TechTarget, Inc. (NASDAQ: TTGT) today announced financial results

for the first quarter ended March 31, 2008. Total revenues for the

first quarter increased by 30% to $23.9 million compared to $18.3

million for the comparable prior year quarter. Online revenues

increased by 38% to $18.9 million and represented 79% of total

revenues. Adjusted EBITDA (earnings before interest, taxes,

depreciation, and amortization, as further adjusted for stock-based

compensation) increased by 24% to $3.6 million compared to $2.9

million for the comparable prior year quarter. "We continue to

execute well against the big opportunity in�our market�as evidenced

by our online revenue growth of 38% in the quarter," said Greg

Strakosch, Chairman and CEO of TechTarget.��The migration of

marketing dollars to targeted, online products that deliver

measurable ROI is continuing to fuel our growth.� Total gross

profit margin for the quarter was 68% compared to 67% for the

comparable prior year quarter. Online gross profit margin for the

quarter was 73% compared to 74% for the comparable prior year

quarter. Net loss for the quarter was $112,000 compared to net

income of $317,000 for the comparable prior year quarter. The

decrease in net income is primarily attributable to increases in

stock-based compensation expense and the amortization of intangible

assets expense. Adjusted net income (net income adjusted for

amortization and stock-based compensation, as further adjusted for

the related income tax impact) increased by 54% to $1.9 million

compared to $1.2 million for the comparable prior year quarter.

Loss per basic share for the quarter was $0.00 compared to net

income per basic share of $0.01 on a pro forma basis for the

comparable prior year quarter. Adjusted net income per share

(adjusted net income divided by adjusted weighted average diluted

shares outstanding) for the quarter was $0.04 compared to $0.03 on

a pro forma basis for the comparable prior year quarter. As of

March 31, 2008 TechTarget had $60.4 million�of cash, cash

equivalents and short term investments, and bank debt of $5.3

million. Recent Company Highlights Launched two new websites in the

Storage market: -- SearchDataBackup.com, focusing on the continued

growth in the backup market, which has been enabled by increased

compliance requirements around the storing and archiving of emails

and documents. Charter advertisers include Symantec, NetApp and

Data Domain. -- SearchSMBStorage.com addressing the storage issues

specific to small and mid-sized companies. Charter advertisers

include Dell and EMC. The integration of the KnowledgeStorm

acquisition continues on schedule. In the first quarter, TechTarget

completed its plan to take advantage of expense synergies. The

integration of the products and the education of the companies and

market are continuing. The Company expects to meet its goal of

completely integrating KnowledgeStorm by the end of Q2 2008.

TechTarget was named by The Boston Business Journal as one of the

2008 Top 20 Best Places to Work, in the Large Companies

category,�for the Greater Boston Area. This is the third time

TechTarget has been recognized by the publication. Other companies

on the list include: Genzyme, Digitas, Vertex Pharmaceuticals, KPMG

LLP and Comcast. Held the TechTarget Online ROI Summit �08 East in

Boston. Hundreds of customers and prospects attended the event to

learn the best ways to measure and improve the ROI of their online

marketing investments. Attendees included representatives from AMD,

CA, CDW, EMC, Google, HP, IBM, Iron Mountain, McAfee, Microsoft,

Motorola, Novell, Pitney Bowes and Sun Microsystems. Financial

guidance In the second quarter of 2008, the Company expects

revenues to be within the range of $30.4 million to $31.6 million

and adjusted EBITDA to be within the range of $8.6 million to $9.4

million. Annual guidance is unchanged from the Company�s guidance

provided in the February 13, 2008 earnings release. For the fiscal

year 2008, the Company expects revenues to be within the range of

$118.0 million to $122.0 million and adjusted EBITDA to be within

the range of $33.0 million to $35.0 million. Conference Call and

Webcast TechTarget will discuss these financial results in a

conference call at 4:30 pm (Eastern Time) today (May 6, 2008). The

public is invited to listen to a live webcast of TechTarget�s

conference call, which can be accessed on the Investor Relations

section of our website at http://investor.techtarget.com/. The

conference call can also be heard via telephone by dialing

888-680-0890 (US callers) or 617-213-4857 (International callers)

ten minutes prior to the call and referencing participant pass code

20740851 for both domestic and international callers. For those

investors unable to participate in the live conference call, a

replay of the conference call will be available via telephone

beginning May 6, 2008 at 7:00 p.m. ET through May 21, 2008. To

listen to the replay, dial 888-286-8010 and use the pass code

55243357. International callers should dial 617-801-6888 and also

use the pass code 55243357 to listen to the replay. The webcast

replay will also be available for replay on

http://investor.techtarget.com/ during the same period. Non-GAAP

Financial Measures This press release and the accompanying tables

include a discussion of adjusted EBITDA, adjusted EBITDA Margin,

adjusted net income and adjusted net income per share, all of which

are non-GAAP financial measures which are provided as a complement

to results provided in accordance with accounting principles

generally accepted in the United States of America ("GAAP"). The

term "adjusted EBITDA" refers to a financial measure that we define

as earnings before net interest, income taxes, depreciation, and

amortization, as further adjusted for stock-based compensation. The

term �adjusted EBITDA Margin� refers to a financial measure which

we define as adjusted EBITDA as a percentage of total revenues. The

term �adjusted net income� refers to a financial measure which we

define as net income adjusted for amortization and stock-based

compensation, as further adjusted for the related income tax impact

for the specific adjustments. The tax rates used in the

reconciliation represent the Company�s forecasted effective tax

rate excluding discrete tax items, such as non-disqualified

dispositions, occurring in the respective periods. The term

�adjusted net income per share� refers to a financial measure which

we define as adjusted net income divided by adjusted weighted

average diluted shares outstanding. These Non-GAAP measures should

be considered in addition to results prepared in accordance with

GAAP, but should not be considered a substitute for, or superior

to, GAAP results. In addition, our definition of adjusted EBITDA,

adjusted EBITDA Margin, adjusted net income and adjusted net income

per share may not be comparable to the definitions as reported by

other companies. We believe adjusted EBITDA, adjusted EBITDA

Margin, adjusted net income and adjusted net income per share are

relevant and useful information because it provides us and

investors with additional measurements to compare the Company�s

operating performance. These measures are part of our internal

management reporting and planning process and are primary measures

used by our management to evaluate the operating performance of our

business, as well as potential acquisitions. The components of

adjusted EBITDA include the key revenue and expense items for which

our operating managers are responsible and upon which we evaluate

their performance. In the case of senior management, adjusted

EBITDA is used as the principal financial metric in their annual

incentive compensation program. Adjusted EBITDA is also used for

planning purposes and in presentations to our board of directors.

Adjusted net income is useful to us and investors because it

presents an additional measurement of our financial performance,

taking into account depreciation, which we believe is an ongoing

cost of doing business, but excluding the impact of certain

non-cash expenses and items not directly tied to the core

operations of our business. Furthermore, we intend to provide these

non-GAAP financial measures as part of our future earnings

discussions and, therefore, the inclusion of these non-GAAP

financial measures will provide consistency in our financial

reporting. A reconciliation of these non-GAAP measures to GAAP is

provided in the accompanying tables. Forward Looking Statements

Certain matters included in this press release may be considered to

be "forward-looking statements" within the meaning of the

Securities Act of 1933 and the Securities Exchange Act of 1934, as

amended by the Private Securities Litigation Reform Act of 1995.

Those statements include statements regarding the intent, belief or

current expectations of the company and members of our management

team. All statements contained in this press release, other than

statements of historical fact, are forward-looking statements,

including those regarding: guidance on our future financial results

and other projections or measures of our future performance; our

expectations concerning market opportunities and our ability to

capitalize on them; and the amount and timing of the benefits

expected from acquisitions, from new products or services and from

other potential sources of additional revenue. Investors and

prospective investors are cautioned that any such forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties, and that actual results may differ

materially from those contemplated by such forward-looking

statements. These statements speak only as of the date of this

press release and are based on our current plans and expectations,

and they involve risks and uncertainties that could cause actual

future events or results to be different than those described in or

implied by such forward-looking statements. These risks and

uncertainties include, but are not limited to, those relating to:

market acceptance of our products and services; relationships with

customers, strategic partners and our employees; difficulties in

integrating acquired businesses; and changes in economic or

regulatory conditions or other trends affecting the Internet,

Internet advertising and information technology industries. These

and other important risk factors are discussed or referenced in our

Annual Report on Form 10-K filed with the Securities and Exchange

Commission, under the heading "Risk Factors" and elsewhere, and any

subsequent periodic or current reports filed by us with the SEC.

Except as required by applicable law or regulation, we do not

undertake any obligation to update our forward-looking statements

to reflect future events or circumstances. About TechTarget

TechTarget, a leading online Information Technology (IT) media

company, provides IT companies with ROI-focused marketing programs

to generate leads, shorten sales cycles, and grow revenues. With

its network of 50 technology-specific Web sites and over 6.6

million registered members, TechTarget is a primary Web destination

for IT professionals researching which products to purchase. The

company is also a leading provider of independent, peer and vendor

content, a leading distributor of white papers, and a leading

producer of vendor-sponsored Webcasts and Podcasts for the IT

market. Its Web sites are complemented by numerous invitation-only

events and two magazines. TechTarget provides proven lead

generation and branding programs to over 1,100 advertisers

including Cisco, Dell, EMC, HP, IBM, Intel, Microsoft, SAP and

Symantec. (C) 2008 TechTarget, Inc. All rights reserved.

TechTarget, KnowledgeStorm and the TechTarget logo are registered

trademarks, and SearchDataBackup.com, SearchSMBStorage.com, and The

IT Media ROI Experts are trademarks, of TechTarget, Inc. All other

trademarks are the property of their respective owners. TechTarget,

Inc. Consolidated Balance Sheets (in $000's) � � March 31, 2008

December 31,2007 Assets (Unaudited) Current assets: Cash and cash

equivalents $ 38,297 $ 10,693 Short-term investments 22,107 51,308

Accounts receivable, net of allowance for doubtful accounts 17,055

15,198 Prepaid expenses and other current assets 4,324 1,962

Deferred tax assets � 2,802 � 2,947 Total current assets 84,585

82,108 � Property and equipment, net 4,094 4,401 Long-term

investments 1,950 - Goodwill 88,326 88,326 Intangible assets, net

of accumulated amortization 20,509 21,939 Deferred tax assets 3,180

2,910 Other assets 199 203 � � � � Total assets $ 202,843 $ 199,887

� Liabilities and Stockholders' Equity Current liabilities: Current

portion of bank term loan payable $ 3,000 $ 3,000 Accounts payable

3,775 2,919 Income taxes payable 47 1,031 Accrued expenses and

other current liabilities 1,740 2,473 Accrued compensation expenses

877 2,600 Deferred revenue � 6,734 � 3,761 Total current

liabilities 16,173 15,784 � Long-term liabilities: Other

liabilities 487 455 Bank term loan payable, net of current portion

� 2,250 � 3,000 Total liabilities 18,910 19,239 � Commitments - - �

Stockholders' equity: Preferred stock - - Common stock 41 41

Additional paid-in capital 213,233 209,773 Warrants 4 13

Accumulated other comprehensive loss (156 ) (102 ) Accumulated

deficit � (29,189 ) � (29,077 ) Total stockholders' equity 183,933

180,648 � � � � Total liabilities and stockholders' equity $

202,843 $ 199,887 TechTarget, Inc. Consolidated Statements of

Operations (in $000's, except�per share information) � For the

Three Months EndedMarch 31, 2008 � 2007 (Unaudited) Revenues:

Online $ 18,863 $ 13,709 Events 3,985 2,939 Print � 1,022 � 1,697

Total revenues � 23,870 � 18,345 � Cost of revenues: Online (1)

5,169 3,525 Events (1) 1,827 1,372 Print (1) � 546 � 1,129 Total

cost of revenues � 7,542 � 6,026 � Gross profit 16,328 12,319 �

Operating expenses: Selling and marketing (1) 8,444 6,152 Product

development (1) 2,762 1,748 General and administrative (1) 3,795

2,610 Depreciation 724 330 Amortization of intangible assets �

1,480 � 759 Total operating expenses � 17,205 � 11,599 � Operating

income (877 ) 720 � Interest income (expense): Interest income 532

360 Interest expense � (114 ) � (427 ) Total interest income

(expense) � 418 � (67 ) � (Loss) income before (benefit from)

provision for income taxes (459 ) 653 � (Benefit from) provision

for income taxes � (347 ) � 336 � Net (loss) income $ (112 ) $ 317

� Net loss per common share: Basic and Diluted $ 0.00 $ (0.28 ) �

Weighted average common shares outstanding: Basic and Diluted �

41,158 � 8,174 � � (1) Amounts include stock-based compensation

expense as follows: Cost of online revenue $ 98 $ 70 Cost of events

revenue 22 12 Cost of print revenue - 9 Selling and marketing 1,392

536 Product development 140 73 General and administrative 601 371

TechTarget, Inc. Reconciliation of GAAP to Non-GAAP Measures � � �

Reconciliation of Net (Loss) Income�to Adjusted EBITDA (in $000's)

� For the Three Months EndedMarch 31, 2008 � 2007 (Unaudited) � � �

Net (Loss) Income $ (112 ) $ 317 Interest Income (Expense), net 418

(67 ) (Benefit From) Provision For Income Taxes (347 ) 336

Depreciation 724 330 Amortization of Intangible Assets � 1,480 �

759 EBITDA � 1,327 � 1,809 Stock-Based Compensation Expense � 2,253

� 1,071 Adjusted EBITDA $ 3,580 $ 2,880 Reconciliation of Net

(Loss) Income to Adjusted Net Income and Net Loss per Diluted Share

to Adjusted Net Income per Share (in $000's, except per share

amounts) � For the Three Months EndedMarch 31, 2008 � 2007

(Unaudited) � � � Net (Loss) Income $ (112 ) $ 317 Amortization of

Intangible Assets 1,480 759 Stock-Based Compensation Expense 2,253

1,071 Impact of Income Taxes � 1,755 � 933 Adjusted Net Income $

1,866 $ 1,214 � � � � � � � � � Net Loss per Diluted Share $ (0.00

) $ (0.28 ) Weighted Average Diluted Shares Outstanding � 41,158 �

8,174 � � � � � Adjusted Net Income per Share $ 0.04 $ 0.03

Adjusted Weighted Average Diluted Shares Outstanding � 43,465 �

36,290 Options, Warrants and Restricted Stock, Treasury Method

Included in Adjusted Weighted Average Diluted Shares Above 2,307 -

Pro Forma Adjustment Including Assumed Conversion of Redeemable

Convertible Preferred Stock � - � 28,116 Weighted Average Diluted

Shares Outstanding � 41,158 � 8,174 TechTarget, Inc. Financial

Guidance Summary (in $000's) � � � For the Three Months EndedJune

30, 2008 For the Year Ended December 31,2008 Range Range � � � � �

� � � � Revenues $ 30,400 $ 31,600 $ 118,000 $ 122,000 � � � � � �

� � � Adjusted EBITDA $ 8,600 $ 9,400 $ 33,000 $ 35,000 Interest

Income, net 295 295 1,287 1,287 Depreciation, Amortization and

Stock-Based Compensation 4,170 4,170 17,184 17,184 Provision for

Income Taxes � 2,079 � 2,431 � 7,823 � 9,703 Net Income $ 2,646 $

3,094 $ 9,280 $ 9,400

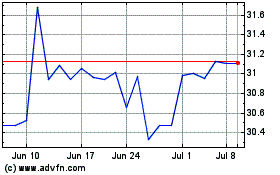

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Jun 2024 to Jul 2024

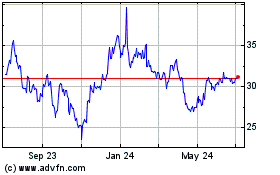

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Jul 2023 to Jul 2024