AG Mortgage Investment Trust, Inc. ("MITT," "we," the "Company"

or "our") (NYSE: MITT) today reported financial results for the

quarter-ended March 31, 2020. AG Mortgage Investment Trust, Inc. is

a hybrid mortgage REIT that opportunistically invests in and

manages a diversified risk-adjusted portfolio of Agency RMBS and

Credit Investments, which include Residential Investments and

Commercial Investments.

FIRST QUARTER 2020 FINANCIAL SNAPSHOT

- $(14.98) of Net Income/(Loss) per diluted common share(1)

- $2.63 Book Value per share(1) as of March 31, 2020 versus

$17.61 as of December 31, 2019

- $1.6 billion Investment Portfolio with a 3.3x Economic Leverage

Ratio as of March 31, 2020 as compared to the $4.4 billion and

4.1x, respectively, as of December 31, 2019(2)(3)(4)

- $1.2 billion of financing arrangements as of March 31, 2020(a)

as compared to the $3.5 billion as of December 31, 2019(a)

- Duration gap was approximately 2.63 years as of March 31,

2020(5)

- We are not disclosing Core Earnings, a non-GAAP financial

measure, for the first quarter of 2020, as we determined that this

measure, as we have historically calculated it, would not

appropriately capture the materially negative economic impact of

the COVID-19 pandemic on our business, liquidity, results of

operations, financial condition, and ability to make distributions

to our stockholders. As financial markets stabilize, we will

evaluate whether core earnings or other non-GAAP financial measures

would help both management and investors evaluate our operating

performance for future periods.

(a) Financing arrangements are shown gross of $44.3 million and

$11.6 million of cash posted as collateral to our financing

counterparties at March 31, 2020 and December 31, 2019,

respectively, and do not include securitized debt of $197.2 million

and $224.3 million at March 31, 2020 and December 31, 2019,

respectively.

IMPACT OF COVID-19 PANDEMIC

- Beginning in mid-March, the global pandemic associated with

COVID-19 and related economic conditions caused financial and

mortgage-related asset markets to come under extreme duress,

resulting in credit spread widening, a sharp decrease in interest

rates and unprecedented illiquidity in repurchase agreement

financing and MBS markets. The illiquidity was exacerbated by

inadequate demand for MBS among primary dealers due to balance

sheet constraints.

- These events, in turn, resulted in falling prices of our assets

and increased margin calls from our repurchase agreement

counterparties. In order to satisfy the margin calls, the Company

sold a significant portion of its investments resulting in a

material adverse impact on book value, earnings and financial

position.

- The change in book value from December 31, 2019 to March 31,

2020 is comprised of:

- Realized and unrealized losses of $(2.91) per share(1) on our

Agency portfolio

- Realized and unrealized losses of $(8.15) per share(1) on our

Residential portfolio

- Realized and unrealized losses of $(4.34) per share(1) on our

Commercial portfolio

- Other income of $0.42 per share(1)

- Book Value per share(1) as of April 30, 2020 was estimated to

be in the range of $1.80 to $1.90

- In an effort to manage the Company's portfolio through this

unprecedented turmoil in the financial markets and improve

liquidity, the Company executed the following measures:

- In March of 2020, we sold our entire 30 year fixed rate Agency

MBS Portfolio

- In March of 2020, unwound entire interest rate swap

portfolio

- Since March 23, 2020, sold residential and commercial mortgage

assets generating proceeds of approximately $1 billion, comprised

of approximately $725 million of residential investments, $250

million of commercial investments and $45 million of Agency MBS

collateralized mortgage obligations

- Based on current circumstances it is our intention to suspend

quarterly dividends on common and preferred stock for the

foreseeable future in order to conserve capital and improve our

liquidity position

- Manager made subordinated loans totaling $20 million to the

Company

- Manager deferred payment of management fees and expense

reimbursements through September 30, 2020

- Entered into multiple forbearance agreements with financing

counterparties beginning on April 10th; exited forbearance on June

10th having satisfied all outstanding margin calls

- Through asset sales, reduced exposure to various counterparties

and brought the number of counterparties with debt outstanding down

from 30 as of December 31, 2019 to 18 as of March 31, 2020 and 6 as

of May 31, 2020

- As of May 31, 2020:

- Investment portfolio of approximately $1 billion(a)(b),

consisting of 78% residential investments(c) and 22% commercial

investments

- Debt obligations of approximately $710 million(d)(e), net of

approximately $25 million of cash posted as collateral to its

financing counterparties, of which approximately $280 million(e)

are recourse repurchase obligations, approximately $410 million(e)

are non-recourse debt obligations and approximately $20 million are

subordinated debt obligations

- Cash and cash equivalents of approximately $45 million

(a) Based on our preliminary analysis, $1 billion investment

portfolio includes approximately $340 million of assets held

through investments in debt and equity of affiliates, consisting of

approximately 99% residential investments and less than 1% agency

derivatives. (b) Investment portfolio does not include the

Company's $20 million net investment in Arc Home. (c) For purposes

of the presentation of the May 31, 2020 portfolio, a 1% interest in

agency derivatives has been shown together with residential

investments. (d) Debt obligations include all financing

arrangements, securitized debt and subordinated debt. (e) $280

million of recourse repurchase obligations includes approximately

$40 million of recourse repurchase obligations held through

investments in debt and equity of affiliates, net of cash posted as

collateral. $410 million of non-recourse debt obligations includes

approximately $220 million of non-recourse debt obligations held

through investments in debt and equity of affiliates, net of cash

posted as collateral.

MANAGEMENT REMARKS

David Roberts, Chief Executive Officer, commented, "The initial

stages of the COVID crisis in March disrupted the markets in every

aspect of MITT’s portfolio. As a result of this disruption, MITT

began to receive a rising tide of margin calls. We met the calls

for as long as we prudently could, using a portion of our cash

reserves and selling those assets we believed were the least-worst

to sell, most notably our portfolio of Agency RMBS. At a certain

point, however, the margin calls became overwhelming. Accordingly,

we announced that we would not meet margin calls and would seek a

forbearance agreement from our repo lenders. As detailed in our

many 8-K filings, we negotiated three forbearance agreements. We

are pleased to announce that we exited forbearance two days ago and

reinstated bilateral agreements with all our current lenders."

"Immediately prior to and during the two month period of our

forbearance, we sold the majority of our assets, paid off the

related financing, and consolidated our remaining repo arrangements

down to six lenders," Roberts added. "In downsizing our portfolio,

mostly during a time of severe dislocation in our markets, MITT

took substantial losses. The Company began the year with a common

equity book value of $17.61 per share. As we reported in our 8-K

filed on May 7th, we estimated that our common book value per share

as of April 30th was in a range from $1.80-$1.90 per share, a

decline of almost 90%. The majority of those losses have been

realized through sales. Based on our preliminary internal analysis,

we estimate that book value as of May 31 was in a range not

substantially higher than it was at April 30. Going forward, we

anticipate continuing to raise liquidity and reducing debt through

selected asset sales. Based on current conditions for our company,

we do not anticipate paying dividends on either our common or

preferred stock for the foreseeable future."

KEY STATISTICS

($ in millions)

March 31, 2020

Investment portfolio(2) (3)

$1,621.1

Financing arrangements(3)

1,231.2

Total Economic Leverage(4)

1,175.5

Stockholders’ equity

358.7

GAAP Leverage Ratio

3.1x

Economic Leverage Ratio(4)

3.3x

Book value, per share(1)

$2.63

INVESTMENT PORTFOLIO

The following summarizes the Company’s investment portfolio as

of March 31, 2020(3)(4):

($ in millions)

Fair Value

Percent of Fair Value

Allocated Equity(7)

Percent of Equity

Agency RMBS

$37.6

2.3%

$18.0

5.0%

Residential Investments

1,285.0

79.3%

244.9

68.3%

Commercial Investments

298.5

18.4%

95.8

26.7%

Total

$1,621.1

100.0%

$358.7

100.0%

Note: The chart above includes fair value of $0.5 million of

Agency RMBS, $331.1 million of Residential Investments and $10.8

million of Commercial Investments that are included in the

“Investments in debt and equity of affiliates” line item on our

consolidated balance sheet.

DIVIDEND

On February 14, 2020, the Company's board of directors declared

first quarter dividends of $0.51563 per share on its 8.25% Series A

Cumulative Redeemable Preferred Stock, $0.50 per share on its 8.00%

Series B Cumulative Redeemable Preferred Stock and $0.50 per share

on its 8.000% Series C Fixed-to-Floating Rate Cumulative Redeemable

Preferred Stock. The dividends were paid on March 17, 2020 to

stockholders of record as of February 28, 2020.

On March 27, 2020, the Company announced that its Board of

Directors approved a suspension of the Company's quarterly

dividends on its common stock, 8.25% Series A Cumulative Redeemable

Preferred Stock, 8.00% Series B Cumulative Redeemable Preferred

Stock, and 8.000% Series C Fixed-to-Floating Rate Cumulative

Redeemable Preferred Stock, beginning with the common dividends

that normally would have been declared in March 2020 and the

preferred dividend that would have been declared in May 2020, in

order to conserve capital and preserve liquidity. As noted above,

based on current circumstances it is our intention to suspend

quarterly dividends on common and preferred stock for the

foreseeable future.

STOCKHOLDER CALL

The Company invites stockholders, prospective stockholders and

analysts to participate in MITT’s first quarter earnings conference

call on June 12, 2020 at 8:30 am Eastern Time. The stockholder call

can be accessed by dialing (888) 424-8151 (U.S. domestic) or (847)

585-4422 (international). Please enter code number 9204165.

A presentation will accompany the conference call and will be

available on the Company’s website at www.agmit.com. Select the Q1

2020 Earnings Presentation link to download the presentation in

advance of the stockholder call.

For those unable to listen to the live call, an audio replay

will be available promptly following the conclusion of the call on

June 12, 2020, through July 12, 2020. To access the replay, please

go to

https://onlinexperiences.com/Launch/QReg/ShowUUID=C5BBC201-5E03-4521-B0D8-E946051AC000&LangLocaleID=1033.

The replay passcode is 49770105.

For further information or questions, please e-mail

ir@agmit.com.

ABOUT AG MORTGAGE INVESTMENT TRUST, INC.

AG Mortgage Investment Trust, Inc. is a hybrid mortgage REIT

that opportunistically invests in and manages a diversified

risk-adjusted portfolio of Agency RMBS and Credit Investments,

which include Residential Investments and Commercial Investments.

AG Mortgage Investment Trust, Inc. is externally managed and

advised by AG REIT Management, LLC, a subsidiary of Angelo, Gordon

& Co., L.P., an SEC-registered investment adviser that

specializes in alternative investment activities.

Additional information can be found on the Company’s website at

www.agmit.com.

ABOUT ANGELO GORDON

Angelo, Gordon & Co., L.P. is a privately held limited

partnership founded in November 1988. The firm manages

approximately $35 billion as of March 31, 2020 with a primary focus

on credit and real estate strategies. Angelo Gordon has over 550

employees, including more than 200 investment professionals, and is

headquartered in New York, with offices in the U.S., Europe and

Asia. For more information, visit www.angelogordon.com.

FORWARD LOOKING STATEMENTS

This press release includes "forward-looking statements" within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995 related to

dividends, book value, our investments, our business and investment

strategy, investment returns, return on equity, liquidity,

financing, taxes, our assets, our interest rate sensitivity, and

our views on certain macroeconomic trends and conditions, among

others. Forward-looking statements are based on estimates,

projections, beliefs and assumptions of management of the Company

at the time of such statements and are not guarantees of future

performance. Forward-looking statements involve risks and

uncertainties in predicting future results and conditions. Actual

results could differ materially from those projected in these

forward-looking statements due to a variety of factors, including,

without limitation, changes in interest rates, changes in the yield

curve, changes in prepayment rates on the loans we own that

underlie our investment securities, increases in default rates or

delinquencies and/or decreased recovery rates on our assets, our

ability to make distributions to our stockholders in the future,

our ability to maintain our qualification as a REIT for federal tax

purposes, our ability to maintain our exemption from registration

under the Investment Company Act of 1940, as amended, the

availability and terms of financing, changes in the fair value of

our assets, including negative changes resulting in margin calls

relating to the financing of our assets, changes in general

economic conditions, in our industry and in the finance and real

estate markets, including the impact on the value of our assets,

conditions in the market for Agency RMBS, Non-Agency RMBS and CMBS

securities, Excess MSRs and loans, conditions in the real estate

market, legislative and regulatory actions by the U.S. Department

of the Treasury, the Federal Reserve and other agencies and

instrumentalities in response to the economic effects of the

COVID-19 pandemic that could adversely affect the business of the

Company, the forbearance program included in the Coronavirus Aid,

Relief, and Economic Security Act (the "CARES Act") and the ongoing

spread and economic effects of the novel coronavirus (COVID-19).

Additional information concerning these and other risk factors are

contained in the Company's filings with the Securities and Exchange

Commission ("SEC"), including its most recent Annual Report on Form

10-K and subsequent filings, including its quarterly report on Form

10-Q for the three months ended March 31, 2020. Copies are

available free of charge on the SEC's website, http://www.sec.gov/.

All information in this press release is as of June 12, 2020. The

Company undertakes no duty to update any forward-looking statements

to reflect any change in its expectations or any change in events,

conditions or circumstances on which any such statement is

based.

NON-GAAP FINANCIAL INFORMATION

In addition to the results presented in accordance with GAAP,

this press release includes certain non-GAAP financial results and

financial metrics derived therefrom, including investment

portfolio, economic leverage ratio, which are calculated by

including or excluding depreciation and amortization,

unconsolidated investments in affiliates, TBAs, and U.S.

Treasuries, or, with respect to our equity allocation calculation,

by allocating all non-investment portfolio related assets and

liabilities to our investment portfolio categories based on the

characteristics of such assets and liabilities, as described in the

footnotes to this press release. Our management team believes that

this non-GAAP financial information, when considered with our GAAP

financials, provides supplemental information useful for investors

as it enables them to evaluate our current core performance using

the same metrics that management uses to operate the business. Our

presentation of non-GAAP financial information may not be

comparable to similarly-titled measures of other companies, who may

use different calculations. This non-GAAP financial information

should not be considered a substitute for, or superior to, the

financial measures calculated in accordance with GAAP. Our GAAP

financial results and the reconciliations from these results should

be carefully evaluated.

AG Mortgage Investment Trust,

Inc. and Subsidiaries Consolidated Balance Sheets (Unaudited) (in

thousands, except per share data)

March 31, 2020

December 31, 2019

Assets

Real estate securities, at fair value:

Agency - $23,132 and $2,234,921 pledged as

collateral, respectively

$

23,132

$

2,315,439

Non-Agency - $165,605 and $682,828 pledged

as collateral, respectively

186,797

717,470

CMBS - $126,042 and $413,922 pledged as

collateral, respectively

129,626

416,923

Residential mortgage loans, at fair value

- $140,633 and $171,224 pledged as collateral, respectively

766,960

417,785

Commercial loans, at fair value - $3,720

and $4,674 pledged as collateral, respectively

158,051

158,686

Investments in debt and equity of

affiliates

119,212

156,311

Excess mortgage servicing rights, at fair

value

14,066

17,775

Cash and cash equivalents

92,299

81,692

Restricted cash

41,400

43,677

Other assets - $12,658 and $0 pledged as

collateral, respectively

27,093

21,905

Assets held for sale - Single-family

rental properties, net

—

154

Total Assets

$

1,558,636

$

4,347,817

Liabilities

Financing arrangements

$

969,857

$

3,233,468

Securitized debt, at fair value

197,182

224,348

Dividend payable

—

14,734

Other liabilities

32,266

24,675

Liabilities held for sale - Single-family

rental properties, net

666

1,546

Total Liabilities

1,199,971

3,498,771

Commitments and Contingencies

Stockholders’ Equity

Preferred stock - $0.01 par value; 50,000

shares authorized:

8.25% Series A Cumulative Redeemable

Preferred Stock, 2,070 shares issued and outstanding ($51,750

aggregate liquidation preference)

49,921

49,921

8.00% Series B Cumulative Redeemable

Preferred Stock, 4,600 shares issued and outstanding ($115,000

aggregate liquidation preference)

111,293

111,293

8.000% Series C Fixed-to-Floating Rate

Cumulative Redeemable Preferred Stock, 4,600 shares issued and

outstanding ($115,000 aggregate liquidation preference)

111,243

111,243

Common stock, par value $0.01 per share;

450,000 shares of common stock authorized and 32,749 and 32,742

shares issued and outstanding at March 31, 2020 and December 31,

2019, respectively

327

327

Additional paid-in capital

662,486

662,183

Retained earnings/(deficit)

(576,605

)

(85,921

)

Total Stockholders’ Equity

358,665

849,046

Total Liabilities & Stockholders’

Equity

$

1,558,636

$

4,347,817

AG Mortgage Investment Trust,

Inc. and Subsidiaries Consolidated Statements of Operations

(Unaudited) (in thousands, except per share data)

Three Months Ended

March 31, 2020

March 31, 2019

Net Interest Income

Interest income

$

40,268

$

41,490

Interest expense

19,971

22,094

Total Net Interest Income

20,297

19,396

Other Income/(Loss)

Net realized gain/(loss)

(151,143

)

(20,583

)

Net interest component of interest rate

swaps

923

1,781

Unrealized gain/(loss) on real estate

securities and loans, net

(313,897

)

46,753

Unrealized gain/(loss) on derivative and

other instruments, net

5,686

(10,086

)

Foreign currency gain/(loss), net

1,649

—

Other income

3

414

Total Other Income/(Loss)

(456,779

)

18,279

Expenses

Management fee to affiliate

2,149

2,345

Other operating expenses

2,342

3,781

Equity based compensation to affiliate

88

126

Excise tax

(815

)

92

Servicing fees

579

371

Total Expenses

4,343

6,715

Income/(loss) before equity in

earnings/(loss) from affiliates

(440,825

)

30,960

Equity in earnings/(loss) from

affiliates

(44,192

)

(771

)

Net Income/(Loss) from Continuing

Operations

(485,017

)

30,189

Net Income/(Loss) from Discontinued

Operations

—

(1,034

)

Net Income/(Loss)

(485,017

)

29,155

Dividends on preferred stock

5,667

3,367

Net Income/(Loss) Available to Common

Stockholders

$

(490,684

)

$

25,788

Earnings/(Loss) Per Share -

Basic

Continuing Operations

$

(14.98

)

$

0.87

Discontinued Operations

—

(0.03

)

Total Earnings/(Loss) Per Share of

Common Stock

$

(14.98

)

$

0.84

Earnings/(Loss) Per Share -

Diluted

Continuing Operations

$

(14.98

)

$

0.87

Discontinued Operations

—

(0.03

)

Total Earnings/(Loss) Per Share of

Common Stock

$

(14.98

)

$

0.84

Weighted Average Number of Shares of

Common Stock Outstanding

Basic

32,749

30,551

Diluted

32,749

30,581

Footnotes

(1) Diluted per share figures are calculated using weighted

average outstanding shares in accordance with GAAP. Per share

figures are calculated using a denominator of all outstanding

common shares including vested shares granted to our Manager and

our independent directors under our equity incentive plans as of

quarter-end. Book value is calculated using stockholders’ equity

less net proceeds of our 8.25% Series A Cumulative Redeemable

Preferred Stock ($49.9 million), 8.00% Series B Cumulative

Redeemable Preferred Stock ($111.3 million), and 8.000% Series C

Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

($111.2 million) as the numerator. The liquidation preference for

the Series A, Series B and Series C Preferred Stock is $51.8

million, $115 million and $115 million, respectively. Book value

includes the current quarter dividend, if any. (2) The investment

portfolio at period end is calculated by summing the net carrying

value of our Agency RMBS, any long positions in TBAs, Residential

Investments, Commercial Investments, and where applicable, ABS

Investments, including securities and mortgage loans owned through

investments in affiliates, exclusive of AG Arc LLC. Our Agency

RMBS, Residential Investments, Commercial Investments, and where

applicable, ABS Investments, are held at fair value. Our Credit

Investments refer to our Residential Investments, Commercial

Investments, and where applicable, ABS Investments. Refer to

footnote (4) for more information on the GAAP accounting for

certain items included in our investment portfolio. See footnote

(6) for further details on AG Arc LLC. (3) Generally, when we

purchase an investment and finance it, the investment is included

in our assets and the financing is reflected in our liabilities on

our consolidated balance sheet as either "Financing arrangements"

or "Securitized debt, at fair value." Throughout this press release

where we disclose our investment portfolio and the related

financing, we have presented this information inclusive of (i)

securities and mortgage loans owned through investments in

affiliates that are accounted for under GAAP using the equity

method and (ii) long positions in TBAs, which are accounted for as

derivatives under GAAP. The related financing includes financing of

$261.4 million and $257.4 million through investments in debt and

equity of affiliates as of March 31, 2020 and December 31, 2019,

respectively. This press release excludes investments through AG

Arc LLC unless otherwise noted. This presentation of our investment

portfolio is consistent with how our management evaluates the

business, and we believe this presentation, when considered with

the GAAP presentation, provides supplemental information useful for

investors in evaluating our investment portfolio and financial

condition. See footnote (6) for further details on AG Arc LLC. (4)

The Economic Leverage Ratio is calculated by dividing total

Economic Leverage, including any net TBA position, by our GAAP

stockholders’ equity at quarter-end. Total Economic Leverage at

quarter-end includes financing arrangements inclusive of financing

arrangements through affiliated entities, exclusive of any

financing utilized through AG Arc LLC, plus the payable on all

unsettled buys less the financing on all unsettled sells and any

net TBA position (at cost). Total Economic Leverage excludes any

fully non-recourse financing arrangements, and any financing

arrangements and unsettled trades on U.S. Treasuries. Non-recourse

financing arrangements include securitized debt of $197.2 million

and $224.3 million as of March 31, 2020 and December 31, 2019,

respectively. Our obligation to repay our non-recourse financing

arrangements is limited to the value of the pledged collateral

thereunder and does not create a general claim against us as an

entity. (5) The Company estimates duration based on third-party

models. Different models and methodologies can produce different

effective duration estimates for the same securities. Duration does

not include our equity interest in AG Arc LLC. (6) The Company

invests in Arc Home LLC through AG Arc LLC, one of its indirect

subsidiaries. (7) The Company allocates its equity by investment

using the fair value of its investment portfolio, less any

associated leverage, inclusive of any long TBA position (at cost).

The Company allocates all non-investment portfolio related assets

and liabilities to its investment portfolio categories based on the

characteristics of such assets and liabilities in order to sum to

stockholders' equity per the consolidated balance sheets. The

Company's equity allocation method is a non-GAAP methodology and

may not be comparable to the similarly titled measure or concepts

of other companies, who may use different calculations and

allocation methodologies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200612005113/en/

AG Mortgage Investment Trust, Inc. Investor Relations (212)

692-2110 ir@agmit.com

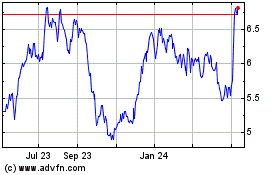

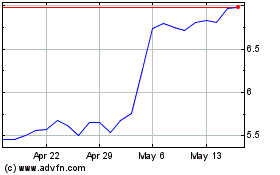

AG Mortgage Investment (NYSE:MITT)

Historical Stock Chart

From Oct 2024 to Nov 2024

AG Mortgage Investment (NYSE:MITT)

Historical Stock Chart

From Nov 2023 to Nov 2024