United Security Bancshares and Legacy Bank, N.A. Agree to Merge

October 06 2006 - 9:04PM

PR Newswire (US)

FRESNO, Calif., Oct. 6 /PRNewswire-FirstCall/ -- United Security

Bancshares ("USB") http://www.unitedsecuritybank.com/ (NASDAQ:UBFO)

and Legacy Bank, N.A. (OTC:LCKB) (BULLETIN BOARD: LCKB) announced

today the signing of a definitive merger agreement providing for

the merger of Legacy Bank, N.A. with and into United Security Bank,

a wholly owned subsidiary of USB. Upon completion of the merger,

Legacy Bank's branch office will be operated as a branch office of

United Security Bank. In the merger, USB will issue shares of its

stock in a tax free exchange for all of the Legacy Bank shares. The

total value of the transaction is expected to be approximately

$21.7 million. The merger is expected to be completed in the first

quarter 2007. Legacy Bank operates one banking office in Campbell,

California serving small business and retail banking clients. As of

September 30, 2006, Legacy Bank had total assets of $82 million and

deposits of $72 million. Dennis Woods, President and Chief

Executive Officer of USB, stated, "The addition of Legacy Bank to

United Security Bank will open a dynamic new market for us. Legacy

Bank has built a solid business banking and retail franchise with

an excellent reputation for service. With its small business and

retail banking focus, Legacy Bank provides a unique opportunity for

United Security Bank to serve a loyal and growing small business

niche and individual client base. The merger is projected to be

accretive to USB in 2007." Thomas Ray, CEO of Legacy Bank,

commented, "We have followed the success of USB over the years and

believe that its community banking philosophy fits extremely well

with the strong community commitment that Legacy has consistently

maintained. This merger will enable us to expand our ability to

serve our clients and increase our lending capabilities. We also

believe this merger will give us an opportunity to participate more

fully in the economic growth of our marketplace." Terms of the

Merger The terms of the merger agreement provide for the

shareholders of Legacy Bank to receive USB shares with a market

value of $13.00 based upon the average closing price of USB shares

during the 20 business day period prior to the merger, less the net

costs of termination of Legacy's data processing/technology

agreements divided by the outstanding number of shares of Legacy

Bank common stock, provided that there are no stock options or

warrants exercised for shares of Legacy Bank common stock. Legacy

Bank currently has 1,672,373 shares of common stock outstanding.

Immediately prior to the merger, all outstanding options and

warrants will be cancelled by Legacy Bank and optionees and warrant

holders will receive a cash payment equal to the difference between

the option exercise price and the merger consideration for each

share subject to an option or a warrant. In the event any options

or warrants for shares of Legacy Bank common stock are exercised,

the market value of USB shares Legacy shareholders receive will

decrease based upon a set formula. The merger is subject to certain

conditions, including the approval of the shareholders of Legacy

Bank, and regulatory approval. Upon consummation of the merger,

former Legacy Bank shareholders will own approximately 7% of USB's

outstanding shares. About United Security Bancshares United

Security Bancshares is a bank holding company registered with the

Board of Governors of the Federal Reserve System. USB's primary

subsidiary is United Security Bank a state chartered bank based in

Fresno, California with over $664 million in assets and with 10

branches and a construction lending office. United Security Bank

offers a full range of commercial banking services primarily to the

business and professional community and individuals located in

Fresno, Madera and Kern Counties. About Legacy Bank, N.A. Legacy

Bank is a National Bank located in Campbell, California which began

operations in 2003 and has approximately $82 million in assets.

Legacy Bank was formed as a community bank and focuses primarily

upon local banking service and community needs including the

banking needs of small-to-medium size businesses, professionals,

entrepreneurs, and hospitality industry clients. As previously

disclosed in its filings with the OCC, Legacy Bank has recently

experienced the loss of certain senior management and Legacy Bank

believes that the consummation of the merger will resolve this

issue. Additional Information about the Merger and Where to Find It

In connection with the Merger, USB intends to file with the

Securities and Exchange Commission a registration statement on Form

S-4 that will contain a Proxy Statement/Prospectus. Investors and

security holders are urged to read the Registration Statement and

the Proxy Statement/Prospectus carefully when they become available

because they will contain important information about USB, Legacy

Bank and the merger. The Proxy Statement/Prospectus and other

relevant materials (when they become available), and any other

documents filed by USB with the SEC, may be obtained free of charge

at the SEC's web site at http://www.sec.gov/. In addition,

investors and security holders may obtain free copies of other

documents filed with the SEC by USB by directing a written request

to: United Security Bancshares, 1525 E. Shaw Avenue, Fresno, CA

93710 Attention: Investor Relations. Investors and security holders

are urged to read the Proxy Statement/Prospectus and the other

relevant materials when they become available before making any

voting or investment decision with respect to the Merger. USB and

its directors and executive officers and Legacy and its directors

and executive officers may be deemed to be participants in the

solicitation of proxies from the shareholders of Legacy Bank in

connection with the Merger. Information regarding the special

interests of these directors and executive officers in the Merger

will be included in the Proxy Statement/Prospectus referred to

above. Additional information regarding the directors and executive

officers of USB is also included in USB's Proxy Statement dated

April 17, 2006, which was filed with the SEC on April 14, 2006.

This document is available free of charge at the SEC's web site

(http://www.sec.gov/) and from Investor Relations at USB at the

address described above. Information regarding directors and

executive officers of Legacy Bank is contained in its Proxy

Statement dated May 26, 2006. This document is available free of

charge from Legacy Bank, Investor Relations, 125 E. Campbell

Avenue, Campbell, CA 95008. This communication shall not constitute

an offer to sell or the solicitation of an offer to buy any

security, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended. DATASOURCE: United Security Bancshares CONTACT: Dennis R.

Woods, President & CEO, +1-559-248-4928, or Ken Donahue, SVP

& CFO, +1-559-248-4943, both of United Security Bancshares; or

Tom Ray, President & CEO of Legacy Bank, N.A., +1-408-896-1647

Web site: http://www.unitedsecuritybank.com/

Copyright

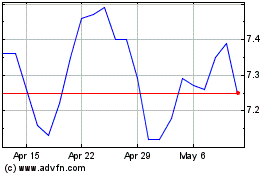

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From Jun 2024 to Jul 2024

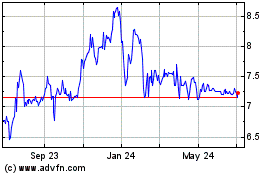

United Security Bancshares (NASDAQ:UBFO)

Historical Stock Chart

From Jul 2023 to Jul 2024