Tractor Supply Reiterated Neutral - Analyst Blog

April 28 2011 - 2:30PM

Zacks

We are maintaining our long-term Neutral recommendation on

Tractor Supply Company

(TSCO).

Tractor Supply is the largest operator of farm and ranch stores

in the U.S., a unique market niche that serve the lifestyle needs

of recreational farmers and ranchers. The company’s stores are

strategically located in small towns, close to its target

customers, which provide a competitive edge over its rivals.

Tractor Supply has successfully tweaked merchandise assortment

across its stores in line with the prolonged economic downturn. The

company has increased the proportion of less discretionary items

such as animal and pet-related products, while reducing shelf space

for certain big-ticket merchandise such as outdoor power

equipment.

Moreover, in an effort to boost margins, Tractor Supply is

expanding its portfolio of private label brands and is also

focusing on direct sourcing. The company has set a long-term target

of generating 25% of sales from private label brands and 13% from

strategic direct sourcing. This provides a strong upside potential

for the company.

Additionally, Tractor Supply recorded a strong operating

performance in the first quarter of 2011. The company’s earnings

per share grew by an impressive 71.4% to 24 cents from 14

cents in the year-ago period, primarily driven by higher

sales, favorable merchandise mix, improved inventory management and

initiatives to control expenses. Management expects earnings in

full fiscal 2011 to benefit from the above factors as well.

Tractor Supply ended the first-quarter 2011 with cash and

equivalents of $140.4 million, while the long-term debt of the

company was merely $104.8 million. That comes to a

debt-capitalization ratio of 10.3%. This offers the company

financial flexibility to drive future growth.

On the flip side, Tractor Supply's business is highly seasonal,

with sales and profits highest in the winter and spring selling

seasons due to the nature of its merchandise offering. Unseasonable

weather, heavy precipitation, drought conditions, and early or late

frosts may have a material effect on the company’s financial

condition and operation results.

Moreover, the company operates in a highly fragmented industry

and faces competition from larger retailers, such as Home

Depot Inc. (HD) and Lowe's Companies Inc.

(LOW), as well as from independently owned retail farm and ranch

stores, privately held regional farm store chains and cooperatives.

Given the highly competitive industry, Tractor Supply may find it

difficult to execute and implement new business strategies, which,

in turn, will impact its operations adversely.

Furthermore, heavy job losses and reduced access to credit have

led to a sharp drop in consumer discretionary spending on

big-ticket items. Although the economy is showing signs of revival,

we believe that spending on big remodeling projects will likely

remain under pressure until the housing market stabilizes and

consumer spending rebounds.

Tractor Supply shares maintain a Zacks #3 Rank, which translates

into a short-term ‘Hold’ rating.

HOME DEPOT (HD): Free Stock Analysis Report

LOWES COS (LOW): Free Stock Analysis Report

TRACTOR SUPPLY (TSCO): Free Stock Analysis Report

Zacks Investment Research

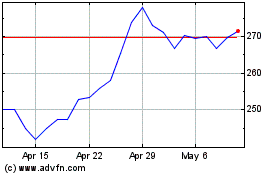

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From May 2024 to Jun 2024

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Jun 2023 to Jun 2024