Progressive Beats by a Penny - Analyst Blog

May 19 2011 - 7:15AM

Zacks

Progressive Corp.’s (PGR) earnings per share

for April 2011 were 18 cents, up a penny from the year-ago earnings

of 17 cents. Net income increased 5.9% from the year-ago period to

total $118 million.

The company recorded net premiums of $1.54 billion during April

2011, up 4.5% from $1.47 billion in April 2010 and 26% from $1.2

billion during March 2011. Net premiums earned were $1.43 billion,

up 4.3% from $1.37 billion in the year-ago period and up 25.7% from

$1.14 billion in the prior month.

Net realized gains on securities were $24.6 million during April

2011, a considerable improvement from $8.0 million in April 2010,

but lower than $48.8 million in March 2011. The combined ratio −

the percentage of premiums paid out as claims and expenses −

deteriorated 70 basis points over the

prior-year period to 91.4% in the month under review.

Progressive reports its results every month. During April,

policies in force remained healthy, with the Personal Auto segment

increasing 6% year over year and 0.6% sequentially. Special Lines

increased 5% year over year and 2% over the preceding month.

In Personal Auto, Direct Auto reported a growth of 9% year over

year and 0.8% from the preceding month. Agency Auto was up 4% year

over year and 0.8% from the last month. However, Progressive’s

Commercial Auto segment continued to drag results, reporting

declines of 1.6% year over year.

Total expenses for the reported month increased 5% to $1.3

billion from $1 billion in April 2010. The major components

contributing to the increase in total expenses were a 6%

year-over-year increase in losses and loss adjustment expenses, a

3% increase in policy acquisition costs and a 4% increase in

underwriting expenses.

Progressive reported a book value per

share of $9.91, up from $9.52 as of April 30, 2010 and from $9.64

as of March 31, 2011.

Return on equity on a trailing 12-month basis was 18.1%, down

from 20.1% in April 2010 but up from 18% in March 2011. The

debt-to-total-capital ratio was 23.2 % as of April 2011, down from

25.4% as of April 2010 and from 23.7% as of March 2011.

We maintain our Neutral recommendation on Progressive. The

quantitative Zacks #3 Rank (short-term Hold rating) for the company

indicates no clear directional pressure on the shares over the near

term.

Headquartered in Mayfield Village, Ohio, The Progressive

Corporation is one of the largest auto insurers in the country. It

is a leading independent agency writer of private passenger auto

coverage, market leader for the motorcycle product and is one of

the leading companies in the commercial auto insurance market. It

competes with Allstate Corporation (ALL).

ALLSTATE CORP (ALL): Free Stock Analysis Report

PROGRESSIVE COR (PGR): Free Stock Analysis Report

Zacks Investment Research

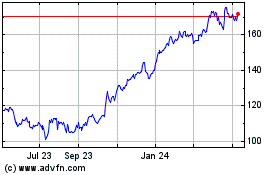

Allstate (NYSE:ALL)

Historical Stock Chart

From Jun 2024 to Jul 2024

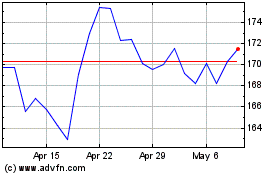

Allstate (NYSE:ALL)

Historical Stock Chart

From Jul 2023 to Jul 2024