Washington Federal, Inc. (Nasdaq: WAFD) (the "Company"), parent

company of Washington Federal, National Association, today

announced quarterly earnings of $51,670,000 or $0.59 per diluted

share for the quarter ended December 31, 2017 compared to

$41,246,000 or $0.46 per diluted share for the quarter ended

December 31, 2016, a $0.13 or 28% increase in fully diluted

earnings per share. Return on equity for the quarter ended

December 31, 2017 was 10.25% compared to 8.31% for the quarter

ended December 31, 2016. Return on assets for the quarter

ended December 31, 2017 was 1.35% compared to 1.11% for the

same quarter in the prior year.

During the quarter, the Company had two unusual events occur

that impacted our financial results. First, as a result of the new

tax legislation commonly known as the Tax Cuts and Jobs Act (the

“Act”), tax expense for the quarter was $9.0 million. Excluding the

effects of the Act, tax expense for the quarter would have been

$18.0 million, or higher by $9.0 million. Second, during the

quarter the Company made the decision to pursue termination of its

loss share agreements with the FDIC related to two acquisitions,

one in 2010 and one in 2012. Because of this decision, a charge of

$8.6 million was recorded in this quarter’s results. Additional

information on both of these items is included in the paragraphs

below.

President and Chief Executive Officer Brent J. Beardall

commented, “As a result of the changes in the tax law there are

several unusual items in this quarter's results. Looking beyond

those items, we are particularly pleased with the continued

improvement in our core banking operations. Excluding the FDIC

charge, this quarter produced a record $69.2 million of pre-tax

income. As we have previously announced, the tax law reduces the

advantage of credit unions and other non-tax paying competitors. It

also allows the Company to further boost investments in its people,

technology and communities while continuing to perform well for our

shareholders. Challenges remain as we make improvements to our

client facing systems and enhance our Bank Secrecy Act Program, but

we are excited about the momentum we have and future

opportunities.”

Total assets were $15.6 billion as of December 31, 2017

compared to $15.3 billion as of September 30, 2017. Asset

growth since September 30, 2017 resulted primarily from a $224

million increase in net loans receivable and a $119 million

increase in held-to-maturity securities.

Customer deposits increased by $167 million or 1.5% since

September 30, 2017 and totaled $11.0 billion as of

December 31, 2017. Transaction accounts increased by $121

million or 1.9% during that period, while time deposits increased

$45 million or 1.0%. The mix of customer deposits has continued to

shift over the last several years as the Company focuses on growing

transaction accounts to lessen sensitivity to rising interest rates

and reduce interest expense. As of December 31, 2017, 58.9% of

the Company’s deposits were in transaction accounts. Core deposits,

defined as all transaction accounts and time deposits less than

$250,000, totaled 94.0% of deposits at December 31, 2017.

Borrowings from the Federal Home Loan Bank ("FHLB") totaled $2.4

billion as of December 31, 2017 and $2.2 billion at

September 30, 2017. The weighted average rate for FHLB

borrowings was 2.56% as of December 31, 2017 and 2.80% at

September 30, 2017, the decline being due to the maturity of

some long-term FHLB advances.

Loan originations totaled $954 million for our first fiscal

quarter 2018 compared to $1.2 billion of originations in the same

quarter one year ago. Partially offsetting loan originations in

each of these respective quarters were loan repayments of $860

million and $896 million. Commercial loans represented 70% of all

loan originations during our first fiscal quarter 2018 with

consumer loans accounting for the remaining 30%. The Company views

organic loan growth as the highest and best use of its capital and

prefers commercial loans in this low rate environment due to the

fact they generally have floating interest rates and shorter

durations. The weighted average interest rate on loans was 4.30% as

of December 31, 2017, an increase from 4.28% as of

September 30, 2017.

Asset quality remained strong and the ratio of non-performing

assets to total assets improved to 0.41% as of December 31,

2017 compared to 0.56% at December 31, 2016 and 0.46% at

September 30, 2017. Since September 30, 2017, real estate

owned decreased by $3 million, or 13%, and non-accrual loans

decreased by $4 million, or 8%. Delinquent loans were 0.43% of

total loans at December 31, 2017 compared to 0.74% at

December 31, 2016 and 0.40% at September 30, 2017. The

allowance for loan losses and reserve for unfunded commitments

totaled $134 million as of December 31, 2017 and was 1.08% of

gross loans outstanding, as compared to $131 million or 1.07% of

gross loans outstanding at September 30, 2017. The slight

increase in the ratio of the total allowance and reserve to gross

loans since the Company's fiscal year end reflects continued

improvement in credit conditions offset by the continued shift in

the loan portfolio mix to include a greater proportion of

commercial loans outstanding, which generally require a higher

level of reserves.

On November 20, 2017, the Company paid a regular cash

dividend of $0.15 per share, which represented the 139th

consecutive quarterly cash dividend. During the quarter, the

Company repurchased 1,147,370 shares of common stock at a weighted

average price of $33.98 per share and has authorization to

repurchase approximately 754 thousand additional shares. The

Company varies the pace of share repurchases depending on several

factors, including share price, lending opportunities and capital

levels. Since September 30, 2017, tangible common

stockholders’ equity per share increased by $0.09 or 0.5% to $19.67

and the ratio of tangible common equity to tangible assets remained

strong at 11.12% as of December 31, 2017.

Net interest income was $116 million for the quarter, an

increase of $12.6 million or 12.2% from the same quarter in the

prior year. The increase in net interest income from the prior year

was primarily due to both higher balances and yield. Average

earning assets increased by $513 million, or 3.8%. Net interest

margin increased to 3.26% in the first fiscal quarter of 2018 from

3.02% for the same quarter in the prior year. The margin increase

is primarily due to changes in the mix of interest earning assets,

including higher yields on variable rate loans, cash and

investments, as well as a lower rate on FHLB advances due to the

maturity of some higher cost long-term advances.

The Company did not record any provision for loan losses in the

first fiscal quarter of 2018 or 2017 as net recoveries and

improvement in credit conditions were offset by strong growth in

the loan portfolio. Net recoveries were $3.1 million for the first

fiscal quarter of 2018 compared to $5.3 million for the prior

year's quarter.

Total other income was $6.8 million for the first fiscal quarter

of 2018, a decrease of $5.1 million from $11.9 million in the same

quarter of the prior year. The decrease from the prior year was

primarily due to $8.6 million of expense from asset and liability

valuation adjustments associated with FDIC loss share agreements.

The Company is actively pursuing the early termination of all FDIC

loss share agreements. The impact of these valuation adjustments

was partially offset by a $2.4 million gain recognized on

bank-owned life insurance and a $1.5 million increase in deposit

fee income, which was driven by the 2017 launch of the Company's

new "Green Checking" product.

Total operating expenses were $61.9 million in the first fiscal

quarter of 2018, an increase of $7.6 million or 14.0% from the

prior year's quarter. Compensation and benefits costs increased by

$2.6 million primarily due to headcount increases and cost of

living adjustments since last year. Information technology costs

increased by $1.5 million and other expenses were elevated due to

consulting and audit work to enhance the Company's Bank Secrecy Act

Program. Charitable contributions increased by $1 million from the

prior year's quarter as the Company fulfilled the first year of its

previously announced commitment to fund its foundation by $1

million annually for the next five years. The Company’s efficiency

ratio in the first fiscal quarter 2018 was 47.3% (excluding the

impact of $8.6 million reduction to noninterest income from the

FDIC loss share valuation adjustments) compared to 48.7% for the

quarter ended September 30, 2017 and 47.2% for the same period

one year ago.

On December 22, 2017, the Tax Cuts and Jobs Act was enacted and

it provides for significant changes to the U.S. Internal Revenue

Code of 1986, as amended, such as a reduction in the federal

corporate tax rate from 35% to 21% effective from January 1, 2018

forward and changes or limitations to certain tax deductions. The

Company has a fiscal year end of September 30, so the change to the

corporate tax rate resulted in a blended federal statutory tax rate

for its fiscal year 2018. The financial statements for the first

fiscal quarter 2018 were also impacted by a one-time revaluation of

the Company’s deferred tax assets and liabilities and this was

recognized as a discrete income tax benefit in the period. For the

quarter ended December 31, 2017, the Company recorded federal

and state income tax expense of $9.0 million, which equates to a

14.79% effective tax rate. This compares to an effective tax rate

of 32.27% for the fiscal year ended September 30, 2017. The

Company estimates that its annual effective tax rate for fiscal

2018 (blended rate year) will be approximately 22-23%. The

effective tax rate for the current quarter was lower than the new

2018 statutory rate due to discrete tax benefits of $4 million

recognized related to the revaluation of deferred tax assets and

liabilities expected to be utilized in 2018 as well as tax benefits

related to stock based compensation. Looking forward, the Company

expects the effective tax rate for fiscal 2019 to be approximately

19.5-20.5%.

Washington Federal, a national bank with headquarters in

Seattle, Washington, has 237 branches in eight western states. To

find out more about Washington Federal, please visit our website

www.washingtonfederal.com. Washington

Federal uses its website to distribute financial and other material

information about the Company.

Non-GAAP Financial

Measures

Adjusted pre-tax income of $69.2 million for the quarter ended

December 31, 2017 is calculated by adding back the FDIC loss

share valuation adjustments of $8.6 million to pre-tax income of

$60.6 million.

Adjusted non-interest income of $15.3 million for the quarter

ended December 31, 2017 is calculated by adding back the FDIC

loss share valuation adjustments of $8.6 million to non-interest

income of $6.8 million.

Adjusted efficiency ratio of 47.3% for the quarter ended

December 31, 2017 is calculated by dividing non-interest

expense of $61.9 million by adjusted total income of $131.1 million

(net interest income of $115.7 million plus adjusted non-interest

income of $15.3 million).

Important Cautionary

Statements

The foregoing information should be read in conjunction with the

financial statements, notes and other information contained in the

Company’s 2017 Annual Report on Form 10-K, Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K.

This press release contains statements about the Company’s

future that are not statements of historical fact. These statements

are “forward-looking statements” for purposes of applicable

securities laws, and are based on current information and/or

management's good faith belief as to future events. The words

“believe,” “expect,” “anticipate,” “project,” and similar

expressions signify forward-looking statements. Forward-looking

statements should not be read as a guarantee of future performance.

By their nature, forward-looking statements involve inherent risk

and uncertainties, which change over time; and actual performance,

could differ materially from those anticipated by any

forward-looking statements. The Company undertakes no obligation to

update or revise any forward-looking statement.

WASHINGTON FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL

CONDITION

(UNAUDITED)

December 31, 2017

September 30, 2017 (In thousands, except share data)

ASSETS

Cash and cash equivalents

$ 309,713 $ 313,070

Available-for-sale securities, at fair value

1,245,855

1,266,209 Held-to-maturity securities, at amortized cost

1,765,886 1,646,856 Loans receivable, net of allowance for

loan losses of

$127,155 and $123,073

11,107,042

10,882,622 Interest receivable

42,146 41,643 Premises and

equipment, net

264,643 263,694 Real estate owned

17,928 20,658 FHLB and FRB stock

130,590 122,990 Bank

owned life insurance

211,833 211,330 Intangible assets,

including goodwill of

$300,288 and $293,153

310,578

298,682 Other assets

177,799 185,826

$ 15,584,013 $ 15,253,580

LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities

Customer accounts Transaction deposit accounts

$

6,482,612 $ 6,361,158 Time deposit accounts

4,518,967 4,473,850

11,001,579

10,835,008 FHLB advances

2,415,000 2,225,000 Advance

payments by borrowers for taxes and insurance

23,924 56,631

Accrued expenses and other liabilities

133,892

131,253

13,574,395 13,247,892

Stockholders’

equity Common stock, $1.00 par value, 300,000,000 shares

authorized;

135,274,618 and 134,957,511 shares issued;

86,363,099 and 87,193,362 shares outstanding

135,275

134,958 Paid-in capital

1,661,866 1,660,885 Accumulated

other comprehensive (loss) income, net of taxes

8,004 5,015

Treasury stock, at cost;

48,911,519 and 47,764,149 shares

(877,044 ) (838,060 ) Retained earnings

1,081,517 1,042,890

2,009,618 2,005,688

$

15,584,013 $ 15,253,580

CONSOLIDATED

FINANCIAL HIGHLIGHTS Common stockholders' equity per share

$ 23.27 $ 23.00 Tangible common stockholders' equity

per share

$ 19.67 $ 19.58 Stockholders' equity to

total assets

12.90 % 13.15 % Tangible common

stockholders' equity to tangible assets

11.12 % 11.41

%

Weighted average rates at period end Loans and

mortgage-backed securities

3.99 % 3.96 % Combined

loans, mortgage-backed securities and investments

3.85 3.82

Customer accounts

0.57 0.54 Borrowings

2.56 2.80

Combined cost of customer accounts and borrowings

0.93 0.92

Net interest spread

2.92 2.90

WASHINGTON

FEDERAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(UNAUDITED)

Three Months Ended December 31,

2017 2016 (In thousands, except share data)

INTEREST INCOME Loans receivable

$ 124,511 $

114,835 Mortgage-backed securities

16,899 12,789 Investment

securities and cash equivalents

4,370

5,140

145,780 132,764

INTEREST EXPENSE

Customer accounts

14,638 13,017 FHLB advances and other

borrowings

15,407 16,595

30,045 29,612

Net interest income 115,735

103,152 Provision (release) for loan losses

—

—

Net interest income after provision (release)

for loan losses 115,735 103,152

OTHER

INCOME Gain on sale of investment securities

— 968 FDIC

loss share valuation adjustments

(8,550 ) — Loan fee

income

1,035 1,334 Deposit fee income

6,686 5,185

Other Income

7,624 4,409

6,795 11,896

OTHER EXPENSE Compensation and benefits

29,619 26,994 Occupancy

8,671 8,450 FDIC insurance

premiums

2,820 2,839 Product delivery

3,956 3,361

Information technology

7,929 6,451 Other

8,946

6,246

61,941 54,341 Gain (loss) on real

estate owned, net

46 398 Income

before income taxes

60,635 61,105 Income tax provision

8,965 19,859

NET INCOME

$ 51,670 $ 41,246

PER SHARE

DATA Basic earnings per share

$ 0.59 $ 0.46

Diluted earnings per share

0.59 0.46 Cash dividends per

share

0.15 0.14 Basic weighted average shares outstanding

86,938,095 89,310,958 Diluted weighted average shares

outstanding

87,082,499 89,731,024

PERFORMANCE

RATIOS Return on average assets

1.35 % 1.11 %

Return on average common equity

10.25 8.31 Net interest

margin

3.26 3.02 Efficiency ratio (a)

47.25 47.23

(a) Efficiency ratio for the quarter ended December 31, 2017

excludes the impact of $8.6 million reduction to other income

related to FDIC loss share valuation adjustments.

Washington Federal, Inc. Fact Sheet December 31,

2017 ($ in Thousands)

As of

06/17 As of 09/17 As of 12/17 Loan Loss Reserve -

Total $ 128,779 $ 130,823 $ 133,905 General and Specific Allowance

122,229 123,073 127,155 Commitments Reserve 6,550 7,750 6,750

Allowance and Reserve as a % of Gross Loans 1.08 % 1.07 % 1.08 %

06/17 QTR 06/17 YTD 09/17 QTR 09/17

YTD 12/17 QTR 12/17 YTD Loan Originations - Total

$ 1,030,996 $ 3,216,125 $ 1,022,853 $ 4,238,978 $ 953,552 $ 953,552

Single-Family Residential 181,721 567,509 189,607 757,116 158,086

158,086 Construction 268,027 774,048 307,416 1,081,464 279,833

279,833 Construction - Custom 129,077 372,678 157,757 530,435

99,720 99,720 Land - Acquisition & Development 21,559 48,124

31,752 79,876 24,449 24,449 Land - Consumer Lot Loans 10,200 27,423

11,728 39,151 9,279 9,279 Multi-Family 43,716 248,954 50,405

299,359 87,586 87,586 Commercial Real Estate 97,962 340,009 103,678

443,687 64,149 64,149 Commercial & Industrial 258,310 779,910

151,930 931,840 212,064 212,064 HELOC 19,310 54,922 17,991 72,913

17,651 17,651 Consumer 1,114 2,548 589 3,137 735 735

Purchased Loans (including acquisitions) $ — $ 72,856 $ — $ 72,856

$ 143,605 $ 143,605 Net Loan Fee and Discount Accretion $

2,348 $ 14,874 $ 4,181 $ 19,055 $ 3,509 $ 3,509

Repayments

Loans $ 793,432 $ 2,400,232 $ 699,619 $ 3,099,851 $ 859,583 $

859,583 MBS 151,218 426,287 96,156 522,443 92,808 92,808 MBS

Premium Amortization $ 2,620 $ 10,651 $ 2,929 $ 13,580 $ 2,206 $

2,206

Efficiency

Operating Expenses/Average Assets 1.52 % 1.51 % 1.66 % 1.55 % 1.62

% 1.62 % Efficiency Ratio (%) (a) 46.57 % 47.51 % 48.68 % 47.82 %

47.25 % 47.25 % Amortization of Intangibles $ 375 $ 1,294 $ 2,053 $

3,347 $ 705 $ 705 (a) Efficiency ratio for the quarter ended

December 31, 2017 excludes the impact of $8.6 million reduction to

noninterest income related to FDIC loss share valuation

adjustments.

EOP

Numbers

Shares Issued and Outstanding 88,750,133 87,193,362 86,363,099

Share repurchase

information

Remaining shares authorized for repurchase (b) 3,468,854 1,900,955

753,585 Shares repurchased 811,034 1,569,279 1,567,899 3,137,178

1,147,370 1,147,370 Average share repurchase price $ 32.14 $ 29.61

$ 33.10 $ 31.36 $ 33.98 $ 33.98

(b) Remaining shares authorized for

repurchase reflects a reduction related to TARP warrants

repurchased for cash to date.

Washington Federal, Inc. Fact Sheet

December 31, 2017 ($ in Thousands)

Tangible Common Book

Value

As of 06/17

As of 09/17 As of 12/17

$ Amount $ 1,725,491 $ 1,707,006 $ 1,699,040 Per

Share 19.44 19.58 19.67 # of Employees 1,815 1,818 1,829

Investments

Available-for-sale:

Agency MBS

$ 809,702 $ 842,688 $ 839,855 Other 460,712 423,521

406,000 $ 1,270,414 $ 1,266,209 $ 1,245,855

Held-to-maturity: Agency MBS $ 1,651,528 $ 1,646,856 $ 1,765,886 $

1,651,528 $ 1,646,856 $ 1,765,886

As of 06/17

As of 09/17 As of

12/17

Loans Receivable by

Category

AMOUNT % AMOUNT % AMOUNT

% Single-Family Residential $ 5,687,850 47.9 % $ 5,711,004

46.8 % $ 5,693,318 45.7 % Construction 1,436,874 12.1 1,597,996

13.1 1,710,418 13.7 Construction - Custom 561,260 4.7 602,631 4.9

583,580 4.7 Land - Acquisition & Development 119,524 1.0

124,308 1.0 136,938 1.1 Land - Consumer Lot Loans 101,626 0.9

104,405 0.9 105,086 0.8 Multi-Family 1,263,187 10.6 1,303,148 10.7

1,312,695 10.5 Commercial Real Estate 1,346,006 11.3 1,434,610 11.8

1,436,508 11.5 Commercial & Industrial 1,116,860 9.4 1,093,360

9.0 1,120,707 9.0 HELOC 148,584 1.3 144,850 1.2 136,995 1.1

Consumer 95,775 0.8 85,075 0.7

219,971 1.8 11,877,546 100 % 12,201,387 100 %

12,456,216 100 % Less: ALL 122,229 123,073 127,155 Loans in

Process 1,054,513 1,149,934 1,175,642 Net Deferred Fees, Costs and

Discounts 46,379 45,758 46,377 Sub-Total

1,223,121 1,318,765 1,349,174 $ 10,654,425 $

10,882,622 $ 11,107,042

Net Loan Portfolio

by Category

AMOUNT % AMOUNT % AMOUNT

% Single-Family Residential $ 5,628,508 52.8 % $ 5,652,365

51.9 % $ 5,636,013 50.7 % Construction 656,287 6.2 763,742 7.0

820,969 7.4 Construction - Custom 265,722 2.5 273,520 2.5 288,162

2.6 Land - Acquisition & Development 103,414 1.0 97,587 0.9

104,426 0.9 Land - Consumer Lot Loans 98,592 0.9 101,265 0.9

101,666 0.9 Multi-Family 1,250,730 11.7 1,290,640 11.9 1,300,179

11.7 Commercial Real Estate 1,327,530 12.5 1,416,188 13.0 1,418,364

12.8 Commercial & Industrial 1,082,486 10.2 1,060,304 9.7

1,086,533 9.8 HELOC 147,012 1.4 143,381 1.3 135,623 1.2 Consumer

94,144 0.9 83,630 0.8 215,107

1.9 $ 10,654,425 100 % $ 10,882,622 100 % $ 11,107,042 100 %

Washington Federal, Inc. Fact Sheet

December 31, 2017 ($ in Thousands)

As of 06/30/17

As of 09/30/17 As of

12/31/17

Deposits by

State

AMOUNT % # AMOUNT

% # AMOUNT %

# Washington $ 5,199,590 48.9 % 81 $ 5,383,764 49.7 % 81 $

5,605,233 50.9 % 81 Idaho 768,049 7.2 24 786,974 7.3 24 771,350 7.0

24 Oregon 1,939,619 18.2 47 1,964,490 18.1 47 1,947,171 17.7 47

Utah 270,224 2.5 10 267,717 2.5 10 263,405 2.4 10 Nevada 328,121

3.1 11 326,436 3.0 11 331,423 3.0 11 Texas 96,264 0.9 5 97,670 0.9

6 97,108 0.9 6 Arizona 1,177,997 11.1 31 1,164,743 10.7 31

1,155,381 10.5 31 New Mexico 854,414 8.0 27

843,214 7.8 27 830,508 7.5

27 Total $ 10,634,278 100 % 236 $ 10,835,008

100 % 237 $ 11,001,579 100 % 237

Deposits by

Type

AMOUNT % AMOUNT % AMOUNT

% Checking (non-interest) $ 1,195,152 11.2 % $ 1,258,274

11.6 % $ 1,299,602 11.8 % NOW (interest) 1,703,994 16.0 1,760,821

16.3 1,848,594 16.8 Savings 871,257 8.2 888,881 8.2 894,879 8.1

Money Market 2,433,547 22.9 2,453,182 22.6 2,439,537 22.2 Time

Deposits 4,430,328 41.7 4,473,850

41.3 4,518,967 41.1 Total $

10,634,278 100 % $ 10,835,008 100 % $ 11,001,579

100 % Deposits greater than $250,000 - EOP $

2,524,536 $ 2,674,914 $ 2,857,838

Time Deposit

Repricing

Amount Rate Amount Rate Amount

Rate Within 3 months $ 879,213 0.65 % $ 668,177 0.65 % $

730,975 0.74 % From 4 to 6 months 649,962 0.67 % 714,935 0.76 %

871,822 0.83 % From 7 to 9 months 450,756 0.83 % 653,760 0.85 %

525,594 0.98 % From 10 to 12 months 625,472 0.87 % 471,057 0.98 %

677,959 1.08 %

Non-Performing

Assets

AMOUNT % AMOUNT % AMOUNT

% Non-accrual loans: Single-Family Residential $ 32,613 57.8

% $ 27,930 56.3 % $ 26,219 57.6 % Construction — — — — 364 0.8

Construction - Custom 536 1.0 91 0.2 — — Land - Acquisition &

Development 71 0.1 296 0.6 1,326 2.9 Land - Consumer Lot Loans

1,066 1.9 605 1.2 976 2.1 Multi-Family 682 1.2 139 0.3 250 0.5

Commercial Real Estate 12,983 23.0 11,815 23.8 8,241 18.1

Commercial & Industrial 8,254 14.6 8,082 16.3 7,596 16.7 HELOC

181 0.3 531 1.1 476 1.0 Consumer 22 —

91 0.2 72 0.2 Total non-accrual

loans 56,408 100 % 49,580 100 % 45,520 100 % Real Estate Owned

19,112 20,658 17,928

Total non-performing assets $ 75,520 $ 70,238 $

63,448 Non-accrual loans as % of total net loans 0.53

% 0.46 % 0.41 % Non-performing assets as % of total assets 0.50 %

0.46 % 0.41 %

Washington Federal, Inc. Fact

Sheet December 31, 2017 ($ in Thousands)

As of 06/30/17 As of

09/30/17 As of 12/31/17 AMOUNT

% AMOUNT %

AMOUNT %

Restructured

loans:

Single-Family Residential $ 196,575 87.9 % $ 181,941 87.7 % $

170,601 85.7 % Construction — — — — — — Construction - Custom — — —

— — — Land - Acquisition & Development 190 0.1 90 — — — Land -

Consumer Lot Loans 8,878 4.0 7,949 3.8 7,405 3.7 Multi-Family 497

0.2 493 0.2 480 0.2 Commercial Real Estate 15,907 7.1 15,079 7.3

11,910 6.0 Commercial & Industrial — — — — 7,256 3.6 HELOC

1,409 0.6 1,728 0.8 1,432 0.7 Consumer 102 —

97 — 91 — Total

restructured loans $ 223,558 100 % $ 207,377 100 % $

199,175 100 %

Restructured loans

were as follows:

Performing $ 215,178 96.3 % $ 202,272 97.5 % $ 194,359 97.6 %

Non-performing (c) 8,380 3.7 5,105

2.5 4,816 2.4 Total restructured

loans $ 223,558 100 % $ 207,377 100 % $ 199,175

100 % (c) Included in "Total non-accrual loans" above

AMOUNT

CO %(d)

AMOUNT

CO %(d)

AMOUNT

CO %(d)

Net Charge-offs

(Recoveries) by Category

Single-Family Residential $ 186 0.01 % $ 267 0.02 % $ 340 0.02 %

Construction — — — — — — Construction - Custom — — 13 0.01 50 0.03

Land - Acquisition & Development (863 ) (2.89 ) (1,729 ) (5.56

) (3,372 ) (9.85 ) Land - Consumer Lot Loans (118 ) (0.46 ) (113 )

(0.43 ) 47 0.18 Multi-Family — — — — — — Commercial Real Estate

(164 ) (0.05 ) — — — — Commercial & Industrial (154 ) (0.06 )

(727 ) (0.27 ) 61 0.02 HELOC (1 ) — (19 ) (0.05 ) — — Consumer

(138 ) (0.58 ) (236 ) (1.11 ) (208 ) (0.38 )

Total net charge-offs (recoveries) $ (1,252 ) (0.04 )% $ (2,544 )

(0.08 )% $ (3,082 ) (0.10 )% (d) Annualized Net Charge-offs

(recoveries) divided by Gross Balance

Interest Rate

Risk

One Year GAP (15.8 )% (15.7 )% (12.9 )% NPV post 200 bps shock (e)

14.5 % 14.6 % 14.2 % Change in NII after 200 bps shock (e) 2.0 %

3.0 % 1.3 % (e) Assumes no balance sheet management actions taken

Washington Federal, Inc. Fact Sheet

December 31, 2017 ($ in Thousands) Historical

CPR Rates (f) WAFD WAFD Average

for Quarter Ended: SFR Mortgages GSE MBS 12/31/2015 16.7%

13.4% 3/31/2016 13.9% 12.0% 6/30/2016 17.3% 17.5% 9/30/2016 17.7%

20.0% 12/31/2016 19.3% 24.8% 3/31/2017 13.6% 13.5% 6/30/2017 15.0%

20.9% 9/30/2017 15.1% 14.3% 12/31/2017 15.3% 13.9% (f) The

CPR Rate (conditional payment rate) is the rate that is equal to

the proportion of the principal of a pool of loans that is paid off

prematurely in each period.

Washington Federal,

Inc. Fact Sheet December 31, 2017 Average

Balance Sheet ($ in Thousands)

June 30, 2017 September 30, 2017

December 31, 2017 Average

Average Average

Average Average

Average Balance Interest Rate

Balance Interest Rate Balance

Interest Rate Assets Loans receivable $

10,579,593 $ 117,457 4.45 % $ 10,747,453 $ 122,197 4.51 % $

10,984,886 $ 124,511 4.50 % Mortgage-backed securities 2,551,598

15,992 2.51 2,493,604 15,605 2.48 2,521,407 16,899 2.66 Cash &

investments 627,197 3,373 2.16 604,198 3,500 2.30 559,370 3,273

2.32 FHLB & FRB Stock 124,968 894

2.87 122,620 938

3.03 126,229 1,097

3.45 Total interest-earning assets

13,883,356 137,716 3.98 % 13,967,875 142,240 4.04 % 14,191,892

145,780 4.08 % Other assets 1,142,899 1,144,200

1,149,607

Total assets $ 15,026,255 $ 15,112,075 $

15,341,499

Liabilities and Equity Customer accounts $

10,567,710 12,764 0.48 % $ 10,704,066 13,850 0.51 % $ 10,850,742

14,638 0.54 % FHLB advances 2,274,451 16,337 2.88 2,214,674 15,958

2.86 2,305,978 15,407 2.65 Other borrowings —

— — — —

— — —

— Total interest-bearing liabilities

12,842,161 29,101 0.91 % 12,918,740 29,808 0.92 % 13,156,720 30,045

0.91 % Other liabilities 155,460 183,542

168,382 Total liabilities 12,997,621 13,102,282 13,325,102

Stockholders’ equity 2,028,634 2,009,793

2,016,397

Total liabilities and equity $ 15,026,255 $

15,112,075 $ 15,341,499

Net interest income $ 108,615

$ 112,432 $ 115,735

Net interest margin (1) 3.13 %

3.22 % 3.26 % (1) Annualized net interest income divided by

average interest-earning assets

Washington

Federal, Inc. Fact Sheet December 31, 2017

Delinquency Summary ($ in Thousands)

AMOUNT OF LOANS

# OF LOANS % based

% based

TYPE OF

LOANS

#LOANS AVG Size NET OF LIP & CHG-OFFs

30 60 90

Total on # $ Delinquent on $

December 31, 2017 Single-Family Residential 25,325

225 $ 5,692,045 51 35 104 190 0.75 % $ 36,172 0.64 % Construction

675 1,262 852,164 1 3 4 8 1.19 4,371 0.51 Construction - Custom

1,241 235 292,255 — — — — — — — Land - Acquisition &

Development 122 920 112,260 — — 4 4 3.28 1,242 1.11 Land - Consumer

Lot Loans 1,209 87 104,996 2 1 10 13 1.08 750 0.71 Multi-Family

1,122 1,170 1,312,673 — — 2 2 0.18 250 0.02 Commercial Real Estate

925 1,553 1,436,508 2 — 6 8 0.86 444 0.03 Commercial &

Industrial 1,849 606 1,120,707 7 2 23 32 1.73 3,467 0.31 HELOC

2,859 48 136,995 8 4 17 29 1.01 991 0.72 Consumer 3,847 57

219,971 43 15 107 165 4.29 567 0.26 39,174 288

$ 11,280,574 114 60 277 451 1.15 % $ 48,254 0.43 %

September 30, 2017 Single-Family Residential 25,556 223 $

5,709,690 64 29 109 202 0.79 % $ 37,757 0.66 % Construction 715

1,110 793,959 — — — — — — — Construction - Custom 1,292 215 277,599

— — 1 1 0.08 91 0.03 Land - Acquisition & Development 122 859

104,856 — — 4 4 3.28 330 0.31 Land - Consumer Lot Loans 1,201 87

104,335 3 6 5 14 1.17 946 0.91 Multi-Family 1,135 1,148 1,303,119 2

1 3 6 0.53 399 0.03 Commercial Real Estate 931 1,541 1,434,610 2 —

8 10 1.07 2,558 0.18 Commercial & Industrial 1,820 601

1,093,360 — 2 20 22 1.21 625 0.06 HELOC 2,877 50 144,850 6 4 15 25

0.87 876 0.60 Consumer 4,039 21 85,075 50 24 103 177 4.38

431 0.51 39,688 278 $ 11,051,453 127 66 268

461 1.16 % $ 44,013 0.40 %

June 30, 2017

Single-Family Residential 25,779 221 $ 5,687,169 68 36 123 227 0.88

% $ 44,653 0.79 % Construction 624 1,095 683,273 — 1 — 1 0.16 686

0.10 Construction - Custom 1,218 221 269,612 — — 2 2 0.16 536 0.20

Land - Acquisition & Development 118 941 111,057 — — 4 4 3.39

123 0.11 Land - Consumer Lot Loans 1,187 86 101,584 1 2 6 9 0.76

615 0.61 Multi-Family 964 1,310 1,263,143 1 1 2 4 0.41 329 0.03

Commercial Real Estate 1,073 1,254 1,345,986 2 3 9 14 1.30 2,911

0.22 Commercial & Industrial 1,816 615 1,116,854 3 1 23 27 1.49

2,673 0.24 HELOC 2,914 51 148,581 14 7 6 27 0.93 1,491 1.00

Consumer 4,275 22 95,774 51 18 97 166 3.88 384

0.40 39,968 271 $ 10,823,033 140 69 272 481 1.20 % $ 54,401

0.50 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180117005413/en/

Washington Federal, Inc.Brad Goode, 206-626-8178SVP, Director of

Communicationsbrad.goode@wafd.com

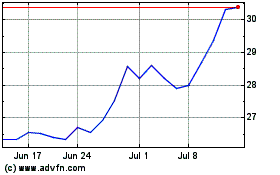

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Jun 2024 to Jul 2024

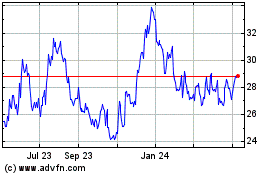

WaFd (NASDAQ:WAFD)

Historical Stock Chart

From Jul 2023 to Jul 2024