Atmos Energy Corporation (NYSE:ATO) today reported consolidated

results for its 2008 fiscal year and fourth quarter ended September

30, 2008. Fiscal 2008 net income was $180.3 million, or $2.00 per

diluted share, compared with net income of $168.5 million, or $1.92

per diluted share, the prior year. Fiscal 2007 net income included

a noncash after-tax charge of $4.1 million, or $0.05 per diluted

share, related to the write-off of obsolete software and a

nonregulated gas gathering project. Regulated operations

contributed $134.1 million of net income, or $1.49 per diluted

share during fiscal 2008, compared with $107.9 million of net

income, or $1.23 per diluted share, during fiscal 2007.

Nonregulated operations contributed $46.2 million of net income

during fiscal 2008, or $0.51 per diluted share, compared with $60.6

million of net income, or $0.69 per diluted share, during fiscal

2007. Unrealized margins contributed $0.20 and $0.14 of net income

per diluted share for fiscal 2008 and 2007. Atmos Energy affirmed

its fiscal 2009 earnings guidance of $2.05 to $2.15 per diluted

share. For the three months ended September 30, 2008, net income

was $1.6 million, or $0.02 per diluted share, compared with a net

loss of $5.9 million, or ($0.07) per diluted share, for the same

period last year. Regulated operations reported a seasonal net loss

of $14.7 million, or ($0.16) per diluted share, during the fiscal

2008 fourth quarter, compared with a seasonal net loss of $13.7

million, or ($0.15) per diluted share, in the prior-year period.

Nonregulated operations contributed $16.3 million of net income

during the fourth quarter of fiscal 2008, or $0.18 per diluted

share, compared with $7.8 million of net income, or $0.08 per

diluted share, in the prior-year quarter. Results for nonregulated

operations for the prior-year quarter included an after-tax charge

of $2.0 million, or $0.02 per diluted share, to write off costs

associated with a nonregulated natural gas gathering project.

Unrealized margins contributed $0.11 and $0.12 of net income per

diluted share for the three months ended September 30, 2008 and

2007. �We are extremely pleased with the financial results achieved

in fiscal 2008,� said Robert W. Best, chairman and chief executive

officer of Atmos Energy Corporation. �Regulated operations

contributed 74 percent of our consolidated net income and

experienced a year-over-year boost in earnings per share of more

than 20 percent. We remain committed to enhancing the stability and

predictability of our regulated earnings by making incremental

improvements to rate design and making prudent, strategic

investments in rate base. Our nonregulated operations contributed

the remaining 26 percent of consolidated net income, reflecting the

tenacity of this business in an environment of weakened natural gas

market volatility and economic downturn. �Looking forward to fiscal

2009 and beyond, we remain focused on continuing to achieve annual

earnings growth per share in the 4 percent to 6 percent range, on

average,� Best said. Results for the Year Ended September 30, 2008

Natural gas distribution gross profit increased to $1.0 billion for

the year ended September 30, 2008, compared with $952.7 million in

the same period last year, before intersegment eliminations. The

$53.4 million year-over-year increase primarily reflects a net

$40.7 million increase in rates and a $7.5 million accrual recorded

during the fiscal 2007 fourth quarter for estimated unrecoverable

gas costs that did not recur in the current year. Regulated

transmission and storage gross profit increased $32.7 million to

$195.9 million for the year ended September 30, 2008, compared with

$163.2 million in the prior year, before intersegment eliminations.

The 20 percent increase primarily reflects higher revenues

resulting from the company�s 2006 and 2007 filings under the Texas

Gas Reliability Infrastructure Program (GRIP). Regulated

transmission and storage gross profit also benefited from continued

favorable market conditions in the Barnett Shale gas producing

region in Texas, resulting in an 18 percent increase in

consolidated throughput and higher per-unit margins. Natural gas

marketing gross profit decreased $11.3 million to $93.0 million for

the year ended September 30, 2008, compared with $104.3 million in

the prior year, before intersegment eliminations. The decrease

primarily reflects a $35.0 million decrease in Atmos Energy

Marketing�s (AEM) realized storage and trading activities resulting

from a less-volatile natural gas market as well as AEM�s decision

to defer physical storage withdrawals and reset its associated

financial positions to forward months to increase the potential

gross profit in future periods. Delivered gas margins increased

$16.6 million as a result of capturing favorable basis gains

coupled with a 5 percent increase in consolidated sales volumes.

AEM�s unrealized margins increased $7.1 million during the 2008

fiscal year compared with the prior year, principally due to a

narrowing of the spreads between current cash prices and forward

natural gas prices. Pipeline, storage and other gross profit

decreased $4.3 million to $28.3 million for the year ended

September 30, 2008, compared with $32.6 million in the prior year,

before intersegment eliminations. The decrease was largely due to

lower realized margins from storage and asset optimization

activities in a less-volatile natural gas market, which created

fewer opportunities to capitalize on price fluctuations.

Consolidated operation and maintenance expense for the year ended

September 30, 2008, was $500.2 million, compared with $463.4

million last year. The $36.8 million increase primarily reflects

higher pipeline maintenance, odorization, fuel and administrative

costs. Additionally, the prior-year expense included the favorable

effect of the Louisiana Public Service Commission�s decision to

permit the recovery of $4.3 million of Hurricane-Katrina-related

expenses from customers. Continued effective collection efforts

during fiscal 2008 partially offset the increase in consolidated

operation and maintenance expense. Bad debt expense decreased $4.0

million to $15.7 million, from $19.7 million last year, despite a

12 percent year-over-year increase in gas costs. Interest charges

for the year ended September 30, 2008, were $137.9 million,

compared with $145.2 million in the prior year. The $7.3 million

year-over-year decrease primarily was due to lower average

short-term debt balances experienced in the current period. This

favorable variance was partially offset by a $6.3 million decrease

in interest income principally associated with lower average cash

balances in the current fiscal year. Interest income is reported as

a component of miscellaneous income. Operating expenses for the

year ended September 30, 2007, included a $6.3 million noncash

charge associated with the write-off of approximately $3.0 million

of costs related to a nonregulated natural gas gathering project

and about $3.3 million of obsolete software costs. The

capitalization ratio at September 30, 2008, was 54.6 percent,

compared with 53.7 percent at September 30, 2007. Short-term debt

of $350.5 million was comprised of $330.5 million of borrowings

under the company�s existing lines of credit and $20.0 million of

commercial paper. Short-term debt was $150.6 million at September

30, 2007, representing amounts outstanding under the company�s

commercial paper program. Operating cash flow for the year ended

September 30, 2008, was $370.9 million, compared with $547.1

million during fiscal 2007. The $176.2 million decrease primarily

reflects the unfavorable timing of gas cost collections, an

increase in cash required to collateralize risk management accounts

as of September 30, 2008, and changes in various other working

capital items. Capital expenditures increased to $472.3 million for

the year ended September 30, 2008, from $392.4 million for the same

period last year. The $79.9 million increase principally reflects

spending in the Mid-Tex Division for the replacement of mains and

regulatory compliance, the company�s new automated metering

initiative in its natural gas distribution business and spending

associated with two nonregulated growth projects. Results for the

2008 Fourth Quarter Ended September 30, 2008 Natural gas

distribution gross profit increased $22.2 million to $175.4 million

for the three months ended September 30, 2008, compared with $153.2

million in the same period last year, before intersegment

eliminations. The increase primarily reflects a net $9.1 million

increase in rates and the aforementioned $7.5 million accrual for

estimated unrecoverable gas costs that did not recur in the current

period. Regulated transmission and storage gross profit increased

$12.5 million to $53.1 million for the three months ended September

30, 2008, compared with $40.6 million for the prior-year quarter.

This increase primarily reflects higher revenues resulting from the

company�s 2006 and 2007 filings under the Texas Gas Reliability

Infrastructure Program (GRIP). Regulated transmission and storage

gross profit also benefited from continued favorable market

conditions in the Barnett Shale gas producing area, resulting in

the realization of higher per-unit margins and a 14 percent

increase in consolidated throughput. Natural gas marketing gross

profit increased $14.7 million to $33.4 million for the three

months ended September 30, 2008, compared to $18.7 million for the

same period one year ago, before intersegment eliminations. The

increase primarily reflects increased storage and trading margins

as AEM realized a portion of the storage withdrawal gains that it

captured earlier in the fiscal year after deferring storage

withdrawals and resetting financial positions to forward months.

Delivered gas margins increased $5.3 million largely due to AEM�s

ability to earn higher per-unit margins from volatility

attributable to weather-related events, which more than offset a 14

percent decrease in consolidated sales volumes. AEM�s unrealized

margins decreased $4.6 million during the current quarter, compared

with the prior-year quarter, principally due to a widening of the

spreads between current cash prices and forward natural gas prices.

Pipeline, storage and other gross profit increased $3.7 million to

$9.5 million for the three months ended September 30, 2008, from

$5.8 million for the three months ended September 30, 2007, before

intersegment eliminations. The increase primarily reflects higher

unrealized margins. Consolidated operation and maintenance expense

for the three months ended September 30, 2008, was $141.2 million,

compared with $121.0 million for the three months ended September

30, 2007. The $20.2 million increase primarily reflects higher

pipeline maintenance, employee and other administrative costs. Bad

debt expense for the quarter was essentially flat compared with the

prior-year quarter. Operating expenses for the three months ended

September 30, 2007, included a $3.0 million noncash charge

associated with the write-off of costs related to a nonregulated

natural gas gathering project. Outlook The leadership of Atmos

Energy remains focused on enhancing shareholder value by delivering

consistent earnings growth. In October 2008, Atmos Energy announced

that it expected fiscal 2009 earnings to be in the range of $2.05

to $2.15 per diluted share, excluding any material mark-to-market

impact. Net income from regulated operations is expected to be in

the range of $140 million to $145 million, and net income from

nonregulated operations is expected to be in the range of $47

million to $52 million. Capital expenditures for fiscal 2009 are

expected to range from $510 million to $525 million. Operation and

maintenance expense is expected to range from $480 million to $490

million in fiscal 2009. The average number of shares outstanding in

fiscal 2009 is expected to be between 91 million and 92 million.

However, the mark-to-market impact on the nonregulated marketing

company�s physical storage inventory at September 30, 2009, and

changes in events or other circumstances that the company cannot

currently anticipate or predict, including adverse credit market

conditions, could result in earnings for fiscal 2009 that are

significantly above or below this outlook. Factors that could cause

such changes are described below in Forward-Looking Statements and

in other company documents on file with the Securities and Exchange

Commission. Atmos Energy believes it has sufficient liquidity to

support its operating and capital spending plans. Amounts available

to the company under existing and new credit facilities coupled

with operating cash flow should provide the necessary liquidity to

fund the company�s common stock dividend, working capital needs and

capital expenditures for fiscal 2009. Conference Call to be Webcast

November 12, 2008 Atmos Energy will host a conference call with

financial analysts to discuss the financial results for the 2008

fiscal year on Wednesday, November 12, 2008, at 8 a.m. ET. The

telephone number is 800-218-8862. The conference call will be

webcast live on the Atmos Energy Web site at www.atmosenergy.com. A

slide presentation and a playback of the call will be available on

the Web site later that day. Atmos Energy officers who will

participate in the conference call include: Bob Best, chairman and

chief executive officer; Kim Cocklin, president and chief operating

officer; Pat Reddy, senior vice president and chief financial

officer; Mark Johnson, senior vice president, nonregulated

operations; Fred Meisenheimer, vice president and controller;

Laurie Sherwood, vice president, corporate development, and

treasurer; and Susan Giles, vice president, investor relations.

Other Highlights and Recent Developments Election of New Director

On August 6, 2008, Ruben E. Esquivel was elected to the Board of

Directors, effective September 1, 2008, with his term expiring at

the 2009 annual meeting of shareholders. Mr. Esquivel was also

appointed to serve as a member of the Audit Committee and Human

Resources Committee. With Mr. Esquivel�s election, the company

currently has 14 directors serving on its Board of Directors.

Appointment of President and Chief Operating Officer Effective

October 1, 2008, Kim R. Cocklin became the president and chief

operating officer of Atmos Energy Corporation. Mr. Cocklin

previously served as senior vice president of the company�s

regulated operations. Robert W. Best continues to serve as the

chairman and chief executive officer. $212.5 Million Revolving

Credit Facility On October 29, 2008, Atmos Energy Corporation

entered into a $212.5 million, 364-day committed revolving credit

facility. The credit facility will expire on October 27, 2009. This

credit facility replaces the company�s $300 million, 364-day

revolving credit facility on essentially the same terms but at a

substantially higher cost. This news release should be read in

conjunction with the attached unaudited financial information.

Forward-Looking Statements The matters discussed in this news

release may contain �forward-looking statements� within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. All statements other than

statements of historical fact included in this news release are

forward-looking statements made in good faith by the company and

are intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of

1995. When used in this news release or in any of the company�s

other documents or oral presentations, the words �anticipate,�

�believe,� �estimate,� �expect,� �forecast,� �goal,� �intend,�

�objective,� �plan,� �projection,� �seek,� �strategy� or similar

words are intended to identify forward-looking statements. Such

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially from those

discussed in this news release, including the risks and

uncertainties relating to regulatory trends and decisions, the

company�s ability to continue to access the capital markets and the

other factors discussed in the company�s filings with the

Securities and Exchange Commission. These factors include the risks

and uncertainties discussed in the company�s Annual Report on Form

10-K for the fiscal year ended September 30, 2007, and in the

company�s Quarterly Report on Form 10-Q for the three and nine

months ended June 30, 2008. Although the company believes these

forward-looking statements to be reasonable, there can be no

assurance that they will approximate actual experience or that the

expectations derived from them will be realized. The company

undertakes no obligation to update or revise forward-looking

statements, whether as a result of new information, future events

or otherwise. About Atmos Energy Atmos Energy Corporation,

headquartered in Dallas, is the country's largest natural-gas-only

distributor, serving about 3.2 million natural gas distribution

customers in more than 1,600 communities in 12 states from the Blue

Ridge Mountains in the East to the Rocky Mountains in the West.

Atmos Energy also provides natural gas marketing and procurement

services to industrial, commercial and municipal customers

primarily in the Midwest and Southeast and manages company-owned

natural gas pipeline and storage assets, including one of the

largest intrastate natural gas pipeline systems in Texas. Atmos

Energy is a Fortune 500 company. For more information, visit

www.atmosenergy.com. � Atmos Energy Corporation Financial

Highlights (Unaudited) � Statements of Income � Year EndedSeptember

30 � Percentage (000s except per share) � 2008 � � � 2007 � Change

� Gross Profit: Natural gas distribution segment $ 1,006,066 $

952,684 6 % Regulated transmission and storage segment 195,917

163,229 20 % Natural gas marketing segment 93,021 104,311 (11 )%

Pipeline, storage and other segment 28,313 32,608 (13 )%

Intersegment eliminations � (1,991 ) � (2,750 ) 28 % Gross profit

1,321,326 1,250,082 6 % � Operation and maintenance expense 500,234

463,373 8 % Depreciation and amortization 200,442 198,863 1 %

Taxes, other than income 192,755 182,866 5 % Impairment of

long-lived assets � � � � 6,344 � (100 )% Total operating expenses

893,431 851,446 5 % � Operating income 427,895 398,636 7 % �

Miscellaneous income 2,731 9,184 (70 )% Interest charges � 137,922

� � 145,236 � (5 )% � Income before income taxes 292,704 262,584 11

% Income tax expense � 112,373 � � 94,092 � 19 % Net income $

180,331 � $ 168,492 � 7 % � Basic net income per share $ 2.02 $

1.94 Diluted net income per share $ 2.00 $ 1.92 � Cash dividends

per share $ 1.30 $ 1.28 � Weighted average shares outstanding:

Basic 89,385 86,975 Diluted 90,272 87,745 � Year EndedSeptember 30

� Percentage Summary Net Income by Segment (000s) 2008 � 2007

Change � Natural gas distribution $ 92,648 $ 73,283 26 % Regulated

transmission and storage 41,425 34,590 20 % Natural gas marketing

29,989 45,769 (34 )% Pipeline, storage and other � 16,269 � 14,850

10 % Consolidated net income $ 180,331 $ 168,492 7 % � Atmos Energy

Corporation Financial Highlights, continued (Unaudited) �

Statements of Income � Three Months EndedSeptember 30 � Percentage

(000s except per share) � 2008 � � � 2007 � Change � Gross Profit:

Natural gas distribution segment $ 175,414 $ 153,227 14 % Regulated

transmission and storage segment 53,145 40,582 31 % Natural gas

marketing segment 33,357 18,700 78 % Pipeline, storage and other

segment 9,457 5,807 63 % Intersegment eliminations � (301 ) � (528

) 43 % Gross profit 271,072 217,788 24 % � Operation and

maintenance expense 141,170 121,000 17 % Depreciation and

amortization 52,783 49,828 6 % Taxes, other than income 39,585

33,172 19 % Impairment of long-lived assets � � � � 3,055 � (100 )%

Total operating expenses 233,538 207,055 13 % � Operating income

37,534 10,733 250 % � Miscellaneous income (loss) (243 ) 1,501 (116

)% Interest charges � 34,119 � � 35,963 � (5 )% � Income (loss)

before income taxes 3,172 (23,729 ) 113 % Income tax expense

(benefit) � 1,590 � � (17,815 ) 109 % Net income (loss) $ 1,582 � $

(5,914 ) 127 % � Basic net income (loss) per share $ 0.02 $ (0.07 )

Diluted net income (loss) per share $ 0.02 $ (0.07 ) � Cash

dividends per share $ .325 $ .320 � Weighted average shares

outstanding: Basic 89,883 88,581 Diluted 90,761 88,581 � Three

Months EndedSeptember 30 � Percentage Summary Net Income (Loss) by

Segment (000s) � 2008 � � � 2007 � Change � Natural gas

distribution $ (20,794 ) $ (19,181 ) (8 )% Regulated transmission

and storage 6,089 5,504 11 % Natural gas marketing 10,424 5,401 93

% Pipeline, storage and other � 5,863 � � 2,362 � 148 %

Consolidated net income (loss) $ 1,582 � $ (5,914 ) 127 % � Atmos

Energy Corporation Financial Highlights, continued (Unaudited) �

Condensed Balance Sheets � September 30, � September 30, (000s)

2008 2007 � Net property, plant and equipment $ 4,136,859 $

3,836,836 � Cash and cash equivalents 46,717 60,725 Accounts

receivable, net 477,151 380,133 Gas stored underground 576,617

515,128 Other current assets � 184,619 � 111,189 � Total current

assets 1,285,104 1,067,175 � Goodwill and intangible assets 739,086

737,692 Deferred charges and other assets � 225,650 � 253,494 � $

6,386,699 $ 5,895,197 � � � Shareholders� equity $ 2,052,492 $

1,965,754 Long-term debt � 2,119,792 � 2,126,315 � Total

capitalization 4,172,284 4,092,069 � Accounts payable and accrued

liabilities 395,388 355,255 Other current liabilities 460,372

408,273 Short-term debt 350,542 150,599 Current maturities of

long-term debt � 785 � 3,831 � Total current liabilities 1,207,087

917,958 � Deferred income taxes 441,302 370,569 Deferred credits

and other liabilities � 566,026 � 514,601 � $ 6,386,699 $ 5,895,197

� Atmos Energy Corporation Financial Highlights, continued

(Unaudited) � Condensed Statements of Cash Flows � Year Ended

September 30 (000s) � 2008 � � � 2007 � � Cash flows from operating

activities � Net income $ 180,331 $ 168,492 Impairment of

long-lived assets � 6,344 Depreciation and amortization 200,589

199,055 Deferred income taxes 97,940 62,121 Changes in assets and

liabilities (127,132 ) 89,813 Other � 19,205 � � 21,270 � Net cash

provided by operating activities 370,933 547,095 � Cash flows from

investing activities � Capital expenditures (472,273 ) (392,435 )

Other, net � (10,736 ) � (10,436 ) Net cash used in investing

activities (483,009 ) (402,871 ) � Cash flows from financing

activities � Net increase (decrease) in short-term debt 200,174

(213,242 ) Net proceeds from long-term debt offering � 247,217

Settlement of Treasury lock agreement � 4,750 Repayment of

long-term debt (10,284 ) (303,185 ) Cash dividends paid (117,288 )

(111,664 ) Net proceeds from equity offering � 191,913 Issuance of

common stock � 25,466 � � 24,897 � Net cash provided by (used in)

financing activities � 98,068 � � (159,314 ) � Net decrease in cash

and cash equivalents (14,008 ) (15,090 ) Cash and cash equivalents

at beginning of period � 60,725 � � 75,815 � Cash and cash

equivalents at end of period $ 46,717 � $ 60,725 � � Three Months

EndedSeptember 30 � Year EndedSeptember 30 Statistics 2008 � 2007

2008 � 2007 Consolidated natural gas distribution throughput (MMcf

as metered) 62,057 60,789 429,354 427,869 Consolidated regulated

transmission and storage transportation volumes (MMcf) 165,784

146,046 595,542 505,493 Consolidated natural gas marketing sales

volumes (MMcf) 91,041 106,343 389,392 370,668 Natural gas

distribution meters in service 3,191,779 3,187,127 3,191,779

3,187,127 Natural gas distribution average cost of gas $11.39 $7.29

$9.05 $8.09 Natural gas marketing net physical position (Bcf) 8.0

12.3 8.0 12.3

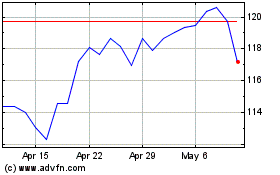

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From May 2024 to Jun 2024

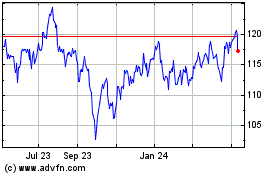

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Jun 2023 to Jun 2024