Atmos Energy Corporation (NYSE: ATO) today reported consolidated

results for its fiscal 2009 second quarter and six months ended

March 31, 2009.

- Fiscal 2009 second quarter net

income was $129.0 million, or $1.41 per diluted share, compared

with net income of $111.5 million, or $1.24 per diluted share in

the prior-year quarter.

- Consolidated results include

noncash, unrealized mark-to-market net losses of $3.3 million, or

$0.04 per diluted share for the second quarter of fiscal 2009,

compared with net losses of $24.2 million, or $0.27 per diluted

share for the prior-year quarter.

- Net income for the second

quarter of fiscal 2009 includes the positive impact of a one-time

tax benefit of $11.3 million, or $0.12 per diluted share.

- Regulated operations contributed

$121.0 million of net income, or $1.32 per diluted share in the

fiscal 2009 second quarter, compared with $100.9 million of net

income, or $1.12 per diluted share in the same period last

year.

- Nonregulated operations

contributed $8.0 million of net income in the fiscal 2009 second

quarter, or $0.09 per diluted share, compared with $10.6 million of

net income, or $0.12 per diluted share, in the prior-year

quarter.

- Atmos Energy still expects

fiscal 2009 earnings to be in the previously announced range of

$2.05 to $2.15 per diluted share.

For the six months ended March 31, 2009, net income was $205.0

million, or $2.24 per diluted share, compared with net income of

$185.3 million, or $2.06 per diluted share for the same period last

year. Net income for the current six months includes the positive

impact of a one-time tax benefit of $11.3 million, or $0.12 per

diluted share. For the current six-month period, regulated

operations contributed $178.9 million of net income, or $1.96 per

diluted share, and nonregulated operations contributed $26.1

million of net income, or $0.28 per diluted share. Nonregulated

operations include noncash, unrealized mark-to-market net losses of

$16.9 million, or $0.19 per diluted share for the six months ended

March 31, 2009, compared with net losses of $5.3 million, or $0.06

per diluted share for the prior-year period.

�The rate and regulatory enhancements achieved in recent years

have allowed our core regulated operations the ability to provide

relatively stable and predictable results, in spite of declining

volumes driven by the downturn in the economy,� said Robert W.

Best, chairman and chief executive officer of Atmos Energy

Corporation. �Also, the company�s credit and liquidity positions

remain strong in the midst of this economic uncertainty. We are

optimistic that Atmos Energy will continue to deliver our annual

earnings growth goal of between 4 to 6 percent, on average.�

Results for the 2009 Second

Quarter Ended March 31, 2009

Natural gas distribution gross profit increased $9.6 million to

$367.1 million for the fiscal 2009 second quarter, compared with

$357.5 million in the prior-year quarter, before intersegment

eliminations. This increase reflects a net $21.9 million increase

in rates, primarily in the company�s Mid-Tex, Louisiana and West

Texas service areas and the reversal of a $7.0 million accrual for

estimated unrecoverable gas costs recorded in a prior year. These

increases were partially offset by an $8.9 million decrease in

revenue-related taxes due to lower gas costs and a $13.5 million

decrease as a result of lower residential and commercial

consumption and warmer weather in the Colorado service area, which

does not have weather-normalized rates.

Regulated transmission and storage gross profit increased $7.8

million to $59.2 million for the three months ended March 31, 2009,

compared with $51.4 million for the three months ended March 31,

2008, before intersegment eliminations. This increase is due

primarily to higher per-unit margins earned on through-system

deliveries of $3.6 million, an increase in demand-based charges of

$3.3 million, a $2.9 million gain associated with the routine sale

of excess inventory and a $1.4 million increase in revenues

resulting from filings under the Texas Gas Reliability

Infrastructure Program (GRIP). These increases were partially

offset by a $4.1 million decrease due to a reduction in

transportation volumes to the company�s Mid-Tex Division, as a

result of warmer weather and a 13 percent decrease in consolidated

throughput, due primarily to a decline in Barnett Shale activity,

industrial demand and electric generation demand.

Natural gas marketing gross profit increased $7.2 million to

$23.5 million for the fiscal 2009 second quarter, compared with

$16.3 million for the fiscal 2008 second quarter, before

intersegment eliminations. This increase is due principally to a

$40.0 million quarter-over-quarter increase in Atmos Energy

Marketing�s (AEM) unrealized margins primarily as a result of lower

volatility between current cash prices and forward natural gas

prices experienced on its net physical position during the current

quarter. This increase was partially offset by a $29.8 million

decrease in margins realized from AEM�s storage and trading

activities. As a result of falling current cash prices during the

quarter, AEM elected to defer physical storage withdrawals into

future periods and inject gas into storage. As a result, AEM

realized lower storage withdrawal gains in the current quarter. In

the prior-year quarter, AEM withdrew gas storage and recognized the

associated gains. Finally, delivered gas margins decreased $3.0

million, primarily as a result of a 13 percent decrease in

consolidated sales volumes.

Pipeline, storage and other gross profit increased $0.9 million

to $10.6 million for the three months ended March 31, 2009,

compared with $9.7 million for the same period last year, before

intersegment eliminations. The increase was attributable primarily

to larger realized gains from the settlement of financial positions

associated with storage and trading activities and basis gains

earned from utilizing leased pipeline capacity. These increases

were essentially offset by lower margins earned in the current

quarter under asset management plans and increased unrealized

losses, due principally to a widening of the spreads between

current cash prices and forward natural gas prices.

Results for the quarter ended March 31, 2009, were favorably

impacted by a one-time tax benefit of $11.3 million. The benefit

arose in the current quarter after the company updated the tax

rates used to record its deferred taxes.

Results for the Six Months Ended

March 31, 2009

Natural gas distribution gross profit increased $34.8 million to

$665.5 million for the six months ended March 31, 2009, compared

with $630.7 million in the prior-year period, before intersegment

eliminations. This increase is due largely to a net $37.2 million

increase in rates, primarily in the company�s Mid-Tex, Louisiana

and West Texas service areas, the reversal of the aforementioned

$7.0 million accrual for uncollectible gas costs and an $8.3

million increase due to a non-recurring update to the estimate for

gas delivered to customers but not yet billed, resulting from base

rate changes in several jurisdictions recorded in the first quarter

of fiscal 2009. These increases were partially offset by a $9.2

million decrease in revenue-related taxes due to lower gas costs

and a $14.8 million decrease as a result of a 4 percent reduction

in residential and commercial consumption, partially due to warmer

weather in the Colorado service area, which does not have

weather-normalized rates.

Regulated transmission and storage gross profit increased $17.4

million to $113.9 million for the six months ended March 31, 2009,

compared with $96.5 million for the same period last year, before

intersegment eliminations. This increase is due primarily to higher

per-unit margins earned on through-system deliveries of $7.6

million, a $6.4 million increase in demand-based charges, a $2.9

million gain associated with the routine sale of excess inventory

and a $2.7 million increase in revenues resulting from filings

under GRIP. These increases were partially offset by a $3.4 million

decrease due to a reduction in transportation volumes to the

company�s Mid-Tex Division, as a result of warmer weather and a 7

percent decrease in consolidated throughput, due principally to a

decline in Barnett Shale activity, industrial demand and electric

generation demand.

Natural gas marketing gross profit decreased $8.7 million to

$53.6 million for the fiscal 2009 six-month period, compared with

$62.3 million for the prior-year period, before intersegment

eliminations. This decrease primarily reflects a $13.7 million

period-over-period decrease in AEM�s unrealized margins, due

principally to greater volatility between current cash prices and

forward natural gas prices experienced on AEM�s net physical

storage position in the current period. Additionally, delivered gas

margins decreased $2.7 million primarily as a result of an 8

percent decrease in consolidated sales volumes. These decreases

were partially offset by a $7.7 million increase in margins

realized from AEM�s storage and trading activities primarily

resulting from the recognition in the first quarter of fiscal 2009

of storage withdrawal gains that AEM had captured during fiscal

2008, as a result of deferring storage withdrawals and rolling the

associated financial instruments to forward months.

Pipeline, storage and other gross profit increased $7.5 million

to $23.2 million for the six months ended March 31, 2009, compared

with $15.7 million for the same period last year, before

intersegment eliminations. The increase was due principally to

larger realized gains from the settlement of financial positions

associated with storage and trading activities, basis gains earned

from utilizing leased pipeline capacity and higher margins earned

under asset management plans during the current-year period

compared with the prior-year period. These increases were partially

offset by increased unrealized losses, due primarily to the

widening of the spreads between current cash prices and forward

natural gas prices.

Consolidated operation and maintenance expense for the six

months ended March 31, 2009, was $256.5 million, compared with

$241.2 million for the prior-year period. Excluding the provision

for doubtful accounts, operation and maintenance expense for the

current six-month period was $251.2 million, compared with $234.8

million for the prior-year period. The $16.4 million increase

resulted from higher pipeline maintenance costs, legal costs and

employee wages and benefits costs.

The provision for doubtful accounts was $5.3 million for the six

months ended March 31, 2009, compared with $6.4 million for the

same period last year. The $1.1 million decrease primarily reflects

the impact of recent rate design changes, which allow for the

recovery of the gas cost portion of uncollectible accounts and a

decline in the average cost of gas.

Interest charges for the six months ended March 31, 2009, were

$74.5 million, compared with $70.3 million for the six months ended

March 31, 2008. The $4.2 million period-over-period increase

reflects higher commercial paper rates, increased line of credit

commitment fees and higher average short-term debt balances

experienced primarily during the first quarter of fiscal 2009.

Results for the six months ended March 31, 2009, were favorably

impacted by a one-time tax benefit of $11.3 million. The benefit

arose after the company updated the tax rates used to record its

deferred taxes in the second quarter.

The debt capitalization ratio at March 31, 2009, was 54.1

percent, compared with 54.6 percent at September 30, 2008, and 50.0

percent at March 31, 2008. The debt capitalization ratio at March

31, 2009, includes an incremental amount of $450 million of senior

notes issued in March 2009. The net proceeds of approximately $446

million were used to redeem the company�s $400 million 4.00% senior

notes on April 30, 2009, which were due October 15, 2009. Had these

senior notes been repaid as of March 31, 2009, the debt

capitalization ratio would have been 49.9 percent. No short-term

debt was outstanding at March 31, 2009 (other than the $400 million

4% senior notes that were called on March 30, 2009 for redemption

on April 30, 2009) and March 31, 2008, while short-term debt was

$350.5 million at September 30, 2008.

For the six months ended March 31, 2009, Atmos Energy generated

operating cash flow of $614.6 million from operating activities

compared with $479.2 million for the six months ended March 31,

2008. Period over period, the $135.4 million increase was

attributable primarily to the favorable impact on the company�s

working capital of the decline in natural gas prices in the current

year compared to the prior-year period which increased operating

cash flow by $61.2 million, coupled with a $51.9 million increase

due to the favorable timing in the recovery of gas costs during the

current year.

Capital expenditures increased to $221.3 million for the six

months ended March 31, 2009, compared with $198.7 million for the

same period last year. The $22.6 million increase is due

principally to spending for a nonregulated storage project and the

construction of a pipeline extension in the company�s regulated

operations.

Outlook

The leadership of Atmos Energy remains focused on enhancing

shareholder value by delivering consistent earnings growth. Atmos

Energy continues to expect fiscal 2009 earnings to be in the range

of $2.05 to $2.15 per diluted share, excluding any material

mark-to-market impact. Major assumptions underlying the earnings

projection remain materially unchanged. Capital expenditures for

fiscal 2009 are expected to range from $500 million to $515

million.

However, the mark-to-market impact on the nonregulated marketing

company�s physical storage inventory at September 30, 2009, and

changes in events or other circumstances that the company cannot

currently anticipate or predict, including adverse credit market

conditions, could result in earnings for fiscal 2009 that are

significantly above or below this outlook. Factors that could cause

such changes are described below in Forward-Looking Statements and

in other company documents on file with the Securities and Exchange

Commission.

Atmos Energy continues to have reasonably economical access to

the commercial paper market and believes it has sufficient

liquidity to support its operating and capital spending plans.

Amounts available to the company under existing and new credit

facilities coupled with operating cash flow should provide the

necessary liquidity to fund the company�s common stock dividend,

working capital needs and capital expenditures for fiscal 2009.

Conference Call to be Webcast May

1, 2009

Atmos Energy will host a conference call with financial analysts

to discuss the financial results for the fiscal 2009 second quarter

and first six months on Friday, May 1, 2009, at 10 a.m. EDT. The

telephone number is 800-218-0204. The conference call will be

webcast live on the Atmos Energy Web site at www.atmosenergy.com. A

playback of the call will be available on the Web site later that

day. Atmos Energy senior leadership who will participate in the

conference call include: Bob Best, chairman and chief executive

officer; Kim Cocklin, president and chief operating officer; Fred

Meisenheimer, senior vice president, chief financial officer and

controller; and Mark Johnson, senior vice president, nonregulated

operations.

Highlights and Recent

Developments

Atmos Energy Completes Successful Senior Note

Offering

On March 26, 2009, Atmos Energy completed the public offering of

$450 million of 8.50% senior notes due 2019. The company used most

of the net proceeds of this offering of approximately $446 million

to redeem the company�s $400 million 4.00% senior notes on April

30, 2009.

AEM Committed Revolving Credit Facility Increased

On April 1, 2009, Atmos Energy Marketing, LLC amended its

existing $375 million committed revolving credit facility to

increase the borrowing base to $450 million. The amended credit

facility will expire on December 29, 2009.

This news release should be read in conjunction with the

attached unaudited financial information.

Forward-Looking Statements

The matters discussed in this news release may contain

�forward-looking statements� within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements other than statements of

historical fact included in this news release are forward-looking

statements made in good faith by the company and are intended to

qualify for the safe harbor from liability established by the

Private Securities Litigation Reform Act of 1995. When used in this

news release or in any of the company�s other documents or oral

presentations, the words �anticipate,� �believe,� �estimate,�

�expect,� �forecast,� �goal,� �intend,� �objective,� �plan,�

�projection,� �seek,� �strategy� or similar words are intended to

identify forward-looking statements. Such forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from those discussed in this

news release, including the risks and uncertainties relating to

regulatory trends and decisions, the company�s ability to continue

to access the capital markets and the other factors discussed in

the company�s filings with the Securities and Exchange Commission.

These factors include the risks and uncertainties discussed in the

company�s Annual Report on Form 10-K for the fiscal year ended

September 30, 2008 and in the company�s Quarterly Report on Form

10-Q for the three months ended December 31, 2008. Although the

company believes these forward-looking statements to be reasonable,

there can be no assurance that they will approximate actual

experience or that the expectations derived from them will be

realized. The company undertakes no obligation to update or revise

forward-looking statements, whether as a result of new information,

future events or otherwise.

About Atmos Energy

Atmos Energy Corporation, headquartered in Dallas, is the

country's largest natural-gas-only distributor, serving about 3.2

million natural gas distribution customers in more than 1,600

communities in 12 states from the Blue Ridge Mountains in the East

to the Rocky Mountains in the West. Atmos Energy also provides

natural gas marketing and procurement services to industrial,

commercial and municipal customers primarily in the Midwest and

Southeast and manages company-owned natural gas pipeline and

storage assets, including one of the largest intrastate natural gas

pipeline systems in Texas. Atmos Energy is a Fortune 500 company.

For more information, visit www.atmosenergy.com.

Atmos Energy

Corporation

Financial Highlights

(Unaudited)

� � �

Statements of Income

Three Months EndedMarch 31 Percentage (000s except per share) �

2009 � � � 2008 � Change � Gross Profit: Natural gas distribution

segment $ 367,080 $ 357,524 3 % Regulated transmission and storage

segment 59,234 51,440 15 % Natural gas marketing segment 23,544

16,332 44 % Pipeline, storage and other segment 10,616 9,684 10 %

Intersegment eliminations �

(423 ) �

(586

)

28 % Gross profit 460,051 434,394 6 % �

Operation and maintenance expense 121,740 120,053 1 % Depreciation

and amortization 53,450 48,790 10 % Taxes, other than income �

58,314 � �

54,408 �

7

% Total operating expenses 233,504 223,251 5 % �

Operating income 226,547 211,143 7 % � Miscellaneous income

(expense) (1,565 ) 1,467 (207 )% Interest charges �

35,533 � �

33,516 �

6

% � Income before income taxes 189,449 179,094 6 %

Income tax expense �

60,446 � �

67,560 �

(11 )% Net income

$

129,003 �

$ 111,534 �

16 % � Basic net income per share $ 1.42

$ 1.25 Diluted net income per share $ 1.41 $ 1.24 � Cash dividends

per share $ .330 $ .325 � Weighted average shares outstanding:

Basic 90,895 89,314 Diluted 91,567 89,990 � Three Months EndedMarch

31 Percentage

Summary Net Income by Segment (000s)

� 2009 � � 2008 � Change � Natural gas distribution $ 101,576 $

85,656 19 % Regulated transmission and storage 19,465 15,224 28 %

Natural gas marketing 3,348 5,279 (37 )% Pipeline, storage and

other �

4,614 � �

5,375 �

(14 )% Consolidated net income

$ 129,003 �

$

111,534 �

16 % �

�

Atmos Energy

Corporation

Financial Highlights,

continued (Unaudited)

� � �

Statements of Income

Six Months EndedMarch 31 Percentage (000s except per share) � 2009

� � � 2008 � Change � Gross Profit: Natural gas distribution

segment $ 665,464 $ 630,724 6 % Regulated transmission and storage

segment 113,916 96,486 18 % Natural gas marketing segment 53,567

62,295 (14 )% Pipeline, storage and other segment 23,161 15,682 48

% Intersegment eliminations �

(845 ) �

(1,155 )

27 % Gross profit

855,263 804,032 6 % � Operation and maintenance expense 256,495

241,242 6 % Depreciation and amortization 106,576 97,303 10 %

Taxes, other than income �

102,451 � �

95,835 �

7 % Total operating

expenses 465,522 434,380 7 % � Operating income 389,741 369,652 5 %

� Miscellaneous income (expense) (1,866 ) 1,374 (236 )% Interest

charges �

74,524 � �

70,333 �

6 % � Income before income taxes 313,351

300,693 4 % Income tax expense �

108,385 � �

115,356 �

(6 )% Net income

$ 204,966 �

$

185,337 �

11 % � Basic net

income per share $ 2.26 $ 2.08 Diluted net income per share $ 2.24

$ 2.06 � Cash dividends per share $ .66 $ .65 � Weighted average

shares outstanding: Basic 90,637 89,133 Diluted 91,311 89,817 � Six

Months EndedMarch 31 Percentage

Summary Net Income by Segment (000s)

� 2009 � � 2008 � Change � Natural gas distribution $ 151,709 $

125,820 21 % Regulated transmission and storage 27,126 25,071 8 %

Natural gas marketing 13,923 25,879 (46 )% Pipeline, storage and

other �

12,208 � �

8,567 �

43 % Consolidated net income

$ 204,966 �

$

185,337 �

11 % �

Atmos Energy

Corporation

Financial Highlights,

continued (Unaudited)

� � �

Condensed Balance Sheets

March 31, September 30, (000s) � 2009 � 2008 � Net property, plant

and equipment $ 4,263,192 $ 4,136,859 � Cash and cash equivalents

482,085 46,717 Accounts receivable, net 531,749 477,151 Gas stored

underground 327,288 576,617 Other current assets �

137,433 �

184,619 � Total current assets

1,478,555 1,285,104 � Goodwill and intangible assets 738,772

739,086 Deferred charges and other assets �

205,242 �

225,650 �

$ 6,685,761

$ 6,386,699 � � � Shareholders� equity $

2,178,494 $ 2,052,492 Long-term debt �

2,169,141 �

2,119,792 � Total capitalization 4,347,635 4,172,284 �

Accounts payable and accrued liabilities 472,078 395,388 Other

current liabilities 413,764 460,372 Short-term debt � 350,542

Current maturities of long-term debt �

400,225 �

785 � Total current liabilities 1,286,067 1,207,087 �

Deferred income taxes 466,868 441,302 Deferred credits and other

liabilities �

585,191 �

566,026 �

$ 6,685,761 $

6,386,699 �

Atmos Energy

Corporation

Financial Highlights,

continued (Unaudited)

�

Condensed Statements of Cash Flows

Six Months EndedMarch 31 (000s) � 2009 � � � 2008 � �

Cash flows

from operating activities � Net income $ 204,966 $ 185,337

Depreciation and amortization 106,597 97,370 Deferred income taxes

97,892 72,277 Changes in assets and liabilities 191,533 117,355

Other �

13,634 � �

6,853 � Net cash

provided by operating activities 614,622 479,192 �

Cash flows

from investing activities � Capital expenditures (221,330 )

(198,722 ) Other, net �

(3,925 ) �

(3,132

) Net cash used in investing activities (225,255 ) (201,854 ) �

Cash flows from financing activities � Net decrease in

short-term debt (353,468 ) (150,582 ) Net proceeds from issuance of

long-term debt 446,188 � Settlement of Treasury lock agreement

1,938 � Repayment of long-term debt (625 ) (2,253 ) Cash dividends

paid (60,446 ) (58,431 ) Issuance of common stock �

12,414 � �

12,839 � Net cash provided by

(used in) financing activities �

46,001 � �

(198,427 ) � Net increase in cash and cash equivalents

435,368 78,911 Cash and cash equivalents at beginning of period �

46,717 � �

60,725 � Cash and cash

equivalents at end of period

$ 482,085 �

$ 139,636 � � � � � Three Months

EndedMarch 31 � Six Months EndedMarch 31

Statistics

� 2009 � � 2008 � 2009 � � 2008 Consolidated natural gas

distributionthroughput (MMcf as metered)

156,621

175,298

282,403

293,814

Consolidated regulated

transmission and storagetransportation volumes (MMcf)

123,285

141,108

259,143

277,308

Consolidated natural gas marketing salesvolumes (MMcf)

104,973

120,023

198,281

216,229

Natural gas distribution meters in service

3,223,769

3,221,195 3,223,769 3,221,195 Natural gas distribution average cost

of gas $ 7.10 $ 8.59 $ 7.61 $ 8.26 Natural gas marketing net

physical position (Bcf) 21.9 20.7 21.9 20.7

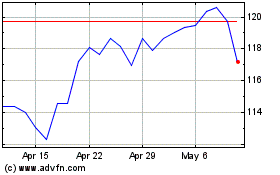

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From May 2024 to Jun 2024

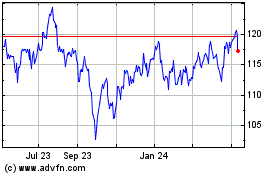

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Jun 2023 to Jun 2024