Bank Of America Says Non-Core Assets Still Up For Sale

December 06 2010 - 1:32PM

Dow Jones News

Bank of America Corp. (BAC) remains committed to shedding

non-core assets, even after the company raises the extra equity

required as part of its exit from the Troubled Asset Relief

Program, a spokesman said Monday.

The Charlotte-based bank has said all year long it wants slimmer

operations, and has committed to selling assets it thinks are no

longer essential to its business or don't fit the bank's strategic

goals. Chief Executive Brian Moynihan has said he wants the company

to get back to the basics of banking. Through the third quarter, it

had sold over $10 billion in assets this year.

But the bank has also been racing to meet a year-end deadline to

raise $3 billion in after-tax equity, a condition it agreed to when

it repaid its $45 billion TARP investment by the U.S. Treasury. As

of the end of September, Bank of America had been short $1.1

billion of those needed funds. Since then it has sold a huge stake

in BlackRock Inc. (BLK) and sold the right to purchase additional

shares in China Construction Bank Corp. (0939.HK, CICHY).

The bank had warned that if it didn't raise the capital, it may

have to pay some employees' bonuses in stock instead of cash.

Investors had also been worried about a possible need for a

dilutive share offering to meet the goal.

The sale of 51.2 million shares of BlackRock, which priced at

$63 each, was expected to net the bank some $300 million in pre-tax

equity capital.

The Financial Times reported Sunday that because of those recent

sales and a reduced tax rate because of its shrunken stake in

BlackRock, Bank of America has reached the $3 billion target.

Bank spokesman Jerry Dubrowski said Monday that Bank of America

continues "to make progress on our commitment and we will provide

an update at the appropriate time."

Shares of the bank were down 1.5% to $11.68 Monday

afternoon.

Dubrowski said that even when the target is reached, Bank of

America would continue to shed non-core assets.

Among those assets the bank has been trying to sell has been its

Balboa insurance unit, which sells so-called creditor-placed

coverage, a type of home insurance that kicks in when a house

enters foreclosure or homeowners stop paying for their own

insurance. Business for creditor-placed insurance has been booming

amid the housing crisis. Bank of America acquired Balboa when it

purchased struggling mortgage lender Countrywide Financial. The

bank said in July it intended to find a buyer for the unit before

the end of the year, but so far has not reached a deal.

Assurant (AIZ), the market leader for creditor-placed insurance,

said as far back as 2008 it was interested in acquiring Balboa.

-By David Benoit, Dow Jones Newswires; 212-416-2458;

david.benoit@dowjones.com

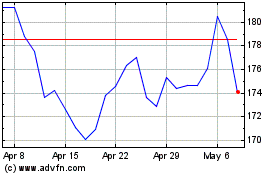

Assurant (NYSE:AIZ)

Historical Stock Chart

From Sep 2024 to Oct 2024

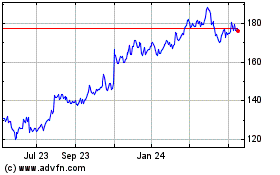

Assurant (NYSE:AIZ)

Historical Stock Chart

From Oct 2023 to Oct 2024