UPDATE: Aflac Sells $750 Million 2-Part Deal In US Credit Markets - Source

February 08 2012 - 6:22PM

Dow Jones News

Aflac Inc. (AFL) completed a $750 million sale of bonds in a

two-part offering to the U.S. credit markets Wednesday, according

to a person familiar with the matter.

The deal featured $400 million of 2.65% coupon, five-year notes

priced to yield 2.669%, or 185 basis points over Treasurys, and

$350 million of 4% coupon, 10-year bonds priced to yield 4.022%, or

205 basis points over Treasurys.

The bonds are expected to be rated A3 by Moody's Investors

Service and A-minus by Standard & Poor's and Fitch Ratings.

They are registered with the Securities and Exchange

Commission.

The Columbus, Ga., health and life insurance holding company

will use the proceeds to redeem $347 million of outstanding Samurai

notes--yen-denominated notes--maturing in June, and for general

corporate purposes.

Goldman Sachs Group and J.P. Morgan are leading the sale.

-By Patrick McGee, Dow Jones Newswires; 212-416-2382;

patrick.mcgee@dowjones.com

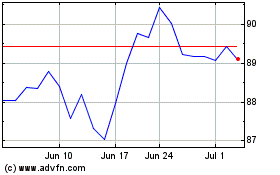

AFLAC (NYSE:AFL)

Historical Stock Chart

From Oct 2024 to Nov 2024

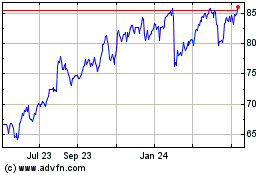

AFLAC (NYSE:AFL)

Historical Stock Chart

From Nov 2023 to Nov 2024