A.M. Best Affirms Ratings of Ameriprise Financial, Inc. and Its Subsidiaries

August 30 2011 - 1:45PM

Business Wire

A.M. Best Co. has affirmed the financial strength rating

(FSR) of A+ (Superior) and issuer credit ratings (ICR) of “aa-” of

RiverSource Life Insurance Company (Minneapolis, MN) and its

wholly owned subsidiary, RiverSource Life Insurance Co. of New

York. (Albany, NY). A.M. Best also has affirmed the FSR of A

(Excellent) and ICR of “a+” of Ameriprise P&C Companies

and its members, IDS Property Casualty Insurance Company

(IDS) and its wholly owned, fully reinsured subsidiary,

Ameriprise Insurance Company (both domiciled in De Pere,

WI). Together, these companies represent the key life insurance and

property/casualty subsidiaries of Ameriprise Financial, Inc.

(Ameriprise) (headquartered in Minneapolis, MN) (NYSE: AMP).

Concurrently, A.M. Best has affirmed the ICR of “a-” and the

existing debt ratings of Ameriprise. The outlook for all ratings is

stable. (Please see below for a detailed listing of the debt

ratings.)

The ratings of the life insurance companies primarily reflect

their strong risk-adjusted capital positions, adequate liquidity

and the financial flexibility and favorable balance sheet strength

of Ameriprise. While overall premium growth has been challenged in

recent periods, statutory operating results have benefitted from

higher fees associated with an increase in separate account asset

valuations and the release of reserves supporting variable annuity

guarantees. Whereas statutory operating results have historically

fluctuated during times of equity market volatility, A.M. Best

notes that Ameriprise employs an effective hedge program that is

constructed to hedge GAAP income, economic risk and statutory

capital. Ameriprise also has taken measures to improve its hedge

effectiveness and decrease the risk profile of some of its product

offerings in recent periods. Furthermore, Ameriprise maintains a

moderate level of financial leverage, adequate fixed charge

coverage and reasonable levels of intangibles and goodwill on its

balance sheet relative to its current ratings.

The ratings also consider Ameriprise’s broad multi-platform

network of financial advisors and strong brand recognition in the

industry. Although the number of financial advisors has declined in

recent periods, A.M. Best notes that productivity per advisor has

improved during this time as the company has focused on improving

the productivity of experienced advisors, while culling less

productive agents.

Ameriprise’s investment portfolio remains relatively

conservative, maintaining a net unrealized gain position of

approximately $1.7 billion as of June 30, 2011. Despite the fact

that the company’s exposure to the commercial real estate market

remains relatively high (with non-agency commercial mortgage-backed

securities and direct commercial loans representing roughly 150% of

statutory capital and surplus) A.M. Best acknowledges that

Ameriprise’s direct commercial loan portfolio has performed well in

recent periods with only one delinquent loan of more than 60 days

as of June 30, 2011. In addition, its commercial mortgage-backed

securities are concentrated primarily in the senior most

tranches.

While Ameriprise’s main business segments, including Asset

Management, Advice and Wealth Management, Annuities and Protection

have all performed well recently, the company’s earnings remain

highly correlated to the performance of the equity markets. As a

result, earning trends may be impacted by fluctuating equity

valuations and will be susceptible to further volatility in the

financial markets.

The Ameriprise P&C Companies’ ratings are based on the

consolidated operating results and financial positions of IDS and

its subsidiary and reflect their synergies with Ameriprise. In

addition, the ratings take into account the group’s solid

risk-adjusted capital position and favorable trend of operating

results.

The following debt ratings have been affirmed:

Ameriprise Financial, Inc.—-- “a-” on $700 million 5.65%

senior unsecured notes, due 2015-- “a-” on $300 million 7.30%

senior unsecured notes, due 2019-- “a-” on $750 million 5.35%

senior unsecured notes, due 2020-- “a-” on $200 million 7.75%

senior unsecured notes, due 2039-- “bbb” on $500 million 7.518%

junior subordinated notes, due 2066

The following indicative shelf ratings have been affirmed:

Ameriprise Financial, Inc.—-- “a-” on senior unsecured

debt-- “bbb+” on subordinated debt-- “bbb” on preferred stock

Ameriprise Capital Trust I, II, III and IV—-- “bbb” on

trust preferred securities

The principal methodology used in determining these ratings is

Best’s Credit Rating Methodology -- Global Life and Non-Life

Insurance Edition, which provides a comprehensive explanation of

A.M. Best’s rating process and highlights the different rating

criteria employed. Additional key criteria utilized include: “Risk

Management and the Rating Process for Insurance Companies”; “A.M.

Best Ratings & the Treatment of Debt”; “Understanding BCAR for

Life and Health Insurers”; “Understanding BCAR for

Property/Casualty Insurers”; “Natural Catastrophe Stress Test

Methodology”; “Catastrophe Analysis in A.M. Best Ratings”; and

“Rating Members of Insurance Groups.” Methodologies can be found at

www.ambest.com/ratings/methodology.

Founded in 1899, A.M. Best Company is the world's oldest and

most authoritative insurance rating and information source. For

more information, visit www.ambest.com.

Copyright © 2011 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

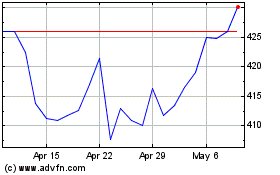

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From May 2024 to Jun 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jun 2023 to Jun 2024