Ameriprise Remains on the Sidelines - Analyst Blog

January 30 2012 - 12:39PM

Zacks

We are maintaining our long-term Neutral recommendation on

Ameriprise Financial Inc. (AMP) after reviewing

the company’s third-quarter 2011 results, which were significantly

below the Zacks Consensus Estimate. The company reported improved

net revenues, which were more than offset by higher operating

expenses.

Moreover, steady capital deployment activities by Ameriprise

raise our hopes for greater investor confidence on the stock.

Though we remain concerned about the sluggish market recovery, an

improvement in retail client activity and a decent growth in Advice

& Wealth Management segment will drive operating leverage in

the upcoming quarters.

Over the years, Ameriprise has grown through acquisitions,

divestitures and spin offs. Further, the company continues to

restructure its operations to serve the changing market needs. In

May 2010, Ameriprise acquired the long-term asset management

business of Columbia Management from Bank of America

Corporation (BAC).

This acquisition has significantly pushed up the performances of

the company’s retail mutual fund and institutional management

businesses. Additionally, in November 2011, the company completed

the sale of Securities America Financial Corp. We believe that

Ameriprise will continue to restructure its business operations

with an aim to remain profitable by focusing on its core

business.

Ameriprise is an asset for yield-oriented investors. Last month,

Ameriprise increased its quarterly cash dividend by 22% to 28

cents. Also, the company continues to buy back shares. In June

2011, Ameriprise had announced a new share buyback program, under

which the company will be able to repurchase its common shares

worth $2 billion through June 2013. We expect management to

continue deploying excess capital in the form of dividends and

share buybacks going forward.

Ameriprise is operating on a healthy balance sheet by utilizing

enterprise risk management capabilities and product hedging to

anticipate and mitigate risk. The drop in the company’s

debt-to-total capital ratio, from 22.1% in 2008 to 17.7% in 2010,

projects management’s ability to pose significant capital leverage

in future.

On the flip side, despite lowering its deferred and acquisition

related costs through re-engineering strategies, Ameriprise’s fixed

interest costs and claims continue to rise. Though the company is

working on increasing advisor productivity by tightening the

productivity standards and improving the technology available to

advisors, we believe more is required to be done to mitigate

continued pressure on fee and asset growth, higher deferred

acquisition costs amortization and hedging.

Additionally, Ameriprise is yet to recover from the effects of

the financial crisis. Weak equity and other credit markets have

brought down the market-driven asset-based fees and hindered the

maintenance of high liquidity levels and lower cash product

spreads.

Ameriprise currently retains a Zacks #3 Rank, which translates

into a short-term Hold rating.

AMERIPRISE FINL (AMP): Free Stock Analysis Report

BANK OF AMER CP (BAC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

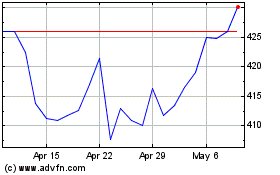

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jul 2023 to Jul 2024