Universal Stainless & Alloy Products, Inc. (Nasdaq:

USAP) today reported net sales of $77.6 million for the

first quarter of 2024, which is the second highest total in company

history, following its record $79.8 million reported in the 2023

fourth quarter, and 18% higher than the first quarter 2023 total of

$65.9 million.

Sales of premium alloys totaled $20.1 million, or

25.9% of net sales, in the 2024 first quarter, compared to a record

$21.1 million, or 26.5% of sales, in the fourth quarter of 2023,

and $17.7 million, or 26.8% of sales, in the first quarter of

2023.

Aerospace is the Company's largest market for

premium alloy products, and strong demand continues. Aerospace

sales totaled $60.2 million, or 77.5% of net sales, in the first

quarter of 2024, versus a record $61.9 million, or 77.6% of sales,

in the fourth quarter of 2023, and $49.0 million, or 74.3% of

sales, in the first quarter of 2023.

Profitability continued to accelerate in the first

quarter of 2024 as gross margin reached $14.7 million, or 18.9% of

sales, versus 16.4% of sales, in the fourth quarter of 2023, and

11.7% of sales in the 2023 first quarter. Gross margin in the most

recent quarter continued to benefit from a rich product mix and

higher selling prices, despite raw material misalignment negatively

impacting margin by an estimated $1.3 million.

First quarter 2024 operating income rose 51% to

$7.3 million from $4.8 million in the fourth quarter of 2023, while

net income increased 59% to $4.1 million, or $0.43 per diluted

share, from $2.6 million, or $0.27 per diluted share, in the fourth

quarter of 2023. In the first quarter of 2023, the Company incurred

a loss of $0.5 million, or $0.06 per diluted share.

EBITDA for the first quarter of 2024 rose to $12.2

million from $9.6 million in the fourth quarter of 2023. Adjusted

EBITDA increased 27% to $12.6 million from $10.0 million in the

fourth quarter 2023. Net cash generated by operating activities

increased to $10.3 million for the first quarter. The Company used

approximately half of this cash to fund capital expenditures and

approximately half to decrease its net debt.

Christopher M. Zimmer, President and CEO,

commented: “We achieved the highest profitability in 12 years in

the first quarter, including a gross margin of 18.9%, on

near-record sales. Our performance was driven by robust aerospace

demand and the continued realization of base price increases

implemented over the past three years.

“Our strategy to focus on growth in premium alloys

has enhanced our results and has yielded a richer product mix and a

broader base of customer approvals.

“Aerospace and defense applications represent the

primary market for those products. The sustainability of aerospace

demand is reinforced in feedback from our customers and reflected

in our strong first quarter order entry and higher backlog.

“In addition to increasing sales in 2024 we are

focused on managing working capital and generating significant

positive cash flow to fund our strategic capital expenditures and

pay down debt.

“We continue to invest capital in our premium

alloy capacity and efficiency, including placing orders for the

addition of a second 18-ton furnace shell for the VIM at our North

Jackson facility, and a new box furnace to support the forge.

“2024 is off to a solid start. For the balance of

the year we see opportunities to increase sales and continue to

expand gross margins. We remain optimistic about our growth

momentum and strategy.”

Financial Position

Managed working capital, defined as accounts

receivable, plus inventory, minus accounts payable, was $152.3

million at March 31, 2024 compared with $148.8 million at December

31, 2023, and $150.7 million at March 31, 2023. Inventory at the

end of the first quarter of 2024 was $142.4 million, a decline of

2% from $144.7 million at the end of the 2023 fourth quarter, and

down 5% from $149.4 million at the end of first quarter of

2023.

Backlog (before surcharges) at March 31, 2024

remained strong at $325.1 million, compared with $318.2 million at

the end of December 2023. The average selling price per pound in

the backlog has increased 19% from the end of the first quarter of

2023.

The Company reduced total debt by $4.3 million to

$81.2 million from $85.6 million at year-end 2023. It is down by

$18.2 million from $99.4 million at the end of the 2023 first

quarter. First quarter 2024 interest expense of $2.0 million was

down 7% from $2.2 million in the fourth quarter of 2023, and was

flat with the 2023 first quarter.

Capital expenditures totaled $5.5 million compared

with $3.4 million in the fourth quarter of 2023 and $4.5 million in

the first quarter of 2023. Full year 2024 capital expenditures are

expected to approximate $18 million.

Conference Call and Webcast

The Company has scheduled a conference call for

today May 1st, at 11:00 a.m. (Eastern) to discuss

final first quarter 2024 results. If you wish to listen to the live

conference call via telephone, please Click Here

to register for the call and obtain your dial-in number and

personal PIN number. A simultaneous webcast will be available on

the Company’s website at www.univstainless.com, and thereafter

archived on the website through the end of the second quarter of

2024.

About Universal Stainless & Alloy

Products, Inc.

Universal Stainless & Alloy Products, Inc.,

established in 1994 and headquartered in Bridgeville, PA,

manufactures and markets semi-finished and finished specialty

steels, including stainless steel, nickel alloys, tool steel and

certain other alloyed steels. The Company's products are used in a

variety of industries, including aerospace, energy, and heavy

equipment manufacturing. More information is available at

www.univstainless.com.

Forward-Looking Information Safe

Harbor Except for historical information contained

herein, the statements in this release are forward-looking

statements that are made pursuant to the “safe harbor” provision of

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements involve known and unknown risks and

uncertainties that may cause the Company’s actual results in future

periods to differ materially from forecasted results. Those risks

include, among others, the Company’s ability to maintain its

relationships with its significant customers and market channels;

the Company’s response to competitive factors in its industry that

may adversely affect the market for finished products manufactured

by the Company or its customers; the Company’s ability to compete

successfully with domestic and foreign producers of specialty steel

products and products fashioned from alternative materials; changes

in overall demand for the Company’s products and the prices at

which the Company is able to sell its products in the aerospace

industry, from which a substantial amount of its sales is derived;

the Company’s ability to develop, commercialize, market and sell

new applications and new products; the receipt, pricing and timing

of future customer orders; the impact of changes in the Company’s

product mix on the Company’s profitability; the Company’s ability

to maintain the availability of raw materials and operating

supplies with acceptable pricing; the availability and pricing of

electricity, natural gas and other sources of energy that the

Company needs for the manufacturing of its products; risks related

to property, plant and equipment, including the Company’s reliance

on the continuing operation of critical manufacturing equipment;

the Company’s success in timely concluding collective bargaining

agreements and avoiding strikes or work stoppages; the Company’s

ability to attract and retain key personnel; the Company’s ongoing

requirement for continued compliance with laws and regulations,

including applicable safety and environmental regulations; the

ultimate outcome of the Company’s current and future litigation

matters; the Company’s ability to meet its debt service

requirements and to comply with applicable financial covenants;

risks associated with conducting business with suppliers and

customers in foreign countries; public health issues, including

COVID-19 and its impact on the Company and our customers and

suppliers; risks related to acquisitions that the Company may make;

the Company’s ability to protect its information technology

infrastructure against service interruptions, data corruption,

cyber-based attacks or network security breaches; the impact on the

Company’s effective tax rates from changes in tax rules,

regulations and interpretations in the United States and other

countries where it does business; and the impact of various

economic, credit and market risk uncertainties. Many of these

factors are not within the Company’s control and involve known and

unknown risks and uncertainties that may cause the Company’s actual

results in future periods to be materially different from any

future performance suggested herein. Any unfavorable change in the

foregoing or other factors could have a material adverse effect on

the Company’s business, financial condition and results of

operations. Further, the Company operates in an industry sector

where securities values may be volatile and may be influenced by

economic and other factors beyond the Company’s control. Certain of

these risks and other risks are described in the Company’s filings

with the SEC, including the Company’s Annual Report on Form 10-K

for the year ended December 31, 2023, copies of which are available

from the SEC or may be obtained upon request from the

Company.

Non-GAAP Financial Measures

This press release includes discussions of financial

measures that have not been determined in accordance with U.S.

Generally Accepted Accounting Principles (GAAP). These measures

include earnings (loss) before interest, income taxes, depreciation

and amortization (EBITDA) and adjusted EBITDA. We include these

measurements to enhance the understanding of our operating

performance. We believe that EBITDA, considered along with net

earnings (loss), is a relevant indicator of trends relating to cash

generating activity of our operations. adjusted EBITDA excludes the

effect of share-based compensation expense and noted special items

such as impairments and costs or income related to special events

such as periods of low activity or insurance claims. We believe

that excluding these costs provides a consistent comparison of the

cash generating activity of our operations. We believe that EBITDA

and adjusted EBITDA are useful to investors as they facilitate a

comparison of our operating performance to other companies who also

use EBITDA and adjusted EBITDA as supplemental operating measures.

These non-GAAP financial measures supplement our GAAP disclosures

and should not be considered an alternative to the GAAP measures.

These non-GAAP measures may not be entirely comparable to similarly

titled measures used by other companies due to potential

differences among calculation methodologies. A reconciliation of

these non-GAAP financial measures to their most directly comparable

financial measure prepared in accordance with GAAP is included in

the tables that follow.

[TABLES FOLLOW]

| UNIVERSAL

STAINLESS& ALLOY PRODUCTS,

INC.FINANCIAL HIGHLIGHTS(Dollars in

Thousands, Except Per Share Information)(Unaudited) |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

|

|

| |

|

Three months

ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Net

sales |

|

$ |

77,637 |

|

|

$ |

65,865 |

|

| |

|

|

|

|

|

|

|

|

| Cost of

products sold |

|

|

62,970 |

|

|

|

58,141 |

|

| |

|

|

|

|

|

|

|

|

|

Gross margin |

|

|

14,667 |

|

|

|

7,724 |

|

| |

|

|

|

|

|

|

|

|

| Selling,

general and administrative expenses |

|

|

7,409 |

|

|

|

6,275 |

|

| |

|

|

|

|

|

|

|

|

|

Operating income |

|

|

7,258 |

|

|

|

1,449 |

|

| |

|

|

|

|

|

|

|

|

| Interest

expense |

|

|

2,049 |

|

|

|

2,032 |

|

| Other

expense (income), net |

|

|

14 |

|

|

|

(42 |

) |

| |

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

|

|

5,195 |

|

|

|

(541 |

) |

| |

|

|

|

|

|

|

|

|

| Income

taxes |

|

|

1,058 |

|

|

|

(29 |

) |

| |

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

4,137 |

|

|

$ |

(512 |

) |

| |

|

|

|

|

|

|

|

|

| Net income

(loss) per common share - Basic |

|

$ |

0.45 |

|

|

$ |

(0.06 |

) |

| Net income

(loss) per common share - Diluted |

|

$ |

0.43 |

|

|

$ |

(0.06 |

) |

|

MARKET SEGMENT INFORMATION |

|

|

|

| |

|

|

|

|

(Dollars in thousands; unaudited) |

|

Three months

ended |

|

| |

|

March 31, |

|

| Net

Sales |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Service

centers |

|

$ |

58,271 |

|

|

$ |

49,323 |

|

| Original

equipment manufacturers |

|

|

6,854 |

|

|

|

4,208 |

|

|

Rerollers |

|

|

3,377 |

|

|

|

6,645 |

|

| Forgers |

|

|

7,846 |

|

|

|

5,029 |

|

| Conversion

services and other |

|

|

1,289 |

|

|

|

660 |

|

| |

|

|

|

|

|

|

|

|

|

Total net sales |

|

$ |

77,637 |

|

|

$ |

65,865 |

|

| MELT

TYPE INFORMATION |

|

|

|

| |

|

|

|

|

(Dollars in thousands; unaudited) |

|

Three months

ended |

|

| |

|

March 31, |

|

| Net

Sales |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Specialty

alloys |

|

$ |

56,255 |

|

|

$ |

47,549 |

|

| Premium

alloys * |

|

|

20,093 |

|

|

|

17,656 |

|

| Conversion

services and other sales |

|

|

1,289 |

|

|

|

660 |

|

| |

|

|

|

|

|

|

|

|

|

Total net sales |

|

$ |

77,637 |

|

|

$ |

65,865 |

|

| END

MARKET INFORMATION ** |

|

|

|

| |

|

|

|

|

(Dollars in thousands; unaudited) |

|

Three months

ended |

|

| |

|

March 31, |

|

| Net

Sales |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Aerospace |

|

$ |

60,208 |

|

|

$ |

48,958 |

|

| Energy |

|

|

6,013 |

|

|

|

5,838 |

|

| Heavy

equipment |

|

|

5,848 |

|

|

|

6,931 |

|

| General

industrial, conversion services and other |

|

|

5,568 |

|

|

|

4,138 |

|

| |

|

|

|

|

|

|

|

|

|

Total net sales |

|

$ |

77,637 |

|

|

$ |

65,865 |

|

|

* |

Premium alloys represent all vacuum induction melted (VIM)

products. |

|

** |

The majority

of our products are sold to service centers rather than the

ultimate end market customers. The end market information in this

press release is our estimate based upon our knowledge of our

customers and the grade of material sold to them, which they will

in-turn sell to the ultimate end market

customer. |

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

| |

|

|

|

|

|

|

|

(Dollars in thousands; unaudited) |

|

March

31, |

|

|

December

31, |

|

| |

|

2024 |

|

|

2023 |

|

|

Assets |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

866 |

|

|

$ |

394 |

|

| Accounts

receivable, net |

|

|

41,653 |

|

|

|

39,034 |

|

|

Inventory |

|

|

142,364 |

|

|

|

144,700 |

|

| Other

current assets |

|

|

10,525 |

|

|

|

11,693 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

195,408 |

|

|

|

195,821 |

|

| Property,

plant and equipment, net |

|

|

159,303 |

|

|

|

159,636 |

|

| Other

long-term assets |

|

|

1,235 |

|

|

|

1,233 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

355,946 |

|

|

$ |

356,690 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

$ |

31,707 |

|

|

$ |

34,855 |

|

| Accrued

employment costs |

|

|

8,113 |

|

|

|

6,492 |

|

| Current

portion of long-term debt |

|

|

3,772 |

|

|

|

3,733 |

|

| Other

current liabilities |

|

|

263 |

|

|

|

829 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

43,855 |

|

|

|

45,909 |

|

| Long-term

debt, net |

|

|

77,471 |

|

|

|

81,846 |

|

| Deferred

income taxes |

|

|

1,016 |

|

|

|

2 |

|

| Other

long-term liabilities, net |

|

|

2,874 |

|

|

|

2,891 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

125,216 |

|

|

|

130,648 |

|

|

Stockholders’ equity |

|

|

230,730 |

|

|

|

226,042 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

355,946 |

|

|

$ |

356,690 |

|

| CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOW |

| |

|

|

|

|

(Dollars in thousands; unaudited) |

|

Three months

ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating activities: |

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

4,137 |

|

|

$ |

(512 |

) |

|

Adjustments for non-cash items: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

5,005 |

|

|

|

5,032 |

|

|

Deferred income tax |

|

|

1,008 |

|

|

|

(68 |

) |

|

Share-based compensation expense |

|

|

454 |

|

|

|

361 |

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

(2,619 |

) |

|

|

(3,232 |

) |

|

Inventory, net |

|

|

1,874 |

|

|

|

4,320 |

|

|

Accounts payable |

|

|

(1,733 |

) |

|

|

(3,102 |

) |

|

Accrued employment costs |

|

|

1,621 |

|

|

|

649 |

|

|

Other, net |

|

|

523 |

|

|

|

57 |

|

| |

|

|

|

|

|

|

|

|

| Net cash

provided by operating activities |

|

|

10,270 |

|

|

|

3,505 |

|

| |

|

|

|

|

|

|

|

|

|

Investing activity: |

|

|

|

|

|

|

|

|

|

Payments for property, plant and equipment |

|

|

(5,462 |

) |

|

|

(4,499 |

) |

| |

|

|

|

|

|

|

|

|

| Net cash

used in investing activity |

|

|

(5,462 |

) |

|

|

(4,499 |

) |

| |

|

|

|

|

|

|

|

|

|

Financing activities: |

|

|

|

|

|

|

|

|

|

Net repayment of borrowings under revolving credit facility |

|

|

(3,484 |

) |

|

|

1,420 |

|

|

Issuance of common stock under share-based plans |

|

|

66 |

|

|

|

- |

|

|

Repayments of term loan facility and finance leases |

|

|

(918 |

) |

|

|

(935 |

) |

| |

|

|

|

|

|

|

|

|

| Net cash

(used in) provided by financing activities |

|

|

(4,336 |

) |

|

|

485 |

|

| |

|

|

|

|

|

|

|

|

| Net increase

(decrease) in cash |

|

|

472 |

|

|

|

(509 |

) |

| Cash at

beginning of period |

|

|

394 |

|

|

|

2,019 |

|

| Cash at end

of period |

|

$ |

866 |

|

|

$ |

1,510 |

|

|

RECONCILIATION OF NET INCOME (LOSS) TO EBITDA AND ADJUSTED

EBITDA |

| |

|

|

|

|

(Dollars in thousands; unaudited) |

|

Three months

ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) |

|

$ |

4,137 |

|

|

$ |

(512 |

) |

|

Interest expense |

|

|

1,984 |

|

|

|

1,968 |

|

|

Income taxes |

|

|

1,058 |

|

|

|

(29 |

) |

|

Depreciation and amortization |

|

|

5,005 |

|

|

|

5,032 |

|

| EBITDA |

|

|

12,184 |

|

|

|

6,459 |

|

|

Share-based compensation expense |

|

|

454 |

|

|

|

361 |

|

| Adjusted

EBITDA |

|

$ |

12,638 |

|

|

$ |

6,820 |

|

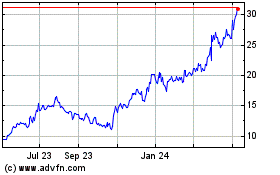

Unversal Stainless and A... (NASDAQ:USAP)

Historical Stock Chart

From Oct 2024 to Nov 2024

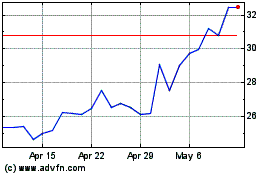

Unversal Stainless and A... (NASDAQ:USAP)

Historical Stock Chart

From Nov 2023 to Nov 2024