SPOKANE, Wash., Feb. 10 /PRNewswire-FirstCall/ -- Avista Corp.

(NYSE:AVA) today reported improvement in both fourth quarter and

annual earnings as compared to 2004 performance. For the fourth

quarter of 2005, net income was $25.4 million, or $0.52 per diluted

share, as compared to net income of $22.6 million, or $0.46 per

diluted share, for the same period in 2004. For the year ended Dec.

31, 2005, Avista Corp.'s net income was $45.2 million, or $0.92 per

diluted share, as compared to net income of $35.2 million, or $0.72

per diluted share, for the year ended Dec. 31, 2004. (Logo:

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO ) "For the

fiscal year 2005, we are pleased with the strong performance of

Avista Utilities and Avista Advantage, and we are expecting

continued improvement in our consolidated results for 2006 as

compared to 2005. Our utility operation continues to move closer to

earning its allowed rates of return," said Avista Chairman,

President and Chief Executive Officer Gary G. Ely. "We had a strong

fourth quarter of 2005 due primarily to the recovery of a

significant portion of the accounting-related losses for Avista

Energy's management of natural gas inventory incurred earlier in

the year," Ely added. Results for the fourth quarter of 2005 and

the year ended Dec. 31, 2005, as compared to the respective periods

of 2004: ($ in thousands, except per-share data) Q4 2005 Q4 2004

YTD 2005 YTD 2004 Operating Revenues $458,432 $340,408 $1,359,607

$1,151,580 Income from Operations $59,811 $56,131 $152,024 $140,470

Net Income $25,412 $22,580 $45,168 $35,154 Net Income (Loss) by

Business Segment: Avista Utilities $16,889 $19,891 $52,479 $32,467

Energy Marketing & Resource Management $8,253 $5,940 $(8,621)

$9,733 Avista Advantage $922 $553 $3,922 $577 Other $(652) $(3,804)

$(2,612) $(7,623) Contribution to earnings per diluted share by

Business Segment: Avista Utilities $0.34 $0.41 $1.07 $0.67 Energy

Marketing & Resource Management $0.17 $0.12 $(0.18) $0.20

Avista Advantage $0.02 $0.01 $0.08 $0.01 Other $(0.01) $(0.08)

$(0.05) $(0.15) SUBTOTAL (before cumulative effect of accounting

change) $0.52 $0.46 $0.92 $0.73 Cumulative effect of accounting

change -- -- -- $(0.01) Total earnings per diluted share $0.52

$0.46 $0.92 $0.72 Fourth Quarter and Year-to-Date 2005 Highlights

Avista Utilities: The increase in Avista Utilities' net income for

2005 as compared to 2004 reflects the positive effects of general

rate increases implemented during the second half of 2004 in

Washington and Idaho, and the gain on the sale of Avista Utilities'

South Lake Tahoe natural gas properties. Results for 2004 were

reduced by write-offs of $14.4 million ($9.4 million, net of tax)

related to the Idaho Public Utility Commission general rate case

order. The fourth quarter is typically a strong earnings quarter

for Avista Utilities due to generally colder weather and increased

heating loads. The decrease in net income for the fourth quarter of

2005 as compared to the fourth quarter of 2004, however, was

primarily due to increases in operating costs. Hydroelectric

generation was approximately 95 percent of normal in 2005. The

earnings impact of below normal hydroelectric generation is

mitigated by regulatory mechanisms in Washington and Idaho that

defer 90 percent of increased power supply costs for recovery in

future periods, excluding the annual $9 million Energy Recovery

Mechanism (ERM) deadband in Washington. For 2005, total electric

resource costs exceeded the amount included in base electric rates

by $18 million, of which $9.9 million was absorbed by Avista

(including the $9 million ERM deadband in Washington and $0.9

million representing 10 percent of costs above the ERM deadband)

while $8.1 million was deferred for future recovery from customers.

These additional electric resource costs were due to below normal

hydroelectric generation, as well as an increase in the volume and

price of purchased power and generation fuel costs. During the

fourth quarter of 2005, natural gas rate increases of 23.5 percent,

23.8 percent and 22.5 percent were implemented in Washington, Idaho

and Oregon, respectively. These natural gas rate increases are

designed to pass through increases in purchased natural gas costs

to customers with no change in Avista's gross margin or net income.

On Dec. 21, 2005, the Washington Utilities and Transportation

Commission (WUTC) approved Avista's combined electric and natural

gas general rate case settlement agreement with certain conditions,

which were subsequently accepted by the settling parties. The WUTC

order provided increases of 7.5 percent for electric and 0.6

percent for natural gas base rates, effective Jan. 1, 2006. The

majority of the increase in electric revenues is related to

increased power supply costs. As such, a significant portion of the

increase in revenues will not increase gross margin or net income

because it will be matched by an increase in costs. The WUTC

rejected the proposal in the settlement agreement to reduce the

annual ERM deadband from $9 million to $3 million. However, Avista

was directed to make a filing with the WUTC by Jan. 31, 2006, with

proposed changes to the ERM, including any changes to the ERM

deadband. On Jan. 31, Avista made its filing with the WUTC,

proposing that the ERM be continued for an indefinite period of

time and that the annual $9 million deadband be eliminated. The

elimination of the $9 million deadband would reduce the volatility

of Avista's earnings that has been caused by variations in

hydroelectric generation, as well as prices for fuel and purchased

power. The WUTC indicated in its order that it would provide for an

expedited process that would allow for a determination of any

change to the deadband or any other aspect of the ERM in early

2006. The WUTC also stated that any changes to the ERM ordered by

the WUTC in 2006 would be effective for the full year (beginning

Jan. 1, 2006). Based on recent snowpack surveys, hydroelectric

generation is forecasted to be slightly above normal in 2006. This

is an early forecast, which will be revised based on precipitation,

temperatures and other variables during the year. However,

temperatures were above normal for the month of January 2006, which

resulted in a reduction in retail electric and natural gas loads.

Energy Marketing and Resource Management: The increase in net

income for the fourth quarter of 2005 was primarily due to the

required accounting treatment for the management of natural gas

inventory and the recovery of unrealized losses recorded during the

first nine months of the year. This business segment's net loss for

2005 was primarily related to losses in Avista Energy's natural gas

portfolio. The net loss for 2005 was the first annual net loss for

this business segment since 1999. While Avista Energy scaled back

its natural gas trading portfolio considerably in the second half

of 2005, some losses did continue to occur during the fourth

quarter as Avista Energy continued to unwind positions established

in earlier periods. Avista Energy continued to produce positive

results on the electric side of its business for 2005, including

trading, marketing, and managing the output and availability of

combustion turbines and hydroelectric assets owned by other

entities. However, the results for 2005 decreased as compared to

2004, and for the fourth quarter of 2005 the electric side of the

business had a slight loss primarily due to unfavorable price

movements. The operations of Avista Energy are managed on an

economic basis, reflecting all contracts and assets under

management at estimated market value consistent with industry

practices, which is different from the required accounting for

certain contracts and physical assets under management. These

differences primarily relate to Avista Energy's management of

natural gas inventory, as well as Avista Energy's control of

natural gas-fired generation through a power purchase agreement.

These differences had a $12.0 million after-tax positive effect on

results for the fourth quarter of 2005, primarily due to the

decrease in natural gas prices during the quarter, which

essentially resulted in the recovery of unrealized losses from the

first nine months of the year under the required accounting for the

management of natural gas inventory. For the full year of 2005, the

difference between the economic management and the required

accounting for certain contracts and assets under management had an

after-tax positive effect on results of $0.4 million. Management is

expecting this business segment to have a profitable year in 2006

for a number of reasons. For example, Avista Energy has already

substantially covered the demand charges for its Lancaster power

purchase agreement for 2006, which is well ahead of where it has

been in past years. Avista Energy also continues to expand its

profitable asset optimization business and its natural gas end-user

business. In addition, Avista Energy has more closely aligned its

natural gas and electric trading activities in an effort to improve

coordination and communication between the groups and is intending

to return its natural gas trading business to profitability during

2006. Avista Advantage: This business segment continues to produce

positive earnings. The significant improvement for fiscal year 2005

as compared to 2004 was primarily due to an increase in operating

revenues from customer growth. Avista Advantage's revenues

increased by 35 percent for 2005, as compared to 2004, while the

average cost of processing a bill decreased by 6 percent for the

same period. Avista Advantage has over 350 clients representing

approximately 175,000 billed sites in North America. The number of

billed sites increased by approximately 33,000, or 24 percent, in

2005. Avista Advantage continues to have strong client retention

with an average 95 percent retention rate over the past three

years. In early 2005, Avista Advantage acquired TelAssess, Inc.

Although not a significant financial transaction, this acquisition

has provided Avista Advantage a foundation on which to expand

beyond existing utility bill information services to provide

similar services relating to telecom expense management. Other

Business Segment: The net loss in the Other business segment was

less for the fourth quarter and fiscal year 2005 as compared to the

respective periods of 2004, primarily due to losses from asset

impairments and write-offs incurred in 2004. Liquidity and Capital

Resources: Total debt outstanding increased approximately $40

million in 2005 primarily to fund utility capital expenditures that

were in excess of operating cash flows. Avista has increased

capital expenditures in order to meet load growth needs and to

continue to provide reliable service to its customers. Utility

capital expenditures totaled approximately $210 million, the most

significant of which were the acquisition of the remaining interest

in Coyote Springs 2, transmission system enhancements, and the

repurchase of Avista's corporate headquarters and central operating

facility in Spokane. For 2006, Avista established a utility capital

budget of approximately $160 million. Significant projects include

the continued enhancement of Avista's transmission system and

upgrades to generating facilities. Avista is committed to

investment in its generation, transmission and distribution systems

with a focus on increasing capacity and improving reliability. As

outlined in Avista's 2005 Electric Integrated Resource Plan, which

was filed with regulators in Washington and Idaho, quarterly energy

deficits are projected to begin in 2007 and annual energy deficits

are projected to begin in 2010. To meet forecasted increases in

electric loads, Avista issued a request for proposals in January

2006 to add approximately 35 average megawatts of long-term

renewable energy supplies to begin in the fourth quarter of 2007.

Avista has also recently entered into an agreement with Idaho Power

to jointly investigate possible future coal-based generation

resources. During the fourth quarter of 2005, Avista issued $150

million of 6.25 percent First Mortgage Bonds due in 2035 primarily

to refinance borrowings on its $350 million committed line of

credit. As of Dec. 31, 2005, Avista had $63 million outstanding on

its line of credit. The quarterly dividend for the fourth quarter

of 2005 was $0.14 per common share, an increase of $0.005 per

common share over the previous quarterly dividend as authorized by

Avista's board of directors. Earnings Guidance and Outlook For

2006, Avista is confirming its guidance for consolidated earnings

to be in the range of $1.30 to $1.45 per diluted share. The company

expects Avista Utilities to contribute in the range of $1.00 to

$1.15 per diluted share for 2006. If the annual ERM deadband

remains at $9 million for 2006, the company expects Avista

Utilities' earnings to be at the lower end of this range. The

outlook for the utility assumes, among other variables, normal

weather and temperatures, and slightly above normal hydroelectric

generation. The 2006 outlook for the Energy Marketing and Resource

Management segment is a contribution range of $0.20 to $0.30 per

diluted share, excluding any positive or negative effects of

changes in natural gas prices on the required accounting for the

management of natural gas inventory. The company expects Avista

Advantage to contribute in a range of $0.10 to $0.12 per diluted

share and the Other business segment to lose $0.05 per diluted

share. Avista Corp. is an energy company involved in the

production, transmission and distribution of energy as well as

other energy-related businesses. Avista Utilities is a company

operating division that provides service to 338,000 electric and

297,000 natural gas customers in three Western states. Avista's

non-regulated subsidiaries include Avista Advantage and Avista

Energy. Avista Corp.'s stock is traded under the ticker symbol

"AVA." For more information about Avista, please visit

http://www.avistacorp.com/. NOTE: Avista Corp. and the Avista Corp.

logo are trademarks of Avista Corporation. NOTE: Avista Corp. will

host a conference call on Feb. 10, 2006, at 10:30 a.m. EST to

discuss this report with financial analysts. Investors, news media

and other interested parties may listen to the simultaneous webcast

of this conference call. To register for the webcast, please go to

http://www.avistacorp.com/. A replay of the conference call will be

available until Feb. 17, 2006. Call 888-286-8010, passcode 80177501

to listen to the replay. The webcast will be archived at

http://www.avistacorp.com/ for one year. The following condensed

consolidated statements of income, condensed consolidated balance

sheets, and financial and operating highlights are integral parts

of this earnings release. This news release contains

forward-looking statements, including statements regarding the

company's current expectations for future financial performance and

cash flows, capital expenditures, the company's current plans or

objectives for future operations, future hydroelectric generation

projections, projected energy deficits in future periods and other

factors, which may affect the company in the future. Such

statements are subject to a variety of risks, uncertainties and

other factors, most of which are beyond the company's control and

many of which could have significant impact on the company's

operations, results of operations, financial condition or cash

flows and could cause actual results to differ materially from the

those anticipated in such statements. The following are among the

important factors that could cause actual results to differ

materially from the forward-looking statements: weather conditions,

including the effect of precipitation and temperatures on the

availability of hydroelectric resources and the effect of

temperatures on customer demand; changes in wholesale energy prices

that can affect, among other things, cash requirements to purchase

electricity and natural gas for retail customers, as well as the

market value of derivative assets and liabilities and unrealized

gains and losses; the impact of state and federal regulatory

decisions affecting the ability of the Company to recover its costs

and/or earn a reasonable return; the outcome of pending regulatory

and legal proceedings arising out of the "western energy crisis" of

2001 and 2002, and including possible retroactive price caps and

resulting refunds; changes in the utility regulatory environment in

the individual states and provinces in which the Company operates

as well as the United States and Canada in general; the outcome of

legal proceedings and other contingencies concerning the Company or

affecting directly or indirectly its operations; the potential

effects of any legislation or administrative rulemaking passed into

law, including the Energy Policy Act of 2005 which was passed into

law in August 2005; the impact from the potential formation of a

Regional Transmission Organization; wholesale and retail

competition; volatility and illiquidity in wholesale energy

markets; changes in global energy markets; the ability to relicense

the Spokane River Project at a cost-effective level with reasonable

terms and conditions; unplanned outages at any Company-owned

generating facilities; unanticipated delays or changes in

construction costs with respect to present or prospective

facilities; natural disasters that can disrupt energy delivery as

well as the availability and costs of materials and supplies and

support services; blackouts or large disruptions of transmission

systems; the potential for future terrorist attacks, particularly

with respect to utility plant assets; changes in the long-term

climate of the Pacific Northwest; changes in future economic

conditions in the Company's service territory and the United States

in general; changes in industrial, commercial and residential

growth and demographic patterns in the Company's service territory;

the loss of significant customers and/or suppliers; failure to

deliver on the part of any parties from which the Company purchases

and/or sells capacity or energy; changes in the creditworthiness of

customers and energy trading counterparties; the Company's ability

to obtain financing through the issuance of debt and/or equity

securities; the impact of any potential change in the Company's

credit ratings; changes in actuarial assumptions, the interest rate

environment and the actual return on plan assets with respect to

the Company's pension plan; increasing health care costs and the

resulting effect on health insurance premiums paid for employees

and on the obligation to provide postretirement health care

benefits; increasing costs of insurance, changes in coverage terms

and the ability to obtain insurance; employee issues, including

changes in collective bargaining unit agreements, strikes, work

stoppages or the loss of key executives, as well as the ability to

recruit and retain employees; changes in rapidly advancing

technologies, possibly making some of the current technology

quickly obsolete; changes in tax rates and/or policies; and changes

in, and compliance with, environmental and endangered species laws,

regulations, decisions and policies, including present and

potential environmental remediation costs. For a further discussion

of these factors and other important factors, please refer to the

company's Annual Report on Form 10-K for the year ended Dec. 31,

2004 and Quarterly Report on Form 10-Q for the quarter ended

September 30, 2005. The forward-looking statements contained in

this news release speak only as of the date hereof. The company

undertakes no obligation to update any forward-looking statement or

statements to reflect events or circumstances that occur after the

date on which such statement is made or to reflect the occurrence

of unanticipated events. New factors emerge from time to time, and

it is not possible for management to predict all of such factors,

nor can it assess the impact of each such factor on the company's

business or the extent to which any such factor, or combination of

factors, may cause actual results to differ materially from those

contained in any forward- looking statement. AVISTA CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (Dollars in

Thousands except Per Share Amounts) Year Ended Fourth Quarter

December 31, 2005 2004 2005 2004 Operating revenues $458,432

$340,408 $1,359,607 $1,151,580 Operating expenses: Resource costs

295,433 183,834 815,590 618,595 Other operating expenses 63,830

63,293 241,131 247,796 Depreciation and amortization 21,449 19,655

86,911 78,425 Utility taxes other than income taxes 17,909 17,495

68,044 66,294 Total operating expenses 398,621 284,277 1,211,676

1,011,110 Gain on sale of utility properties -- -- 4,093 -- Income

from operations 59,811 56,131 152,024 140,470 Other income

(expense): Interest expense, net of capitalized interest (22,733)

(23,064) (91,025) (91,654) Other income - net 2,857 1,662 10,030

8,390 Total other income (expense) - net (19,876) (21,402) (80,995)

(83,264) Income before income taxes 39,935 34,729 71,029 57,206

Income taxes 14,523 12,149 25,861 21,592 Net income before

cumulative effect of accounting change 25,412 22,580 45,168 35,614

Cumulative effect of accounting change (net of tax) (Note 1) -- --

-- (460) Net income $25,412 $22,580 $45,168 $35,154

Weighted-average common shares outstanding (thousands), basic

48,568 48,446 48,523 48,400 Weighted-average common shares

outstanding (thousands), diluted 48,997 48,935 48,979 48,886

Earnings per common share, basic: Earnings before cumulative effect

of accounting change $0.52 $0.47 $0.93 $0.74 Loss from cumulative

effect of accounting change (Note 1) -- -- -- (0.01) Total earnings

per common share, basic $0.52 $0.47 $0.93 $0.73 Earnings per common

share, diluted: Earnings before cumulative effect of accounting

change $0.52 $0.46 $0.92 $0.73 Loss from cumulative effect of

accounting change (Note 1) -- -- -- (0.01) Total earnings per

common share, diluted $0.52 $0.46 $0.92 $0.72 Dividends paid per

common share $0.140 $0.130 $0.545 $0.515 Note 1. Amount for the

year ended December 31, 2004 represents the implementation of

Financial Accounting Standards Board Interpretation No. 46R,

"Consolidation of Variable Interest Entities," which resulted in

the consolidation of several minor entities. Issued February 10,

2006 AVISTA CORPORATION CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) (Dollars in Thousands) December 31, December 31, 2005

2004 Assets Cash and cash equivalents $25,917 $88,317 Restricted

cash 25,634 26,175 Accounts and notes receivable 502,947 313,899

Current energy commodity assets 918,609 284,231 Current utility

energy commodity derivative assets 69,494 12,557 Other current

assets 220,478 182,961 Total net utility property 2,126,417

1,956,063 Investment in exchange power-net 33,483 35,933

Non-utility properties and investments-net 77,731 78,564

Non-current energy commodity assets 511,280 254,657 Investment in

affiliated trusts 13,403 13,403 Other property and investments-net

15,058 19,721 Regulatory assets for deferred income taxes 117,354

123,159 Other regulatory assets 26,660 43,428 Non-current utility

energy commodity derivative assets 46,731 55,825 Power and natural

gas deferrals 147,622 148,206 Unamortized debt expense 48,522

53,413 Other deferred charges 17,110 21,109 Total Assets $4,944,450

$3,711,621 Liabilities and Stockholders' Equity Accounts payable

$511,427 $325,194 Current energy commodity liabilities 906,794

253,527 Current portion of long-term debt 39,524 85,432 Short-term

borrowings 63,494 68,517 Other current liabilities 208,649 149,168

Long-term debt 989,990 901,556 Long-term debt to affiliated trusts

113,403 113,403 Preferred stock (subject to mandatory redemption)

26,250 28,000 Non-current energy commodity liabilities 488,644

215,055 Regulatory liability for utility plant retirement costs

186,635 175,575 Non-current utility energy commodity derivative

liabilities 88 33,490 Deferred income taxes 484,890 488,471 Other

non-current liabilities and deferred credits 153,534 121,028 Total

Liabilities 4,173,322 2,958,416 Common stock - net (48,593,139 and

48,471,511 outstanding shares) 620,598 617,884 Retained earnings

and accumulated other comprehensive loss 150,530 135,321 Total

Stockholders' Equity 771,128 753,205 Total Liabilities and

Stockholders' Equity $4,944,450 $3,711,621 Issued February 10, 2006

AVISTA CORPORATION FINANCIAL AND OPERATING HIGHLIGHTS (Dollars in

Thousands) Year Ended Fourth Quarter December 31, 2005 2004 2005

2004 Avista Utilities Retail electric revenues $138,653 $132,258

$511,864 $506,428 Retail kWh sales (in millions) 2,303 2,187 8,530

8,363 Retail electric customers at end of period 338,369 331,014

338,369 331,014 Wholesale electric revenues $50,692 $21,886

$151,429 $62,399 Wholesale kWh sales (in millions) 549 393 2,508

1,472 Sales of fuel $8,709 $5,063 $41,831 $63,990 Other electric

revenues $6,056 $4,463 $17,988 $19,264 Total natural gas revenues

$177,464 $120,161 $438,205 $320,493 Total therms delivered (in

thousands) 188,528 164,254 562,307 495,584 Retail natural gas

customers at end of period 297,277 304,850 297,277 304,850 Income

from operations (pre-tax) $47,585 $50,274 $165,378 $134,073 Net

income $16,889 $19,891 $52,479 $32,467 Energy Marketing and

Resource Management Gross margin (operating revenues less resource

costs) $16,415 $14,114 $2,016 $38,842 Realized gross margin $19,411

$8,217 $40,142 $39,520 Unrealized gross margin $(2,996) $5,897

$(38,126) $(678) Income (loss) from operations (pre-tax) $10,974

$8,056 $(18,267) $11,681 Net income (loss) $8,253 $5,940 $(8,621)

$9,733 Electric sales (millions of kWhs) 6,923 7,875 28,377 32,629

Natural gas sales (thousands of dekatherms) 51,561 64,479 182,874

219,719 Avista Advantage Revenues $8,605 $6,636 $31,748 $23,444

Income from operations (pre-tax) $1,637 $1,092 $6,973 $1,742 Net

income $922 $553 $3,922 $577 Other Revenues $5,056 $4,483 $18,532

$17,127 Loss from operations (pre-tax) $(385) $(3,291) $(2,060)

$(7,026) Net loss before cumulative effect of accounting change

$(652) $(3,804) $(2,612) $(7,163) Net loss $(652) $(3,804) $(2,612)

$(7,623) Issued February 10, 2006 First Call Analyst: FCMN Contact:

debbie.simock@avistacorp.com

http://www.newscom.com/cgi-bin/prnh/20040128/SFW031LOGO

http://photoarchive.ap.org/ DATASOURCE: Avista Corp. CONTACT:

media, Jessie Wuerst, +1-509-495-8578, or , or investors, Jason

Lang, +1-509-495-2930, or , both of Avista Corp.; or Avista 24/7

Media Access, +1-509-495-4174 Web site: http://www.avistacorp.com/

Copyright

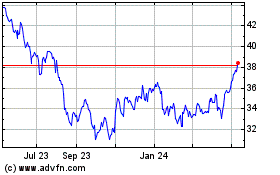

Avista (NYSE:AVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

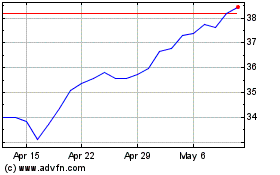

Avista (NYSE:AVA)

Historical Stock Chart

From Nov 2023 to Nov 2024