Acadia Realty Trust Hires David Robinov as Senior Vice President

December 05 2008 - 1:19PM

Business Wire

The Board of Trustees of Acadia Realty Trust (NYSE:AKR � �Acadia�

or the �Company�) today announced the hiring of David Robinov as

Senior Vice President, Investments, a new position focused on

sourcing acquisition, development and investment opportunities to

grow Acadia's broad retail platform. Mr. Robinov was formerly a

Managing Director of Eastdil Secured, the 41-year old real estate

investment bank that is a wholly owned subsidiary of Wells Fargo.

As a co-leader of Eastdil Secured's retail transaction team, Mr.

Robinov represented numerous private and institutional owners

during his 20-years at Eastdil and specialized in the acquisition,

disposition and recapitalization of major shopping centers and

other assets located primarily throughout the East Coast of the

United States. Prior to joining Eastdil, Mr. Robinov worked for

three years as a developer with Lazard Realty. Mr. Robinov holds a

B.A.S. in Civil Engineering from the University of Pennsylvania and

a B.S.E. in Real Estate Finance from its Wharton School. He is a

member of ICSC, and YMWREA, and sits on the Board of the Real

Estate Board of New York's Commercial Division, and also serves as

Co-Chair of the UJA-Federation's Sites and Sounds Committee.

�During his more than 20-year career in the real estate industry,

David has developed numerous relationships in the institutional

investment community and will add tremendous depth to our

investment team,� said Joel Braun, Executive Vice President and

Chief Investment Officer. Acadia Realty Trust, headquartered in

White Plains, NY, is a fully integrated, self-managed and

self-administered equity REIT focused primarily on the ownership,

acquisition, redevelopment and management of retail and mixed-use

properties including neighborhood and community shopping centers

located in urban and suburban markets in major metropolitan areas.

Certain matters in this press release may constitute

forward-looking statements within the meaning of the federal

securities laws and as such may involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performances or achievements of Acadia to be materially different

from any future results, performances or achievements expressed or

implied by such forward-looking statements. Factors that could

cause or contribute to such differences include, but are not

limited to, those discussed under the headings "Management's

Discussion and Analysis of Financial Condition and Results of

Operations" and �Risk Factors� in the Company�s most recent annual

report on Form 10-K filed with the SEC on February 29, 2008 (the

�Form 10-K�) and other periodic reports filed with the SEC,

including risks related to: (i) the Company�s reliance on revenues

derived from major tenants; (ii) the Company�s limited control over

joint venture investments; (iii) the Company�s partnership

structure; (iv) real estate and the geographic concentration of our

properties; (v) market interest rates; (vi) leverage; (vii)

liability for environmental matters;(viii) the Company�s growth

strategy; (ix) the Company�s status as a REIT (x) uninsured losses

and (xi) the loss of key executives. Copies of the Form 10-K and

the other periodic reports Acadia files with the SEC are available

on the Company�s website at www.acadiarealty.com. Any

forward-looking statements in this press release speak only as of

the date hereof. Acadia expressly disclaims any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in Acadia's expectations with regard thereto or change in events,

conditions or circumstances on which any such statement is based.

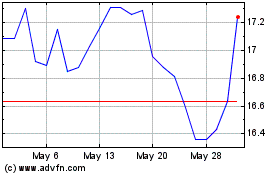

Acadia Realty (NYSE:AKR)

Historical Stock Chart

From May 2024 to Jun 2024

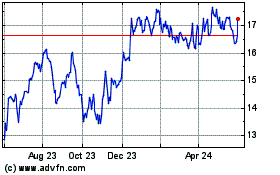

Acadia Realty (NYSE:AKR)

Historical Stock Chart

From Jun 2023 to Jun 2024