Talkspace, Inc. (NASDAQ: TALK), today reported second quarter 2023

financial results.

|

|

|

Three Months |

|

Six Months |

|

Period Ended June 30, 2023 (Unaudited) |

|

Results |

|

Variance fromPrior Year % |

|

Results |

|

Variance fromPrior Year % |

|

(In thousands unless otherwise noted) |

|

|

|

|

|

|

|

|

| Number of B2B eligible lives

at period end (in millions) |

|

110 |

|

42% |

|

110 |

|

42% |

| Number of completed B2B

sessions |

|

200.5 |

|

109% |

|

372.2 |

|

100% |

| Number of Consumer active

members at period end |

|

13.7 |

|

(32)% |

|

13.7 |

|

(32)% |

| |

|

|

|

|

|

|

|

|

| Total revenue |

|

$35,645 |

|

19% |

|

$68,981 |

|

15% |

| Gross profit |

|

$17,812 |

|

22% |

|

$34,560 |

|

17% |

| Gross margin % |

|

50.0% |

|

|

|

50.1% |

|

|

| Operating expenses |

|

$24,220 |

|

(32)% |

|

$50,007 |

|

(30)% |

| Net loss |

|

$(4,704) |

|

80% |

|

$(13,462) |

|

69% |

| Adjusted EBITDA1 |

|

$(3,977) |

|

77% |

|

$(10,407) |

|

71% |

| Cash and cash equivalents at

period end |

|

$126,104 |

|

— |

|

$126,104 |

|

— |

|

(1) Adjusted EBITDA is a non-GAAP financial measure. For a

definition of the measure and a reconciliation to the most directly

comparable GAAP measure, see “Reconciliation of Non-GAAP Results to

GAAP Results.” |

Dr. Jon Cohen, CEO of Talkspace, said, “We built on

the first quarter’s strong momentum in our payor business by

expanding our relationships with commercial partners while

activating a growing proportion of our member base. We continued to

introduce product innovations and grow our clinical network while

maintaining stringent quality standards, driving gains in access

and engagement metrics and improving network productivity. As we

look to the second half of the year and beyond, we remain confident

in our ability to capitalize on the growing need for covered mental

health services and to deliver profitable growth.”

Jennifer Fulk, CFO of Talkspace, said, “Our revenue growth

continued to accelerate in the second quarter, with the

business-to-business (“B2B”) categories contributing an increasing

portion of overall revenue as planned. We unlocked significant

efficiencies in our cost structure as we drove further operating

leverage, accelerated collection timing and enhanced treasury

operations, which enabled us to achieve positive cash flow for the

quarter.”

Second Quarter 2023 Key Performance Metrics

- Revenue increased 19% over the prior-year period to $35.6

million, driven by an 82% year-over-year increase in the B2B

revenue categories, partially offset by a 41% year-over-year

consumer revenue decline.

- Gross profit increased 22% over the prior-year period to $17.8

million, and gross margin expanded to 50.0% from 48.7%

year-over-year, driven by higher network productivity.

- Operating expenses were $24.2 million, down 32% year-over-year,

driven by a reduction across all our operating cost

categories.

- Net loss was $(4.7) million, an improvement from $(23.0)

million in the second quarter of 2022, primarily driven by lower

operating expenses and an increase in revenues.

Financial Outlook

The following guidance is based on current market conditions and

expectations and what the Company knows today.

For the Fiscal Year 2023, Talkspace expects:

- Revenue to be in the range of $137 million to $142 million,

improved from our previous expectations of $130 million to $135

million.

- Adjusted EBITDA loss to be in the range of $(16) million to

$(19) million, improved from our previous expectations of $(19)

million to $(21) million.

The Company expects to reach break-even Adjusted EBITDA by the

end of the first quarter of 2024, with a cash balance of over $100

million.

Conference Call, Presentation Slides,

and Webcast Details

The conference call will be available via audio webcast at

investors.talkspace.com and can also accessed by dialing (888)

330-2391 for U.S. participants, or +1 (240) 789-2702 for

international participants, and referencing participant code

2348878. A replay will be available shortly after the call’s

completion and remain available for approximately 90 days.

About Talkspace

Talkspace (Nasdaq: TALK) is a leading virtual behavioral

healthcare company committed to helping people lead healthier,

happier lives through access to high-quality mental healthcare. At

Talkspace, we believe that mental healthcare is core to overall

healthcare and should be available to everyone.

Talkspace pioneered the ability to text with a licensed

therapist from anywhere and now offers a comprehensive suite of

mental health services from self-guided products to individual and

couples therapy, in addition to psychiatric treatment and

medication management. With Talkspace’s core psychotherapy

offering, members are matched with one of thousands of licensed

providers across all 50 states and can choose from a variety of

subscription plans including live video, text or audio chat

sessions and/or asynchronous text messaging.

All care offered at Talkspace is delivered through an

easy-to-use, fully-encrypted web and mobile platform that meets

HIPAA, federal, and state regulatory requirements. Talkspace covers

approximately 110 million lives as of June 30, 2023, through our

partnerships with employers, health plans, and paid benefits

programs.

For more information, visit www.talkspace.com.

For Investors:

Neal NagarajanSloane & Company(301)

273-5662nnagarajan@sloanepr.com

For Media:John KimSKDK(310)

997-5963jkim@skdknick.com

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, as amended. All statements contained in this press release

that do not relate to matters of historical fact should be

considered forward-looking, including statements regarding our

financial condition, anticipated financial performance, achieving

profitability, business strategy and plans, market opportunity and

expansion and objectives of our management for future operations.

These forward-looking statements generally are identified by the

words “anticipate,” “believe,” “contemplate,” “continue,” “could,”

“estimate,” “expect,” “forecast”, “future”, “intend,” “may,”

“might”, “opportunity”, “plan,” “possible”, “potential,” “predict,”

“project,” “should,” “strategy”, “strive”, “target,” “will,” or

“would”, the negative of these words or other similar terms or

expressions. The absence of these words does not mean that a

statement is not forward-looking. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many important

factors could cause actual future events to differ materially from

the forward-looking statements in this press release, including but

not limited to factors and the other risks and uncertainties

described under the caption “Risk Factors” in our Annual Report on

Form 10-K for the year ended December 31, 2022 filed with the

Securities and Exchange Commission (“SEC”) on March 10, 2023, and

our other documents filed from time to time with the SEC. These

filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking

statements, and we assume no obligation and do not intend to update

or revise these forward-looking statements, whether as a result of

new information, future events, or otherwise unless required to do

so under applicable law. We do not give any assurance that we will

achieve our expectations.

|

Talkspace, Inc.Condensed Consolidated Statements

of OperationsUnaudited |

|

|

|

Three Months EndedJune 30, |

|

|

|

Six Months EndedJune 30, |

|

|

|

|

|

2023 |

|

2022 |

|

% Change |

|

2023 |

|

2022 |

|

% Change |

| (in thousands, except

percentages, share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Payor revenue |

|

$18,539 |

|

$7,880 |

|

135.3 |

|

$33,350 |

|

$15,990 |

|

108.6 |

|

DTE revenue |

|

8,039 |

|

6,685 |

|

20.3 |

|

16,715 |

|

12,346 |

|

35.4 |

|

Total B2B revenue |

|

26,578 |

|

14,565 |

|

82.5 |

|

50,065 |

|

28,336 |

|

76.7 |

|

Consumer revenue |

|

9,067 |

|

15,279 |

|

(40.7) |

|

18,916 |

|

31,658 |

|

(40.2) |

| Total revenue |

|

35,645 |

|

29,844 |

|

19.4 |

|

68,981 |

|

59,994 |

|

15.0 |

| Cost of revenues |

|

17,833 |

|

15,297 |

|

16.6 |

|

34,421 |

|

30,426 |

|

13.1 |

| Gross profit |

|

17,812 |

|

14,547 |

|

22.4 |

|

34,560 |

|

29,568 |

|

16.9 |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development, net |

|

4,171 |

|

5,576 |

|

(25.2) |

|

9,524 |

|

10,611 |

|

(10.2) |

|

Clinical operations, net |

|

1,675 |

|

2,316 |

|

(27.7) |

|

3,276 |

|

4,092 |

|

(19.9) |

|

Sales and marketing |

|

13,045 |

|

18,931 |

|

(31.1) |

|

26,514 |

|

40,339 |

|

(34.3) |

|

General and administrative |

|

5,329 |

|

8,792 |

|

(39.4) |

|

10,693 |

|

16,802 |

|

(36.4) |

| Total operating expenses |

|

24,220 |

|

35,615 |

|

(32.0) |

|

50,007 |

|

71,844 |

|

(30.4) |

| Operating loss |

|

(6,408) |

|

(21,068) |

|

69.6 |

|

(15,447) |

|

(42,276) |

|

63.5 |

| Financial (income) expense,

net |

|

(1,712) |

|

1,865 |

|

* |

|

(2,136) |

|

996 |

|

* |

| Loss before taxes on

income |

|

(4,696) |

|

(22,933) |

|

79.5 |

|

(13,311) |

|

(43,272) |

|

69.2 |

| Taxes on income |

|

8 |

|

89 |

|

(91.0) |

|

151 |

|

110 |

|

37.3 |

| Net loss |

|

$(4,704) |

|

$(23,022) |

|

79.6 |

|

$(13,462) |

|

$(43,382) |

|

69.0 |

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

$(0.03) |

|

$(0.15) |

|

80.0 |

|

$(0.08) |

|

$(0.28) |

|

71.4 |

| Weighted average number of

common shares: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted |

|

164,195,697 |

|

155,709,901 |

|

|

|

163,003,363 |

|

154,901,165 |

|

|

| * Percentage not

meaningful. |

|

Talkspace, Inc.Condensed Consolidated Balance

Sheets |

| |

|

June 30, 2023 |

|

|

December 31, 2022 |

|

| (in thousands) |

|

(Unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

126,104 |

|

|

$ |

138,545 |

|

| Accounts receivable |

|

|

8,420 |

|

|

|

9,640 |

|

| Other current assets |

|

|

2,920 |

|

|

|

4,372 |

|

| Total current assets |

|

|

137,444 |

|

|

|

152,557 |

|

| Property and equipment,

net |

|

|

456 |

|

|

|

677 |

|

| Intangible assets, net |

|

|

2,157 |

|

|

|

2,529 |

|

| Other assets |

|

|

464 |

|

|

|

491 |

|

| Total assets |

|

$ |

140,521 |

|

|

$ |

156,254 |

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

| Accounts payable |

|

$ |

5,484 |

|

|

$ |

6,461 |

|

| Deferred revenues |

|

|

3,683 |

|

|

|

4,355 |

|

| Accrued expenses and other

current liabilities |

|

|

10,444 |

|

|

|

16,502 |

|

| Total current

liabilities |

|

|

19,611 |

|

|

|

27,318 |

|

| Warrant liabilities |

|

|

820 |

|

|

|

939 |

|

| Other liabilities |

|

|

295 |

|

|

|

461 |

|

| Total liabilities |

|

|

20,726 |

|

|

|

28,718 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

| Common stock |

|

|

16 |

|

|

|

16 |

|

|

Additional paid-in capital |

|

|

384,443 |

|

|

|

378,722 |

|

| Accumulated deficit |

|

|

(264,664 |

) |

|

|

(251,202 |

) |

| Total stockholders’

equity |

|

|

119,795 |

|

|

|

127,536 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

140,521 |

|

|

$ |

156,254 |

|

|

Talkspace, Inc.Condensed Consolidated Statements

of Cash FlowsUnaudited |

| |

|

Six Months EndedJune 30, |

|

| |

|

2023 |

|

|

2022 |

|

| (in thousands) |

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(13,462 |

) |

|

$ |

(43,382 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

608 |

|

|

|

697 |

|

| Stock-based compensation |

|

|

4,432 |

|

|

|

6,207 |

|

| Remeasurement of warrant

liabilities |

|

|

(119 |

) |

|

|

1,217 |

|

| Decrease (increase) in

accounts receivable |

|

|

1,220 |

|

|

|

(1,650 |

) |

| Decrease in other current

assets |

|

|

1,452 |

|

|

|

5,622 |

|

| (Decrease) increase in

accounts payable |

|

|

(977 |

) |

|

|

381 |

|

| Decrease in deferred

revenues |

|

|

(672 |

) |

|

|

(1,236 |

) |

| Decrease in accrued expenses

and other current liabilities |

|

|

(6,058 |

) |

|

|

(1,145 |

) |

| Other |

|

|

(172 |

) |

|

|

178 |

|

| Net cash used in operating

activities |

|

|

(13,748 |

) |

|

|

(33,111 |

) |

| Cash flows from

investing activities: |

|

|

|

|

|

|

| Purchase of property and

equipment |

|

|

(10 |

) |

|

|

(160 |

) |

| Proceeds from sale of property

and equipment |

|

|

28 |

|

|

|

— |

|

| Net cash provided by (used in)

investing activities |

|

|

18 |

|

|

|

(160 |

) |

| Cash flows from

financing activities: |

|

|

|

|

|

|

| Proceeds from exercise of

stock options |

|

|

1,490 |

|

|

|

2,349 |

|

| Payments for employee taxes

withheld related to vested stock-based awards |

|

|

(201 |

) |

|

|

(67 |

) |

| Payments from reverse

capitalization, net of transaction costs |

|

|

— |

|

|

|

(645 |

) |

| Net cash provided by financing

activities |

|

|

1,289 |

|

|

|

1,637 |

|

| Net decrease in cash and cash

equivalents |

|

|

(12,441 |

) |

|

|

(31,634 |

) |

| Cash and cash equivalents at

the beginning of the period |

|

|

138,545 |

|

|

|

198,256 |

|

| Cash and cash equivalents at

the end of the period |

|

$ |

126,104 |

|

|

$ |

166,622 |

|

| |

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

In addition to our financial results determined in accordance

with GAAP, we believe adjusted EBITDA, a non-GAAP measure, is

useful in evaluating our operating performance, and our management

uses it as a key performance measure to assess our operating

performance. Because adjusted EBITDA facilitates internal

comparisons of our historical operating performance on a more

consistent basis, we use this measure for business planning

purposes and in evaluating acquisition opportunities. We also use

adjusted EBITDA to evaluate our ongoing operations and for internal

planning and forecasting purposes. We believe that this non-GAAP

financial measure, when taken together with the corresponding GAAP

financial measures, provides meaningful supplemental information

regarding our performance by excluding certain items that may not

be indicative of our business, results of operations or outlook. We

believe that the use of adjusted EBITDA is helpful to our investors

as it is a metric used by management in assessing the health of our

business and our operating performance. However, non-GAAP financial

information is presented for supplemental informational purposes

only, has limitations as an analytical tool and should not be

considered in isolation or as a substitute for financial

information presented in accordance with GAAP.

Some of the limitations of adjusted EBITDA include (i) adjusted

EBITDA does not necessarily reflect capital commitments to be paid

in the future and (ii) although depreciation and amortization are

non-cash charges, the underlying assets may need to be replaced and

adjusted EBITDA does not reflect these requirements. In evaluating

adjusted EBITDA, you should be aware that in the future we will

incur expenses similar to the adjustments described herein. Our

presentation of adjusted EBITDA should not be construed as an

inference that our future results will be unaffected by these

expenses or any unusual or non-recurring items. Our adjusted EBITDA

may not be comparable to similarly titled measures of other

companies because they may not calculate adjusted EBITDA in the

same manner as we calculate the measure, limiting its usefulness as

a comparative measure. Adjusted EBITDA should not be considered as

an alternative to loss before income taxes, net loss, loss per

share, or any other performance measures derived in accordance with

U.S. GAAP. When evaluating our performance, you should consider

adjusted EBITDA alongside other financial performance measures,

including our net loss and other GAAP results.

A reconciliation is provided below for adjusted EBITDA to net

loss, the most directly comparable financial measure stated in

accordance with GAAP. Investors are encouraged to review our

financial statements prepared in accordance with GAAP and the

reconciliation of our non-GAAP financial measure to its most

directly comparable GAAP financial measure, and not to rely on any

single financial measure to evaluate our business. We do not

provide a forward-looking reconciliation Adjusted EBITDA guidance

as the amount and significance of the reconciling items required to

develop meaningful comparable GAAP financial measures cannot be

estimated at this time without unreasonable efforts. These

reconciling items could be meaningful.

Adjusted EBITDA

We calculate adjusted EBITDA as net loss adjusted to exclude (i)

depreciation and amortization, (ii) interest and other expenses

(income), net, (iii) tax benefit and expense, and (iv) stock-based

compensation expense.

|

Talkspace, Inc.Reconciliation of Non-GAAP Results

to GAAP ResultsUnaudited |

| |

|

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| (in thousands) |

|

|

|

|

|

|

|

|

| Net loss |

|

$(4,704) |

|

$(23,022) |

|

$(13,462) |

|

$(43,382) |

| Add: |

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

302 |

|

268 |

|

608 |

|

697 |

| Financial (income) expense,

net(1) |

|

(1,712) |

|

1,865 |

|

(2,136) |

|

996 |

| Taxes on income |

|

8 |

|

89 |

|

151 |

|

110 |

| Stock-based compensation |

|

2,129 |

|

3,839 |

|

4,432 |

|

6,207 |

| Adjusted EBITDA |

|

$(3,977) |

|

$(16,961) |

|

$(10,407) |

|

$(35,372) |

|

(1) For the three months ended June 30, 2023, financial (income),

net, primarily consisted of $1.5 million of interest income from

our money market accounts and $0.3 million in gains resulting from

the remeasurement of warrant liabilities. For the six months ended

June 30, 2023, financial (income), net, primarily consisted of $2.1

million of interest income from our money market accounts.For the

three and six months ended June 30, 2022, financial expense net,

primarily consisted of $2.1 million and $1.2 million, respectively,

in losses resulting from the remeasurement of warrant

liabilities. |

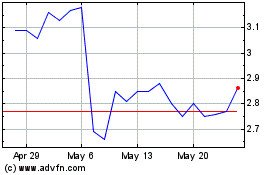

Talkspace (NASDAQ:TALK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Talkspace (NASDAQ:TALK)

Historical Stock Chart

From Jul 2023 to Jul 2024