United Security Bancshares - 16.8% ROE for 2nd Quarter of 2004

FRESNO, Calif., July 12 /PRNewswire-FirstCall/ -- Dennis R. Woods,

President and Chief Executive Officer of United Security Bancshares

http://www.unitedsecuritybank.com/ (NASDAQ:UBFO) reported today the

results of operations for the 2nd quarter of 2004. Return on

average equity for the 2nd quarter was 16.8% and the return on

average assets was 1.52%. Net income was $2,072,000, as compared

with $2,211,000 in 2003, a decrease of 6.29%. Net income was

$3,770,000 for the six months ended June 30, 2004 as compared with

$3,946,000 in 2003, a decline of 4.46%. The net income decrease of

$176,000 in first half of 2004 resulted from several factors which,

except for income taxes, were more than offset by increased core

earnings. In the first half of 2003 the company earned shared

appreciation income of $406,000 while none was earned in 2004.

Costs associated with the Taft National Bank acquisition and

opening and operating the new Convention Center branch added costs

in excess of $100,000. The company earned $331,000 more, up 5.8%,

in pretax income in 2004 but accrued $507,000 more income tax than

in 2003. This resulted from the elimination of real estate

investment trust (REIT) tax benefits by the California Franchise

Tax Board (FTB). Core earnings growth outpaced these adversities,

except for income tax accruals, as evidenced by the increase in

pretax 2004 earnings. In 2003 the company utilized the tax benefit

provided by regulation in all but the 4th quarter. In the 4th

quarter 2003, after the FTB announcement, the company accrued state

income tax without regard to the REIT benefits for the entire year.

As a result, the tax accrual variance will continue to distort

comparative net income until the 4th quarter 2004. Basic earnings

per share for the 2nd quarter were $0.37 compared with $0.41 for

2003, a 9.8% decrease. Diluted earnings per share for the quarter

were also $0.37 compared with $0.40 a year ago. Year to date basic

earnings per share for 2004 were $0.68 compared with $0.73 in 2003,

a 6.8% decrease. Year to date diluted earning per share for 2004

were $0.67 compared with $0.72 in 2003, a 6.9% decrease. Woods

added, "I am very pleased with the pretax earnings numbers, up

$331,000 year to date. Once we get to the 4th quarter, net income

will once again be comparable. We continue to project a record year

for earnings." Return on average equity for the 2nd quarter was

16.8% and the return on average assets was 1.52%. For the same

period in 2003, ROAE was 20.9% and ROAA was 1.75%. For the six

months just ended, return on average equity was 15.9% and the

return on average assets was 1.45%. For the same period in 2003,

ROAE was 18.9% and ROAA was 1.57%. The stability of these key

ratios is indicative of the banks' consistent performance and

ability to build shareholder value, even during expansion. The 63rd

consecutive quarterly cash dividend of $0.16 per share, up from

$0.145 for an 10.3% increase from a year ago, was declared on June

22, 2004 to be paid on July 21, 2004, to shareholders of record on

July 9, 2004. Shareholders' equity ended the quarter at

$50,358,000, an increase of 16.8% over June 30, 2003. Dividends of

$3.3 million were paid out of shareholders' equity to shareholders

during the past 12 months. During the last 12 months $2,260,965

from shareholders' equity was used to purchase and retire Company

stock. The average price paid per share was $23.69 and the number

of shares purchased and retired was 95,445 shares. In addition,

$6,439,000 was added to shareholders' equity as a result of the

Taft National Bank acquisition. Net interest income for the 2nd

quarter 2004 was $6.0 million, up $1.5 million from 2003 for an

increase of 32.5%. The net interest margin increased from 3.87% in

2003 to 4.86% in the 2nd quarter of 2004. The increase is primarily

attributable to growth in earning assets and a decrease in funding

costs. Earning assets increased by $28 million over the past 12

months. Noninterest income for the 2nd quarter of 2004 was

$1,210,000, down from $1,551,000 in 2003 for a decrease of $341,000

or 22%. The decrease primarily resulted from $395,000 in shared

appreciation income in the 2nd quarter 2003 that did not reoccur in

2004 and was partially offset from increases in service charges on

deposit accounts. 2nd quarter operating expenses for the three

months ended June 30 were $3,540,000 for 2004 and $2,693,000 for

2003, an increase of $834,000 or 31.4%. The primary factors

contributing to the rise were salaries and other employee benefits

related to the Taft acquisition, Convention Center branch, and

other key staff position additions to better poise the company for

continued strong growth. The efficiency ratio changed to 50.1% for

2004 from 47.0% in 2003. The provision for loan loss was $640,000

for the first half of 2004 and $501,000 for same period in 2003.

The banks model used to determine the adequacy of the allowance for

loan losses is the primary factor for establishing the amount of

the provision for loan losses and is considered adequate.

Nonperforming assets improved to 3.25% of total assets on June 30,

2004 from 4.05% at March 31, 2004. United Security Banc shares is a

$562 million bank holding company. United Security Bank, it's

principal subsidiary is a state chartered bank and member of the

Federal Reserve Bank of San Francisco. FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements about the

company for which the company claims the protection of the safe

harbor provisions contained in the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are based on

management's knowledge and belief as of today and include

information concerning the company's possible or assumed future

financial condition, and its results of operations, business and

earnings outlook. These forward-looking statements are subject to

risks and uncertainties. A number of factors, some of which are

beyond the company's ability to control or predict, could cause

future results to differ materially from those contemplated by such

forward-looking statements. These factors include (1) changes in

interest rates, (2) significant changes in banking laws or

regulations, (3) increased competition in the company's market, (4)

other-than-expected credit losses, (5) earthquake or other natural

disasters impacting the condition of real estate collateral, (6)

the effect of acquisitions and integration of acquired businesses,

(7) the impact of proposed and/or recently adopted changes in

regulatory, judicial, or legislative tax treatment of business

transactions, particularly recently enacted California tax

legislation and the subsequent Dec. 31, 2003, announcement by the

Franchise Tax Board regarding the taxation of REITs and Riches; and

(8) unknown economic impacts caused by the State of California's

budget issues. Management cannot predict at this time the severity

or duration of the effects of the recent business slowdown on our

specific business activities and profitability. Weaker or a further

decline in capital and consumer spending, and related recessionary

trends could adversely affect our performance in a number of ways

including decreased demand for our products and services and

increased credit losses. Likewise, changes in deposit interest

rates, among other things, could slow the rate of growth or put

pressure on current deposit levels. Forward-looking statements

speak only as of the date they are made, and the company does not

undertake to update forward-looking statements to reflect

circumstances or events that occur after the date the statements

are made, or to update earnings guidance including the factors that

influence earnings. For a more complete discussion of these risks

and uncertainties, see the company's Quarterly Report on Form 10-K

for the year ended December 31, 2003, and particularly the section

of Management's Discussion and Analysis. United Security Bancshares

Consolidated Balance Sheets (unaudited) (Dollars in thousands) June

30, June 30, 2004 2003 Cash & noninterest-bearing deposits in

other banks $24,170 $17,802 Interest-bearing deposits in other

banks 8,113 9,001 Federal funds sold 22,455 12,090 Investment

securities 94,889 99,913 Loans, net of unearned fees 383,001

349,268 Less: allowance for loan losses (6,951) (5,060) Loans, net

376,049 344,209 Premises and equipment, net 7,286 5,251 Intangible

assets 4,228 2,123 Other assets 24,974 21,338 TOTAL ASSETS $562,165

$511,726 Deposits: Noninterest-bearing demand & NOW $160,734

$122,524 Savings 31,121 24,974 Time 298,590 293,056 Total deposits

490,445 440,554 Borrowed funds 194 9,482 Other liabilities 5,704

3,569 Trust Preferred Securities 0 15,000 Junior subordinated

debentures 15,464 0 TOTAL LIABILITIES $511,807 $468,605

Shareholders' equity: Common shares outstanding: 5,701,355 at Jun.

30, 2004 5,445,145 at Jun. 30, 2003 $22,835 $17,724 Retained

earnings 29,065 25,013 Unallocated ESOP shares (162) (441) Other

comprehensive income (loss) ($1,379) $826 Total shareholders'

equity $50,358 $43,121 TOTAL LIABILITIES & SHAREHOLDERS' EQUITY

$562,165 $511,726 United Security Bancshares Consolidated

Statements of Income (unaudited) Three Three Six Six Months Months

Months Months Ending Ending Ending Ending Jun 30 Jun 30 Jun 30 Jun

30 2004 2003 2004 2003 Interest income $7,574 $6,418 $14,140

$13,176 Interest expense 1,554 1,876 3,009 4,055 Net interest

income 6,020 4,542 11,130 9,121 Provision for loan losses 397 256

640 501 Other income 1,210 1,551 2,314 2,659 Other expenses 3,540

2,693 6,737 5,541 Income before income taxes 3,293 3,144 6,067

5,738 Provision for income taxes 1,221 932 2,297 1,792 NET INCOME

$2,072 $2,211 $3,770 $3,946 United Security Bancshares Selected

Financial Data Three Three Six Six Months Months Months Months

Ended Ended Ended Ended 06/30 06/30 06/30 06/30 /2004 /2004 /2004

/2004 Basic Earnings Per Share $0.37 $0.41 $0.68 $0.73 Diluted

earning Per share $0.37 $0.40 $0.67 $0.72 Annualized Return on:

Average Assets 1.52% 1.75% 1.45% 1.57% Average Equity 16.76% 20.90%

15.93% 18.93% Net Interest Margin 4.86% 3.88% 4.69% 3.90% Net

Charge-offs to Average Loans -0.01% 0.05% 0.09% 0.28% 06/30/2004

06/30/2004 Book Value Per Share $8.83 $7.92 Tangible Book Value Per

Share $8.09 $7.53 Efficiency Ratio 50.11% 47.04% Non Performing

Assets to Total Assets 3.25% 4.49% Allowance for Loan Losses to

Total Loans 1.81% 1.45% Shares Outstanding - period end 5,701,355

5,445,145 DATASOURCE: United Security Bancshares CONTACT: Dennis R.

Woods, President and Chief Executive Officer of United Security

Bank, +1-559-248-4928 Web site: http://www.unitedsecuritybank.com/

Copyright

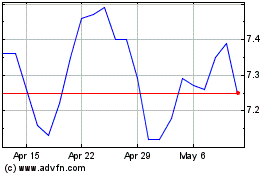

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From May 2024 to Jun 2024

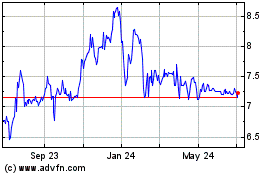

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From Jun 2023 to Jun 2024