Allstate Corporation’s (ALL) third quarter 2011

operating earnings of 16 cents per share came in a nickel higher

than the Zacks Consensus Estimate of 11 cents but significantly

lagged the year-ago quarter’s earnings of 83 cents per share.

Results for the quarter reflected higher catastrophe (CAT)

losses that also led to increased claims expenses coupled with

lower average premiums and policies-in-force in Property-Liability

insurance unit and lower investment income. However, prudent

capital management and liquidity were quite impressive during the

reported quarter. This is reflected from stability in book value

per share and combined ratio, excluding the effect of

catastrophes.

Allstate’s net income for the reported quarter came in at $165

million or 32 cents per share, compared with $367 million or 68

cents per share in the prior-year quarter, reflecting a radical

decline.

Operating income, which excludes realized net capital gains and

losses and deferred acquisition costs (DAC) and DSI related to them

along with valuation changes on embedded unhedged derivatives,

gains and losses on disposition of operations and accruals on

unhedged derivative instruments, plunged to $84 million against

$452 million in the year-ago quarter.

Allstate reported total net revenue growth of 4.2% year over

year to $8.24 billion but substantially exceeded the Zacks

Consensus Estimate of $6.90 billion. Besides, property-liability

insurance claims and claims expenses grew 11.5% year over year to

$5.13 billion while operating costs and expenses remained almost

flat at $825 million.

Particularly, catastrophe losses for the reported quarter

escalated to $1.08 billion, in line with management’s projection,

contributing 15.6 point to the combined ratio but were

substantially higher than $386 million in the year-ago period.

During the reported quarter, Allstate experienced 23 catastrophe

loss events including Hurricane Irene and Tropical Storm Lee.

Quarter in Detail

Property-Liability net written

premiums were $6.73 billion, inching down 0.6% from the prior-year

quarter. The segment’s combined ratio was 104.8% against 95.9% in

the year-ago quarter, reflecting increased catastrophe losses.

However, the underlying combined ratio, which excludes

catastrophes and prior-year reserve estimates, was 89.2% in the

reported quarter, flat from the year-ago quarter. This was also

within management’s outlook of underlying combined ratio of 88 to

91 for 2011.

Besides, Allstate brand standard auto premiums written for the

reported quarter declined 0.8% from the prior-year quarter as a

result of a fall in policies in force along with a 13.2% decline in

new issued applications. Average gross premium also dipped 1.1%

from the year-ago period, reflecting slight rate increases offset

by reduced volumes in vast markets of New York and Florida. As a

result, the Allstate brand standard auto combined ratio increased

1.0 point year over year to 94.2%.

Nevertheless, Allstate-branded homeowners’ written premiums for

the quarter improved 1.5% year over year, reflecting a 5.0% climb

in average gross premium that was partially mitigated by a 4.2%

decline in policies in force. Higher catastrophe losses resulted in

Allstate-branded homeowners combined ratio of 131.9%, although

underlying combine ratio moderated marginally to 73.3% against

75.0% in the prior-year quarter.

Property-Liability net income sank to $40 million against $331

million in the year-ago quarter. Operating income for this segment

was $21 million, decreasing from $394 million in the year-ago

quarter. However, the Property-Liability expense ratio for the

reported quarter improved marginally to 25.0 from 25.1 in the

prior-year quarter.

However, operating income for Allstate

Financial spiked 24.1% year over year to $134

million. The increase reflected improvement in the profitability of

investment spread products along with expansion of underwritten

products sales through Allstate agencies and growing Allstate

Benefits. Meanwhile, net income came in at $183 million against $85

million in the year-ago quarter, primarily driven by lower

operating costs and net realized capital gains in the reported

quarter against losses, in the comparable period.

Corporate & Other segment reported

a net income of $165 million, deteriorating from $367 million in

the prior-year quarter. Total operating cost and expenses stood at

$116 million, climbing from $95 million in the year-ago

quarter.

Investment and Capital Position

As of September 30, 2011, Allstate’s total investment portfolio

decreased $3.0 billion from 2010-end to $97.5 billion, reflecting

reductions in the Allstate Financial portfolio and its fixed

annuity business. However, the pre-tax net unrealized capital gains

jumped to $2.4 billion as on September 30, 2011 from $1.4 billion

at the end of 2010. Meanwhile, net realized capital gains totaled

$264 million compared to a loss of $144 million in the year-ago

period, primarily due to sales of foreign government and the U.S.

Treasury securities, which were partly offset by interest rate

derivatives losses.

Allstate’s net investment income came in at $994 million, down

1.1% from the year-ago quarter, although portfolio yields were

stable at 4.5%. As on September 30, 2011, reported book value per

share inched up 0.2% year over year to $35.56. Book value per

share, excluding the impact of unrealized net capital gains and

losses on fixed income securities, was almost flat at $33.39.

Operating cash flow totaled $1.67 billion at the end of the

reported quarter, significantly down from $3.02 billion at the end

of the prior-year quarter. Long-term debt stood at $5.9 billion and

total equity was $18.1 billion, while total assets were recorded at

$127.0 billion at the end of September 30, 2011.

Additionally, during the reported quarter, Allstate repurchased

shares worth $308 million, thereby completing the $1.0 billion

share repurchase program that was authorized in November 2010. The

company has deployed about $20 billion of capital through share

repurchases over the last 17 years.

Outlook

Management expects to maintain the profitability of the auto

business and improve homeowners’ profitability, resulting in an

underlying combined ratio outlook of 88% to 91% for 2011.

Meanwhile, Allstate aims to generate long-term shareholder value

and an operating return on equity (ROE) of 13% by 2014. As a

long-term growth strategy, management also plans to reposition

products and distribution platforms to meet changing needs of

consumers. Besides, the company’s near-term priorities include

maintaining standard auto margins, improving returns in homeowners

and Allstate Financial and managing capital aggressively.

Allstate is taking strategic actions to reduce losses for

Allstate business from catastrophes through enhanced property

catastrophe reinsurance program, non-renewals, stricter

underwriting guidelines, increased deductibles and discontinuance

of selected lines of coverage, including earthquake.

We anticipate continued benefits from Allstate’s

diversification, superior financial strength rating and proactive

approach to investment. These factors have helped Allstate gain the

second-largest personal lines writer position in the US, which also

reflects its competitive strength against arch rivals such as

Berkshire Hathaway-B (BRK.B) and The

Travelers Companies (TRV).

However, Allstate’s exposure to catastrophe risks, capital

losses and volatility in pricing, interest and loss costs will

continue to impact the premiums and investment portfolio in the

upcoming quarters.

ALLSTATE CORP (ALL): Free Stock Analysis Report

BERKSHIRE HTH-B (BRK.B): Free Stock Analysis Report

TRAVELERS COS (TRV): Free Stock Analysis Report

Zacks Investment Research

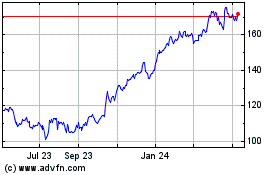

Allstate (NYSE:ALL)

Historical Stock Chart

From Jun 2024 to Jul 2024

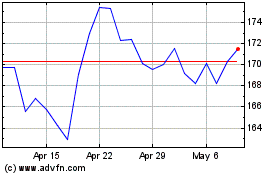

Allstate (NYSE:ALL)

Historical Stock Chart

From Jul 2023 to Jul 2024