Fed Okays Zions' Capital Plan - Analyst Blog

March 15 2012 - 12:46PM

Zacks

Earlier this week, the Federal Reserve notified Zions

Bancorporation (ZION) that it has approved the

company’s capital plan, which was submitted in regard to the Fed's

2012 Capital Plan and Review (CapPR). This will help the company

repay its Troubled Asset Relief Program (TARP) dues soon.

Moreover, Zions will not be required to raise additional capital

for this.

TARP Repayment

Zions will entirely redeem its TARP preferred equity in 2012.

This redemption is expected to transpire in two installments of

$700 million each. The first installment will be paid after

receiving the approval of the U.S Treasury. The company is expected

to apply for this approval as early as next week.

However, the payment of the second installment is subject to

certain conditions. These conditions require the parent company to

have sufficient liquidity and no significant weakening in the

company's overall condition. Additionally, Zions’ subsidiary banks

need to return $500 million of capital to the parent company in

2012, after seeking the approval of the primary bank regulator.

The U.S. government had granted a $1.4 billion TARP loan to

Zions in November 2008 in the form of preferred stock warrants to

help it recover from the financial crisis. Over the last three

years, total dividends paid by the company on the TARP preferred

stock sums up to $270.4 million.

However, due to its moderately improving earnings after the

economic crisis, Zions was not getting permission to pay back the

bail-out money. But, during the last earnings conference call, the

company claimed to have ample liquidity to repay the TARP dues

without diluting its shares. This claim was authenticated by the

Fed’s approval.

Additionally, Zions also announced the issuance of $600 million

of senior debt, redemption of Temporary Liquidity Guarantee Program

(TLGP) debt of $255 million on its maturity in June and unchanged

quarterly dividend of 1 cent per share throughout 2012.

J.P. Morgan Securities LLC, a division of JPMorgan Chase

& Co. (JPM) acted as the financial advisor to Zions in

submitting its capital plan.

Story Behind CapPR

Comprehensive Capital Analysis and Review (CCAR) is an

assessment of the company’s financial position, which is undertaken

by the Fed to avoid the reoccurrence of financial crisis as

encountered in 2008. The Fed wants to ensure that the 19

participating banks have enough capital to survive economic and

financial downturn.

Additionally, as per the CapPR framework, banks with assets of

$50 billion or more, that were not included in the CCAR, were also

included in the stress test. These banks were put through bleakest

economic scenario to review their financial ability to confront

another recession. The hypothetical scenario presumed more than 13%

rise in unemployment rate, more than 50% plunge in the Dow Jones

Industrial Average and more than 21% fall in home prices.

Based on examination of several economic metrics, the Fed tested

the preparedness of these 11 additional banks.Further, the Fed

required the participating banks’ Tier 1 common equity to remain

above 5% to get approval for their capital plans. Using those

hypothetical conditions, Zions projected its Tier 1 common equity

ratio to be about 7.9%.

Impacts of the Stress Test

Meeting the stress test criteria signifies that Zions is well

positioned in terms of capital and can outlive another economic

downturn. Also, it is a relief for the shareholders that the

company will not be required to issue new equity for the repayment

of TARP.

In addition, after settling the TARP obligation, Zions will look

forward to deploy its capital through dividend hike and share

repurchase, which will further enhance investors’ confidence on the

stock.

Zions currently retains a Zacks #3 rank, which translates into a

short-term Hold rating.

JPMORGAN CHASE (JPM): Free Stock Analysis Report

ZIONS BANCORP (ZION): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

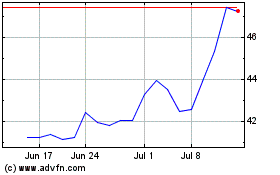

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Jun 2024 to Jul 2024

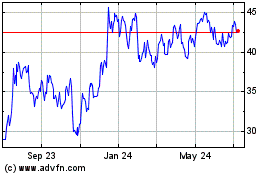

Zions Bancorporation NA (NASDAQ:ZION)

Historical Stock Chart

From Jul 2023 to Jul 2024