Ashford Prices Share Offering - Analyst Blog

July 07 2011 - 10:00AM

Zacks

Ashford Hospitality Trust

Inc. (AHT), the second largest lodging real estate

investment trust (REIT) in the U.S., has recently priced its public

offering of 7.0 million common shares at $12.50 each. The equity

offer is part of the corporate strategy of the company to raise

capital to repay debt. The company will also grant the underwriters

an option to purchase an additional 1.05 million shares to cover

any over-allotments.

Morgan Stanley

(MS) – a global financial services firm; KeyBanc Capital Markets –

the investment banking division of KeyCorp (KEY);

UBS Securities LLC, a subsidiary of UBS AG (UBS);

and Credit Suisse Securities (USA) LLC – the investment banking

division of Credit Suisse Group (CS) are acting as

joint book-running managers for the secondary offering.

Ashford intends to utilize the

proceeds from the secondary offering primarily to repay debt under

its senior credit facility. The remainder of the proceeds would be

used for other corporate purposes such as acquisition and other

hotel-related investments. By the end of first quarter 2011, the

company had a staggering debt burden of approximately $1.1 billion,

primarily due to its acquisition binge.

Ashford has continually focused on

acquiring upper-upscale and luxury hotels in diversified markets

throughout the U.S. The company seeks to own assets in some of the

premium markets of the country at discounted prices as property

prices has nose-dived in the last couple of years.

Ashford also has a well-experienced

management team that puts on board a unique perspective to hotel

investment sourcing, underwriting, asset managing, selling, and

financing. The company’s proactive asset management strategy

further provides the flexibility to adapt to the changing market

conditions to maximize operating margins and enhance the customer

experience.

We currently have a ‘Neutral’

rating on Ashford, which presently has a Zacks #3 Rank translating

into a short-term ‘Hold’ recommendation.

ASHFORD HOSPTLY (AHT): Free Stock Analysis Report

CREDIT SUISSE (CS): Free Stock Analysis Report

KEYCORP NEW (KEY): Free Stock Analysis Report

MORGAN STANLEY (MS): Free Stock Analysis Report

UBS AG (UBS): Free Stock Analysis Report

Zacks Investment Research

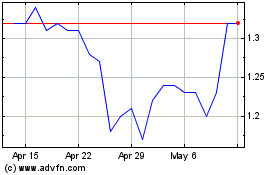

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From May 2024 to Jun 2024

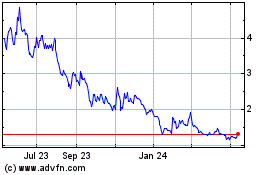

Ashford Hospitality (NYSE:AHT)

Historical Stock Chart

From Jun 2023 to Jun 2024