Assurant Stays Neutral - Analyst Blog

January 11 2012 - 12:28PM

Zacks

We reiterate our Neutral recommendation on the shares of

Assurant Inc. (AIZ) prior to its fourth quarter

earnings release on February 1, 2012. We remain concerned

about the company’s top-line growth given cyclical and secular

headwinds faced by its different business units. Earnings from

Assurant Health are expected to remain uncertain owing to the

implications of the Health Reform Act.

A weak economic scenario is expected to drag the earnings from

Employee Benefits and Solutions business. Moreover, mortgage

weakness continues to drain out Specialty Property revenues.

However, we expect that the company’s strong capital position will

help it to address the challenging macro conditions. Bottom-line

growth in the near term is expected to come from share

repurchases.

The Zacks Consensus EPS estimate for the quarter stands at

$1.35, generating expected earnings growth of 9.5% year over

year.

Assurant Specialty Property, which derives most of its premium

from creditor-placed homeowners’ insurance, is witnessing a decline

in outstanding mortgage loans. This trend is expected to continue

until the mortgage market rebounds.

The Employee Benefits segment has been under pressure from

persistent economic challenges in the small group sector leading to

higher lapse rates and lower premium growth on in-force policies.

Since there have been a few new employee additions and a modest

wage growth, premium income from the segment will remain under

pressure in the near term.

Assurant Health has traditionally been underperforming in the

face of a challenging environment. It has concentrated on this

business by enhancing its product offerings and changing its

pricing and plan designs.

Management expects the changes to improve the segment’s

performance and has thus raised its 2011 net operating income

guidance to the range of $10–$15 million from the break-even level

expected earlier. However, we are uncertain about the impact these

initiatives (particularly pricing increases) will have on improving

margins as the health insurance market remains very

competitive.

Despite the fundamental headwinds faced by the company, a strong

capital position will help it to sail through the tough operating

environment. For the past several years, the company has been

utilizing a vast amount of cash flow for share buybacks. Given

enough deployable capital, with no debt maturing near term, we

expect a high level of buyback in the near term will aid

bottom-line earnings.

The company competes with Unum Group (UNM) and

Reinsurance Group of America Inc. (RGA). Assurant

currently retains a Zacks #4 Rank, which translates into a

short-term ‘Sell’ rating.

ASSURANT INC (AIZ): Free Stock Analysis Report

REINSURANCE GRP (RGA): Free Stock Analysis Report

UNUM GROUP (UNM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

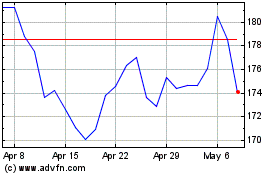

Assurant (NYSE:AIZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

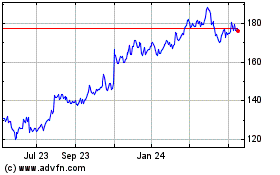

Assurant (NYSE:AIZ)

Historical Stock Chart

From Nov 2023 to Nov 2024