OptionsXpress Broker-Dealer Targets More Advisers Over Time

July 22 2010 - 1:10PM

Dow Jones News

OptionsXpress Holdings Inc.'s (OXPS) brokersXpress, a

broker/dealer for registered investment advisers and independent

brokers, plans to double the number of advisers who use its

services over the next three to five years.

In an interview with Dow Jones Newswires, brokersXpress Chief

Executive Barry Metzger says the unit, which works with 300

advisers, would like to boost that number to 600.

BrokersXpress typically targets advisers from independent

broker/dealers such as LPL Financial Corp. and Securities America,

a unit of Ameriprise Financial Corp. (AMP), who generate $250,000

to $500,000 in fees and commissions and specialize in trading

options, though the firm does recruit some $1

million-producers.

Financial advisers in the $250,000-$500,000 range are generally

more recruitable in recent years as wirehouses, or major

brokerages, have been increasingly focused on adding higher

producing brokers.

In such large entities, Metzger says, brokers must work with a

large number of clients, albeit with more support staff, but

advisers rarely get to devote the same amount of personal attention

to their customers.

"The top advisers there have over 500 accounts, but if they come

to manage their business with us, they can work with 200 accounts,"

he said.

Advisers at independent shops have the opportunity to collect

higher payouts than wirehouse peers, though they miss out on

collecting large recruiting bonuses offered by firms such as Bank

of America Corp.'s (BAC) Merrill Lynch Wealth Management and Morgan

Stanley Smith Barney. Independent brokers also must handle other

issues such as compliance and finding office space.

While major brokerages will always have prestige and brand

recognition, Metzger says brokerXpress is "at the end of the day a

technology sell."

In particular, brokersXpress, like its parent company,

specializes in options trading, though the firm offers futures and

other asset classes.

Although Metzger declined to provide specific metrics for the

business, brokersXpress has attracted over 24,000 accounts and $1.4

billion in customer assets since its inception, according to its

parent company's annual report filed with the Securities and

Exchange Commission.

OptionsXpress, along with its online brokerage peers, has been

hurt by low interest rates over the past year, though the company

has said it has hit a bottom in terms of low rates cutting into net

interest income. The company, which reports second-quarter earnings

next week, is likely to benefit from heavy trading volume from May

6's stock market "flash crash."

Shares of optionsXpress were up 2% at $15.13 in midmorning

trading on a day when many financial stocks were strong.

-By Brett Philbin, Dow Jones Newswires; 212-416-2173;

brett.philbin@dowjones.com

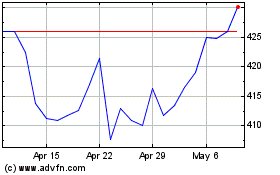

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From May 2024 to Jun 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Jun 2023 to Jun 2024