uniQure N.V. (NASDAQ: QURE), a leading gene therapy company

advancing transformative therapies for patients with severe medical

needs, today reported its financial results for the first quarter

of 2020 and highlighted recent progress across its business.

“Despite the ongoing global crisis caused by the

coronavirus pandemic, we ended the first quarter of 2020 in a

position of strength and remain well capitalized,” stated Matt

Kapusta, chief executive officer of uniQure. “I am very proud of

the continued dedication of our employees in both the United States

and the Netherlands, and thank them for the outstanding work they

continue to do in driving forward our clinical programs, research

pipeline, and manufacturing and technology operations. We are

well positioned for an important second half of the year when we

expect to announce new clinical data and advancements from across

the business.”

Recent Company Progress

• Advancing late-stage development of

etranacogene dezaparvovec (AMT-061) for the treatment of hemophilia

B

- In the first quarter, the Company

announced the achievement of targeted dosing of patients in the

HOPE-B pivotal trial of etranacogene dezaparvovec (AMT-061), an

investigational AAV5-based gene therapy incorporating the

patent-protected FIX-Padua variant for the treatment of patients

with severe and moderately severe hemophilia B. A total of 54

patients now have received the one-time dose of etranacogene

dezaparvovec.

- The Company remains on track to

provide 26-weeks of Factor IX data for all 54 patients in the

HOPE-B trial before the end of this year and to file an application

for marketing authorization in 2021.

- The manufacturing process

validation for etranacogene dezaparvovec is ongoing, and the

Company believes it is able to produce material at commercial

scale.

• Advancing AMT-130 into clinical

development for the treatment of Huntington’s

disease

- In March 2020, the Company

announced that the first two patients in the Phase I/II clinical

trial of AMT-130 in Huntington’s disease have been enrolled after

successfully meeting all screening and eligibility criteria. Due to

the impact of the coronavirus pandemic, the two procedures that

were scheduled to occur in late March have been temporarily

postponed.

- The Company continues its work to

resume treatment in the Phase I/II trial as soon as it is

clinically appropriate and will provide further updates on the

program at that time.

• Advancing research pipeline of gene

therapy candidates and the Company’s proprietary

technologies

- Earlier this month, the Company

announced its significant scientific presence at the upcoming

American Society of Gene and Cell Therapy Virtual Annual Meeting,

to be held May 12-15, 2020. In total, 22 data presentations will be

delivered by the Company’s researchers and scientists, including

five oral presentations.

- The data presentations will

highlight the Company’s industry-leading research and technology

capabilities and feature new preclinical findings on the Company’s

gene therapy candidates for hemophilia A, spinocerebellar ataxia

type 3 and Fabry disease.

• Strong cash position to advance the

Company’s programs

- As of March 31, 2020, the Company

held cash and cash equivalents of $342.0 million, which is expected

to be sufficient to fund the Company’s operations into 2022.

Upcoming Investor Events

• SunTrust Robinson Humphrey

(STRH) Virtual Life Sciences Summit, May 5 – 6, 2020.

• American Society of Gene and

Cell Therapy Virtual Annual Meeting, May 12 -15, 2020.

• Huntington's Disease

Regulatory Science Consortium Virtual Annual Meeting, May 18 – 19,

2020.

• Goldman Sachs Virtual Annual

Healthcare Conference, June 9 – 11, 2020.

• Credit Suisse 2020 Summer

Biotech Conference, June 22 -24, 2020.

Financial Highlights

Cash Position: As of March 31,

2020, the Company held cash and cash equivalents of $342.0 million,

compared to $377.8 million as of December 31, 2019. The

Company currently expects cash and cash equivalents will be

sufficient to fund operations into 2022.

Revenues: Revenue for the three

months ended March 31, 2020 was $0.1 million, compared to $1.1

million for the same period 2019. The decrease in 2020

reflects the reduction of activities following the end of the

initial Research Term in May 2019 of our collaboration with

Bristol-Myers Squibb (“BMS”).

R&D Expenses: Research and

development expenses were $26.0 million for the three months ended

March 31, 2020, compared to $20.5 million for the same period 2019.

The change was primarily related to increased activities associated

with our ongoing clinical studies of etranacogene dezaparvovec, the

Phase I/II trial of AMT-130, increased share-based compensation and

the additional recruitment of personnel to support the development

of product candidates.

SG&A Expenses: Selling,

general and administrative expenses were $9.1 million for the three

months ended March 31, 2020, compared to $8.1 million for the same

period 2019. The change was primarily related to increases in

personnel and contractor related expenses.

Other income, net: Other income

was $6.5 million for the three months ended March 31, 2020,

compared to other expense of $0.3 million for the same period 2019,

primarily reflecting foreign currency gains and a gain related to

the change in fair value of the BMS warrants.

Net Loss: The net loss for the

three months ended March 31, 2020 and March 31, 2019, was $28.0

million, or $0.63 loss per share and $27.8 million, or $0.74 loss

per share, respectively.

About uniQure

uniQure is delivering on the promise of gene

therapy – single treatments with potentially curative results. We

are leveraging our modular and validated technology platform to

rapidly advance a pipeline of proprietary gene therapies to treat

patients with hemophilia B, hemophilia A, Huntington's disease,

Fabry disease, spinocerebellar ataxia Type 3 and other

diseases. www.uniQure.com

uniQure Forward-Looking

Statements

This press release contains forward-looking

statements. All statements other than statements of historical fact

are forward-looking statements, which are often indicated by terms

such as "anticipate," "believe," "could," "estimate," "expect,"

"goal," "intend," "look forward to", "may," "plan," "potential,"

"predict," "project," "should," "will," "would" and similar

expressions. Forward-looking statements are based on management's

beliefs and assumptions and on information available to management

only as of the date of this press release. These forward-looking

statements include, but are not limited to, our ability to provide

top-line data or any further clinical updates and data with respect

to our pivotal Phase III trial of AMT-061 before the end of 2020 or

ever, our ability to submit a BLA for marketing authorization of

etranacogene dezaparvovec in 2021, or ever, our ability to resume

treatment or to dose the first two patients in the AMT-130 Phase

I/II clinical trial, our ability to fund operations into 2022, and

our ability to announce new clinical data and advancements from

across the business later in 2020. Our actual results could differ

materially from those anticipated in these forward-looking

statements for many reasons, including, without limitation, risks

associated with the impact of the ongoing COVID-19 pandemic on our

Company and the wider economy and health care system, our clinical

development activities, clinical results, collaboration

arrangements, regulatory oversight, product commercialization and

intellectual property claims, as well as the risks, uncertainties

and other factors described under the heading "Risk Factors" in our

Quarterly Report on Form 10-Q filed on April 29, 2020. Given these

risks, uncertainties and other factors, you should not place undue

reliance on these forward-looking statements, and we assume no

obligation to update these forward-looking statements, even if new

information becomes available in the future.

|

uniQure Contacts: |

|

|

| |

|

|

| FOR INVESTORS: |

|

FOR MEDIA: |

| |

|

|

| Maria E. Cantor |

Eva M. Mulder |

Tom Malone |

| Direct: 339-970-7536 |

Direct: +31 20 240 6103 |

Direct: 339-970-7558 |

| Mobile: 617-680-9452 |

Mobile: +31 6 52 33 15 79 |

Mobile:339-223-8541 |

| m.cantor@uniQure.com |

e.mulder@uniQure.com |

t.malone@uniQure.com |

uniQure N.V.

UNAUDITED CONSOLIDATED BALANCE

SHEETS

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

March

31, |

|

December

31, |

|

|

2020 |

|

2019 |

|

|

|

(in

thousands, except share and per share amounts) |

|

|

Current assets |

|

|

|

|

|

Cash and cash equivalents |

$ |

342,029 |

|

$ |

377,793 |

|

| Accounts

receivable and accrued income from related party |

|

258 |

|

|

947 |

|

| Prepaid

expenses |

|

5,738 |

|

|

4,718 |

|

| Other

current assets |

|

1,576 |

|

|

748 |

|

|

Total current assets |

|

349,601 |

|

|

384,206 |

|

|

Non-current assets |

|

|

|

|

| Property,

plant and equipment, net of accumulated depreciation of $29.8

million as of March 31, 2020 and $28.6 million as of December 31,

2019 respectively |

|

27,736 |

|

|

28,771 |

|

| Operating

lease right-of-use assets |

|

26,288 |

|

|

26,797 |

|

| Intangible

assets, net |

|

7,211 |

|

|

5,427 |

|

|

Goodwill |

|

486 |

|

|

496 |

|

| Restricted

cash |

|

2,921 |

|

|

2,933 |

|

|

Total non-current assets |

|

64,642 |

|

|

64,424 |

|

|

Total assets |

$ |

414,243 |

|

$ |

448,630 |

|

|

Current liabilities |

|

|

|

|

| Accounts

payable |

$ |

4,989 |

|

$ |

5,681 |

|

| Accrued

expenses and other current liabilities |

|

9,507 |

|

|

12,457 |

|

| Current

portion of operating lease liabilities |

|

5,900 |

|

|

5,865 |

|

| Current

portion of deferred revenue |

|

6,732 |

|

|

7,627 |

|

|

Total current liabilities |

|

27,128 |

|

|

31,630 |

|

|

Non-current liabilities |

|

|

|

|

| Long-term

debt |

|

36,209 |

|

|

36,062 |

|

| Operating

lease liabilities, net of current portion |

|

30,518 |

|

|

31,133 |

|

| Deferred

revenue, net of current portion |

|

23,713 |

|

|

23,138 |

|

| Derivative

financial instruments related party |

|

1,004 |

|

|

3,075 |

|

| Other

non-current liabilities |

|

524 |

|

|

534 |

|

|

Total non-current liabilities |

|

91,968 |

|

|

93,942 |

|

|

Total liabilities |

$ |

119,096 |

|

$ |

125,572 |

|

|

Total shareholders' equity |

|

295,147 |

|

|

323,058 |

|

|

Total liabilities and shareholders' equity |

$ |

414,243 |

|

$ |

448,630 |

|

| |

|

|

|

|

uniQure N.V.

UNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS

| |

|

|

|

|

| |

|

|

|

|

| |

Three months ended March 31, |

|

|

|

2020 |

|

2019 |

|

| |

(in

thousands, except share and per share amounts) |

|

|

Total revenues |

$ |

104 |

|

$ |

1,136 |

|

|

Operating expenses: |

|

|

|

|

| Research and

development expenses |

|

(26,013) |

|

|

(20,537) |

|

| Selling,

general and administrative expenses |

|

(9,072) |

|

|

(8,067) |

|

|

Total operating expenses |

|

(35,085) |

|

|

(28,604) |

|

| Other

income |

|

857 |

|

|

313 |

|

| Other

expense |

|

(339) |

|

|

(349) |

|

| Loss

from operations |

|

(34,463) |

|

|

(27,504) |

|

| Non

operating items, net |

|

6,464 |

|

|

(268) |

|

| Net

loss |

$ |

(27,999) |

|

$ |

(27,772) |

|

| |

|

|

|

|

| Basic and

diluted net loss per ordinary share |

$ |

(0.63) |

|

$ |

(0.74) |

|

| Weighted

average shares used in computing basic and diluted net loss per

ordinary share |

|

44,279,456 |

|

|

37,676,172 |

|

| |

|

|

|

|

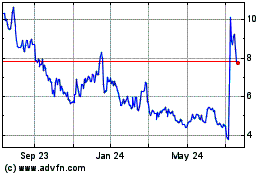

uniQure NV (NASDAQ:QURE)

Historical Stock Chart

From Jun 2024 to Jul 2024

uniQure NV (NASDAQ:QURE)

Historical Stock Chart

From Jul 2023 to Jul 2024