Atmos Energy Corporation (NYSE: ATO) today reported consolidated

results for its 2010 fiscal year and fourth quarter ended September

30, 2010.

- Fiscal 2010 consolidated results,

excluding net unrealized margins were $210.1 million, or $2.25 per

diluted share, compared with $212.6 million, or $2.30 per diluted

share in the prior year.

- After including noncash, unrealized net

losses of $4.3 million, or ($0.05) per diluted share, fiscal 2010

net income was $205.8 million, or $2.20 per diluted share. Net

income was $191.0 million, or $2.07 per diluted share in the prior

year, after including unrealized net losses of $21.6 million, or

($0.23) per diluted share.

- Included in current year net income is

the positive impact of a state sales tax refund of $4.6 million, or

$0.05 per diluted share. Net income for the prior year included the

positive impact of net one-time adjustments of $17.1 million, or

$0.19 per diluted share.

- Atmos Energy expects fiscal 2011

earnings to be in the range of $2.25 to $2.35 per diluted share,

excluding unrealized gains and losses.

For the quarter ended September 30, 2010, consolidated net

income was $1.5 million, or $0.02 per diluted share, compared with

a net loss of $16.0 million, or ($0.17) per diluted share for the

same quarter last year. Results include noncash, unrealized net

gains of $1.6 million, or $0.02 per diluted share for the current

quarter, compared with unrealized net losses of $12.2 million, or

($0.13) per diluted share for the prior-year quarter. For the

current quarter, regulated operations incurred a net loss of $4.8

million, or ($0.05) per diluted share, and nonregulated operations

contributed $6.3 million of net income, or $0.07 per diluted

share.

“Fiscal 2010 was an exceptional year and we are gratified to

again deliver on our stated earnings objectives, especially during

these challenging economic times,” said Robert W. Best, executive

chairman of Atmos Energy Corporation. “The predictable and stable

contribution from our regulated operations remains the cornerstone

of our earnings framework, while the nonregulated assets continue

to complement these base earnings. Looking forward to fiscal 2011,

we believe that we are positioned to continue delivering average

annual earnings growth in the 4 percent to 6 percent range,” Best

concluded.

Results for the Year Ended September 30,

2010

Natural gas distribution gross profit increased $24.8 million to

$1,049.4 million for the year ended September 30, 2010, compared

with $1,024.6 million in the prior year. This increase is due

largely to a net $33.7 million increase in rates, primarily in the

company’s Texas, Louisiana and Mississippi service areas and an

$11.2 million increase associated with an 11 percent rise in

consolidated distribution throughput. Partially offsetting these

increases in gross profit was a decrease resulting from the absence

in the current period of a non-recurring $7.6 million adjustment to

the revenue estimate for gas delivered to customers but not yet

billed, which was recorded in the prior-year period. Additionally,

gross profit decreased $7.0 million as a result of the prior-year

reversal of an accrual for estimated unrecoverable gas costs that

did not recur in the current year.

Regulated transmission and storage gross profit decreased $6.7

million to $203.0 million for the year ended September 30, 2010,

compared with $209.7 million for the same period last year. This

period-over-period decrease is due primarily to a $13.3 million

decrease attributable to lower per-unit transportation margins

largely due to narrower basis spreads, and a $2.6 million decrease

due to a 19 percent decline in consolidated throughput. Partially

offsetting these decreases was a $9.3 million increase in revenues

resulting from filings under the Texas Gas Reliability

Infrastructure Program (GRIP).

Natural gas marketing gross profit increased $1.4 million to

$86.0 million for the 2010 fiscal year, compared with $84.6 million

for the prior year. Atmos Energy Marketing’s (AEM) delivered gas

margins decreased $15.8 million year over year due to reduced

per-unit margins and a five percent decrease in consolidated sales

volumes. Additionally, storage and trading margins decreased $0.5

million due primarily to higher storage demand fees paid, partially

offset by an increase in realized storage and trading gains

experienced in the current fiscal year. Offsetting these decreases

was a $17.6 million year-over-year increase in unrealized

margins.

Pipeline, storage and other gross profit decreased $1.4 million

to $28.1 million for the year ended September 30, 2010, compared

with $29.5 million last year. The decrease was due principally to

lower margins earned from storage optimization activities of $4.9

million, a $3.9 million decrease arising from lower physical basis

spreads and lower margins earned under asset management plans of

$2.4 million. Partially offsetting these decreases was a $10.5

million increase in unrealized margins.

Consolidated operation and maintenance expense for the year

ended September 30, 2010, was $468.0 million, compared with $494.0

million for the prior year. Excluding the provision for doubtful

accounts, operation and maintenance expense for the current year

was $460.3 million, compared with $486.2 million for the prior

year. The $25.9 million decrease resulted primarily from lower

pipeline maintenance costs in the company’s Atmos Pipeline-Texas

Division of $14.3 million, a one-time $7.4 million state sales tax

refund and a $4.6 million reduction in legal and other

administrative costs.

Prior-year results include the favorable impact of a one-time

tax benefit of $11.3 million. This benefit arose in the second

quarter of fiscal 2009 after the company updated the tax rates used

to record its deferred taxes. Additionally, fiscal 2009 includes a

$5.4 million noncash charge to impair certain available-for-sale

investments. These items did not recur in the current year.

The debt capitalization ratio at September 30, 2010, was 51.3

percent, compared with 50.7 percent at September 30, 2009. At

September 30, 2010, there was $126.1 million of short-term debt

outstanding, compared with $72.6 million at September 30, 2009.

For the year ended September 30, 2010, the company generated

operating cash flow of $726.5 million, a $192.8 million reduction

compared with fiscal 2009. Operating cash flow for fiscal 2010

reflects the recovery of lower gas costs through purchased gas

recovery mechanisms. This is in contrast to fiscal 2009, when

operating cash flow was favorably influenced by the recovery of

high gas costs during a period of falling prices.

Capital expenditures increased to $542.6 million for fiscal

2010, compared with $509.5 million last year. The $33.1 million

increase primarily reflects spending for the relocation of the

company’s information technology data center, the construction of

two service centers and the steel service line replacement program

in the Mid-Tex Division.

Results for the Fiscal 2010 Fourth

Quarter

Natural gas distribution gross profit increased $5.0 million to

$172.5 million for the fiscal 2010 fourth quarter, compared with

$167.5 million in the prior-year quarter. This increase reflects a

net $5.8 million increase in rates principally in the company’s

Kentucky, Texas and Louisiana service areas.

Regulated transmission and storage gross profit increased $9.6

million to $56.0 million for the quarter ended September 30, 2010,

compared with $46.4 million for the prior-year quarter. This

increase is due primarily to a $4.8 million increase from the sale

of excess gas, a $3.1 million increase in revenues resulting from

filings under GRIP and a $3.0 million increase resulting from

higher levels of compression activity. These increases were

partially offset by a $1.3 million quarter-over-quarter decrease in

per-unit transportation margins on through-system deliveries,

largely due to narrower basis spreads.

Natural gas marketing gross profit decreased $2.6 million to

$13.4 million for the fiscal 2010 fourth quarter, compared with

$16.0 million for the fiscal 2009 fourth quarter. Realized storage

and trading margins decreased by $19.8 million quarter over

quarter. AEM experienced a decrease in realized trading gains

during the current quarter due to unfavorable natural gas market

fundamentals. This contrasts to the prior-year quarter, where AEM

settled its financial positions and cycled gas during a period of

wider spot to forward spread values. Additionally, delivered gas

margins decreased $3.2 million due to decreased per-unit margins,

combined with about a 2 percent quarter-over-quarter decrease in

consolidated sales volumes. Partially offsetting these decreases

was a $20.4 million quarter-over-quarter increase in unrealized

margins.

Pipeline, storage and other gross profit increased $2.7 million

to $5.0 million for the quarter ended September 30, 2010, compared

with $2.3 million for the same period last year. The increase is

due primarily to higher margins earned from storage optimization

activities of $0.6 million and an increase in storage demand fees

of $0.5 million. Additionally, unrealized margins increased $1.4

million quarter over quarter.

Consolidated operation and maintenance expense for the quarter

ended September 30, 2010 was $113.7 million, compared with $128.7

million for the prior-year quarter. Excluding the provision for

doubtful accounts, operation and maintenance expense for the

current quarter decreased $14.5 million, compared with the same

period last year. The decrease is due primarily to an $8.3 million

decrease in employee wages and benefit costs and a $7.3 million

decrease in contract labor costs primarily in the company’s Atmos

Pipeline-Texas Division.

Outlook

The leadership of Atmos Energy remains focused on enhancing

shareholder value by delivering consistent earnings growth. Atmos

Energy projects fiscal 2011 earnings to be in the range of $2.25 to

$2.35 per diluted share, excluding unrealized gains and losses. Net

income from regulated operations is expected to be in the range of

$161 million to $168 million, and net income from nonregulated

operations is expected to be in the range of $45 million to $47

million. Capital expenditures for fiscal 2011 are expected to range

from $580 million to $595 million.

However, the valuation on September 30, 2011, of the company’s

nonregulated physical storage inventory and associated financial

instruments (“mark-to-market”), as well as changes in events or

other circumstances that the company cannot currently anticipate or

predict, could result in earnings for fiscal 2011 that are

significantly above or below this outlook. Factors that could cause

such changes are described below in Forward-Looking Statements and

in other company reports filed with the Securities and Exchange

Commission.

Conference Call to be Webcast November 4,

2010

Atmos Energy will host a conference call with financial analysts

to discuss fiscal 2010 financial results on Thursday November 4,

2010, at 10 a.m. Eastern Time. The telephone number is

877-485-3107. The conference call will be webcast live on the Atmos

Energy website at www.atmosenergy.com. A playback of the call will

be available on the website later that day. Atmos Energy senior

leadership who will participate in the conference call include: Bob

Best, executive chairman; Kim Cocklin, president and chief

executive officer; and Fred Meisenheimer, senior vice president,

chief financial officer and treasurer.

Highlights and Recent Developments

Leadership Changes

Effective October 1, 2010, Kim R. Cocklin became president and

chief executive officer of Atmos Energy Corporation. Mr. Cocklin

served as president and chief operating officer since October 2008.

In addition, Robert W. Best became executive chairman of Atmos

Energy after having served as chairman and chief executive officer

since 1997.

$200 Million Revolving Credit Facility

On October 15, 2010, Atmos Energy Corporation entered into a

$200 million, 180-day committed revolving credit facility. The

credit facility will expire on April 13, 2011. This credit facility

replaces the company’s $200 million, 364-day revolving credit

facility on essentially the same terms, except for the duration of

the facility.

This news release should be read in conjunction with the

attached unaudited financial information.

Forward-Looking Statements

The matters discussed in this news release may contain

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements other than statements of

historical fact included in this news release are forward-looking

statements made in good faith by the company and are intended to

qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. When used in this

news release or in any of the company’s other documents or oral

presentations, the words “anticipate,” “believe,” “estimate,”

“expect,” “forecast,” “goal,” “intend,” “objective,” “plan,”

“projection,” “seek,” “strategy” or similar words are intended to

identify forward-looking statements. Such forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from those discussed in this

news release, including the risks and uncertainties relating to

regulatory trends and decisions, the company’s ability to continue

to access the capital markets and the other factors discussed in

the company’s reports filed with the Securities and Exchange

Commission. These factors include the risks and uncertainties

discussed in the company’s Annual Report on Form 10-K for the

fiscal year ended September 30, 2009 and in the company’s Quarterly

Report on Form 10-Q for the three and nine months ended June 30,

2010. Although the company believes these forward-looking

statements to be reasonable, there can be no assurance that they

will approximate actual experience or that the expectations derived

from them will be realized. The company undertakes no obligation to

update or revise forward-looking statements, whether as a result of

new information, future events or otherwise.

About Atmos Energy

Atmos Energy Corporation, headquartered in Dallas, is the

country's largest natural-gas-only distributor, serving over three

million natural gas distribution customers in more than 1,600

communities in 12 states from the Blue Ridge Mountains in the East

to the Rocky Mountains in the West. Atmos Energy also provides

natural gas marketing and procurement services to industrial,

commercial and municipal customers primarily in the Midwest and

Southeast and manages company-owned natural gas pipeline and

storage assets, including one of the largest intrastate natural gas

pipeline systems in Texas. Atmos Energy is a Fortune 500 company.

For more information, visit www.atmosenergy.com.

Atmos Energy Corporation

Financial Highlights

(Unaudited)

Statements of

Income

Year EndedSeptember 30 Percentage (000s except per share) 2010

2009 Change Gross Profit: Natural gas distribution

segment $ 1,049,447 $ 1,024,628 2 % Regulated transmission and

storage segment 203,013 209,658 (3 )% Natural gas marketing segment

85,951 84,612 2 % Pipeline, storage and other segment 28,140 29,496

(5 )% Intersegment eliminations

(1,610 )

(1,692 ) 5 % Gross profit 1,364,941 1,346,702 1 %

Operation and maintenance expense 468,038 494,010 (5 )%

Depreciation and amortization 216,960 217,208 — % Taxes, other than

income 190,507 182,700 4 % Asset impairments

—

5,382 (100 )% Total operating

expenses 875,505 899,300 (3 )% Operating income 489,436

447,402 9 % Miscellaneous expense (339 ) (3,303 ) (90 )%

Interest charges

154,471

152,830 1 % Income before income taxes

334,626 291,269 15 % Income tax expense

128,787

100,291 28 % Net income

$ 205,839 $

190,978 8 % Basic net income per share $

2.22 $ 2.08 Diluted net income per share $ 2.20 $ 2.07 Cash

dividends per share $ 1.34 $ 1.32 Weighted average shares

outstanding: Basic 91,852 91,117 Diluted 92,422 91,620

Year EndedSeptember 30 Percentage

Summary Net Income

by Segment (000s)

2010 2009 Change Natural gas distribution $ 125,949 $

116,807 8 % Regulated transmission and storage 41,486 41,056 1 %

Natural gas marketing 34,059 37,334 (9 )% Pipeline, storage and

other 8,672 17,353 (50 )% Unrealized margins, net of tax

(4,327 )

(21,572 ) 80 %

Consolidated net income

$ 205,839

$ 190,978 8 %

Atmos Energy Corporation

Financial Highlights, continued

(Unaudited)

Statements of

Income

Three Months EndedSeptember 30 Percentage (000s

except per share) 2010 2009 Change Gross Profit:

Natural gas distribution segment $ 172,542 $ 167,482 3 % Regulated

transmission and storage segment 56,015 46,397 21 % Natural gas

marketing segment 13,381 16,023 (16 )% Pipeline, storage and other

segment 5,003 2,321 116 % Intersegment eliminations

(398 )

(424 ) 6 % Gross profit

246,543 231,799 6 % Operation and maintenance expense

113,740 128,698 (12 )% Depreciation and amortization 56,753 56,451

1 % Taxes, other than income

35,859

32,672 10 % Total operating expenses

206,352 217,821 (5 )% Operating income 40,191 13,978 188 %

Miscellaneous income (expense) 731 (2,656 ) 128 % Interest

charges

38,891

36,795 6 % Income (loss) before income

taxes 2,031 (25,473 ) 108 % Income tax expense (benefit)

494 (9,521 ) 105 % Net

income (loss)

$ 1,537

$ (15,952 ) 110 % Basic net income

(loss) per share $ 0.02 $ (0.17 ) Diluted net income (loss) per

share $ 0.02 $ (0.17 ) Cash dividends per share $ .335 $

.330 Weighted average shares outstanding: Basic 89,890

91,617 Diluted 90,454 91,617 Three Months

EndedSeptember 30 Percentage

Summary Net Income

(Loss) by Segment (000s)

2010 2009 Change Natural gas distribution $ (17,328 ) $

(19,961 ) 13 % Regulated transmission and storage 12,497 976 1,180

% Natural gas marketing 2,204 15,858 (86 )% Pipeline, storage and

other 2,561 (609 ) 520 % Unrealized margins, net of tax

1,603 (12,216 ) 113 %

Consolidated net income (loss)

$ 1,537

$ (15,952 ) 110 %

Atmos Energy Corporation

Financial Highlights, continued

(Unaudited)

Condensed Balance

Sheets

September 30, September 30, (000s) 2010 2009 Net property,

plant and equipment $ 4,793,075 $ 4,439,103 Cash and cash

equivalents 131,952 111,203 Accounts receivable, net 273,207

232,806 Gas stored underground 319,038 352,728 Other current assets

150,995 132,203

Total current assets 875,192 828,940 Goodwill and intangible

assets 740,148 740,064 Deferred charges and other assets

355,376 358,976

$ 6,763,791 $

6,367,083 Shareholders’ equity $

2,178,348 $ 2,176,761 Long-term debt

1,809,551

2,169,400 Total capitalization 3,987,899

4,346,161 Accounts payable and accrued liabilities 266,208

207,421 Other current liabilities 413,640 457,319 Short-term debt

126,100 72,550 Current maturities of long-term debt

360,131 131 Total current

liabilities 1,166,079 737,421 Deferred income taxes 829,128

570,940 Deferred credits and other liabilities

780,685 712,561

$ 6,763,791 $

6,367,083

Atmos Energy Corporation

Financial Highlights, continued

(Unaudited)

Condensed Statements

of Cash Flows

Year EndedSeptember 30 (000s) 2010 2009

Cash flows

from operating activities Net income $ 205,839 $ 190,978

Asset impairments — 5,382 Depreciation and amortization 217,133

217,302 Deferred income taxes 196,731 129,759 Changes in assets and

liabilities 83,455 352,131 Other

23,318

23,681 Net cash provided by operating

activities 726,476 919,233

Cash flows from investing

activities Capital expenditures (542,636 ) (509,494 )

Other, net

(66 )

(7,707 )

Net cash used in investing activities (542,702 ) (517,201 )

Cash flows from financing activities Net increase

(decrease) in short-term debt 54,268 (283,981 ) Net proceeds from

issuance of long-term debt — 445,623 Settlement of Treasury lock

agreement — 1,938 Repayment of long-term debt (131 ) (407,353 )

Cash dividends paid (124,287 ) (121,460 ) Repurchase of common

stock (100,450 ) — Repurchase of equity awards (1,191 ) — Issuance

of common stock

8,766

27,687 Net cash used in financing activities

(163,025 )

(337,546

) Net increase in cash and cash equivalents

20,749 64,486 Cash and cash equivalents at beginning of period

111,203 46,717

Cash and cash equivalents at end of period

$

131,952 $ 111,203

Three Months EndedSeptember 30 Year

EndedSeptember 30

Statistics 2010 2009 2010

2009 Consolidated natural gas distribution throughput (MMcf

as metered) 55,902 56,804 454,175 408,885 Consolidated regulated

transmission and storage transportation volumes (MMcf) 133,473

127,990 428,599 528,689 Consolidated natural gas marketing sales

volumes (MMcf) 86,717 88,126 353,853 370,569 Natural gas

distribution meters in service 3,186,040 3,178,844 3,186,040

3,178,844 Natural gas distribution average cost of gas $ 5.83 $

4.96 $ 5.77 $ 6.95 Natural gas marketing net physical position

(Bcf) 13.7 13.8 13.7 13.8

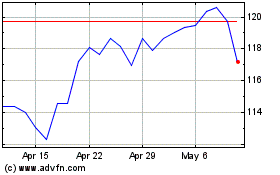

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From May 2024 to Jun 2024

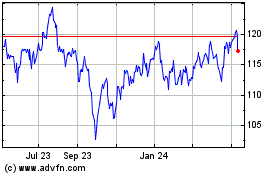

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Jun 2023 to Jun 2024