Ameriprise Boosts Shareholder Value - Analyst Blog

December 08 2011 - 7:00AM

Zacks

On Wednesday, Ameriprise Financial Inc. (AMP)

announced that it has raised its quarterly cash dividend. This is

the fifth dividend rise for the company since 2005, when it became

a publicly traded company. During that period, the company paid

quarterly dividend of 11 cents per share.

This time, Ameriprise declared a quarterly cash dividend of 28

cents per share, payable on February 24, 2012 to shareholders of

record as on February 2010. Hence, the annual dividend payable to

the shareholders now stands at $1.12 per share, a jump of about 22%

from the prior annual dividend of 92 cents.

Earlier in the second quarter of 2011, Ameriprise had raised its

quarterly dividend to 23 cents per share from 18 cents. Amazingly,

even at the height of the financial crisis in 2008, Ameriprise

increased its quarterly dividend by 2 cents to 17 cents.

Furthermore, Ameriprise is also actively boosting its

shareholders’ wealth through share repurchases. Through September

30, 2011, the company has repurchased $1.2 billion of shares and

still has $1.7 billion available in its share repurchase

authorization, which will expire in June 2013.

Hence, it can be said that the company is quite sincere about

enhancing the shareholders’ value regularly through dividend hikes

and share buyback programs. This also reflects Ameriprise’s strong

financial backbone even during the sluggish economic recovery.

Similar to Ameriprise, one of the industry participants –

BlackRock Inc. (BLK) is also an active enhancer of

shareholder value through dividend hikes. BlackRock has been

increasing its dividend at regular intervals. Since 2005, it has

also hiked its quarterly dividend nearly 360% from 30 cents per

share in 2005 to the present $1.375.

Our Viewpoint

Though there are concerns over the sluggish market recovery,

improvement in retail client activity as well as decent growth in

Advice & Wealth Management and Asset Management businesses

would drive Ameriprise’s operating leverage in the upcoming

quarters. Furthermore, Ameriprise’s capital deployment activity

will boost investors’ confidence.

Currently, Ameriprise’s shares retain a Zacks #3 Rank, which

translates into a short-term ‘Hold’ rating. Also, considering the

fundamentals, we are maintaining a long-term “Neutral”

recommendation on the stock.

AMERIPRISE FINL (AMP): Free Stock Analysis Report

BLACKROCK INC (BLK): Free Stock Analysis Report

Zacks Investment Research

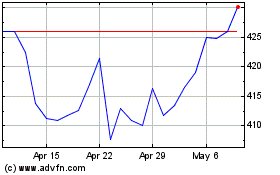

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From May 2024 to Jun 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jun 2023 to Jun 2024