Tractor Supply Ahead of Estimate - Analyst Blog

July 21 2011 - 5:00AM

Zacks

Tractor Supply Co.

(TSCO), a leading retail firm and ranch store brand, recorded yet

another quarter of good growth. Earnings per share in the second

quarter of fiscal 2011 came in at $1.23, surpassing the Zacks

Consensus Estimate of $1.20 as well as the prior-year earnings of

$1.04 per share.

Robust performance in core

consumable, usable and edible products − for instance, pet food and

animal feed − acted as a catalyst for an increase of 4.6% in

same-store sales compared with a rise of 6.1% in the prior-year

quarter. Tractor Supply has been witnessing increasing trends in

same-store sales.

During the recession, Tractor

Supply had suffered setbacks as buyers avoided big-ticket purchases

such as mowers, but recent quarters have positively seen an uptick

in results. The company's impressive merchandising improvement

strategy and solid same-store sales trend resulted in double-digit

top-line growth for the company. Net sales in the quarter surged

10.6% to $1,178.4 million from $1,065.7 million in the prior-year

quarter. However, total revenue fell short of the Zacks Consensus

Estimate of $1,193.0 million.

Better direct product margin was

partially offset by higher transportation costs. The resultant

gross profit surged 11.8% to $402.5 million compared with $360.1

million in the prior-year quarter. Gross margin expanded 30 basis

points to 34.1% in the quarter primarily due to improved inventory

management, strategic sourcing, private branding and pricing.

Strong same-store sales coupled

with cost control on advertising and store occupancy expenses

resulted in a 30 basis point improvement in selling and

administration expenses, as a percentage of sales, which came in at

21.9% versus 22.2% in the prior-year quarter. Tractor Supply earned

$91.2 million in the quarter, exceeding the prior-year quarter net

income of $77.3 million.

Financial

Position

Tractor Supply's balance sheet had

cash and cash equivalents of $185.5 million at the end of the

quarter compared with $181.1 million at the end of the prior-year

period. Stockholders' equity came in at $940.7 million compared

with $864.4 million in the second quarter of fiscal 2010. In the

first six months of fiscal 2011, the company generated $117.4

million of cash from its operating activities compared with $71.0

million in the prior-year period.

Store Update

In the quarter under review,

Tractor Supply opened 16 new stores and relocated 1 store. The

company currently runs as many as 1,043 stores in 44 states.

Management

Guidance

Tractor is well positioned to

capitalize on positive long-term trends. The company now expects

sales for fiscal 2011 to range between $4.10 billion and $4.14

billion backed by expectation of same-store sales increase of 5% to

6.0%. This is higher from the previous sales and same-store sales

guidance of $4.04 to $4.11 billion and 3.5% and 5%,

respectively.

On the back of perked-up results

and brighter sales trends, Tractor Supply raised its earnings

expectation for 2011 to range between $2.75 and $2.82 per share

from $2.62 to $2.70 per share.

Competition

The company operates in a highly

fragmented industry and faces competition from larger retailers

such as The Home Depot Inc. (HD).

Tractor Supply’s shares maintain a

Zacks #2 Rank, which translates into a short-term 'Buy'

recommendation. Our long-term recommendation on the stock remains

'Neutral'.

HOME DEPOT (HD): Free Stock Analysis Report

TRACTOR SUPPLY (TSCO): Free Stock Analysis Report

Zacks Investment Research

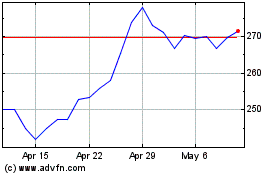

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From May 2024 to Jun 2024

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Jun 2023 to Jun 2024