UPDATE: CME Signs 8 Banks To Credit Derivatives Clearing Push

December 03 2009 - 1:12PM

Dow Jones News

CME Group Inc. (CME) announced Thursday that its long-delayed

credit derivatives clearing effort would officially launch Dec. 15,

with the support of eight dealer banks as founding members in the

effort.

The Chicago-based derivatives exchange operator said that it had

signed agreements with Barclays Capital, Citigroup Inc. (C), Credit

Suisse, Deutsche Bank AG (DB), Goldman Sachs Group Inc. (GS), J.P.

Morgan Chase & Co. (JPM), Morgan Stanley (MS) and UBS AG (UBS)

to support the initiative.

In a news release, CME said that Bank of America Merrill Lynch,

Nomura Group, and Royal Bank of Scotland (RBS) will also become

clearing member firms in the credit default swaps service.

CME joins rivals IntercontinentalExchange Inc. (ICE) and Deutche

Boerse AG's (DB1.XE) Eurex unit, which began clearing credit

derivatives transactions earlier this year.

Clearing, the process in which a central counterparty stands as

the seller to every buyer and the buyer to every seller, has been

identified by regulators and lawmakers as one way to reduce

systemic risk in the over-the-counter derivatives market, which has

taken heat for exacerbating the global financial crisis.

In Washington, proposals are being considered that would mandate

clearing of over-the-counter derivatives trades, though dealer

banks and other participants have already moved to utilize existing

clearinghouses for swaps.

Atlanta-based ICE, which announced its own partnership with

dealer banks in March, has taken the early lead, clearing about $4

trillion in CDS trades since launching its service.

While dealer banks make up the lion's share of the market, CME,

which is also angling to clear interest rate swaps and

over-the-counter foreign exchange transactions, has sought to focus

its credit derivatives effort on buy-side participants like hedge

funds and financial institutions.

In September, the exchange announced agreements with

AllianceBernstein Holding LP (AB), BlackRock Inc. (BLK),

BlueMountain Capital Management, D. E. Shaw & Co. and Allianz

SE's (AZ) Pimco, in addition to Chicago-based Citadel Investment

Group.

CME, the world's biggest futures exchange by volume, has been

planning its entry into the credit derivatives clearing business

for more than a year.

The effort has seen multiple delays as regulators debated how

the swaps market would be overseen and banks balked at a trading

platform developed between CME and Citadel.

In an effort to gain dealer support as rival clearing providers

got a head start, CME in September shelved the trading platform in

favor of clearing swaps business as it's currently done, with most

deals negotiated privately between parties.

CME's credit derivatives clearing service will provide immediate

processing of CDS trades, according to Chief Executive Craig

Donohue, and will incorporate industry practices set forth by the

International Swaps and Derivatives Association.

The CME service will clear trades in the CDX and iTraxx indexes,

as well as single-name constituents of those indexes and "select

liquid single names," according to the exchange operator.

-By Jacob Bunge, Dow Jones Newswires; (312) 750 4117;

jacob.bunge@dowjones.com

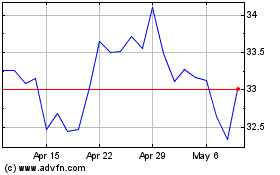

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From May 2024 to Jun 2024

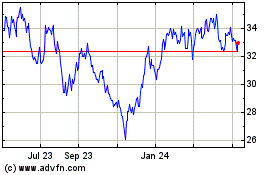

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From Jun 2023 to Jun 2024