Atmos Energy Announces Public Offering of 5,500,000 Shares of Common Stock

December 04 2006 - 6:25AM

Business Wire

Atmos Energy Corporation (NYSE: ATO) said today that it plans to

make a public offering of 5,500,000 shares of its common stock. The

offering will be made under the company�s effective registration

statement on Form S-3 filed today with the Securities and Exchange

Commission. Lehman Brothers and Goldman, Sachs & Co. will serve

as the joint book-running managers for the offering with Banc of

America Securities LLC, JP Morgan, Merrill Lynch & Co.,

SunTrust Robinson Humphrey and Wachovia Securities serving as

co-managers. The underwriters will be granted an option to purchase

up to an additional 825,000 shares. The company will offer all of

the shares. Atmos Energy intends to use the net proceeds of this

offering to repay existing indebtedness under its commercial paper

program. The offering of the shares of common stock may be made

only by means of a prospectus supplement and the accompanying

prospectus. A copy of the preliminary prospectus supplement and the

accompanying prospectus may be obtained from Lehman Brothers or

Goldman, Sachs & Co. at the following: Lehman Brothers c/o ADP

Financial Services Integrated Distribution Services 1155 Long

Island Avenue Edgewood, NY 11717 Monica_Castillo@adp.com Goldman

Sachs & Co.Prospectus Department85 Broad StreetNew York, NY

10004 This news release does not constitute an offer to sell any

securities under the offering. As a result of this public offering,

Atmos Energy will not conduct the previously scheduled analyst

conferences in New York on December 6, 2006, or Boston on December

8, 2006. Atmos Energy Corporation (NYSE: ATO) said today that it

plans to make a public offering of 5,500,000 shares of its common

stock. The offering will be made under the company's effective

registration statement on Form S-3 filed today with the Securities

and Exchange Commission. Lehman Brothers and Goldman, Sachs &

Co. will serve as the joint book-running managers for the offering

with Banc of America Securities LLC, JP Morgan, Merrill Lynch &

Co., SunTrust Robinson Humphrey and Wachovia Securities serving as

co-managers. The underwriters will be granted an option to purchase

up to an additional 825,000 shares. The company will offer all of

the shares. Atmos Energy intends to use the net proceeds of this

offering to repay existing indebtedness under its commercial paper

program. The offering of the shares of common stock may be made

only by means of a prospectus supplement and the accompanying

prospectus. A copy of the preliminary prospectus supplement and the

accompanying prospectus may be obtained from Lehman Brothers or

Goldman, Sachs & Co. at the following: -0- *T Lehman Brothers

Goldman Sachs & Co. c/o ADP Financial Services Prospectus

Department Integrated Distribution Services 85 Broad Street 1155

Long Island Avenue New York, NY 10004 Edgewood, NY 11717

Monica_Castillo@adp.com *T This news release does not constitute an

offer to sell any securities under the offering. As a result of

this public offering, Atmos Energy will not conduct the previously

scheduled analyst conferences in New York on December 6, 2006, or

Boston on December 8, 2006.

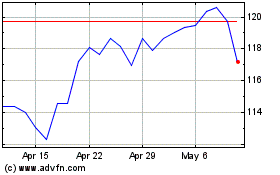

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From May 2024 to Jun 2024

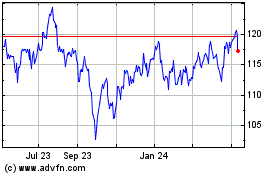

Atmos Energy (NYSE:ATO)

Historical Stock Chart

From Jun 2023 to Jun 2024