Verint Requests Stay of NASDAQ Panel Decision and Additional Extension from NASDAQ Listing Council; Continues to Wait for Final

September 06 2006 - 8:15AM

Business Wire

Verint Systems Inc. (NASDAQ: VRNT) today announced that the Company

has made a submission to The NASDAQ Listing and Hearing Review

Council requesting that the Listing Council grant a stay of the

NASDAQ Listing Qualifications Panel's August 18, 2006 decision

which established a deadline of September 25, 2006 for the Company

to file its Annual Report on Form 10-K for the fiscal year ended

January 31, 2006, its Quarterly Report on Form 10-Q for the fiscal

quarter ended April 30, 2006, and the Current Report on Form 8-K/A

to amend the Form 8-K dated January 9, 2006. The Company also

requested an additional 60 day extension from the date of the

Listing Council's decision to make the necessary filings. In

accordance with NASDAQ regulations, the Company's right to submit

this stay request expires on September 5, 2006. Therefore, the

Company has made this request to the NASDAQ Listing and Hearing

Review Council in order to avoid a potential de-listing because the

Company expects that it will be unable to meet the September 25,

2006 deadline. The Company was recently provided preliminary

measurement dates of Comverse Technology, Inc. stock options issued

to Verint's employees when the Company was a wholly-owned

subsidiary of Comverse. In that regard, the Company expects to

record non-cash stock-based compensation expense to prior periods.

Based on the preliminary measurement date conclusions of Comverse,

the Company expects that such non-cash charges may be material for

certain periods and the Company therefore preliminarily expects to

restate its historical financial statements for each of the fiscal

years ended January 31, 2005, 2004, 2003 and 2002. Such charges

could also affect periods prior to the fiscal year ended January

31, 2002. In addition to such stock based compensation charges, the

Company also expects to record certain material tax charges, make

various tax payments and pay third party fees and expenses relating

to the impact of the Comverse backdated options. These amounts have

not yet been determined. The Company believes that all stock

options issued by Verint Systems Inc. were granted at fair market

value on the date of grant and the related accounting for these

stock options in its publicly filed historical financial statements

was correct. There can be no assurance that the Listing Council

will grant the Company's requested extension or that the Company's

securities will remain listed on The NASDAQ Stock Market. The

Company intends to announce the Listing Council's decision promptly

after it receives written notice of such decision. About Verint

Systems Inc. Verint Systems Inc., headquartered in Melville, New

York, is a leading provider of analytic software-based solutions

for security and business intelligence. Verint software, which is

used by over 1,000 organizations in over 50 countries worldwide,

generates actionable intelligence through the collection, retention

and analysis of voice, fax, video, email, Internet and data

transmissions from multiple communications networks. Visit us at

our website www.verint.com. Note: Certain statements concerning

Verint's future revenues, earnings per share, results or prospects

are "forward-looking statements" under the Private Securities

Litigation Reform Act of 1995. There can be no assurances that

forward-looking statements will be achieved, and actual results

could differ materially from forecasts and estimates. Important

risks, uncertainties and other important factors that could cause

actual results to differ materially include, among others:

potential impact on Verint's financial results as a result of

Comverse's creation of a special committee of the Board of

Directors of Comverse to review matters relating to grants of

Comverse stock options, including but not limited to, the accuracy

of the stated dates of Comverse option grants and whether Comverse

followed all of its proper corporate procedures and the results of

the Comverse special committee's review; the effect of Verint's

failure to timely file all required reports under the Securities

Exchange Act of 1934, and the resultant potential delisting of

Verint's common stock on NASDAQ; the impact of governmental

inquiries arising out of or related to option grants; introducing

quality products on a timely basis that satisfy customer

requirements and achieve market acceptance; lengthy and variable

sales cycles create difficulty in forecasting the timing of

revenue; integrating the business and personnel of Mercom and CM

Insight; risks associated with significant foreign operations,

including fluctuations in foreign currency exchange rates;

aggressive competition in all of Verint's markets, which creates

pricing pressure; integrating the business and personnel of

MultiVision, including implementation of adequate internal

controls; managing our expansion in the Asia Pacific region; risks

that Verint's intellectual property rights may not be adequate to

protect its business or that others may claim that Verint infringes

upon their intellectual property rights; risks associated with

integrating the business and employees of Opus and RP

Sicherheissysteme GMBH; risks associated with Verint's ability to

retain existing personnel and recruit and retain qualified

personnel in all geographies in which Verint operates; decline in

information technology spending; changes in the demand for Verint's

products; challenges in increasing gross margins; risks associated

with changes in the competitive or regulatory environment in which

Verint operates; dependence on government contracts; expected

increase in Verint's effective tax rate; perception that Verint

improperly handles sensitive or confidential information; inability

to maintain relationships with value added resellers and systems

integrators; difficulty of improving Verint's infrastructure in

order to be able to continue to grow; risks associated with

Comverse Technology, Inc. controlling Verint's business and

affairs; and other risks described in filings with the Securities

and Exchange Commission. All documents are available through the

SEC's Electronic Data Gathering Analysis and Retrieval system

(EDGAR) at www.sec.gov or from Verint's website at www.verint.com.

Verint makes no commitment to revise or update any forward-looking

statements. Verint, the Verint word mark, Actionable Intelligence,

Powering Actionable Intelligence, STAR-GATE, RELIANT, NEXTIVA,

LORONIX, SmartSight, Lanex and ULTRA are trademarks of Verint

Systems Inc. Other names may be trademarks of their respective

owner.

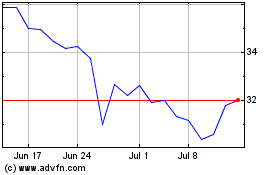

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From May 2024 to Jun 2024

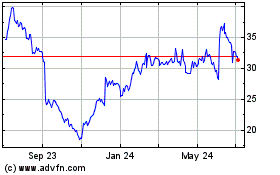

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Jun 2023 to Jun 2024