Acadia Realty Trust Announces Quarterly Dividend and Annual Meeting Date

March 04 2010 - 4:34PM

Business Wire

Acadia Realty Trust (NYSE:AKR), today announced the Company’s

dividend for the first quarter ending March 31, 2010.

Acadia’s Board of Trustees has declared a cash dividend of $0.18

per Common Share payable on April 15, 2010 to holders of record as

of March 31, 2010.

The Company also announced details for its upcoming Annual

Shareholder Meeting. Acadia's Board of Trustees has set the meeting

date for Monday, May 10, 2010 at 10:00 AM EDT. The meeting will be

held at Acadia’s corporate office at 1311 Mamaroneck Avenue, Suite

260, White Plains, NY 10605. The record date for determination of

shareholders entitled to vote is March 31, 2010.

Acadia Realty Trust, a real estate investment trust (“REIT”)

headquartered in White Plains, NY, is a fully integrated,

self-managed and self-administered equity REIT focused primarily on

the ownership, acquisition, redevelopment and management of retail

and mixed-use properties including neighborhood and community

shopping centers located in urban and suburban markets in major

metropolitan areas.

Certain matters in this press release may constitute

forward-looking statements within the meaning of federal securities

law and as such may involve known and unknown risk, uncertainties

and other factors that may cause the actual results, performances

or achievements of Acadia to be materially different from any

future results, performances or achievements expressed or implied

by such forward-looking statements. These forward-looking

statements include statements regarding Acadia’s future financial

results and its ability to capitalize on potential opportunities

arising from the current economic turmoil. Factors that could cause

the Company’s forward-looking statements to differ from its future

results include, but are not limited to, those discussed under the

headings “Risk Factors” and "Management's Discussion and Analysis

of Financial Condition and Results of Operations" in the Company’s

most recent annual report on Form 10-K filed with the SEC on March

1, 2010 (“Form 10-K”) and other periodic reports filed with the

SEC, including risks related to: (i) the current global financial

crisis and its effect on retail tenants, including several recent

bankruptcies of major retailers; (ii) the Company’s reliance on

revenues derived from major tenants; (iii) the Company’s limited

control over joint venture investments; (iv) the Company’s

partnership structure; (v) real estate and the geographic

concentration of our properties; (vi) market interest rates; (vii)

leverage; (viii) liability for environmental matters;(ix) the

Company’s growth strategy; (x) the Company’s status as a REIT (xi)

uninsured losses and (xii) the loss of key executives. Copies of

the Form 10-K and the other periodic reports Acadia files with the

SEC are available on the Company’s website at www.acadiarealty.com.

Any forward-looking statements in this press release speak only as

of the date hereof. Acadia expressly disclaims any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in Acadia's expectations with regard thereto or change in events,

conditions or circumstances on which any such statement is

based.

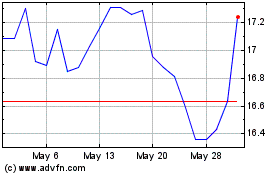

Acadia Realty (NYSE:AKR)

Historical Stock Chart

From Jun 2024 to Jul 2024

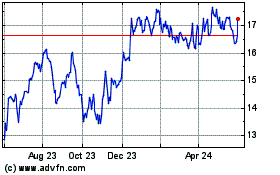

Acadia Realty (NYSE:AKR)

Historical Stock Chart

From Jul 2023 to Jul 2024