Earnings Preview: Tractor Supply - Analyst Blog

July 19 2011 - 12:52PM

Zacks

Tractor Supply

Company (TSCO), a leading retail firm and ranch store

brand, is scheduled to report its second-quarter 2011 financial

results after the market closes on July 20, 2011. The current Zacks

Consensus Estimate for the quarter is $1.19 per share. For the

quarter under review, revenue is expected at $1,191.0 million,

according to the Zacks Consensus Estimate.

First-Quarter 2011,

Summary

Tractor Supply's first-quarter 2011

earnings came in at 24 cents, breezing past the Zacks Consensus

Estimate of 16 cents as well as the prior-year earnings of 14 cents

per share.

Strong performance in consumable,

usable and edible categories − for instance, pet food and animal

feed − acted as a catalyst for an increase of 10.7% in same-store

sales compared with a mere rise of 2.8% in the prior-year quarter.

Tractor Supply has been witnessing increasing trends in same-store

sales.

During the recession, Tractor

Supply had suffered setbacks as buyers avoided big-ticket purchases

such as mowers, but the recent quarters have positively seen an

uptick in results. The company's impressive merchandising

improvement strategy and solid same-store sales trend resulted in

double-digit top-line growth for the company. Net sales in the

quarter surged 17.7% to $836.6 million from $710.9 million in the

prior-year quarter. Total revenue beats the Zacks Consensus

Estimate of $794.0 million.

Guidance for Fiscal

2011

Tractor is well positioned to

capitalize on positive long-term trends. The company now expects

sales for fiscal 2011 to range between $4.04 billion and $4.11

billion backed by expectation of same-store sales increase of 3.5%

to 5.0%. This is higher than the previous sales and same-store

sales guidance of $4.00 to $4.07 billion and 2.5% and 4.5%,

respectively.

On the back of perked-up results

and brighter sales trends, Tractor Supply raised its earnings

expectation for 2011 to range between $2.62 and $2.70 per share

from $2.54 to $2.62 per share.

Second-Quarter 2011 Zacks

Consensus

The Zacks Consensus Estimate for

the second-quarter is currently $1.19 a share, faring better than

earnings of $1.02 delivered in the prior-year quarter. Current

analyst estimates range from $1.12 to $1.23 a share.

Zacks Agreement &

Magnitude

The current Zacks Consensus

Estimate has remained constant despite of 4 out of 19 analysts

revised their estimates upward over the last 30 days. Over the last

7 days only one analyst raised its estimate keeping the Zacks

Consensus Estimate unchanged.

Positive Earnings Surprise

History

With respect to earnings surprises,

Tractor Supply has topped the Zacks Consensus Estimate over the

last four quarters in the range of approximately 1.0% to 50.0%. The

average remained at 18.8%. This suggests that Tractor Supply has

beaten the Zacks Consensus Estimate by an average of 18.8% in the

trailing four quarters.

Our View

Tractor Supply is the largest

operator of farm and ranch stores in the U.S., a unique market

niche that serves the lifestyle needs of recreational farmers and

ranchers. The company's stores are strategically located in small

towns, close to its target customers, which provide it with a

competitive edge over its rivals. Moreover, in an effort to boost

margins, Tractor Supply is expanding its portfolio of private label

brands and is also focusing on direct sourcing. The company has set

a long-term target of generating 25% of sales from private label

brands and 13% from strategic direct sourcing. This provides a

strong upside potential to the company.

However, the company operates in a

highly fragmented industry and faces competition from larger

retailers, such as The Home Depot Inc. (HD) and

Lowe’s Companies Inc. (LOW) as well as from

independently-owned retail farm and ranch stores, privately-held

regional farm store chains and cooperatives. Being in such a high

competitive industry, Tractor Supply may find it difficult to

execute and implement new business strategies, which in turn, may

impact its operations adversely.

Tractor Supply’s shares maintain a

Zacks #2 Rank, which translates into a short-term 'Buy'

recommendation. Our long-term recommendation on the stock remains

'Neutral'.

HOME DEPOT (HD): Free Stock Analysis Report

LOWES COS (LOW): Free Stock Analysis Report

TRACTOR SUPPLY (TSCO): Free Stock Analysis Report

Zacks Investment Research

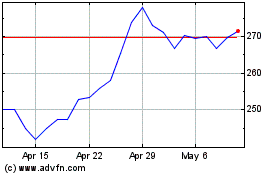

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From May 2024 to Jun 2024

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Jun 2023 to Jun 2024