Announces Filing and Availability of 2009 Form 10-K NEW YORK, Feb.

11 /PRNewswire-FirstCall/ -- AllianceBernstein Holding L.P.

("AllianceBernstein Holding") (NYSE:AB) and AllianceBernstein L.P.

("AllianceBernstein") today reported financial and operating

results for the quarter ended December 31, 2009. Private Assets

Under Management ($ billions) Institutions Retail Client

----------------------- ------------ ------ ------- Ending Assets

Under Management: $496 $300 $121 $75 Net Flows for Three Months

Ended 12/31/09:($16.8) ($15.6) ($0.4) ($0.8) Three Months Ended

Financial Results ($ millions ------------------------ except per

Unit amounts) 12/31/2009 12/31/2008 Change

------------------------------ ---------- ---------- ------

AllianceBernstein L.P. Net Revenues $782 $581 35% Net Income $192

$92 108% Operating Margin 25.7% 16.2% 9.5% AllianceBernstein

Holding L.P Diluted Net Income per Unit $0.62 $0.27 130%

Distribution per Unit $0.62 $0.29 114% The distribution is payable

on March 4, 2010 to holders of record of AllianceBernstein Holding

Units at the close of business on February 22, 2010. Performance

For the fourth quarter of 2009, the performance of

AllianceBernstein's investment services relative to benchmarks or

peer averages was strong in non-US Growth Equities and Fixed Income

but mixed in our Value services. For the full year 2009, most of

our services outperformed, materially so in many cases, exemplified

by the exceptional returns in our Blend Strategies portfolios, with

our top four institutional Blend services outperforming their

benchmarks by 280 to over 1,000 basis points for the year.

Furthermore, Fixed Income services had a stellar year, with three

of our five largest institutional services outperforming benchmarks

by more than 1,000 basis points. In addition, three of our four

largest retail Fixed Income services generated returns of more than

1,500 basis points above peer averages. Assets Under Management

Total assets under management as of December 31, 2009 were $496

billion, down $2 billion from the third quarter of 2009, as net

outflows of $16.8 billion were largely offset by positive

investment performance. In the Institutions channel, net outflows

increased to $15.6 billion from $10.0 billion in the third quarter

of 2009. However, our pipeline of won but unfunded Institutional

mandates increased by 6% sequentially to $3.6 billion. Net outflows

in our other channels decreased sequentially, from $1.9 billion to

$400 million in Retail and from $1.0 billion to $800 million in

Private Client. Assets under management increased 7%

year-over-year, as strong performance by many of our investment

services during 2009 more than offset substantially higher net

asset outflows. Full-year 2009 net outflows increased significantly

in our Institutions channel, were up modestly in our Private Client

channel and decreased materially in our Retail channel. Financial

Results In the fourth quarter of 2009, Net Income Attributable to

AllianceBernstein Unitholders more than doubled from the fourth

quarter of 2008 and our operating margin increased to 25.7% from

16.2%. The majority of this improvement is due to positive

investment gains on deferred compensation-related investments, with

the remainder attributable to stronger operational results. Diluted

net income per Unit for the publicly-traded partnership increased

130% to $0.62 from $0.27 in the prior-year quarter. The $0.62

distribution per Unit represents a 114% increase compared to the

prior-year quarter's $0.29 distribution. Base fee revenues

increased by $14 million, or 3%, compared to the prior-year quarter

due to higher revenue in our Retail channel. In addition, we

generated $16 million in performance fees during the current

quarter, compared to only $1 million in the fourth quarter of 2008,

largely from hedge funds in our Private Client channel. Fourth

quarter 2009 investment gains of $14 million resulted almost

entirely from gains on deferred compensation-related investments.

This compares favorably to investment losses of $162 million in the

fourth quarter of 2008, including $132 million from investments

related to deferred compensation obligations. Bernstein Research

Services revenues declined 8% compared to the fourth quarter of

2008, as higher European revenues were more than offset by declines

in the US. Notably, new services such as derivatives and equity

capital markets made important contributions to fourth quarter 2009

revenue. Operating expenses for the fourth quarter of 2009 were

$582 million, an increase of $73 million, or 14%, compared to the

fourth quarter of 2008. Compensation and benefits increased 22%

year-over-year, the result of substantially higher incentive

compensation in the fourth quarter of 2009, which was caused by two

factors. The first is higher amortization of deferred compensation

due to mark-to-market gains on related investments compared to

losses in the prior-year quarter. The second is the substantially

reduced cash bonus accrual in the prior-year quarter, reflecting

the decline in 2008 income caused by severe capital market declines

in the second half of that year. The increase was partially offset

by lower base compensation, the result of lower severance charges

and headcount, and lower commissions. Promotion and servicing

expenses increased by $15 million, or 14%, due to higher

distribution plan expenses associated with higher Retail AUM,

in-line with increased distribution revenues. General and

administrative expenses were flat compared to the fourth quarter of

2008, as lower technology and occupancy expenses were offset by

lower foreign exchange gains. General and administrative expenses

also benefited from a reimbursement for claims accrued in the

second quarter of 2009. Although assets under management grew by 7%

in 2009 compared to 2008, a 31% decline in average AUM resulted in

a decrease of more than $900 million, or 32%, in advisory fee

revenues. Despite higher trading volumes, reflecting market share

gains, and revenues from new services, Bernstein Research Services

revenues fell 8% for the full year compared to a record 2008 due to

a mix shift toward low-touch trading and lower securities

valuations in Europe, where fees are calculated as basis points on

the value of securities traded. And while a nearly $500 million

positive variance in investment gains mitigated a portion of these

declines, net revenue fell by 17% for the full year. Operating

expenses declined by 11% due to lower compensation and benefits as

well as lower promotion and servicing expenses. Net Income

Attributable to AllianceBernstein Unitholders fell 34%

year-over-year and our operating margin also declined, down 650

basis points to 19.6%. Management Commentary "Our firm made

significant progress in 2009 following a very difficult 2008,

posting strong relative investment returns for clients across our

global platform. We enhanced our investment process while staying

true to our philosophy of combining our high-quality, in-depth

fundamental research with innovative quantitative tools to deliver

alpha to our clients," said Peter S. Kraus, Chairman and Chief

Executive Officer. "The strong capital markets of 2009, coupled

with our broad-based relative outperformance, enabled us to grow

AUM in 2009 despite higher net client outflows for the full year,

which peaked in the second quarter of 2009. I feel confident that

the trend of improving sales we have seen since then will continue

into 2010, and I am optimistic that the direction of net client

flows will reverse before the year is out. Specifically, I expect

that our Private Client and Retail channels will be the first to

show positive quarterly net flows, with our Institutions channel

lagging. In order for this to happen, we will need to sustain the

positive performance we achieved in 2009. Additionally, the

successful launch of new services in all our channels, which we are

aggressively pursuing, will aid in achieving this goal. "Despite

lower Bernstein Research Services revenues in 2009 compared to

2008, due primarily to market forces, our sell-side business made

important strides in gaining market share and launching new

products. We anticipate this trend will continue, as we further

globalize our research footprint and expand our array of client

services in 2010. Specifically, we expect to grow our US and

European research market share, build out our newly established

Asia research platform, expand equity derivatives and electronic

trading services and develop our nascent equity capital markets

business. The Bernstein Research brand has never been stronger, and

we will capitalize on this strength to build an even larger and

more successful business. "We began 2010 with AUM 8% higher than

average AUM for 2009 and with a much smaller expense base. We

reduced headcount by 13% compared to the end of 2008, and have also

reduced other controllable costs, creating strong operating

leverage in our business model. Increased AUM should lead to higher

revenues which, when supported by a lower expense base, will

generate a greater amount of income. Capital Markets Commentary "We

see evidence continuing to mount that economies are on the mend

globally. Global GDP rebounded strongly in the second half of 2009,

led initially by impressive gains in many of the emerging market

economies, and then by a solid rebound in the US. Surveys of

industrial activity in early 2010, as well as trends in global

trade, indicate that the economic recovery is gaining speed and

breadth. We expect economies globally to continue to record solid

growth in 2010, with emerging markets running more than twice as

fast as the industrialized economies. With actions by governments

and central banks beginning to take hold, investors are

increasingly turning their attention toward the risks associated

with unwinding the massive stimulus programs in place. We expect

interest rates to rise from their current extremely low levels, but

for monetary policy to remain accommodative. Ongoing deleveraging

of household balance sheets, high unemployment, lack of credit

creation, government regulatory initiatives (health and finance) as

well as the fiscal soundness of governments are the major risks in

this outlook. "Global equity markets, as measured by the MSCI World

index, are still only halfway back to their October 2007 peak, even

after rising over 70% from the bottom. Furthermore, cumulative

10-year returns for the S&P 500 and the MSCI World indices are

both still negative. Short term measures of valuation, such as

price to trailing earnings, may not be provocative, but with

profitability at 30-year lows, we expect corporate earnings to

rise. Most importantly, the uncertainty regarding the shape of the

recovery has produced significant disagreement about individual

company prospects. This creates a particularly rich environment in

which active equity managers can generate alpha for their clients.

"While spreads in the credit markets have contracted significantly

from the high levels reached in 2009, the opportunity for

out-performance of non-government sectors still looks attractive in

the global fixed income marketplace. Spreads in nearly all markets,

with the exception of agency mortgage backed securities, are still

above historical averages and, if as we expect, the economic

recovery continues, there will be opportunity for excess returns.

While interest rates on government securities are expected to

normalize, the record steepness in most yield curves should help to

cushion the impact of rising rates on returns. Concluding Remarks

"In closing, we began 2009 with three objectives: improving

investment performance, reducing net asset outflows and

right-sizing our firm and I believe we have succeeded on all three

fronts. For 2010, we are focused on continuing to provide solid

investment returns and world class service for our clients,

expanding our product offerings, acquiring new clients, engaging

and motivating our employees and improving returns for Unitholders

- in short, executing on our strategy," concluded Mr. Kraus. Fourth

Quarter 2009 Earnings Conference Call Information

AllianceBernstein's management will review fourth quarter 2009

financial and operating results on Thursday, February 11, 2010

during a conference call beginning at 5:00 p.m. (EST), following

the release of its financial results after the close of trading on

the New York Stock Exchange. The conference call will be hosted by

Peter S. Kraus, Chairman and Chief Executive Officer, David A.

Steyn, Chief Operating Officer and Robert H. Joseph, Jr., Chief

Financial Officer. Parties may access the conference call by either

webcast or telephone: 1. To listen by webcast, please visit

AllianceBernstein's Investor Relations website at

http://ir.alliancebernstein.com/investorrelations at least 15

minutes prior to the call to download and install any necessary

audio software. 2. To listen by telephone, please dial (866)

556-2265 in the U.S. or (973) 935-8521 outside the U.S., 10 minutes

before the 5:00 p.m. (EST) scheduled start time. The conference ID#

is 50182270. The presentation that will be reviewed during the

conference call will be available on AllianceBernstein's Investor

Relations website shortly after the release of its financial

results. A replay of the webcast will be made available beginning

at approximately 7:00 p.m. (EST) on February 11, 2010 and will be

available on our website for one week. An audio replay of the

conference call will also be available for one week. To access the

audio replay, please call (800) 642-1687 from the U.S., or outside

the U.S. call (706) 645-9291, and provide conference ID# 50182270.

Availability of 2009 Form 10-K Unitholders may obtain a copy of our

Form 10-K for the year ended December 31, 2009 in either electronic

format or hard copy on http://www.alliancebernstein.com/ --

Download Electronic Copy: Unitholders with internet access can

download an electronic version of the report by visiting

http://www.alliancebernstein.com/ and clicking on

"AllianceBernstein 2009 Form 10-K". The report is also accessible

in the "Featured Documents" section of the "Investor & Media

Relations" page at

http://www.alliancebernstein.com/investorrelations. -- Order Hard

Copy Electronically or by Phone: Unitholders may also order a hard

copy of the report, which is expected to be available for mailing

in approximately eight weeks, free of charge. Unitholders with

internet access can follow the above instructions to order a hard

copy electronically. Unitholders without internet access, or who

would prefer to order by phone, can call 800-227-4618. Cautions

Regarding Forward-Looking Statements Certain statements provided by

management in this news release are "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such forward-looking statements are subject to risks,

uncertainties, and other factors that could cause actual results to

differ materially from future results expressed or implied by such

forward-looking statements. The most significant of these factors

include, but are not limited to, the following: the performance of

financial markets, the investment performance of sponsored

investment products and separately managed accounts, general

economic conditions, industry trends, future acquisitions,

competitive conditions, and government regulations, including

changes in tax regulations and rates and the manner in which the

earnings of publicly-traded partnerships are taxed. We caution

readers to carefully consider such factors. Further, such

forward-looking statements speak only as of the date on which such

statements are made; we undertake no obligation to update any

forward-looking statements to reflect events or circumstances after

the date of such statements. For further information regarding

these forward-looking statements and the factors that could cause

actual results to differ, see "Risk Factors" and "Cautions

Regarding Forward-Looking Statements" in our Form 10-K for the year

ended December 31, 2009. Any or all of the forward-looking

statements that we make in this news release, Form 10-K, other

documents we file with or furnish to the SEC, and any other public

statements we issue, may turn out to be wrong. It is important to

remember that other factors besides those listed in "Risk Factors"

and "Cautions Regarding Forward-Looking Statements", and those

listed below, could also adversely affect our financial condition,

results of operations and business prospects. The forward-looking

statements referred to in the preceding paragraph include

statements regarding: -- Our pipeline of new institutional mandates

not yet funded: Before they are funded, institutional mandates do

not represent legally binding commitments to fund and, accordingly,

the possibility exists that not all mandates will be funded in the

amounts and at the times we currently anticipate. -- Our optimism

regarding improving sales and the direction of client flows: Our

ability to sustain our improved investment performance, as well as

the actual performance of the capital markets and other factors

beyond our control, will affect our asset flows. -- Our expectation

that we will further globalize our sell-side research footprint and

expand our array of client services in 2010: Factors beyond our

control, including the effect of the performance of the financial

markets on our results of operations, may adversely affect our

ability to implement our strategic initiatives. -- Our expectation

that increased levels of AUM should lead to increased revenues

which, when supported by a lower expense base, will generate a

greater amount of income: Unanticipated events and factors,

including pursuit of strategic initiatives, may cause us to expand

our expense base, thus limiting the extent to which we benefit from

any positive leverage in future periods. Growth in our revenues

will depend on the level of our assets under management, which in

turn depends on factors such as the actual performance of the

capital markets, the performance of our investment products and

other factors beyond our control. -- Our expectation that corporate

earnings will rise and the economic recovery will continue: The

extent to which global economies have recently stabilized is not

necessarily indicative of future growth and there are significant

obstacles that may hinder sustained growth. The actual performance

of the capital markets and other factors beyond our control will

affect our investment success for clients and asset flows.

Qualified Tax Notice This announcement is intended to be a

qualified notice under Treasury Regulation section 1.1446-4(b).

Please note that 100% of AllianceBernstein Holding's distributions

to foreign investors is attributable to income that is effectively

connected with a United States trade or business. Accordingly,

AllianceBernstein Holding's distributions to foreign investors are

subject to federal income tax withholding at the highest applicable

tax rate, currently 35%. About AllianceBernstein AllianceBernstein

is a leading global investment management firm that offers

high-quality research and diversified investment services to

institutional clients, individuals and private clients in major

markets around the world. AllianceBernstein employs more than 500

investment professionals with expertise in growth equities, value

equities, fixed income securities, blend strategies and alternative

investments and, through its subsidiaries and joint ventures,

operates in more than 20 countries. AllianceBernstein's research

disciplines include fundamental research, quantitative research,

economic research and currency forecasting capabilities. Through

its integrated global platform, AllianceBernstein is

well-positioned to tailor investment solutions for its clients.

AllianceBernstein also offers high-quality, in-depth research,

portfolio strategy and brokerage-related services to institutional

investors, and equity capital markets services to issuers of

publicly-traded securities. At December 31, 2009, AllianceBernstein

Holding L.P. owned approximately 36.5% of the issued and

outstanding AllianceBernstein Units and AXA, one of the largest

global financial services organizations, owned an approximate 62.1%

economic interest in AllianceBernstein. AllianceBernstein L.P. (The

Operating Partnership) SUMMARY CONSOLIDATED STATEMENT OF INCOME |

December 31, 2009 Three Months Ended Twelve Months Ended

------------------ ------------------- $ thousands, unaudited

12/31/09 12/31/08 12/31/09 12/31/08 ---------------------- --------

-------- -------- -------- Revenues: Investment Advisory &

Services Fees $543,162 $514,428 $1,920,332 $2,839,526 Distribution

Revenues 80,891 64,477 277,328 378,425 Bernstein Research Services

108,775 118,122 434,605 471,716 Dividend and Interest Income 7,386

20,501 26,730 91,752 Investment Gains (Losses) 13,720 (162,078)

144,447 (349,172) Other Revenues 28,430 28,739 107,848 118,436

------ ------ ------- ------- Total Revenues 782,364 584,189

2,911,290 3,550,683 Less: Interest Expense 503 3,667 4,411 36,524

--- ----- ----- ------ Net Revenues 781,861 580,522 2,906,879

3,514,159 ------- ------- --------- --------- Expenses: Employee

Compensation & Benefits 323,391 264,207 1,298,053 1,454,691

Promotion & Servicing Distribution Plan Payments 61,261 46,474

207,643 274,359 Amortization of Deferred Sales Commissions 12,819

17,250 54,922 79,111 Other 47,833 42,853 173,250 207,506 General

& Administrative 130,779 131,872 558,361 539,198 Interest on

Borrowings 566 1,144 2,696 13,077 Amortization of Intangible Assets

4,956 5,179 21,126 20,716 ----- ----- ------ ------ 581,605 508,979

2,316,051 2,588,658 ------- ------- --------- --------- Operating

Income 200,256 71,543 590,828 925,501 Non-Operating Income 4,552

5,464 33,657 18,728 ----- ----- ------ ------ Income Before Income

Taxes 204,808 77,007 624,485 944,229 Income Taxes 13,901 7,509

45,977 95,803 ------ ----- ------ ------ Net Income 190,907 69,498

578,508 848,426 Net Loss (Income) of Consolidated Entities

Attributable to Non- Controlling Interests 733 22,481 (22,381)

(9,186) --- ------ ------- ------ Net Income Attributable to

AllianceBernstein Unitholders $191,640 $91,979 $556,127 $839,240

======== ======= ======== ======== Operating Margin(1) 25.7% 16.2%

19.6% 26.1% (1) Operating Margin = (Operating Income less Net

Income/plus Net Loss of Consolidated Entities Attributable to

Non-Controlling Interests) / Net Revenues. AllianceBernstein

Holding L.P. (The Publicly-Traded Partnership) SUMMARY STATEMENT OF

INCOME Three Months Ended Twelve Months Ended ------------------

------------------- $ thousands except per Unit amounts, unaudited

12/31/09 12/31/08 12/31/09 12/31/08 ------------------ --------

-------- -------- -------- Equity in Net Income Attributable to

AllianceBernstein Unitholders $67,086 $30,661 $192,513 $278,636

Income Taxes 7,415 6,643 25,324 33,910 -------- -------- --------

-------- NET INCOME 59,671 24,018 167,189 244,726 Additional Equity

in Earnings of Operating Partnership (1) 731 - 328 1,133 --------

-------- -------- -------- NET INCOME - Diluted (2) $60,402 $24,018

$167,517 $245,859 ======= ======= ======== ======== DILUTED NET

INCOME PER UNIT $0.62 $0.27 $1.80 $2.79 ======= ======= ========

======== DISTRIBUTION PER UNIT $0.62 $0.29 $1.77 $2.68 =======

======= ======== ======== (1) To reflect higher ownership in the

Operating Partnership resulting from application of the treasury

stock method to outstanding options. (2) For calculation of Diluted

Net Income per Unit. AllianceBernstein L.P. and AllianceBernstein

Holding L.P. UNITS OUTSTANDING AND WEIGHTED AVERAGE UNITS

OUTSTANDING - 2009 Weighted Average Units Weighted Average Units

Three Months Ended Twelve Months Ended Period

---------------------- ---------------------- End Units Basic

Diluted Basic Diluted ----- ----- ------- ------ -------

AllianceBernstein L.P. 274,745,592 268,554,450 270,165,289

266,299,938 266,543,601 AllianceBernstein Holding L.P 101,351,749

95,160,607 96,771,446 92,906,095 93,149,758 AllianceBernstein L.P.

ASSETS UNDER MANAGEMENT | December 31, 2009 ($ billions) Ending and

Average Three Month Period Twelve Month Period --------------------

------------------- 12/31/09 12/31/08 12/31/09 12/31/08 --------

-------- --------- -------- Ending Assets Under Management $495.5

$462.0 $495.5 $462.0 Average Assets Under Management $494.0 $496.7

$458.6 $665.1 Three-Month Changes By Distribution Channel

Institutions Retail Private Client Total ------------ ------

-------------- ----- Beginning of Period $307.5 $116.7 $73.6 $497.8

Sales/New accounts 4.3 7.9 2.4 14.6 Redemptions/Terminations (12.5)

(6.0) (1.7) (20.2) Cash flow (7.4) (2.0) (1.2) (10.6) Unreinvested

dividends - (0.3) (0.3) (0.6) ------ ------ ------ ------ Net Flows

(15.6) (0.4) (0.8) (16.8) Investment Performance 8.1 4.4 2.0 14.5

------ ------ ------ ------ End of Period $300.0 $120.7 $74.8

$495.5 ====== ====== ====== ====== Three-Month Changes By

Investment Service Value Growth Fixed Income (1) Other(1)(2) Total

------ ------- --------------- ----------- ----- Beginning of

Period $175.7 $93.3 $181.6 $47.2 $497.8 Sales/New accounts 2.7 1.7

7.1 3.1 14.6 Redemptions/ Terminations (10.5) (5.2) (4.4) (0.1)

(20.2) Cash flow (2.9) (1.3) (0.9) (5.5) (10.6) Unreinvested

dividends (0.1) (0.1) (0.4) - (0.6) ---- ---- ---- ---- ---- Net

Flows (10.8) (4.9) 1.4 (2.5) (16.8) Investment Performance 6.3 5.7

1.3 1.2 14.5 --- --- --- --- ---- End of Period(3) $171.2 $94.1

$184.3 $45.9 $495.5 ====== ===== ====== ===== ====== (1) Certain

client assets were reclassified among investment services to more

accurately reflect how these assets are managed by our firm. (2)

Includes index, structured, asset allocation services and other

non- actively managed AUM. (3) Approximately $90 billion in Blend

Strategies AUM are reported in their respective services. By Client

Domicile Institutions Retail Private Client Total ------------

------ -------------- ----- U.S. Clients $159.2 $86.1 $72.7 $318.0

Non-U.S. Clients 140.8 34.6 2.1 177.5 ----- ----- ----- ----- Total

$300.0 $120.7 $74.8 $495.5 ====== ====== ===== ======

AllianceBernstein L.P. ASSETS UNDER MANAGEMENT | December 31, 2009

continued ($ billions) By Investment Service Institutions Retail

Private Client Total ------------ ------ -------------- -----

Equity: Value U.S. $19.0 $11.3 $14.1 $44.4 Global &

International 88.8 26.2 11.8 126.8 ---- ---- ---- ----- 107.8 37.5

25.9 171.2 ----- ---- ---- ----- Growth U.S. 18.1 9.6 10.4 38.1

Global & International 34.8 14.3 6.9 56.0 ---- ---- --- ----

52.9 23.9 17.3 94.1 ---- ---- ---- ---- 160.7 61.4 43.2 265.3 -----

---- ---- ----- Fixed Income:(1) U.S. 71.8 9.6 30.9 112.3 Global

& International 41.1 30.3 0.6 72.0 ---- ---- --- ---- 112.9

39.9 31.5 184.3 ----- ---- ---- ----- Other:(1) (2) U.S. 9.7 16.4 -

26.1 Global & International 16.7 3.0 0.1 19.8 ---- --- --- ----

26.4 19.4 0.1 45.9 ---- ---- --- ---- Total: U.S. 118.6 46.9 55.4

220.9 Global & International 181.4 73.8 19.4 274.6 ----- ----

---- ----- Total(3) $300.0 $120.7 $74.8 $495.5 ====== ====== =====

====== (1) Certain client assets were reclassified among investment

services to more accurately reflect how these assets are managed by

our firm. (2) Includes index, structured, asset allocation services

and other non-actively managed AUM. (3) Approximately $90 billion

in Blend Strategies AUM are reported in their respective services.

DATASOURCE: AllianceBernstein CONTACT: Philip Talamo, Investor

Relations, +1-212-969-2383, , or John Meyers, Media,

+1-212-969-2301, Web Site: http://www.alliancebernstein.com/

Copyright

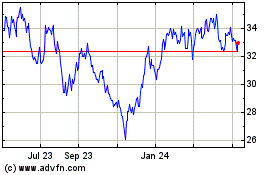

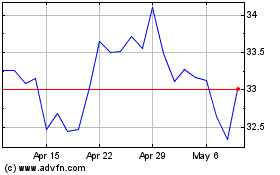

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From May 2024 to Jun 2024

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From Jun 2023 to Jun 2024