total other income (expense) -

net (21,251) (20,693) (42,100) (41,857) Income before income taxes

21,327 28,526 71,416 45,545 Income taxes 7,868 9,922 26,385 16,752

Net income $13,459 $18,604 $45,031 $28,793 Weighted-average common

shares outstanding (thousands), basic 48,958 48,508 48,877 48,493

Weighted-average common shares outstanding (thousands), diluted

49,694 48,904 49,498 48,893 Total earnings per common share, basic

$0.27 $0.38 $0.92 $0.59 Total earnings per common share, diluted

$0.27 $0.38 $0.91 $0.59 Dividends paid per common share $0.140

$0.135 $0.280 $0.270 Issued August 2, 2006 AVISTA CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (Dollars in

Thousands) June 30, December 31, 2006 2005 Assets Cash and cash

equivalents $35,849 $25,917 Restricted cash 40,140 25,634 Accounts

and notes receivable 211,161 502,947 Current energy commodity

derivative assets 416,906 918,609 Other current assets 326,128

297,261 Total net utility property 2,156,918 2,126,417 Non-utility

properties and investments-net 60,255 77,731 Non-current energy

commodity derivative assets 383,883 511,280 Other property and

investments-net 61,384 61,944 Regulatory assets for deferred income

taxes 108,737 114,109 Other regulatory assets 29,940 26,660

Non-current utility energy commodity derivative assets 61,405

46,731 Power and natural gas deferrals 109,747 147,622 Unamortized

debt expense 45,627 48,522 Other deferred charges 18,957 17,110

Total Assets $4,067,037 $4,948,494 Liabilities and Stockholders'

Equity Accounts payable $230,095 $511,427 Current energy commodity

derivative liabilities 398,472 906,794 Current portion of long-term

debt 201,435 39,524 Short-term borrowings 7,000 63,494 Other

current liabilities 254,250 208,649 Long-term debt 820,400 989,990

Long-term debt to affiliated trusts 113,403 113,403 Preferred stock

(subject to mandatory redemption) 26,250 26,250 Non-current energy

commodity derivative liabilities 378,549 488,644 Regulatory

liability for utility plant retirement costs 191,760 186,635

Deferred income taxes 470,887 488,934 Other non-current liabilities

and deferred credits 155,831 153,622 Total Liabilities 3,248,332

4,177,366 Common stock - net (49,043,990 and 48,593,139 outstanding

shares) 630,380 620,598 Retained earnings and accumulated other

comprehensive loss 188,325 150,530 Total Stockholders' Equity

818,705 771,128 Total Liabilities and Stockholders' Equity

$4,067,037 $4,948,494 Issued August 2, 2006 AVISTA CORPORATION

FINANCIAL AND OPERATING HIGHLIGHTS (Dollars in Thousands) Six

Months Ended Second Quarter June 30, 2006 2005 2006 2005 Avista

Utilities Retail electric revenues $126,394 $115,372 $271,788

$251,219 Retail kWh sales (in millions) 2,011 1,930 4,303 4,180

Retail electric customers at end of period 339,091 331,311 339,091

331,311 Wholesale electric revenues $33,278 $32,743 $72,429 $60,477

Wholesale kWh sales (in millions) 929 864 1,404 1,362 Sales of fuel

$8,310 $16,606 $39,247 $26,253 Other electric revenues $4,513

$4,025 $11,038 $7,843 Retail natural gas revenues $63,019 $52,674

$229,980 $191,868 Wholesale natural gas revenues $19,682 $13,676

$50,897 $13,790 Transportation and other natural gas revenues

$2,880 $3,223 $5,987 $6,585 Total therms delivered (in thousands)

121,150 110,244 342,774 293,337 Retail natural gas customers at end

of period 298,490 289,688 298,490 289,688 Income from operations

(pre-tax) $49,338 $48,903 $112,250 $100,509 Net income $16,879

$18,407 $43,051 $37,393 Energy Marketing and Resource Management

Gross margin (operating revenues less resource costs) $(3,881)

$3,773 $7,534 $(4,811) Realized gross margin $12,197 $3,565 $17,472

$12,493 Unrealized gross margin $(16,078) $208 $(9,938) $(17,304)

Income (loss) from operations (pre-tax) $(8,906) $(973) $(2,586)

$(14,781) Net income (loss) $(4,610) $(250) $436 $(8,608) Electric

sales (millions of kWhs) 6,891 6,902 13,870 13,670 Natural gas

sales (thousands of dekatherms) 46,367 31,221 96,530 86,116

Advantage IQ Revenues $9,545 $7,703 $18,622 $14,943 Income from

operations (pre-tax) $2,563 $1,658 $4,962 $3,134 Net income $1,558

$918 $2,985 $1,726 Other Revenues $5,458 $4,784 $10,751 $8,632 Loss

from operations (pre-tax) $(417) $(369) $(1,110) $(1,460) Net loss

$(368) $(471) $(1,441) $(1,718) Issued August 2, 2006

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO

http://photoarchive.ap.org/ DATASOURCE: Avista Corp. CONTACT:

media, Jessie Wuerst, +1-509-495-8578, or , or investors, Jason

Lang, +1-509-495-2930, or , or Avista 24/7 Media Access,

+1-509-495-4174 all of Avista Corp. Web site:

http://www.avistacorp.com/

Copyright

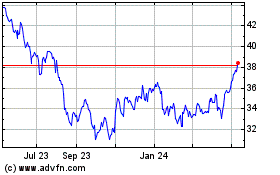

Avista (NYSE:AVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

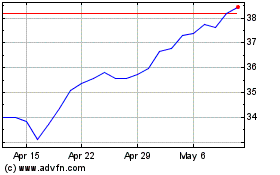

Avista (NYSE:AVA)

Historical Stock Chart

From Nov 2023 to Nov 2024