Verint® Systems Inc. (NASDAQ: VRNT), a

global leader in Actionable Intelligence® solutions and value-added

services, today announced results for the quarter ended April 30,

2011.

“Behind Verint’s success and leadership is a commitment to

innovation. Earlier this year, we introduced new innovative

solutions for the workforce optimization and security intelligence

markets, including the latest version of our Impact 360® Workforce

Optimization™ suite, our Voice-of-the-Customer platform, our

Situational Management solution and our Web Investigation solution.

Verint’s continued investment in innovation coupled with our strong

operating margins positions us well for future success and growth,”

said Dan Bodner, CEO and President of Verint Systems Inc.

Below is selected financial information for the three months

ended April 30, 2011 and 2010 prepared in accordance with generally

accepted accounting principles (“GAAP”) and not prepared in

accordance with GAAP (“non-GAAP”).

(Dollars in thousands, except per share data) Selected GAAP

Information Selected Non-GAAP Information Three Months Ended

April 30, Three Months Ended April 30, 2011 2010 2011

2010 Revenue $ 176,332 $ 172,613 $ 176,567 $ 172,613

Gross Profit 120,983 114,806 124,837 119,447 Gross Margin 68.6%

66.5% 70.7% 69.2% Operating Income (Loss) 18,834 (3,982)

39,517 42,279 Operating Margin 10.7% (2.3%) 22.4% 24.5%

Diluted Net (Loss) Income per Common Share Attributable to Verint

Systems Inc. $ (0.10) $ (0.60) $ 0.56 $ 0.57

Outlook for the Year Ending January 31,

2012

- We expect revenue to increase

approximately 8% compared to the year ended January 31, 2011.

- We are targeting a non-GAAP operating

margin in the low 20%.

Conference Call Information

We will be conducting a conference call today at 8:30 a.m. to

discuss our results for the first quarter and outlook for the year

ending January 31, 2012. An on-line, real-time webcast of the

conference call will be available on our website at www.verint.com.

The conference call can also be accessed live via telephone at

1-888-680-0878 (United States) and 1-617-213-4855 (international)

and the passcode is 72480035. Please dial in 5-10 minutes prior to

the scheduled start time.

About Non-GAAP Financial Measures

This press release and the accompanying tables include non-GAAP

financial measures. For a description of these non-GAAP financial

measures, including the reasons management uses each measure, and

reconciliations of these non-GAAP financial measures to the most

directly comparable financial measures prepared in accordance with

GAAP, please see Table 2 as well as "Supplemental Information About

Non-GAAP Financial Measures" at the end of this press release.

Because we do not predict special items that might occur in the

future, and our outlook is developed at a level of detail different

than that used to prepare GAAP financial measures, we are not

providing a reconciliation to GAAP of our forward-looking financial

measures for the year ending January 31, 2012.

About Verint Systems Inc.

Verint® Systems Inc. is a global leader in Actionable

Intelligence® solutions and value-added services. Our solutions

enable organizations of all sizes to make timely and effective

decisions to improve enterprise performance and make the world a

safer place. More than 10,000 organizations in over 150

countries—including over 85 percent of the Fortune 100—use Verint

Actionable Intelligence solutions to capture, distill, and analyze

complex and underused information sources, such as voice, video,

and unstructured text. Headquartered in Melville, New York, we

support our customers around the globe directly and with an

extensive network of selling and support partners. Visit us at our

website www.verint.com.

Cautions About Forward-Looking Statements

This press release contains forward-looking statements,

including statements regarding expectations, predictions, views,

opportunities, plans, strategies, beliefs, and statements of

similar effect relating to Verint Systems Inc. These

forward-looking statements are not guarantees of future performance

and they are based on management's expectations that involve a

number of risks and uncertainties, any of which could cause actual

results to differ materially from those expressed in or implied by

the forward-looking statements. Some of the factors that could

cause actual future results or conditions to differ materially from

current expectations include: uncertainties regarding the impact of

general economic conditions, particularly in information technology

spending, on our business; risks due to aggressive competition in

all of our markets, including with respect to maintaining margins

and sufficient levels of investment in our business; risks

associated with keeping pace with technological changes and

evolving industry standards in our product offerings and with

successfully introducing new, quality products which meet customer

needs and achieve market acceptance; risks created by continued

consolidation of competitors or introduction of large competitors

in our markets with greater resources than we have; risks

associated with successfully competing for, consummating, and

implementing mergers and acquisitions, including risks associated

with capital constraints, post-acquisition integration activities,

and potential asset impairments; risks that customers or partners

delay or cancel orders or are unable to honor contractual

commitments due to liquidity issues, challenges in their business,

or otherwise; risks relating to our implementation and maintenance

of adequate systems and internal controls for our current and

future operations and reporting needs and related risks of

financial statement omissions, misstatements, restatements, or

filing delays; risks associated with being a consolidated,

controlled subsidiary of Comverse Technology, Inc. (“Comverse”) and

formerly part of Comverse’s consolidated tax group, including risks

of any future impact on us resulting from Comverse’s extended

filing delay or any other future issues; risks associated with

Comverse controlling our board of directors and the outcome of all

matters submitted for stockholder action, including the approval of

significant corporate transactions, such as certain equity

issuances or mergers and acquisitions, as well as speculation or

announcements regarding Comverse’s strategic plans; risks that

products may contain undetected defects which could expose us to

substantial liability; risks associated with allocating limited

financial and human resources to opportunities that may not come to

fruition or produce satisfactory returns; risks associated with

significant foreign and international operations, including

exposure to regions subject to political instability or

fluctuations in exchange rates; risks associated with complex and

changing local and foreign regulatory environments; risks

associated with our ability to recruit and retain qualified

personnel in geographies in which we operate; challenges in

accurately forecasting revenue and expenses and maintaining

profitability; risks relating to our ability to improve our

infrastructure to support growth; risks that our intellectual

property rights may not be adequate to protect our business or

assets or that others may make claims on our intellectual property

or claim infringement on their intellectual property rights; risks

associated with a significant amount of our business coming from

domestic and foreign government customers, including the ability to

maintain security clearances for certain projects; risks that we

improperly handle sensitive or confidential information or

perception of such mishandling; risks associated with our

dependence on a limited number of suppliers or original equipment

manufacturers (“OEMs”) for certain components of our products;

risks that we are unable to maintain and enhance relationships with

key resellers, partners, and systems integrators; risks that

contract terms may expose us to unlimited liability or other

unfavorable positions and risks that we may experience losses that

are not covered by insurance; risks that we will experience

liquidity or working capital issues and related risks that

financing sources will be unavailable to us on reasonable terms or

at all; risks associated with significant leverage resulting from

our current debt position; risks that we will be unable to comply

with the leverage ratio covenant under our credit facility; risks

that our credit rating could be downgraded or placed on a credit

watch; risks relating to timely implementation of new accounting

pronouncements or new interpretations of existing accounting

pronouncements and related risks of future restatements or filing

delays; risks associated with future regulatory actions or private

litigations relating to our extended filing delay and related

circumstances; and risks that use of our tax benefits may be

restricted or eliminated in the future. We assume no obligation to

revise or update any forward-looking statement, except as otherwise

required by law. For a detailed discussion of these risk factors,

see our Annual Report on Form 10-K for the fiscal year ended

January 31, 2011.

VERINT, the VERINT logo, ACTIONABLE INTELLIGENCE, POWERING

ACTIONABLE INTELLIGENCE, INTELLIGENCE IN ACTION, ACTIONABLE

INTELLIGENCE FOR A SMARTER WORKFORCE, VERINT VERIFIED, WITNESS

ACTIONABLE SOLUTIONS, STAR-GATE, RELIANT, VANTAGE, X-TRACT,

NEXTIVA, EDGEVR, ULTRA, AUDIOLOG, WITNESS, the WITNESS logo, IMPACT

360, the IMPACT 360 logo, IMPROVE EVERYTHING, EQUALITY,

CONTACTSTORE, EYRETEL, BLUE PUMPKIN SOFTWARE, BLUE PUMPKIN, the

BLUE PUMPKIN logo, EXAMETRIC and the EXAMETRIC logo, CLICK2STAFF,

STAFFSMART, AMAE SOFTWARE and the AMAE logo are trademarks and

registered trademarks of Verint Systems Inc. Other trademarks

mentioned are the property of their respective owners.

Table 1

Verint Systems Inc. and Subsidiaries

Condensed Consolidated Statements of

Operations

(Unaudited)

(In thousands, except per share data)

Three Months Ended April 30, 2011 2010

Revenue: Product $ 83,278 $ 92,070 Service and support

93,054 80,543

Total revenue

176,332 172,613 Cost

of revenue: Product 22,531 26,852 Service and support 30,168

28,722 Amortization of acquired technology 2,650

2,233

Total cost of revenue

55,349 57,807 Gross

profit 120,983 114,806

Operating expenses: Research and development, net

26,368 26,432 Selling, general and administrative 70,235 87,017

Amortization of other acquired intangible assets 5,546

5,339

Total operating expenses

102,149 118,788 Operating

income (loss) 18,834 (3,982

) Other income (expense), net Interest income 148 83

Interest expense (8,794 ) (5,948 ) Loss on extinguishment of debt

(8,136 ) - Other income (expense), net 1,012

(3,698 )

Total other expense, net (15,770

) (9,563 ) Income (loss) before

provision for income taxes 3,064 (13,545 )

Provision for income taxes 1,509 2,071

Net income (loss) 1,555 (15,616 ) Net

income attributable to noncontrolling interest 1,667

592

Net loss attributable to Verint Systems

Inc. (112 ) (16,208 ) Dividends on

preferred stock (3,549 ) (3,403 )

Net loss

attributable to Verint Systems Inc. common shares $

(3,661 ) $ (19,611 )

Net loss per common share attributable to Verint Systems

Inc. Basic $ (0.10 ) $

(0.60 ) Diluted $ (0.10 )

$ (0.60 ) Weighted-average common

shares outstanding Basic 37,392

32,663 Diluted 37,392

32,663

Table 2

Verint Systems Inc. and Subsidiaries

Reconciliation of GAAP to Non-GAAP

Results

(Unaudited)

(In thousands, except per share data)

Three Months Ended April 30,

2011 2010

Table of

Reconciliation from GAAP Revenue to Non-GAAP Revenue

GAAP revenue $ 176,332 $ 172,613 Revenue adjustments related to

acquisitions 235 - Non-GAAP revenue $

176,567 $ 172,613

Table of

Reconciliation from GAAP Gross Profit to Non-GAAP Gross

Profit

GAAP gross profit $ 120,983 $ 114,806 Revenue adjustments

related to acquisitions 235 - Amortization of acquired technology

2,650 2,233 Stock-based compensation expenses 969

2,408 Non-GAAP gross profit $ 124,837 $

119,447

Table of

Reconciliation from GAAP Operating Income (Loss) to Non-GAAP

Operating Income

GAAP operating income (loss) $ 18,834 $ (3,982 ) Revenue

adjustments related to acquisitions 235 - Amortization of acquired

technology 2,650 2,233 Amortization of other acquired intangible

assets 5,546 5,339 Stock-based compensation expenses 7,550 17,969

Other adjustments 3,711 507 Expenses related to our filing delay

991 20,213 Non-GAAP operating income $

39,517 $ 42,279

Table of

Reconciliation from GAAP Other Expense, Net to Non-GAAP Other

Expense, Net

GAAP other expense, net $ (15,770 ) $ (9,563 ) Loss on

extinguishment of debt 8,136 - Unrealized (gains) losses on

derivatives, net 1,107 (3,967 ) Non-GAAP other

expense, net $ (6,527 ) $ (13,530 )

Table of

Reconciliation from GAAP Provision for Income Taxes to Non-GAAP

Provision for Income Taxes

GAAP provision for income taxes $ 1,509 $ 2,071 Non-cash tax

adjustments 2,120 1,091 Non-GAAP

provision for income taxes $ 3,629 $ 3,162

Table of

Reconciliation from GAAP Net Loss Attributable to Verint Systems

Inc. to Non-GAAP Net Income Attributable to Verint Systems

Inc.

GAAP net loss attributable to Verint Systems Inc. $ (112 ) $

(16,208 ) Revenue adjustments related to acquisitions 235 -

Amortization of acquired technology 2,650 2,233 Amortization of

other acquired intangible assets 5,546 5,339 Stock-based

compensation expenses 7,550 17,969 Other adjustments 3,711 507

Expenses related to our filing delay 991 20,213 Loss on

extinguishment of debt 8,136 - Unrealized (gains) losses on

derivatives, net 1,107 (3,967 ) Non-cash tax adjustments

(2,120 ) (1,091 ) Total GAAP net loss adjustments

27,806 41,203 Non-GAAP net income attributable

to Verint Systems Inc. $ 27,694 $ 24,995

Table of

Reconciliation from GAAP Net Loss Attributable to Verint Systems

Inc. Common Shares to Non-GAAP Net Income Attributable to Verint

Systems Inc. Common Shares

GAAP net loss attributable to Verint Systems Inc. common

shares $ (3,661 ) $ (19,611 ) Total GAAP net loss adjustments

27,806 41,203 Non-GAAP net income

attributable to Verint Systems Inc. common shares $ 24,145 $

21,592

Table Comparing GAAP

Diluted Net Loss Per Common Share Attributable to Verint Systems

Inc. to Non-GAAP Diluted Net Income Per Common Share Attributable

to Verint Systems Inc.

GAAP diluted net loss per common share attributable to

Verint Systems Inc. $ (0.10 ) $ (0.60 ) Non-GAAP diluted net

income per common share attributable to Verint Systems Inc. $ 0.56

$ 0.57 Shares used in computing GAAP diluted

net loss per common share (in thousands) 37,392

32,663 Shares used in computing non-GAAP

diluted net income per common share (in thousands) 49,553

43,946 Table 3 Verint Systems Inc. and

Subsidiaries Segment Revenue (Unaudited) (In thousands)

Three Months Ended April 30, 2011 2010 GAAP Revenue By

Segment Workforce Optimization Segment $ 97,271 $ 96,880

Video Intelligence Segment 30,034 31,545 Communications

Intelligence Segment 49,027 44,188 Total Video and

Communications Intelligence 79,061 75,733 GAAP Total

Revenue $ 176,332 $ 172,613 Revenue adjustments related to

acquisitions $ 235 $ - Non-GAAP Revenue By Segment Workforce

Optimization Segment $ 97,271 $ 96,880 Video Intelligence

Segment 30,269 31,545 Communications Intelligence Segment

49,027 44,188 Total Video and Communications Intelligence

79,296 75,733 Non-GAAP Total Revenue $ 176,567 $

172,613 Table 4 Verint Systems Inc. and Subsidiaries Condensed

Consolidated Balance Sheets (Unaudited) (In thousands, except share

and per share data)

April 30,

January 31,

2011 2011

Assets Current Assets: Cash and cash

equivalents $ 179,358 $ 169,906 Restricted cash and bank time

deposits 12,305 13,639 Accounts receivable, net 137,553 150,769

Inventories 20,650 16,987 Deferred cost of revenue 5,500 6,269

Prepaid expenses and other current assets 45,157

44,374

Total current assets

400,523 401,944 Property and

equipment, net 24,297 23,176 Goodwill 757,463 738,674 Intangible

assets, net 155,554 157,071 Capitalized software development costs,

net 6,630 6,787 Long-term deferred cost of revenue 20,924 21,715

Other assets 32,776 26,760

Total

assets $ 1,398,167 $

1,376,127 Liabilities, Preferred Stock, and

Stockholders' Equity Current Liabilities: Accounts

payable $ 37,502 $ 36,861 Accrued expenses and other current

liabilities 147,646 163,029 Current maturities of long-term debt

4,500 - Deferred revenue 144,048 142,465 Liabilities to affiliates

1,951 1,847

Total current

liabilities 335,647 344,202

Long-term debt 592,500 583,234 Long-term deferred revenue

39,391 40,424 Other liabilities 43,821 45,038

Total liabilities 1,011,359

1,012,898 Preferred Stock - $0.001 par value;

authorized 2,500,000 shares. Series A convertible preferred stock;

293,000 shares issued and outstanding; aggregate liquidation

preference and redemption value of $341,918 at April 30, 2011.

285,542 285,542

Commitments and Contingencies Stockholders' Equity:

Common stock - $0.001 par value; authorized 120,000,000 shares.

Issued 38,579,000 and 37,349,000 shares, respectively; outstanding

38,305,000 and 37,089,000 shares, as of April 30, 2011 and January

31, 2011, respectively. 39 38 Additional paid-in capital 531,422

519,834 Treasury stock, at cost - 274,000 and 260,000 shares as of

April 30, 2011 and January 31, 2011, respectively. (7,141 ) (6,639

) Accumulated deficit (394,869 ) (394,757 ) Accumulated other

comprehensive loss (31,196 ) (42,069 )

Total

Verint Systems Inc. stockholders' equity 98,255

76,407 Noncontrolling interest 3,011

1,280

Total liabilities stockholders' equity

101,266 77,687 Total

liabilities, preferred stock, and stockholders' equity $

1,398,167 $ 1,376,127 Table 5

Verint Systems Inc. and Subsidiaries Condensed Consolidated

Statements of Cash Flows (Unaudited) (In thousands)

Three Months Ended April 30, 2011 2010

Cash flows from operating

activities: Net income (loss) $ 1,555 $ (15,616 )

Adjustments to reconcile net income (loss) to net cash provided

by (used in) operating activities: Depreciation and

amortization 12,954 11,898 Stock-based compensation 5,785 7,546

Non-cash losses on derivative financial instruments, net 1,933

1,703 Loss on extinguishment of debt 8,136 - Other non-cash items,

net 3,132 1,189

Changes in operating assets and liabilities, net

of effects of business combination: Accounts receivable 14,164

(13,787 ) Inventories (3,421 ) (488 ) Deferred cost of revenue

2,516 6,161 Prepaid expenses and other assets 1,178 1,501 Accounts

payable and accrued expenses (22,568 ) 14,959 Deferred revenue

(4,201 ) (18,476 ) Other, net (1,869 ) (1,110 )

Net cash provided by (used in) operating activities

19,294 (4,520 ) Cash

flows from investing activities: Cash paid for business

combination, net of cash acquired (11,958 ) (15,292 ) Purchases of

property and equipment (3,131 ) (1,878 ) Settlements of derivative

financial instruments not designated as hedges (826 ) (6,333 ) Cash

paid for capitalized software development costs (1,076 ) (462 )

Change in restricted cash and bank time deposits 1,543

205

Net cash used in investing

activities (15,448 ) (23,760

) Cash flows from financing activities:

Proceeds from borrowings, net of original issuance discount 597,000

- Repayments of borrowings and other financing obligations (583,362

) (580 ) Payment of debt issuance and other debt-related costs

(13,952 ) (897 ) Proceeds from exercises of stock options 5,122 -

Purchases of treasury stock (502 ) (3,312 ) Other financing

activities (1,804 ) -

Net cash provided by

(used in) financing activities 2,502

(4,789 ) Effect of exchange rate changes on

cash and cash equivalents 3,104

(1,863 ) Net increase (decrease) in cash and cash

equivalents 9,452 (34,932 ) Cash and

cash equivalents, beginning of period 169,906

184,335 Cash and cash equivalents,

end of period $ 179,358 $

149,403 Supplemental disclosures of cash

flow information: Cash paid for interest $ 13,027 $

3,538 Cash paid for income taxes, net of refunds received $

4,136 $ 1,525

Non-cash investing and financing

transactions: Accrued but unpaid purchases of property and

equipment $ 1,435 $ 495 Inventory transfers to

property and equipment $ 181 $ 77 Liabilities for

contingent consideration in business combinations $ 904 $

3,224 Stock options exercised, proceeds received subsequent

to period end $ 156 $ - Accrued but unpaid debt

issuance and other debt-related costs $ 999 $ -

Verint Systems Inc. and Subsidiaries

Supplemental Information About Non-GAAP

Financial Measures

This press release contains non-GAAP financial measures. Table 2

includes a reconciliation of each non-GAAP financial measure

presented in this press release to the most directly comparable

GAAP financial measure. Non-GAAP financial measures should not be

considered in isolation or as a substitute for comparable GAAP

financial measures. The non-GAAP financial measures we present have

limitations in that they do not reflect all of the amounts

associated with our results of operations as determined in

accordance with GAAP, and these non-GAAP financial measures should

only be used to evaluate our results of operations in conjunction

with the corresponding GAAP financial measures. These non-GAAP

financial measures do not represent discretionary cash available to

us to invest in the growth of our business, and we may in the

future incur expenses similar to or in addition to the adjustments

made in these non-GAAP financial measures.

We believe that the non-GAAP financial measures we present

provide meaningful supplemental information regarding our operating

results primarily because they exclude certain non-cash charges or

items that we do not believe are reflective of our ongoing

operating results when budgeting, planning and forecasting,

determining compensation, and when assessing the performance of our

business with our individual operating segments or our senior

management. We believe that these non-GAAP financial measures also

facilitate the comparison by management and investors of results

between periods and among our peer companies. However, those

companies may calculate similar non-GAAP financial measures

differently than we do, limiting their usefulness as comparative

measures.

Adjustments to Non-GAAP Financial

Measures

Revenue adjustments related to acquisitions. We exclude from our

non-GAAP revenue the impact of fair value adjustments required

under GAAP relating to acquired customer support contracts which

would have otherwise been recognized on a standalone basis. We

exclude these adjustments from our non-GAAP financial measures

because these are not reflective of our ongoing operations.

Amortization of acquired intangible assets, including acquired

technology. When we acquire an entity, we are required under GAAP

to record the fair value of the intangible assets of the acquired

entity and amortize it over their useful lives. We exclude the

amortization of acquired intangible assets, including acquired

technology, from our non-GAAP financial measures. These expenses

are excluded from our non-GAAP financial measures because they are

non-cash charges. In addition, these amounts are inconsistent in

amount and frequency and are significantly impacted by the timing

and size of acquisitions. Thus, we also exclude these amounts to

provide better comparability of pre- and post-acquisition operating

results.

Stock-based compensation expenses. We exclude stock-based

compensation expenses related to stock options, restricted stock

awards and units, and phantom stock from our non-GAAP financial

measures. These expenses are excluded from our non-GAAP financial

measures because they are primarily non-cash charges. In recent

periods, we also incurred significant cash-settled stock

compensation due to our extended filing delay and restrictions on

our ability to issue new shares of common stock to our

employees.

Other adjustments. We exclude from our non-GAAP financial

measures legal, other professional fees and certain other expenses

associated with acquisitions and certain extraordinary

transactions, in both cases, whether or not consummated. These

expenses are excluded from our non-GAAP financial measures because

we believe that they are not reflective of our ongoing

operations.

Expenses related to our filing delay. We exclude from our

non-GAAP financial measures expenses related to our restatement of

previously filed financial statements and our extended filing

delay. These expenses included professional fees and related

expenses, as well as expenses associated with a special cash

retention program. These expenses are excluded from our non-GAAP

financial measures because we believe that they are not reflective

of our ongoing operations.

Unrealized (gains) losses on derivatives, net. We exclude from

our non-GAAP financial measures unrealized gains and losses on

interest rate swaps and foreign currency derivatives. These gains

and losses are excluded from our non-GAAP financial measures

because they are non-cash transactions.

Loss on extinguishment of debt. We exclude from our non-GAAP

financial measures loss on extinguishment of debt attributable to

refinancing of our debt because we believe it is not reflective of

our ongoing operations.

Non-cash tax adjustments. Non-cash tax adjustments represent the

difference between the amount of taxes we actually paid and our

GAAP tax provision on an annual basis. On a quarterly basis, this

adjustment reflects our expected annual effective tax rate on a

cash basis.

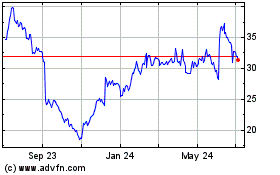

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From May 2024 to Jun 2024

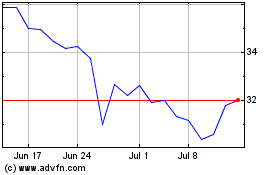

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Jun 2023 to Jun 2024