Smaller Investment Banks Jump Into Equity Capital Markets

January 11 2010 - 2:42PM

Dow Jones News

Boutique and regional firms are hoping 2010 will be the year of

equities. That's why some midsized advisory and investment

management firms, such as Evercore Partners Inc. (EVR) and Sanford

C. Bernstein, are expanding into the lucrative, yet competitive,

business of equity capital markets.

"Capital markets is a popular business to start today," said

George Ball, chairman of Sanders Morris Harris Group, which does

have a capital markets arm.

Firms are attracted to the capital markets business, which can

include research and handling sales and trading among other

activities, because it generates high revenue and it offers

one-stop shopping to corporate clients. Moreover, the investment

banking landscape has been shaken--with the collapse of Lehman

Brothers, and the acquisitions of Bear Stearns and Merrill Lynch by

J.P. Morgan Chase & Co. (JPM) and Bank of America Corp. (BAC),

respectively. And now, the industry is forecasting a big pickup in

equity capital markets activity.

However, the expansion isn't without risks. The business is

competitive, and bulge bracket firms, such as Goldman Sachs Group

Inc. (GS) and JPMorgan, have a strong hold on the underwriting

business that boutiques will have to break through.

When a firm only advises companies on raising capital, it ends

up passing on a large percentage of underwriting fees to other

banks. "M&A firms have long been uncomfortable watching their

clients take capital-raising transactions to another firm," David

Trone, analyst at Macquarie Securities, wrote in a note last

month.

In 2009, as equity capital markets performed poorly, many banks

churned profits in fixed income. Now, analysts expect profits from

fixed income trading to wane. Citigroup analyst Keith Horowitz

wrote in a note last week that fixed income trading volume will

fall 15%-20% this year.

By contrast, this year merger and acquisition activity, equity

underwriting and equities trading will benefit from the rebound in

the global equity markets and pent-up demand, Trone wrote in a note

Friday.

The financial crisis left buy-side clients skittish about their

relationships with large Wall Street investment banks. Many

institutional investors are now willing to form partnerships with

smaller firms and boutiques in order to diversify risk and have

trading capabilities with a number of firms.

"Some traditional relationships have been disrupted by the

crisis and some well known firms have an opportunity to expand into

the market," said Bob Gach, global managing director in Accenture

Plc's (ACN) capital markets practice.

Additionally, now is the time for firms to hire bankers at a

lower cost than years prior, as Wall Street laid off many

high-quality professionals. Some bankers are still worried about

potential regulatory restrictions on compensation at the large Wall

Street banks.

Evercore plans an aggressive push in the area with an expected

launch of the unit in the first half of this year. The boutique has

attracted experienced bankers to start the business including Jim

Birle, who spent 20 years at Merrill Lynch in capital markets. He

will advise Evercore's clients on strategic capital markets issues.

Bart McDade, former global head of equities at Lehman Brothers, has

come onboard as an investor in the business, which will be

majority-owned by Evercore. He will also serve as an adviser to the

new equities business and help recruit talent.

Sanford C. Bernstein, the brokerage unit of AllianceBernstein

Holding LP (AB), is re-entering the capital markets business after

a seven-year break. It brought on board Tom Morrison, who recently

was a managing director in equity capital markets at Bank of

America, to head the effort.

However, challenges lie ahead. David Weild, founder of Capital

Markets Advisory Partners, said "capital markets is a tough

business to get started in as margins are razor thin, and you can

really kill yourself if you don't do it properly."

Ball of Sanders Morris said, "investment banks tend to have a

lemming instinct to them, so a number of other boutiques will

likely be tempted by the waters."

-By Jessica Papini, Dow Jones Newswires; 212-416-2172;

jessica.papini@dowjones.com

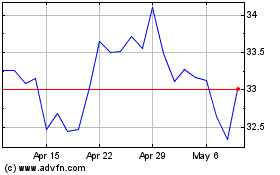

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From May 2024 to Jun 2024

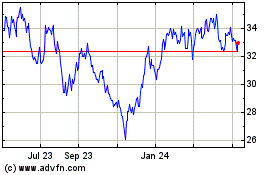

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From Jun 2023 to Jun 2024