Ameriprise Unit Sees $30 Million Yearly Savings For Fund Holders

September 27 2010 - 5:31PM

Dow Jones News

Ameriprise Financial Inc.'s (AMP) Columbia Management business

on Monday said it expects mutual-fund shareholders to see about $30

million per year in savings from fee changes and fund mergers,

including nine newly planned mergers and a slew announced in

August.

Ameriprise bought Columbia's long-term asset management business

from Bank of America Corp. (BAC) this spring and has been working

since to consolidate that business with its RiverSource unit.

Ameriprise has rebranded RiverSource funds Columbia, and Columbia

is pursuing a series of fund mergers that will take the combined

roster to just above 150 funds from more than 200.

"We're very comfortable now" with the planned fund line-up, said

Chris Thompson, head of product management and marketing at

Columbia, in an interview Monday. There could be one or two

additional moves announced this fall, he said.

All the fund proposals require shareholder approval, which is

expected either late in the first quarter or early second quarter

next year. Columbia also expects fee changes to be fully

implemented in the first half next year.

The additional nine fund mergers follow the proposal in August

for 62 mergers aimed in part at eliminating overlap between the

fund businesses. Because that effort is wrapping up, the company is

now projecting yearly savings, Thompson said.

The company said these moves won't trigger staffing cuts.

Columbia made personnel changes prior to the April 30 close of the

deal with Ameriprise, but hasn't described those changes in

detail.

-By Jon Kamp, Dow Jones Newswires; 617-654-6728;

jon.kamp@dowjones.com

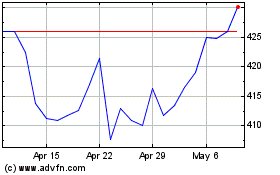

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From May 2024 to Jun 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jun 2023 to Jun 2024