Retail Stocks: Poised to Pop - Investment Ideas

October 19 2011 - 8:00PM

Zacks

Say what you will, consumers aren't listening...and that's a good

thing.

A couple months ago stocks dropped off of a cliff as investors

began fretting over the economy heading back into a recession.

Citing slower growth in coming quarters, a stagnant labor market,

and any number of data points that would back them up.

News from the European Union also has the market in a

hammerlock. Headlines alone have sparked 3% swings in both

directions. That has many on edge and quick to sell assets.

Falling on Deaf Ears

Now, I'm not saying those faceless consumers, i.e. you and me,

don't care about the possibility of tougher times ahead, but they

certainly aren't acting like they do.

Surveys are showing that those issues do weigh on our minds.

Last week the Thomson Reuters/University of Michigan consumer

sentiment reading slipped, unexpectedly, falling short of analyst

expectations.

But, that didn't seem the change anyone's spending habits.

Retail sales last month were up 1.1%, about 40 basis points higher

than expected. So, if consumers are worried, maybe they are just

coping by treating themselves.

Cha Ching!

Who knows the real reasons for the disconnect, but it does mean

we could see a great quarter for retailers. The industry was hit

pretty hard, because most assumed discretionary spending would be

reined in.

Maybe some have, but the data isn't showing that. So, here are a

few retailers that could have a strong finish to 2011.

Tractor Supply Co (TSCO) is no stranger to most,

constantly setting new all-time highs over the past couple years.

The company focuses on rural markets in the U.S., offering a wide

variety of products from home decor and clothing to truck and farm

equipment.

Just yesterday, the company beat Wall Street's forecast for

sales and earnings, then went on to raise the outlook for the rest

of the year. The low end of TSCO's sales and earnings guidance is

now above the current consensus for both figures. Same store sales

jumped almost 12%. EPS came in at $0.58, up 35% and 6 cents above

the Zacks Consensus Estimate.

Shares jumped about 8% on the news.

Select Comfort (SCSS) probably didn't do that well, I

mean who is mattress shopping in a shaky economy?

Apparently, a lot of people. And these aren't your

run-of-the-mill mattresses; the company offers its signature "Sleep

Number" beds that offer adjustable firmness on each side and come

with a pretty hefty price tag.

SCSS also came in well ahead of expectations yesterday, with EPS

of $0.31 compared to the $0.27 that analysts were looking for. The

company also went on to raise guidance and is seeing double-digit

revenue growth.

The stock soared 20% on the earnings surprise.

Looking Ahead

Those are just 2 examples and they already posted surprises.

However, there are plenty of retailer and discretionary stocks on

deck if you're looking to get in ahead of a report.

Dick's Sporting Goods, Inc (DKS) is not coming up for a

few weeks, but could benefit from surprising consumer spending

trends. Shares are a Zacks #1 Rank (Strong Buy).

Maybe casinos are doing better than expected. Plenty are set to

report in the next week or 2, including Ameristar Casinos

(ASCA) which is due up on Nov 3. Estimates are rising into the

number, which is a great sign. Pinnacle Entertainment (PNK)

is also seeing upward earnings revisions ahead of its earnings

release next week.

Follow the Money

Consumers are spending, despite their economic worries. So, if

sales have been above expectations recently, that means there

should be plenty of earnings surprises for companies that rely on

consumer spending. There are a few examples above, but hundreds

more are out there. Roll up your sleeves and dig in.

Bill Wilton is the Aggressive Growth Stock Strategist for

Zacks.com. He is also the Editor in charge of the Zacks Home Run

Investor service

AMERISTAR CASIN (ASCA): Free Stock Analysis Report

DICKS SPRTG GDS (DKS): Free Stock Analysis Report

PINNACLE ENTRTN (PNK): Free Stock Analysis Report

SELECT COMFORT (SCSS): Free Stock Analysis Report

TRACTOR SUPPLY (TSCO): Free Stock Analysis Report

Zacks Investment Research

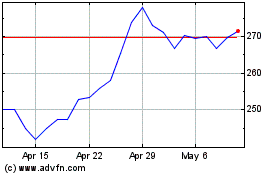

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From May 2024 to Jun 2024

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Jun 2023 to Jun 2024