Money Management Stocks Gaining Momentum - Investment Ideas

March 31 2011 - 8:00PM

Zacks

The big stock market rally of the last two years has been driven by

massive capital inflows into equities. But a good portion of that

volume has come on the back of large institutional players like

hedge fund and pension managers that control big blocks of cash.

But now, with the rally entering its third year,

many retail investors are finally gaining the nerve to dip back

into a market that saw steep losses in the financial crises of 2008

and 2009. That trend comes to light when taking a look at recent

mutual fund inflows.

Retail Investors Back in the Game

It kicked off with a very bullish January that saw

inflows of $34 billion into equity and fixed-income funds, a very

bullish signal that retail investors are looking to get back in the

game. Since then, inflows into equity and fixed-income funds have

been on a 10-week win streak, more evidence that retail investors

are regaining their appetite for risk

That macro-level shift from a large group of

investors represents a huge opportunity for money and asset

managers, who get paid on both assets under management (AUM) and

the actual performance of those assets.

More Fuel in the Tank?

And even though the bull is two years in the

making, there is plenty of evidence to support more gains. The

S&P500 is on the verge of regaining peak earnings from 2007

while trading at an 18% discount. That means the valuation picture

is compelling, with the S&P 500 trading at a relatively cheap

14X forward earnings.

So if retail investors are piling back into a wide

basket of assets, it means money managers are well positioned to

gain from the trend and increase their assets under management.

Let's go ahead and take a look at our top picks in the

category.

Top 4 Investment Management Stocks

Blackstone Group LP (BX) is a private equity

firm that specializes in private equity, real estate and debt with

a market cap of $8.3 billion. Increased capital inflows and higher

asset prices have been a boon for Blackstone, with this Zacks #2

rank stock recently hitting a new multi-year high. But the

valuation picture is still in check, with a forward P/E of 12X.

Take a look below.

BlackRock, Inc. (BLK) is one of the largest

asset managers in the world and has a market cap of $36 billion.

This Zacks #2 rank stock has an average earnings surprise of 11%

over the last three quarters and a bullish next-year estimate

calling for 15% growth. And with a PEG ratio (PE/Growth) of 1,

shares are trading at the traditional benchmark for value. Take a

look at shares trading near the 52-week high below.

Invesco Ltd (IVZ) is an asset manager that

specializes in high net-worth and institutional investors with a

market cap of $11.7 billion. This Zacks #2 rank stock recently hit

a new multi-year high on an average earnings surprise of 8% over

the last four quarters. With a bullish growth projection of 17% and

compelling valuation, IVZ looks well positioned to benefit from

additional capital inflows. Take a look at the chart below.

Ameriprise Financial (AMP) has been a high

flier for the last 6 months, recently topping off at a new

multi-year high above $65. The investment services and management

company is projected to grow earnings by 14% next year and has a

discounted forward P/E of 11X, well below its peer average of 14X.

Take a look at the chart below.

The Take Away

The strong equity rally of the last two years is

driving capital inflows into investment services and management

companies. And with the trend of strong corporate earnings well in

play, these companies are well positioned to benefit from more

gains.

Michael Vodicka is the Momentum Stock Strategist

for Zacks.com. He is also the Editor in charge of the new Zacks

Momentum Trader Service.

AMERIPRISE FINL (AMP): Free Stock Analysis Report

BLACKROCK INC (BLK): Free Stock Analysis Report

BLACKSTONE GRP (BX): Free Stock Analysis Report

INVESCO LTD (IVZ): Free Stock Analysis Report

Zacks Investment Research

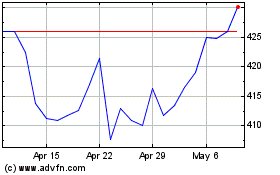

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From May 2024 to Jun 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jun 2023 to Jun 2024