Current Report Filing (8-k)

April 06 2021 - 5:28PM

Edgar (US Regulatory)

VERINT SYSTEMS INC NASDAQ false 0001166388 --01-31 0001166388 2021-04-06 2021-04-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 6, 2021

Verint Systems Inc.

(Exact name of registrant as specified in its charter)

001-34807

(Commission File Number)

|

|

|

|

|

Delaware

|

|

11-3200514

|

|

(State or other jurisdiction

of incorporation)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

175 Broadhollow Road

|

|

Melville, New York 11747

|

|

(Address of principal executive offices, with zip code)

|

(631) 962-9600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

symbol

|

|

Name of exchange

on which registered

|

|

Common Stock, $0.001 par value per share

|

|

VRNT

|

|

The NASDAQ Stock Market, LLC

|

|

|

|

|

|

(NASDAQ Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 3.02

|

Unregistered Sale of Equity Securities

|

On April 6, 2021 (the “Second Closing Date”), Verint Systems Inc. (the “Company”) closed the second tranche of the previously announced strategic partnership (the “Second Closing”) with Valor Buyer LP (the “Apax Investor”), an affiliate of Apax Partners L.P. (“Apax Partners”). Pursuant to the Investment Agreement (the “Investment Agreement”), dated as of December 4, 2019, by and between the Company and the Apax Investor (as the assignee of Valor Parent LP (“Valor Parent”)), at the Second Closing, the Company sold to the Apax Investor, in a private placement under the Securities Act of 1933 (the “Securities Act”), 200,000 shares of the Company’s Series B Convertible Perpetual Preferred Stock, par value $0.001 per share (the “Series B Preferred Stock”), for an aggregate purchase price of $200.0 million (the “Private Placement”). On May 7, 2020, pursuant to the Investment Agreement, the Company issued to Valor Parent (the “First Closing”) 200,000 shares of the Company’s Series A Convertible Perpetual Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock” and, together with the Series B Preferred Stock, the “Preferred Stock”), which shares were subsequently transferred to the Apax Investor.

In connection with the Second Closing, the Company filed the Certificate of Designation, Preferences and Rights of Series B Convertible Perpetual Preferred Stock (the “Certificate of Designation”) with the Secretary of State of the State of Delaware on April 6, 2021 setting forth the terms, rights, obligations and preferences of the Series B Preferred Stock.

The issuance and sale of shares of Series B Preferred Stock to the Apax Investor at the Second Closing was exempt from registration under the Securities Act, pursuant to Section 4(a)(2) of the Securities Act. The Apax Investor represented to the Company that it is an “accredited investor” as defined in Rule 501 of the Securities Act and that the Series B Preferred Stock was being acquired for investment purposes and not with a view to, or for sale in connection with, any distribution thereof. Appropriate legend notations were applied to the shares of Series B Preferred Stock and will be applied to any of the Company’s common stock, par value $0.001 per share (“Common Stock”), issuable upon conversion thereof.

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On April 6, 2021, the Company filed the Certificate of Designation to establish and fix the terms of the Series B Preferred Stock. The Certificate of Designation became effective with the Secretary of State of the State of Delaware upon filing.

The Series B Preferred Stock ranks senior to the shares of the Company’s Common Stock and pari passu with shares of Series A Preferred Stock with respect to dividend rights and rights on the distribution of assets on any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Company. The Series B Preferred Stock has a liquidation preference of $1,000 per share. Holders of Series B Preferred Stock will be entitled to a cumulative dividend at a rate of 5.20% per annum until the 48-month anniversary of date of the First Closing and thereafter at a rate of 4.00% per annum, subject in each case to adjustment under certain circumstances. Dividends on the Series B Preferred Stock will be cumulative and payable semi-annually in arrears in cash, as set forth in the Certificate of Designation. All dividends that are not paid in cash will remain accumulated dividends with respect to each share of Series B Preferred Stock. The dividend rate is subject to increase (i) to 6.00% per annum if the Company fails to pay cash dividends in specified circumstances and (ii) by 1.00% each year, up to a maximum dividend rate of 10.00% per annum, in the event the Company fails to satisfy its obligations to redeem the Series B Preferred Stock in specified circumstances.

The Series B Preferred Stock is convertible into Common Stock at the election of the holder at any time at an initial conversion price of $50.25. At any time after 36 months following the Second Closing Date, the Company will have the option to require that all (but not less than all) of the then-outstanding shares of Series B Preferred Stock convert into Common Stock if the VWAP of the Common Stock for at least 30 trading days in any 45 consecutive trading day period (including the last five consecutive trading days in such period) exceeds 175% of the then-applicable conversion price.

The Company may redeem any or all of the Series B Preferred Stock for cash at any time after the 72-month anniversary of the Second Closing Date at a redemption price equal to 100% of the liquidation preference of the Series B Preferred Stock, plus any accrued and unpaid dividends to, but excluding, the redemption date, plus the make-whole amount designed to allow the Apax Investor to earn a total 8.00% internal rate of return on such shares. At any time after the 102-month anniversary of the Second Closing Date, the holders will have the right to cause the Company to redeem all of the outstanding shares of Series B Preferred Stock for cash at a redemption price equal to 100% of the liquidation preference of the Series B Preferred Stock, plus any accrued and unpaid dividends to, but excluding, the redemption date. Upon the occurrence of a Change of Control Triggering Event (as defined in the Certificate of Designation), the Company is also required to redeem all of the outstanding shares of Series B Preferred Stock for cash at a redemption price equal to the greater of (i) 100% of the liquidation preference of the shares, plus any accrued and unpaid dividends to, but excluding, the redemption date, or (ii) the payment that such holders would have received had such holders, immediately prior to such Change of Control (as defined in the Certificate of Designation), converted such shares then held by such holder into shares of Common Stock at the applicable Conversion Price then in effect.

The Certificate of Designation provides that holders will have the right to vote on matters submitted to a vote of the holders of Common Stock on an as-converted basis unless required by applicable law, but in no event will the holders have the right to vote shares of the Preferred Stock on an as-converted basis in excess of 19.9% of the voting power of the Common Stock outstanding immediately prior to the date of the Investment Agreement.

The foregoing description of the Certificate of Designation does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Certificate of Designation, which is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

VERINT SYSTEMS INC.

|

|

|

|

|

By:

|

|

/s/ Peter Fante

|

|

Name:

|

|

Peter Fante

|

|

Title:

|

|

Chief Administrative Officer

|

Date: April 6, 2021

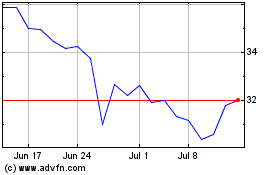

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Jun 2024 to Jul 2024

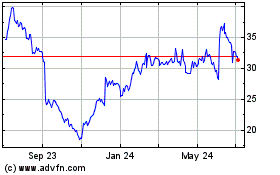

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Jul 2023 to Jul 2024