TechTarget, Inc. (NASDAQ: TTGT) today announced financial results

for the three months and year ended December 31, 2007. Total

revenues for the fourth quarter increased by 23% to $28.4 million

compared to $23.1 million for the comparable prior year quarter.

Online revenues increased by 23% to $19.0 million compared to $15.4

million for the comparable prior year quarter. Adjusted EBITDA

(earnings before interest, taxes, depreciation, and amortization,

as adjusted for stock-based compensation) increased by 13% to $8.4

million compared to $7.4 million for the comparable prior year

quarter. Total revenues for 2007 increased by 20% to $94.7 million

compared to $79.0 million for 2006. Online revenues, which

represented 67% of total revenues, increased by 24% to $63.7

million compared to $51.2 million for 2006. In 2007, adjusted

EBITDA increased by 22% to $24.6 million compared to $20.1 million

for 2006. �We are pleased to deliver another quarter and year of

strong growth both on the top and bottom line,� said Greg

Strakosch, Chairman and CEO of TechTarget.�"Our primary focus

during the quarter was the acquisition of KnowledgeStorm. We

finalized due diligence, closed the transaction and made tremendous

progress integrating KnowledgeStorm into TechTarget. We�re

confident that this acquisition has expanded our competitive lead

and allows us to further scale the business.� Gross profit margin

increased for both the quarter and year to 73% and 70%,

respectively, compared to 71% and 69%, respectively, as compared to

the comparable prior year periods. Online gross profit margin

continued to demonstrate high operating leverage, increasing for

both the quarter and year to 77% and 76%, respectively, compared to

76% and 75%, respectively, as compared to comparable prior year

periods. Adjusted EBITDA margin was 30% and 26%, respectively, for

the fourth quarter of 2007 and 2007. Net income for the quarter was

$2.8 million, unchanged from the prior year quarter.�Net income for

2007 was $8.2 million, an increase of 14% compared to 2006.

Earnings per basic and diluted share for the quarter and year were

$0.07 and $0.06 and $0.15 and $0.13, respectively, compared to

earnings per basic and diluted share of $0.00 and ($0.46) in the

fourth quarter of 2006 and 2006, respectively. As of December 31,

2007, TechTarget had $62 million�of cash, cash equivalents and

short term investments, and bank debt of $6 million. Additionally,

as separately disclosed, the Company will be restating certain of

its filings as a result of overstatements of its provision for

income taxes in 2007; the restatement results in increases in net

income of $534,000 and $290,000 for the quarters ended June 30,

2007 and September 30, 2007, respectively. Recent Company

Highlights Integrated KnowledgeStorm product offerings with

TechTarget�s product offerings. Introduced a new lead generation

program that combines the TechTarget and KnowledgeStorm offerings

called FlexROI�. We sold more than 70 FlexROI programs in the first

60 days since the launch. Made significant progress integrating the

KnowledgeStorm employee base and reducing expenses. Material sales

and operational efficiencies have allowed us to reduce the expense

base against the KnowledgeStorm business by approximately 50%,

which equates to an annual projected reduction of approximately $8

million. At year end, approximately half of the KnowledegeStorm

employees had been integrated into the TechTarget workforce,

increasing our capabilities against product development, product

management and search engine optimization and marketing. Expense

reductions have primarily come from selling & marketing and

general and administration. Launched five new websites. We expect

to launch at least ten new websites in 2008. This is expected to

contribute to organic growth in the second half of 2008, 2009 and

beyond. We launched our first direct websites outside the United

States, SearchStorage.co.UK and SearchSecurity.co.UK. Charter

advertisers include Brocade and EqualLogic. Consistent with our

sub-segmentation strategy we launched SearchVMWare.com, to provide

more specific coverage of VMWare-related topics that were

previously covered on our fast-growing

SearchServerVirtualization.com site. Charter advertisers include

VMWare, Intel, Dell and Red Hat. We also launched

SearchFinancialSecurity.com and ConstructionSoftwareReview.com as

part of our ongoing strategy to expand into vertical industries.

Continued to optimize our web sites for search engines. Visits from

search engines were up approximately 40% in the quarter. Our

success in attracting a growing amount of search engine traffic, as

well as the large amount of direct visits to our sites, allows us

to attract over 90% of our new registered members with minimal

incremental expenses. Financial guidance for Fiscal Year 2008 and

the First Quarter of 2008 For the fiscal year 2008, the Company

expects revenue to grow between 25% - 29% and be within the range

of $118.0 and $122.0 million and adjusted EBITDA to grow between

34% - 42% and to be within the range of $33.0 - $35.0 million. The

Company expects its online growth rate to be approximately 40% in

2008. For the first quarter of 2008, the Company expects revenues

to be within the range of $23.0 million to $24.0 million and

adjusted EBITDA to be within the range of $3.0 million to $3.8

million. Conference Call and Webcast TechTarget will discuss these

financial results in a conference call at 4:30 pm (Eastern Time)

today (February 13, 2008). The public is invited to listen to a

live webcast of TechTarget�s conference call, which can be accessed

on the Investor Relations section of our website at

http://investor.techtarget.com/. We ask that participants please

access the conference call at least 10 minutes prior to the time

the conference call is set to begin. The conference call can also

be heard via telephone by dialing 888-679-8037 or 617-213-4849 for

international callers�five minutes prior to the call and

referencing conference code 85115918 for both domestic and

international callers. For those investors unable to participate in

the live conference call, a replay of the conference call will be

available via telephone beginning February 13, 2008 at 7:00 p.m. ET

through February 27, 2008. To listen to the replay, call

888-286-8010 and use the pass code: 46268289. International callers

should dial 617-801-6888 and enter the pass code: 46268289 to

listen to the replay. The webcast replay will also be available on

http://investor.techtarget.com/ during the same period. Non-GAAP

Financial Measures This press release and the accompanying tables

include a discussion of adjusted EBITDA and adjusted EBITDA Margin,

all of which are non-GAAP financial measures which are provided as

a complement to results provided in accordance with accounting

principles generally accepted in the United States of America

("GAAP"). The term "adjusted EBITDA" refers to a financial measure

that we define as earnings before net interest, income taxes,

depreciation, and amortization, as further adjusted for stock-based

compensation. The term �adjusted EBITDA Margin� refers to a

financial measure which we define as adjusted EBITDA as a

percentage of total revenues. These Non-GAAP measures should be

considered in addition to results prepared in accordance with GAAP,

but should not be considered a substitute for, or superior to, GAAP

results. In addition, our definition of adjusted EBITDA and

adjusted EBITDA Margin may not be comparable to the definitions as

reported by other companies. We believe adjusted EBITDA and

adjusted EBITDA Margin are relevant and useful information to our

investors as these measures are an integral part of our internal

management reporting and planning process and are primary measures

used by our management to evaluate the operating performance of our

business, as well as potential acquisitions. The components of

adjusted EBITDA include the key revenue and expense items for which

our operating managers are responsible and upon which we evaluate

their performance. In the case of senior management, adjusted

EBITDA is used as the principal financial metric in their annual

incentive compensation program. Adjusted EBITDA is also used for

planning purposes and in presentations to our board of directors.

Furthermore, we intend to provide these non-GAAP financial measures

as part of our future earnings discussions and, therefore, the

inclusion of these non-GAAP financial measures will provide

consistency in our financial reporting. A reconciliation of these

non-GAAP measures to GAAP is provided in the accompanying tables.

Forward Looking Statements Certain matters included in this press

release may be considered to be "forward-looking statements" within

the meaning of the Securities Act of 1933 and the Securities

Exchange Act of 1934, as amended by the Private Securities

Litigation Reform Act of 1995. Those statements include statements

regarding the intent, belief or current expectations of the company

and members of our management team. All statements contained in

this press release, other than statements of historical fact, are

forward-looking statements, including those regarding: guidance on

our future financial results and other projections or measures of

our future performance; our expectations concerning market

opportunities and our ability to capitalize on them; and the amount

and timing of the benefits expected from acquisitions, from new

products or services and from other potential sources of additional

revenue. Investors and prospective investors are cautioned that any

such forward-looking statements are not guarantees of future

performance and involve risks and uncertainties, and that actual

results may differ materially from those contemplated by such

forward- looking statements. These statements speak only as of the

date of this press release and are based on our current plans and

expectations, and they involve risks and uncertainties that could

cause actual future events or results to be different than those

described in or implied by such forward-looking statements. These

risks and uncertainties include, but are not limited to, those

relating to: market acceptance of our products and services;

relationships with customers, strategic partners and our employees;

difficulties in integrating acquired businesses; and changes in

economic or regulatory conditions or other trends affecting the

Internet, Internet advertising and information technology

industries. Further information about these matters, as well as

others, can be found in our Registration Statement on Form S-1 as

well as subsequent filings that have been filed with the Securities

and Exchange Commission. Except as required by applicable law or

regulation, we do not undertake any obligation to update our

forward-looking statements to reflect future events or

circumstances. Click here to view TechTarget, Inc. Consolidated

Balance Sheets, Consolidated Statements of Operations and

Reconciliation of GAAP to Non-GAAP Measures About TechTarget

TechTarget, a leading online Information Technology (IT) media

company, provides IT companies with ROI-focused marketing programs

to generate leads, shorten sales cycles, and grow revenues. With

its network of 49 technology-specific Web sites and over six

million active registered members, TechTarget is a primary Web

destination for IT professionals researching which products to

purchase. The company is also a leading provider of independent,

peer and vendor content, a leading distributor of white papers, and

a leading producer of vendor-sponsored webcasts and Podcasts for

the IT market. Its Web sites are complemented by numerous

invitation-only events and two magazines. TechTarget provides

proven lead generation and branding programs to over 1,000

advertisers including Cisco, Dell, EMC, HP, IBM, Intel, Microsoft,

SAP and Symantec. (C) 2008 TechTarget, Inc. All rights reserved.

TechTarget, KnowledgeStorm and the TechTarget logo are registered

trademarks, and FlexROI, SearchStorage.co.UK and

SearchSecurity.co.UK, SearchVMWare.com,

SearchFinancialSecurity.com, ConstructionSoftwareReview.com and

SearchServerVirtualization.com are trademarks, of TechTarget, Inc.

All other trademarks are the property of their respective owners.

TechTarget, Inc. Consolidated Balance Sheets (in thousands) �

December 31, 2007 � 2006 Assets Current assets: Cash and cash

equivalents $ 10,693 $ 30,830 Short-term investments 51,308 -

Accounts receivable, net of allowance for doubtful accounts 15,198

12,096 Prepaid expenses and other current assets 1,962 952 Deferred

tax assets � 2,947 � 1,784 Total current assets 82,108 45,662

Property and equipment, net 4,401 2,520 Goodwill 88,326 36,190

Intangible assets, net of accumulated amortization 21,939 6,066

Other assets 203 854 Deferred tax assets 2,910 1,355 � � � � Total

assets $ 199,887 $ 92,647 Liabilities, Redeemable Convertible

Preferred Stock and Stockholders' Equity (Deficit) Current

liabilities: Current portion of bank term loan payable $ 3,000 $

3,000 Accounts payable 2,919 2,928 Income taxes payable 1,031 1,854

Accrued expenses and other current liabilities 2,473 1,904 Accrued

compensation expenses 2,600 2,322 Deferred revenue � 3,761 � 2,544

Total current liabilities 15,784 14,552 Long-term liabilities:

Other liabilities 455 555 Bank term loan payable, net of current

portion � 3,000 � 6,000 Total liabilities 19,239 21,107 Commitments

- - Redeemable convertible preferred stock: Series A - 30,468

Series B - 88,260 Series C � - � 18,038 Total redeemable

convertible preferred stock - 136,766 Stockholders' equity

(deficit): Common stock 41 32 Additional paid-in capital 209,773 -

Warrants 13 105 Accumulated other comprehensive loss (102 ) (56 )

Accumulated deficit � (29,077 ) � (65,307 ) Total stockholders'

equity (deficit) 180,648 (65,226 ) � � � � Total liabilities,

redeemable convertible preferred stock and stockholders' equity

(deficit) $ 199,887 $ 92,647 TechTarget, Inc. Consolidated

Statements of Operations (in thousands, except share and per share

information) � � For the Three Months EndedDecember 31, For the

Years EndedDecember 31, 2007 � 2006 2007 � 2006 Revenues: Online $

18,960 $ 15,424 $ 63,686 $ 51,176 Events 8,053 5,746 24,254 19,708

Print � 1,402 � 1,947 � 6,725 � 8,128 Total revenues � 28,415 �

23,117 � 94,665 � 79,012 Cost of revenues: Online (1) 4,381 3,731

15,575 12,988 Events (1) 2,546 1,852 8,611 6,493 Print (1) � 798 �

1,124 � 3,788 � 5,339 Total cost of revenues � 7,725 � 6,707 �

27,974 � 24,820 Gross profit 20,690 16,410 66,691 54,192 Operating

expenses: Selling and marketing (1) 8,237 5,750 28,048 20,305

Product development (1) 2,299 1,555 7,320 6,295 General and

administrative (1) 3,675 2,755 12,592 8,756 Depreciation 515 447

1,610 1,144 Amortization of intangible assets � 1,769 � 1,143 �

4,740 � 5,029 Total operating expenses � 16,495 � 11,650 � 54,310 �

41,529 Operating income 4,195 4,760 12,381 12,663 Interest income:

Interest income 757 387 2,815 1,613 Interest expense � (133 ) �

(188 ) � (984 ) � (1,292 ) Total interest income � 624 � 199 �

1,831 � 321 Income before provision for income taxes 4,819 4,959

14,212 12,984 Provision for income taxes � 2,050 � 2,188 � 6,046 �

5,811 Net income $ 2,769 $ 2,771 $ 8,166 $ 7,173 Net income (loss)

per common share: Basic $ 0.07 $ 0.00 $ 0.15 $ (0.46 ) Diluted $

0.06 $ 0.00 $ 0.13 $ (0.46 ) Weighted average common shares

outstanding: Basic � 40,690 � 7,938 � 28,384 � 7,824 Diluted �

43,833 � 10,611 � 31,347 � 7,824 (1) Amounts include stock-based

compensation expense as follows: Cost of online revenue $ 33 $ 73 $

189 $ 87 Cost of events revenue 10 26 53 31 Cost of print revenue

(3 ) 10 15 12 Selling and marketing 945 536 2,999 606 Product

development 104 74 334 90 General and administrative � 823 � 374 �

2,244 � 424 $ 1,912 $ 1,093 $ 5,834 $ 1,250 TechTarget, Inc.

Reconciliation of GAAP to Non-GAAP Measures (in thousands,

unaudited) � � Reconciliation of Net Income to Adjusted EBITDA � �

� For the Three MonthsEnded December 31, For the Years

EndedDecember 31, 2007 � � 2006 2007 � � 2006 Net income $ 2,769 $

2,771 $ 8,166 $ 7,173 Interest income, net 624 199 1,831 321

Provision for income taxes 2,050 2,188 6,046 5,811 Depreciation 515

447 1,610 1,144 Amortization of intangible assets � 1,769 � 1,143 �

4,740 � 5,029 EBITDA 6,479 6,350 18,731 18,836 Stock-based

compensation expense � 1,912 � 1,093 � 5,834 � 1,250 Adjusted

EBITDA $ 8,391 $ 7,443 $ 24,565 $ 20,086 TechTarget, Inc. Financial

Guidance Summary (in thousands) � � For the Three Months Ended

March 31, 2008 For the Year Ended December 31, 2008 Range Range � �

� Revenues $ 23,000 $ 24,000 $ 118,000 $ 122,000 Adjusted EBITDA $

3,000 $ 3,800 $ 33,000 $ 35,000 Reconciliation of Adjusted EBITDA

to net income (loss): Adjusted EBITDA $ 3,000 $ 3,800 $ 33,000 $

35,000 Interest income, net 453 453 1,890 1,890 Depreciation,

amortization and stock-based compensation 4,510 4,510 17,110 17,110

Provision for (benefit from) income taxes � (465 ) � (113 ) � 7,823

� 8,703 Net income (loss) $ (592 ) $ (144 ) $ 9,957 $ 11,077

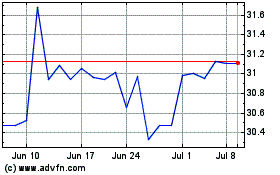

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Jun 2024 to Jul 2024

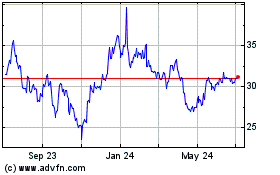

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Jul 2023 to Jul 2024