Merckle Family Could Sell Parts Of Phoenix - Sources

March 12 2010 - 9:49AM

Dow Jones News

Germany's Merckle family will likely need to sell parts of

pharmaceuticals distribution business Phoenix Pharmahandel GmbH

& Co KG in addition to all of its generic drug making business

Ratiopharm to reduce its crippling debts, a person familiar with

the matter told Dow Jones Newswires.

"The sale of individual parts is the most likely scenario at

present," the person said about Phoenix.

Phoenix's German operations are expected to remain a part of the

Merckle empire, but foreign holdings such as pharmacy chains owned

by Phoenix's Finnish unit Tamro could be divested, another person

familiar with the matter said. Specifically, Tamro acquired several

pharmacy chains in the Baltic region in recent years which could be

sold by the Merckle family, the person added.

A spokesman for Phoenix declined to comment on the matter.

A third person familiar with the matter said that more details

on what parts of Phoenix could be divested will emerge after a

buyer is lined up for Ratiopharm.

"Currently the interested bidders are waiting for signs which

parts of Phoenix are for sale," the person said. Fully-financed,

binding bids for Ratiopharm are due March 18. The bidders include

U.S. pharmaceuticals company Pfizer Inc. (PFE), Israeli drug maker

Teva Pharmaceutical Industries Ltd. (TEVA) and Iceland's

privately-held Actavis Group.

According to media reports, Phoenix's holding company VEM

Vermögensverwaltung GmbH has already received interest from

potential buyers in the past, including the U.K. pharmaceuticals

company Alliance Boots PLC (AB.YY), U.S. drug distributor McKesson

Corp. (MCK) and U.S. health care services company Medco Health

Solutions Inc (MHS)

VEM is the holding company which controls Phoenix, Ratiopharm

and the Merckle family's other holdings.

VEM is said to face up to EUR4 billion in debts, in part the

result of soured stock bets amassed by its founder Adolf Merckle.

Merckle killed himself early last year, leaving his eldest son

Ludwig to sort through the family empire's financial woes. Aside

from VEM's larger debts, Phoenix is also seriously over-leveraged,

a fourth person familiar with the company's situation said.

Phoenix's net debts are around six times its earnings before

interest, taxes, depreciation and amortization, or EBITA, the

person said. "Phoenix has its own problems to solve."

The Phoenix group employed 23,000 people and earned EUR21.5

billion in revenues for the financial year ending January 31. The

German Phoenix subsidiary earned EUR6.5 billion in revenues for the

time period, with earnings before interest and taxes of EUR68.6

million.

-By Eyk Henning; Dow Jones Newswires; +49 69 29 725 515;

eyk.henning@dowjones.com

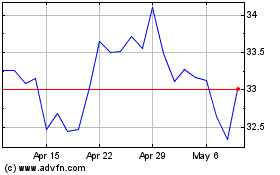

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From May 2024 to Jun 2024

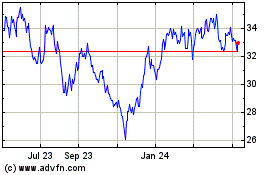

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From Jun 2023 to Jun 2024