Steve Madden (Nasdaq: SHOO), a leading designer and marketer of

fashion footwear and accessories for women, men and children, today

announced financial results for the first quarter ended March 31,

2010.

- First quarter net sales

increased 22.5% to $131.6 million.

- Retail comparable store sales

increased 13.6% for the first quarter.

- Operating margin reached 18.9%

of sales in the first quarter 2010, compared with operating margin

of 9.6% in the same period of 2009.

- First quarter net income

increased 134% to $15.4 million, or $0.55 per diluted share,

compared to $6.6 million, or $0.24 per diluted share adjusted for

stock split, in the prior year's first quarter.

Edward Rosenfeld, Chairman and Chief Executive Officer,

commented, "We are extremely pleased with the continued momentum in

our core business as well as with the initial success of our recent

initiatives. Steve and the design team continue to capitalize on

the latest trends with fresh, fashion-forward product, leading to

strong demand for our existing brands. At the same time, our new

business ventures – including Big Buddha, Elizabeth and James,

Olsenboye and Madden – are off to a great start and are expected to

contribute nicely to our sales and earnings growth in 2010 and

beyond.”

First Quarter 2010 Results

First quarter net sales were $131.6 million compared to $107.4

million reported in the comparable period of 2009. Net sales from

the wholesale business were $103.1 million compared to $81.3

million in the first quarter of 2009, driven by strong gains in the

Company’s existing wholesale footwear divisions as well as

contributions from our new license for the Elizabeth and James

brand and our recent acquisitions, Madden Zone and Big Buddha.

Retail net sales grew 9.1% to $28.5 million compared to $26.1

million in the first quarter of the prior year despite a smaller

store base. Same store sales increased 13.6%.

Gross margin improved to 45.5% from 40.5%, reflecting margin

improvement in both the wholesale and retail divisions. Gross

margin in the wholesale business increased to 42.5% from 38.1% in

the prior year's first quarter due primarily to higher initial

mark-ups and more full-price selling. Retail gross margin increased

to 56.7% from 47.8% in the comparable period of the prior year as a

result of less discounting and higher initial mark-ups.

Operating expenses as a percent of sales were 31.4% compared to

33.6% in the same period of the prior year, due to leverage on

increased sales.

Operating income for the first quarter increased to $24.9

million, or 18.9% of net sales, compared with operating income of

$10.3 million, or 9.6% of net sales, in the same period of

2009.

Net income increased 134% to $15.4 million, or $0.55 per diluted

share, compared to $6.6 million, or $0.24 per diluted share

adjusted for the 3-for-2 stock split, in the prior year's first

quarter.

During the first quarter of 2010, the Company closed five stores

and opened one, ending the quarter with 85 retail locations,

including the Internet store.

At the end of the first quarter, cash, cash equivalents and

marketable securities totaled $157.4 million.

Arvind Dharia, Chief Financial Officer, commented, "We

maintained a healthy balance sheet during the first quarter of 2010

supported by strong operating cash flow and prudent capital

management.”

Company Outlook

For fiscal 2010, the Company now expects sales to increase 17% –

19%. Diluted EPS is now expected to be in the range of $2.30 –

$2.40, compared to previous guidance of diluted EPS in the range of

$2.07 – $2.20 on an adjusted basis to address our recently effected

3-for-2 stock split in the form of a stock dividend on the

Company’s outstanding common stock.

Conference Call Information

As previously announced, interested stockholders are invited to

listen to the first quarter earnings conference call scheduled for

today, Tuesday, May 4, 2010, at 8:30 a.m. Eastern Time. The call

will be broadcast live over the Internet and can be accessed by

logging onto http://www.stevemadden.com. An online archive of the

broadcast will be available within one hour of the conclusion of

the call and will be accessible for a period of 30 days following

the call. Additionally, a replay of the call can be accessed by

dialing 888-203-1112, passcode 7481052, and will be available until

June 4, 2010.

About Steve Madden

Steve Madden designs, sources, markets, and sells

fashion-forward footwear and accessories for women, men and

children under both owned and licensed brands.

Safe Harbor

This press release and oral statements made from time to time by

representatives of the Company contain certain “forward looking

statements” as that term is defined in the federal securities laws.

The events described in forward looking statements may not occur.

Generally these statements relate to business plans or strategies,

projected or anticipated benefits or other consequences of the

Company's plans or strategies, projected or anticipated benefits

from acquisitions to be made by the Company, or projections

involving anticipated revenues, earnings or other aspects of the

Company's operating results. The words "may," "will," "expect,"

"believe," "anticipate," "project," "plan," "intend," "estimate,"

and "continue," and their opposites and similar expressions are

intended to identify forward looking statements. The Company

cautions you that these statements concern current expectations

about the Company’s future results and condition and are not

guarantees of future performance or events and are subject to a

number of uncertainties, risks and other influences, many of which

are beyond the Company's control, that may influence the accuracy

of the statements and the projections upon which the statements are

based. Factors which may affect the Company's results include, but

are not limited to, the risks and uncertainties discussed in the

Company's Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K filed with the Securities and

Exchange Commission. Any one or more of these uncertainties, risks

and other influences could materially affect the Company's results

of operations and condition and whether forward looking statements

made by the Company ultimately prove to be accurate and, as such,

the Company's actual results, performance and achievements could

differ materially from those expressed or implied in these forward

looking statements. The Company undertakes no obligation to

publicly update or revise any forward looking statements, whether

as a result of new information, future events or otherwise.

STEVEN MADDEN, LTD.

CONSOLIDATED STATEMENT OF OPERATIONS

DATA

(In thousands, except per share data) Quarter

Ended

Mar 31 2010 Mar 31 2009

(Unaudited) (Unaudited) Net sales $

131,608 $ 107,429 Cost of sales 71,671 63,942 Gross

profit 59,937 43,487 Commission and licensing fee income 6,184

2,905 Operating expenses 41,262 36,088 Income from

operations 24,859 10,304 Interest and other income, net 784

396 Income before provision for income taxes 25,643 10,700

Provision for income taxes 10,258 4,123 Net income $

15,385 $ 6,577

Post-split

Basic income per share $ 0.56 $ 0.25 Diluted income per share $

0.55 $ 0.24 Weighted average common shares outstanding -

Basic 27,455 26,834 Weighted average

common shares outstanding - Diluted 28,155

26,958

Pre-split

Basic income per share $ 0.84 $ 0.37 Diluted income per share $

0.82 $ 0.37 Weighted average common shares outstanding -

Basic 18,304 17,889 Weighted average

common shares outstanding - Diluted 18,770

17,972

CONSOLIDATED BALANCE SHEET

HIGHLIGHTS

(In thousands) Mar 31 2010 Dec 31, 2009

Mar 31 2009

(Unaudited) (Unaudited) Cash and cash equivalents $

69,221 $ 69,266 $ 63,235 Marketable securities (current and

non-current) 88,172 85,684 29,395 Total current assets 198,341

191,369 167,081 Total assets 355,970 326,859 254,145 Total current

liabilities 51,186 52,362 34,061 Total liabilities 69,901 59,072

40,045 Total stockholders' equity 286,069 267,787 214,100

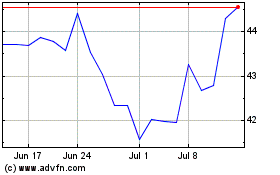

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Jun 2024 to Jul 2024

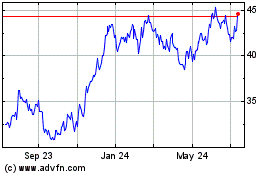

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Jul 2023 to Jul 2024