KKR to Buy BMC Software From Private-Equity Led Group -- Update

May 29 2018 - 8:31AM

Dow Jones News

By Allison Prang

KKR & Co. has agreed to buy BMC Software from an investor

group led by private-equity firms for an undisclosed amount.

KKR said Tuesday it is buying the Houston-based software company

from a group that includes Bain Capital Private Equity and Golden

Gate Capital along with Insight Venture Partners, hedge fund

Elliott Management Corp. and GIC.

BMC, founded in 1980, was taken private in September 2013 in a

roughly $7 billion deal. The company has more than 10,000 customers

and about 6,000 employees across the world.

The software company had been looking at combining with CA Inc.,

a software company based in New York, but those talks ended last

year, The Wall Street Journal had reported.

Before it went private, BMC had been fighting with activist

investor Elliot Management, which didn't want BMC to stay

independent.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

May 29, 2018 08:16 ET (12:16 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

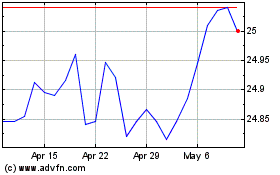

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From May 2024 to Jun 2024

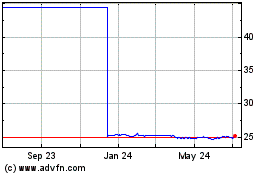

Xtrackers California Mun... (NASDAQ:CA)

Historical Stock Chart

From Jun 2023 to Jun 2024