- Second Quarter Net Income $7.6 Million, or $0.43 Per Diluted

Share - LONG ISLAND CITY, N.Y., Aug. 5 /PRNewswire-FirstCall/ --

Steven Madden, Ltd. (NASDAQ:SHOO), a leading designer, wholesaler

and marketer of fashion footwear and accessories for women, men and

children, today announced financial results for the second quarter

ended June 30, 2008. Second quarter net sales were $109.3 million

compared to $108.3 million in the second quarter of 2007. Gross

margin decreased slightly to 41.7% compared to 42.0% in the second

quarter of the prior year due to a margin decline in the retail

division, which was partially offset by a margin increase in the

wholesale division. Operating expenses as a percent of sales were

33.5% versus 31.0% in the same period of 2007, due primarily to

increased expenses in the retail division for new stores, the

write-off of fixed assets related to store closures and remodels,

and severance. Operating income was $12.1 million, or 11.1% of

sales, compared with operating income of $17.5 million, or 16.2% of

sales, in the second quarter of 2007. This decline was due

primarily to higher operating expenses as a percent of sales and a

decline in commission income from the private label business versus

the prior year period. Net income was $7.6 million, or $0.43 per

diluted share, compared to $10.5 million, or $0.49 per diluted

share, in the prior year's second quarter. Revenues from the

wholesale business were $79.4 million compared to $78.6 million in

the second quarter of 2007 due primarily to the strength of the

Madden Girl and Daniel M. Friedman divisions, which offset relative

softness in the Steve Madden Women's and Steve Madden Men's

divisions during the quarter. Gross margin in the wholesale

business increased to 34.7% from 34.2% in last year's second

quarter as a result of margin improvement in both the wholesale

footwear and Daniel M. Friedman accessories divisions. Retail

revenues were $29.9 million compared to $29.6 million in the second

quarter of the prior year due to sales from new stores. Same store

sales decreased 3.3%. Retail gross margin decreased to 60.3% from

62.4% in the comparable period of the prior year, due primarily to

increased promotional activity due to the challenging retail

environment. During the second quarter of 2008, the Company closed

two stores. For the first six months of fiscal 2008, net sales were

$209.9 million compared to $214.9 million in the comparable period

last year. Net income totaled $9.7 million, or $0.51 per diluted

share, for the first six months of fiscal 2008, compared to $20.1

million, or $0.92 per diluted share, in the comparable period last

year. Excluding a one-time after-tax charge of $3.0 million in

first quarter resulting from the resignation of the Company's

former Chief Executive Officer, net income totaled $12.7 million,

or $0.67 per diluted share, for the first six months of fiscal

2008. Edward Rosenfeld, Interim Chief Executive Officer, stated,

"In wholesale, Madden Girl and Daniel M. Friedman were bright spots

as we generated strong sales increases in these two divisions in

the second quarter. We also remain pleased with our wholesale gross

margin, which rose modestly and reflects positive trends in both

footwear and accessories. While we continue to experience the

effects of the challenging macroeconomic environment, we are

beginning to see some renewed momentum in our business. We are

experiencing a positive response to our merchandise from both our

wholesale customers and consumers, and we are encouraged by

emerging footwear trends and the current sell-through of our

product." Arvind Dharia, Chief Financial Officer, commented, "We

are pleased with our ability to maintain a strong financial

position despite the challenging macroeconomic environment. Our

balance sheet continues to demonstrate the Company's strength as we

ended the quarter with $46.3 million in cash, cash equivalents, and

marketable securities, no debt, and total stockholders' equity of

$184.0 million. We remain confident the Company is well positioned

for long-term growth." Company Outlook Based on trends to date this

year and current visibility, the Company is maintaining its

guidance for the full fiscal year. The Company continues to expect

2008 net sales will be flat to an increase of 2% compared to fiscal

2007 and earnings per diluted share will range between $1.55 and

$1.65, excluding the previously mentioned impact of the one-time

charge recognized in first quarter. Including the impact of the

one-time charge, earnings per diluted share are expected to range

between $1.39 and $1.49. Mr. Rosenfeld concluded, "While we are

maintaining a conservative approach to managing our business this

year due to the challenging retail environment, we are encouraged

by our recent performance and believe we are well-positioned as we

move into the latter half of fiscal 2008. The Company has a solid

foundation for long-term success based on the increasing

diversification of our business, the strength of our design team

and our strong focus on execution." Conference Call Information

Interested shareholders are invited to listen to the second quarter

earnings conference call scheduled for today, Tuesday, August 5,

2008, at 10 a.m. Eastern Time. The call will be broadcast live over

the Internet and can be accessed by logging onto

http://www.stevemadden.com/. An online archive of the broadcast

will be available within one hour of the conclusion of the call and

will be accessible until August 19, 2008. Additionally, a replay of

the call can be accessed by dialing 800-642-1687, passcode

56721800, and will be available until August 12, 2008. Steven

Madden, Ltd. designs and markets fashion-forward footwear and

accessories for women, men and children. The shoes and accessories

are sold through company-owned retail stores, department stores,

apparel and footwear specialty stores, and online at

http://www.stevemadden.com/. The Company has several licensees for

its brands, including for outerwear, cold weather accessories,

eyewear, and hosiery and owns and operates 99 retail stores,

including its online store. Through its wholly-owned subsidiary,

Daniel M. Friedman & Associates, the Company is the licensee

for handbags and belts for Betsey Johnson, Daisy Fuentes and Tracy

Reese. Statements in this press release that are not statements of

historical or current fact constitute "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995. Such forward-looking statements involve known and unknown

risks, uncertainties and other unknown factors that could cause the

actual results of the Company to be materially different from the

historical results or from any future results expressed or implied

by such forward-looking statements. In addition to statements which

explicitly describe such risks and uncertainties readers are urged

to consider statements labeled with the terms "believes", "belief",

"expects", "intends", "anticipates" or "plans" to be uncertain and

forward-looking. The forward looking statements contained herein

are also subject generally to other risks and uncertainties that

are described from time to time in the Company's reports and

registration statements filed with the Securities and Exchange

Commission. STEVEN MADDEN LTD CONSOLIDATED STATEMENT OF OPERATIONS

(In thousands, except per share data) - Unaudited Three Months

Ended Six Months Ended Consolidated: Jun 30, Jun 30, Jun 30, Jun

30, 2008 2007 2008 2007 Net Sales $109,317 $108,256 $209,856

$214,910 Cost of Sales 63,780 62,836 124,104 127,296 Gross Profit

45,537 45,420 85,752 87,614 Commission and licensing fee income

3,203 5,669 6,559 11,115 Operating Expenses 36,593 33,599 77,327

65,570 Income from Operations 12,147 17,490 14,984 33,159 Interest

and other Income, Net 368 803 894 1,713 Income Before provision for

Income Taxes 12,515 18,293 15,878 34,872 Provision for Income Tax

4,881 7,775 6,192 14,821 Net Income $7,634 $10,518 $9,686 $20,051

Basic income per share $0.43 $0.51 $0.51 $0.96 Diluted income per

share $0.43 $0.49 $0.51 $0.92 Weighted average common shares

outstanding - Basic 17,662 20,659 18,839 20,809 Weighted average

common shares outstanding - Diluted 17,810 21,626 19,023 21,793

BALANCE SHEET HIGHLIGHTS Jun 30, Dec 31, Jun 30, 2008 2007 2007

Consolidated Consolidated Consolidated (Unaudited) (Unaudited) Cash

and cash equivalents $18,849 $29,446 $23,933 Investment Securities

27,462 80,411 69,973 Total Current Assets 158,198 168,855 195,875

Total Assets 227,498 266,521 266,670 Total Current Liabilities

38,968 47,717 36,524 Total Stockholder Equity 184,032 215,334

226,839 DATASOURCE: Steven Madden, Ltd. CONTACT: Investors: Cara

O'Brien, or Leigh Parrish, Media: Diane Zappas, all of FD, for

Steven Madden, Ltd., +1-212-850-5600 Web site:

http://www.stevemadden.com/

Copyright

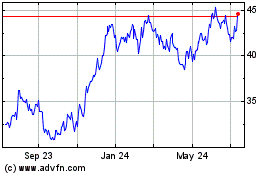

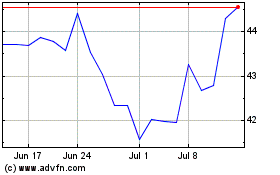

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Apr 2024 to May 2024

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From May 2023 to May 2024